- Money Market User Guide

- Process Repayments

- Schedule Preferences

4.2 Schedule Preferences

This topic provides the instructions to capture the product schedule preferences.

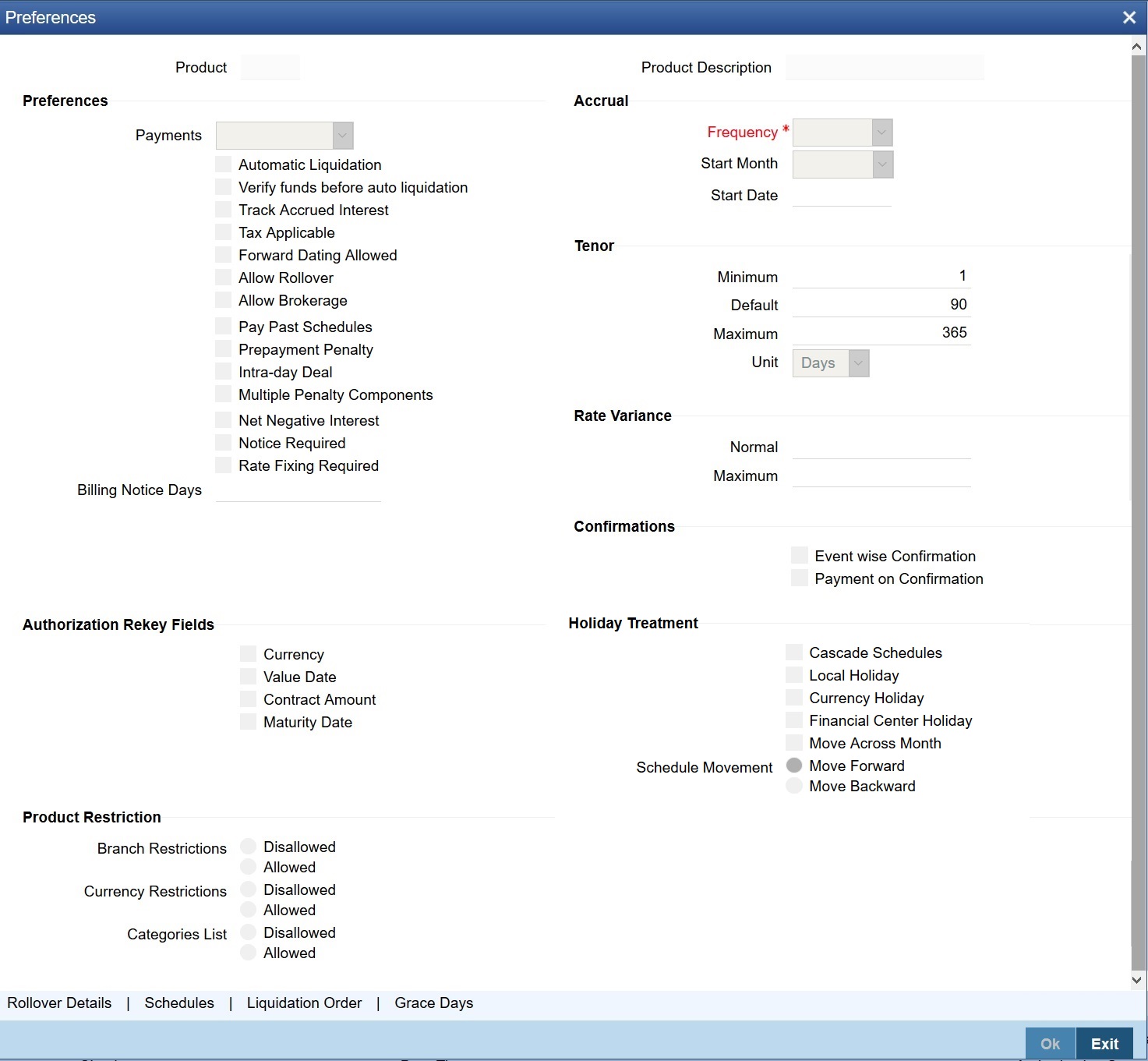

Define the attributes of the schedules for a product through the Preferences screen.

- On the Money Market Product Definition screen, click Preferences.

Preferences screen is displayed.

- On the Preferences screen, specify the details as required.

For information on fields, refer to the below table.

Table 4-1 Preferences - Field Description

Field Description Bearing

The interest is liquidated on the scheduled payment date(s).

Discounted

In this interest payment method, the interest is deducted at the time of initiating the deal.

True discounted

In this interest payment method, the interest is calculated on the principal in a manner differing slightly from the ‘Discounted’ method. The interest rate is applied on the Principal instead of the Nominal, as it is done in the ‘Discounted’ method.

To go to the Product Default Schedules screen, click on the Schedules button in the Product Preferences screen.

Indicating the Schedule Type

You can define schedules for each component for the product through the Product Default Schedules screen. This involves specifying the reference date, the frequency, the month and date for each component.

Mode of Liquidation

Components of a deal are liquidated automatically or manually. In the Product Preferences screen, you should indicate whether the mode of liquidation of repayment schedules is to be automatic.

Specify Auto liquidation if you want the components of a deal (involv ing a product) to be liquidated automatically. If you so specify, a schedule is automatically liquidated the day it falls due, during the beginning of day processing (by the Automatic Contract Update function.)

Now, consider the following situation:

- You have indicated automatic liquidation

- The scheduled date falls on a holiday, and

You have specified (through the contract preferences screen), that the holiday be ignored while calculating the scheduled date.

In such a situation, a repayment falling on a holiday would be processed according to your specifications for holiday handling (in the MM Branch Parameters screen). It would be as follows:

- If you have specified that processing has to be done (on the last working day before the holiday) for automatic events right up to the day before the next working day, the schedule falling on the holiday will be liquidated during the end of day processing on the last working day before the holiday.

- If you have specified that processing has to be done only up to the System Date (today), then only those events scheduled for today (the last working day before the holiday) will be processed. The events falling due on holiday are processed on the next working day after the holiday, during the beginning of day processing.

In such a situation, a repayment falling on a holiday would be processed according to your specifications for holiday handling (in the MM Branch Parameters screen). It would be as follows:

- If you have specified that processing has to be done (on the last working day before the holiday) for automatic events right up to the day before the next working day, the schedule falling on the holiday will be liquidated during the end of day processing on the last working day before the holiday.

- If you have specified that processing has to be done only up to the System Date (today), then only those events scheduled for today (the last working day before the holiday) will be processed. The events falling due on holiday are processed on the next working day after the holiday, during the beginning of day processing.

If a borrowing has been defined for verification of funds before automatic liquidation (through the Contract Online Preferences screen), those components whose schedule dates fall on the same day will be liquidated in the order you have specified when defining the product.

If the funds are insufficient, the liquidation is done to the extent of the available balance in the repayment account. The components will be liquidated in the order that you specify. This will be reported in the Exception Report generated at the end of every day, automatically (by the Automatic Contract Update function). If you have not specified that the funds be verified, and there are insufficient funds in the repayment account:

- The repayment account will be put into a debit balance (if you have allowed overdraft) and the schedules for the components liquidated to the extent of the debit balance that you have allowed for the account. You can liquidate beyond the allowed debit balance for an account after overriding a warning message. This override will be recorded for audit trail purposes. Debit interest, as specified for the type of account (current or savings); is applied on the debit balance.

- If the repayment account has not been defined with an overdraft, the liquidation will not be processed.

If you specify manual liquidation for deals involving the product, then you will have to do the liquidation manually, through the Manual Liquidation screen.

Liquidate Back Valued Schedules During Initiation

Indicate whether for a backdated deal that has schedules before today’s date; the schedules have to be liquidated when the deal is initiated. A backdated deal is one, which has an initiation date, which falls before today’s date.

Specifying the Payment Method

You have to specify whether the payment method for the main interest is to be bearing, discounted, or true discounted. This cannot be changed at the time of processing a deal.

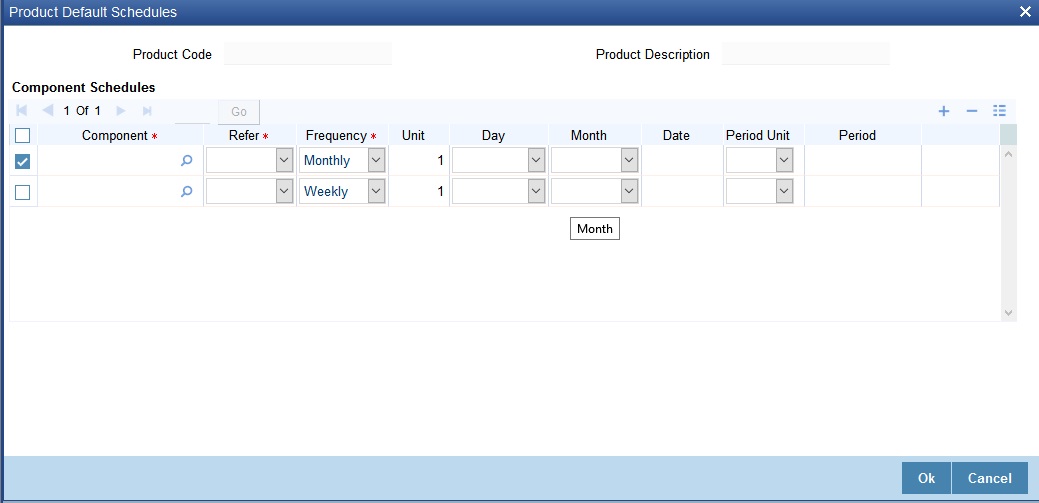

- On the Preferences screen, click Schedules.

When creating a product (in the Product Default Schedules screen), you can define schedules for all deal components. This involves specifying the reference date, the month and the date for each component etc. All deals, involving the product, will acquire these attributes. The system generates multiple schedules for the principal schedule as per the maintenance, and the interest is calculated based on the principal due.

Product Default Schedules screen is displayed.

- On the Product Default Schedules screen, specify the details as required.

Note:

The multiple partial payment of principal component is possible only if MULTI_SCH_PRIN is installed. You can check it through the CSDTRFEM screen.

For information on fields, refer to:.

Table 4-2 Product Default Schedules - Field description

Field Description Component

Define different repayment schedules for the different components according to your needs. First of all, you should specify the component for which you want to define the schedule. All components of the principal and any other component depending upon your ICCB definition for the deal are available in the adjoining option list. You will have to define schedules for each of them.

When defining repayment schedules for specific deals, the amounts for components like interest, commission, and the fee will be calculated by the system automatically, depending on the repayment date and amount of the principal. However, for deals with special interest, you will also have to provide the interest amount.

Refer

Indicate whether the dates of repayment schedules should be calculated based on the Value Date (date of initiation of the deal) of the deal involving the product, or a Calendar Date. If you specify that the Reference is the Value Date (date of initiation of the money market deal), the dates for scheduled repayments are based on this date and the frequency.

If the Reference is specified as the Calendar Date, the dates for scheduled repayments are based on the Start Date (specified by you), the Month and the Frequency. The following example illustrates this concept.

If Reference is set to Value Date (deal initiation date), you need to specify only the frequency (monthly, quarterly etc.) and the unit of frequency (if you specify the frequency as weekly and the unit as 1, it means once a week). The system will set the schedule according to the Frequency and Unit of Frequency you have specified, beginning on the Value Date.

Frequency

You can have multiple schedules for payment of partial principal component. The list displays the following frequencies:

- Daily

- Weekly

- Quarterly

- Monthly

- Half-yearly

- Yearly

- Bullet

The frequency is based on the requirements, and the units should be 1.

By default, the frequency will be Bullet, meaning all the repayments will be made on maturity. If the frequency is defined as Bullet, you cannot enter a value into the subsequent fields.

Unit

You can specify the number of units for the frequency you have set for a particular component.

For example, if you want a payment every 15 days, you will have to specify

- The frequency as Daily and

- The units as 15.

For payments every three weeks, you will have to define

- The frequency as weekly and

- The unit as three.

Day

If you have set the Reference as Calendar Date and the frequency as weekly, quarterly, half-yearly or annual indicate the day on which the first schedule falls due. Based on this, the subsequent schedule dates are calculated.

Month

If you have set the Reference as Calendar Date and the frequency as weekly, quarterly, half-yearly or annual indicate the month in which the first schedule falls due. Based on this, the subsequent schedule dates are calculated.

Date

If you have set the Reference as Calendar Date, you should indicate the date on which the schedule should fall due. Specify 31 to indicate that the schedule should fall due on the last day of the month (that is, 31 for months with 31 days, 30 for months with 30 days and 28 or 29, for February).

The schedule repayment dates are computed using the Frequency, (Start) Month and the (Start) Date.

A scheduled date:

- Should be later than or the same as the Value Date

- It cannot be beyond the Maturity Date.

Period Unit

You need to specify the unit for the interest period. The available options are as follows:

- Days

- Months

- Years

Parent topic: Process Repayments