- Money Market User Guide

- Process an MM Deal

- Capture Deal Details

- Features of the Contract Details screen

- Money Market Contract Input

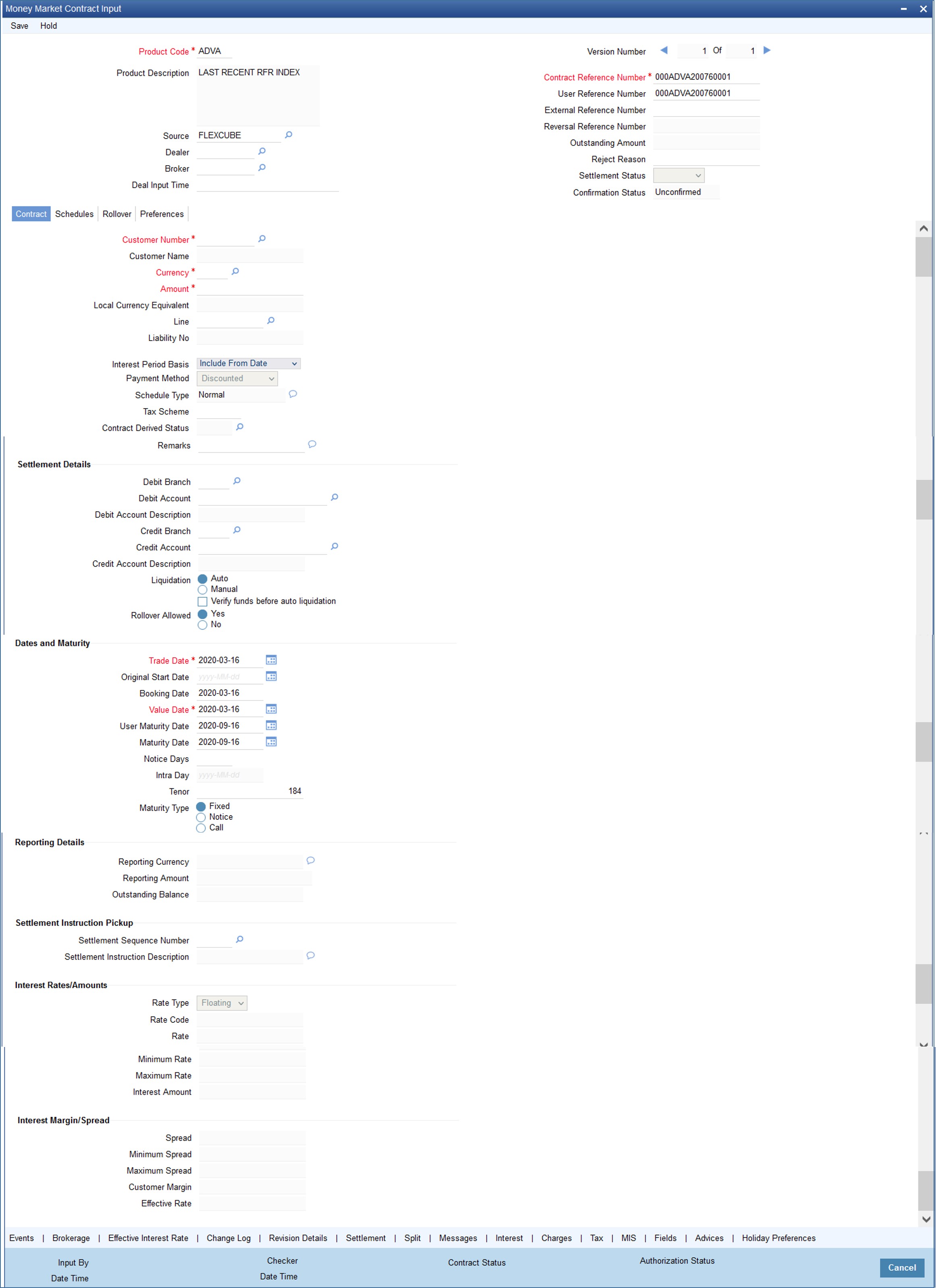

3.1.1.1 Money Market Contract Input

This topic provides the instructions to capture the details of Money Market Contract Input.

- On the Home page, type

MMDTRONL in the text box, and click the next arrow.

Money Market Contract Input screen is displayed.

- On the Money Market Contract Input screen, specify the

following information:

- The base number of the counterparty (customer)

- The currency of the contract

- The principal amount (for a deal with True Discounted interest, you should enter the nominal)

- The credit line under which the placement has to be tracked

- The tenor related details for the deal

- The code of the broker involved

- The dealer involved

- The default settlement account

- The maturity details

- The related reference number, if any

- The interest details

- Whether the deal is rolled over

- The status of the placement if it is to be changed manually

The following details displayed cannot be changed:

- Product type

- Default tax scheme

- Schedule payment method

- Interest type Rollover count

For information on fields, refer to the below table.

Table 3-2 Contract Details - Field Description

Field Description Product Code

This is a Mandatory field.

Every deal that you enter into would involve a specific service that you offer (which you have defined as a product). When processing a deal that you enter into, you should specify the product that it involves.

All the attributes of the product that you specify will apply to the deal. However, you can change some of these attributes while entering the details of the contract. When you specify the product, the product type - placement or borrowing - is displayed.

Source

You have to indicate the source from which contracts have to be uploaded.

If this value is left null, then you will not be able to amend the contract. Amendment for the contract is uploaded only through the same source as that used for creation.

Contract Reference number

The Contract Reference Number identifies the deal. It is automatically generated by the system for each deal. It is a combination of the branch code, the product code, the date on which the deal is booked (in Julian format) and a running serial number for the booking date.

The Reference Number consists of a three-digit branch code, a four-character product code, a five-digit Julian Date and a four-digit serial number.

The Julian Date has the following format:

“YYDDD”

Here, YY stands for the last two digits of the year

and DDD for the number of days (s) that has/have elapsed in the year.

For example, 31 January 1998 translates into the Julian Date: 98031. Similarly, 5 February 1998 becomes 98036 in the Julian format. Here, 036 is arrived at by adding the number of days elapsed in January with those that elapsed in February (31+5=36).

User Reference Number

You can enter any reference number for a deal that you enter. The deal is identified through this number in addition to the Contract Reference Number generated by the system. No two deals can have the same User Reference Number. By default, the Contract Reference Number generated by the system is taken as the User Reference Number. You can use this number, besides the deal Reference Number, to retrieve information relating to a deal.

External Reference

If the transaction is being uploaded from an external source, you can specify the identification for the transaction in the external source, as the external reference number. You cannot amend this value post-contact save.

In a scenario where your customer is tracking a deal in her system, she would probably assign it a unique reference number. If she offers the number for reference purposes, it is recorded in this screen. This reference number is printed on the advices sent to the customer to enable her to identify, and track, the deal with ease.

Reversal Reference Number

The reference number of the contract that is being reversed and rebooked is displayed here. To enable amendment of MM Contract details, Oracle Banking Treasury Management will reverse the old contract and rebook a new contract with the old user reference number and external reference number. The old contract is reversed, and a new contract is booked with Reversed FCC ref as the parent contract.

For further details on reversing and rebooking of a contract, refer to the section titled 'Reversing and Rebooking a Contract' of this user manual.

Outstanding Amount

The system displays the total amount due as of the value date.

Settlement Status The system displays the settlement account status. If the fund in settlement account is found insufficient after verification, then the settlement status is displayed as 'Pending'.

Confirmation Status

The system displays the status of MM contract confirmation on confirming the MM deal manually or automatically. Confirmation Status is Confirmed, Unconfirmed or Waived.

If a completely matched deal is unconfirmed manually from ‘Manual Matching’ screen, then the confirmation message is changed to ‘Unconfirmed’.

Deal Input Time

This field captures the deal execution time at the time of deal booking received from front office. Format: YYYY-MM-DD HH:MM:SS:SSS (Default). Here SSS is milliseconds.System throws an error when you give the wrong date or time format on modification.Note:

The above date format can be changed in the user setting option based on requirement.Contract Tab

The contract details like the customer, currency, amount etc are maintained as Contract Details. The Contract Details are entered in the ‘Contract’ tab.

Customer Number

This is a Mandatory Field.

When entering the details of a deal, you should specify the customer (the counterparty) involved in the deal. The category of customers (or the customers themselves) that is the counterparty to a deal is defined for the product. Specify the code of an authorized customer who falls into a category allowed for the product.

Customer Name

The system displays the name of the specified customer ID based on the details maintained at ‘Customer Maintenance’ level.

Currency

This is a Mandatory Field.

When processing a deal, you should specify the currency of the deal. You can select any currency that is allowed for the product, which the deal involves. Amendment to this field is considered a financial amendment.

Amount

This is a Mandatory Field.

If a product has bearing or discounted type of interest, you should enter the principal of the deal in this screen. For a deal involving a true discounted product, you should enter the face value (nominal) of the deal. You can enter “T” or “M” to indicate thousands or millions, respectively. For example, 10T means 10,000 and 10M means 10 million. Amendment to this field is considered a financial amendment.

Note that the amount, which you enter, would be taken to be in the currency that you specify as the deal currency.

On saving the transaction after entering all the required details in the system, the system validates the value of the contract amount against the following:

- Product transaction limit

- User Input limit

If the transaction currency and the limit currency are different, then the system converts the amount financed to limit currency and checks if the same is more than the product transaction limit and user input limit. If this holds, the system indicates the same with below override/error messages:

- Number of levels required for authorizing the transaction

- The transaction amount is more than the input limit of the user

Local Currency Amount

If the deal amount is in foreign currency, the system displays the equivalent local currency amount.

Line

By default, you will view the placement credit line defined for the customer. You can change over to another authorized credit line if you want to track the placement under a different line.

During upload, the credit lines for the given Counterparty, Product, Branch, Currency combination are fetched by the system. If there is only one credit line available, the system will display it here. If there are multiple lines found, the field is left blank.

Interest Period Basis

You need to indicate how the system must consider the tenor basis upon which profit is computed over a schedule or interest period, in respect of the contract.

You can choose any of the following options:

- Including the From Date - For all schedules, the period considered for interest calculation would include the start date and exclude the end date. Therefore, the value date of the deal is considered for interest calculation, and the maturity date is excluded.

- Including the To Date - For all schedules, the period considered for interest calculation would exclude the start date and include the end date. Therefore, the value date of the deal is excluded, but the maturity date is included for interest calculation.

- Including both From and To Dates - The period considered for interest calculation would include both the value date and the maturity date. This would mean:

- For the first schedule, it would include the Value Date as well as the end date. Interest would be calculated for the Value Date.

- For all other schedules, it would include the end date. Interest would be calculated for the Maturity Date. This option would work similar to the Include To Date option - that is, interest would be calculated for the period between the start date (excluding the start date) and the end date (including the end date) of the schedule.

- Excluding both From and To Dates - The period considered for interest calculation would exclude both the value date and the maturity date. This would mean:

- For the first schedule, it would exclude both the Value Date as well as the end date of the schedule. No interest would be calculated for the Value Date.

- For all other schedules, it would exclude the end date. No interest would be calculated for the Maturity Date. This option would work similar to the Include From Date option - that is interest would be calculated for the period between the start date (including the start date) and the end date (excluding the end date) of the schedule.

Payment Method

The payment method defined for the main interest for the product (whether bearing, discounted or true discounted) applies to the contract as well. The method defined for the product is displayed here.

- Bearing: Interest is liquidated on schedule payment date(s).

- Discounted: In this interest payment method, the interest is deducted at the time of initiating the deal.

- True discounted: In this interest payment method, the interest is calculated on the principal of the deal and not on the nominal. All the same, like the discounted method, here too, it is deducted from the principal at the time of initiation of the deal.

Schedule Type

If you have defined repayment schedules for a product, they is applied to a deal involving the product, automatically. However, you can change the schedules while processing a deal under the product.

When a deal for which the repayment schedules were changed is rolled over, the new deal can have the repayment schedules defined for the product, or the schedules for the deal.

Tax Scheme

The tax scheme, which has been specified for the product, is displayed in this screen. The tax scheme cannot be changed at the time of deal processing.

Contract Derived Status

The “status” of placement is indicative of the status of repayments on it. If you have specified automatic status movement for the placement, it is moved automatically to the status, as per your definition. However, if you indicated that the status change is made manually on the placement, you can change the status manually in this screen. Even if you have defined placement with automatic status movement, you can still change the status manually before the automatic status change is due.

There is yet another scenario, where you have defined placement with automatic status moving forward, but manual status movement in the reverse direction. That is, when the conditions for placement being in a particular status no longer exist, if you have specified manual reverse movement, then you will have to move the placement to the appropriate status manually.

A placement on which the latest repayment has been made is in the Active status. If a payment is outstanding on a placement, its status is changed, based on your requirements of reporting placements with outstanding payments. The different status codes applicable for placement are defined for a product, and it applies to the placement, by default. However, you can change the status of the contract through this screen.

When you are capturing placement details, the system allows the status of “Active” by default. You may change it to any of the status codes as per your requirement. While doing manual status changes, ensure that you change the status in the order they are defined. For example, the status codes are defined as follows, in that order:

- Active

- Past Due

- Non-accrual

- Write-off

You cannot change the status of placement from Active to Non-accrual, bypassing Past Due. If the requirement is that the placement has to be put in the Non-accrual status from the Active status, you should first change the status to Past Due, store and authorize this status change and then change it to the Non-accrual status. If a status change is defined with a change in the GL, the entries are passed for the GL movement.

Remarks

You can enter information describing the deal that you are processing. This is available when you retrieve information on the deal. However, this information will not be printed on any advice printed for the customer's benefit. This information displayed whenever you retrieve information on the deal either as a display or in print.

Debit Branch

When selecting the settlement details of a deal, you should specify the debit account Branch.

Debit Account

Specify the account to be debited for the money market deal.

Debit Account Description

The system displays the description of the specified debit account number based on the details maintained at 'Customer Account Maintenance' level.

Credit Branch

When selecting the settlement details of a deal, you should specify the credit account branch.

Credit Account

Specify the account to be credited for the money market deal.

Credit Account Description

The system displays the description of the specified credit account number based on the details maintained at 'Customer Account Maintenance' level.

Liquidation

When setting up a product, you specify the mode of liquidation, whether automatic or manual, for the different components of a deal. By default, all deals involving the product will inherit this definition. However, you can change the mode of liquidation, from automatic to manual, or vice versa, while processing a deal.

Verify Funds Before Auto Liquidation

The system defaults the product preferences for ‘Verify Funds Before Auto Liquidation’ during MM contract booking. However you can modify it. During auto liquidation if ‘Verify Funds Before Auto Liquidation’ is checked at contract level, the system checks the available balance in the settlement account.

The available balance is calculated as available balance in the account + available limits + overdraft limits of the account. This validation is not applicable during manual liquidation.

If settlement account available balance is less than amount due, then the system will update contract settlement status as 'Pending' and park it in Contract Exceptions data store. If there is sufficient balance in the settlement account, the system will proceed with auto liquidation.

Rollover Allowed

While setting up a product, if you specified that deals involving the product are automatically rolled over, all deals involving the product are rolled over on their respective Maturity Dates, if they are not liquidated. This feature is called “auto” rollover. If the auto rollover is specified for the product, the deal involves, it is indicated on this screen. However, if you do not want the deal (whose details are being captured) to be rolled over, you can disallow rollover for the deal. If rollover has been disallowed for a product, you cannot rollover deals involving the product.

Note:

For rollover to be applicable for the deal, it has to be defined for the product.

Trade Date

This is the date on which the deal is agreed with the counterparty trade date cannot be modified once authorized. The system will display error messages under the following conditions:- Trade date is greater than current system date

- Trade date is holiday as per the deal currency

- Trade date is blank

- Trade date is later than the value date

- Trade date is earlier than the product start date

Original Start Date

For a deal that has been rolled over, this is the date on which the deal was originally initiated. If a deal has been rolled over more than once, this is the date on which the first deal was initiated.

If you are entering a deal that has already been initiated, you should enter the date on which the deal began. In this case, the date is for information purposes only and for all accounting purposes the Value Date is considered as the date on which the deal was initiated.

Booking Date

The date on which the deal details are entered would be displayed in this screen. This defaults to the system date (today’s date). This date is for information purposes only. The accounting entries are passed as of the Value Date of the deal (initiation date of the deal). Amendment to this field is considered a financial amendment

Value Date

This is the date on which a deal takes effect. The accounting entries for the initiation of the deal is passed as of this date. The tenor of the deal will begin from this date, and all calculations for interest and all the other components based on tenor is made from this date onwards.

The system defaults to today’s date. You can enter a Value Date of your choice here. The date that you enter is any one of the following:

- Today’s date

- A date in the past

- A date in the future (you can enter a date in the future only if Future Dating has been allowed for the product).

The Value Date should not be earlier than the Start Date or later than the End Date defined for the product involved in the deal. In case of a child rolled over the contract, this value is the same as the maturity date of the parent contract.

If the liquidation date for any component falls before today’s date, the liquidation entries (as defined by you for the product) is passed if you have so specified for the product. If the Maturity Date of a deal is earlier than today, maturity entries are passed.

Once the deal details have been stored and authorized, this date is amended, if the deposit has a bearing type of interest and NO schedule has been liquidated. Modification to this field is considered as a financial amendment.

An override is sought if the Value Date falls on a holiday, in the country of the deal currency.

User Maturity Date

Change the maturity date of the deal here, based on the requirement.

Maturity Date

If the Maturity Type is fixed (that is, the Maturity Date of the deal is known when the deal is initiated) specify the Maturity Date. This date should be later than the Start Date of the product. If the product has a Default Tenor, this date is defaulted based on the tenor and the From date of the contract. If you change this date, you should give an override when you save the deal.

For a deal with Call or Notice type of maturity, the Maturity Date is not entered at the time of deal booking. You can get this date updated through value dated amendment. This date should be later than the Start Date of the product.

If the product has a Default Tenor, this date is defaulted based on the tenor and the From date of the contract. If you have specified auto liquidation for the deal, liquidation is done automatically on that date. If manual liquidation has been specified, you will have to liquidate the deal through the Manual Liquidation function manually.

For a deal with Fixed Maturity Type, this date can either be extended or brought backwards through the Value Dated Changes function, once the deal has been initiated.

Notice Days

For a contract maturing at notice, you should enter the notice period (in days). This is for information purposes only. When the notice to repay is issued to the counterparty, you should indicate the Maturity Date of the deal using value dated amendment screen.

Intra Day

For intra-day deals, the system populates the intra-day deal date in this field. The intra-day deal date is populated as value date +1. You can only enter intra-day deals using a product meant for intra-day deals (as set in the Product Preferences).

Tenor

If the product has a Default Tenor, this tenor is defaulted based on the tenor. On overriding this maturity date will get adjusted.

Maturity Type If the Maturity Type is fixed (that is, the Maturity Date of the deal is known when the deal is initiated) specify the Maturity Date in this screen. This date should be later than the Start Date of the product. If the product has a Default Tenor, this date will be defaulted based on the tenor and the From Date of the contract. If you change this date, you should give an override when you store the deal.

For a deal with Call or Notice type of maturity, the Maturity Date should be entered in the screen when it is known. This date should be later than the Start Date of the product. You can unlock the record and add the date.

If the product has a Default Tenor, this date will be defaulted based on the tenor and the From Date of the contract. If you change this date, you will have to give an override when you store the deal.

If you have specified auto liquidation for the deal, liquidation will be done automatically on that date. If manual liquidation has been specified, you will have to manually liquidate the deal through the Manual Liquidation function.

For a deal with Fixed Maturity Type, this date can either be extended or brought backward through the Value Dated Changes function, once the deal has been initiated.

Reporting Currency

Select the reporting currency from the option list.

Reporting Amount

The system displays the amount.

Outstanding Balance

The system displays the total amount due as of the value date.

Settlement Sequence Number

Choose a settlement instruction by specifying a settlement sequence number. You can skip this field if any default settlement instruction is already specified.

Note:

At the time of specifying settlement instructions, it is now possible to choose from multiple instructions that are maintained for the same branch, customer, currency, module and product combinations. You can choose any settlement instruction from a list of values. The list of values displays the Settlement Sequence Number and Settlement Instruction Description.

Settlement Instruction Description

Specifies the description of the selected settlement instruction.

Rate Type

The rate type applicable for the selected product will be displayed. It can be one of the following:

Fixed: a fixed interest rate

Floating rate: an interest rate that changes periodically or automatically as per your specifications in the Floating Rate Table

Special: an amount instead of a rate. You cannot modify the displayed value.

Rate Code

For Floating Rate, the rate code will be displayed. You cannot modify it.

Rate

The Rate applicable for the selected product will be displayed. You cannot modify it.

Max Rate & Minimum Rate

The maximum and minimum rate allowed for the selected product will be displayed. You cannot modify it.

Customer Margin

The margin specified at customer level will be displayed here. You cannot modify it.

Interest Amount

The interest amount for the selected product will be displayed. You cannot modify it.

Interest Margin/Spread

The following are Interest Margin/spread details:

Spread

The spread value for the selected product is displayed as specified in the product level. You can modify it.

Minimum Spread & Maximum Spread

The maximum and minimum spread that is applied for the selected product is displayed. You cannot modify it.

Note:

This spread should be greater than or equal to the Minimum Spread and less than or equal to the Maximum Spread defined for the product involved in the deal. If the spread you apply happens to be greater than the Maximum Spread, then the Maximum Spread is applied on the rate. On the other hand, if it is less than the Minimum Spread defined for the product, the Minimum Spread is picked up. For a floating rate, the spread is applied over the market rate applicable for the day.

Negative Interest Rates

Negative fixed rates or resolved rates is allowed in the MM contract or amendment only if negative interest is allowed for the main interest component. You can maintain the contract interest rate (negative or positive) against main interest component only.

If the effective interest rate is negative, then it is internally assigned to negative interest component, and you have to set up accrual and liquidation entries for the negative interest component. Special interest amount and negative interest amount will not be allowed in Interest Amount and Acquired Amount fields of ICCB screen respectively.

If negative interest is not allowed for a product and if the effective rate becomes negative during batch rate revision, then the rate revision is skipped for the contract and exception will be logged.

Parent topic: Features of the Contract Details screen