- Money Market User Guide

- Risk Free Rates

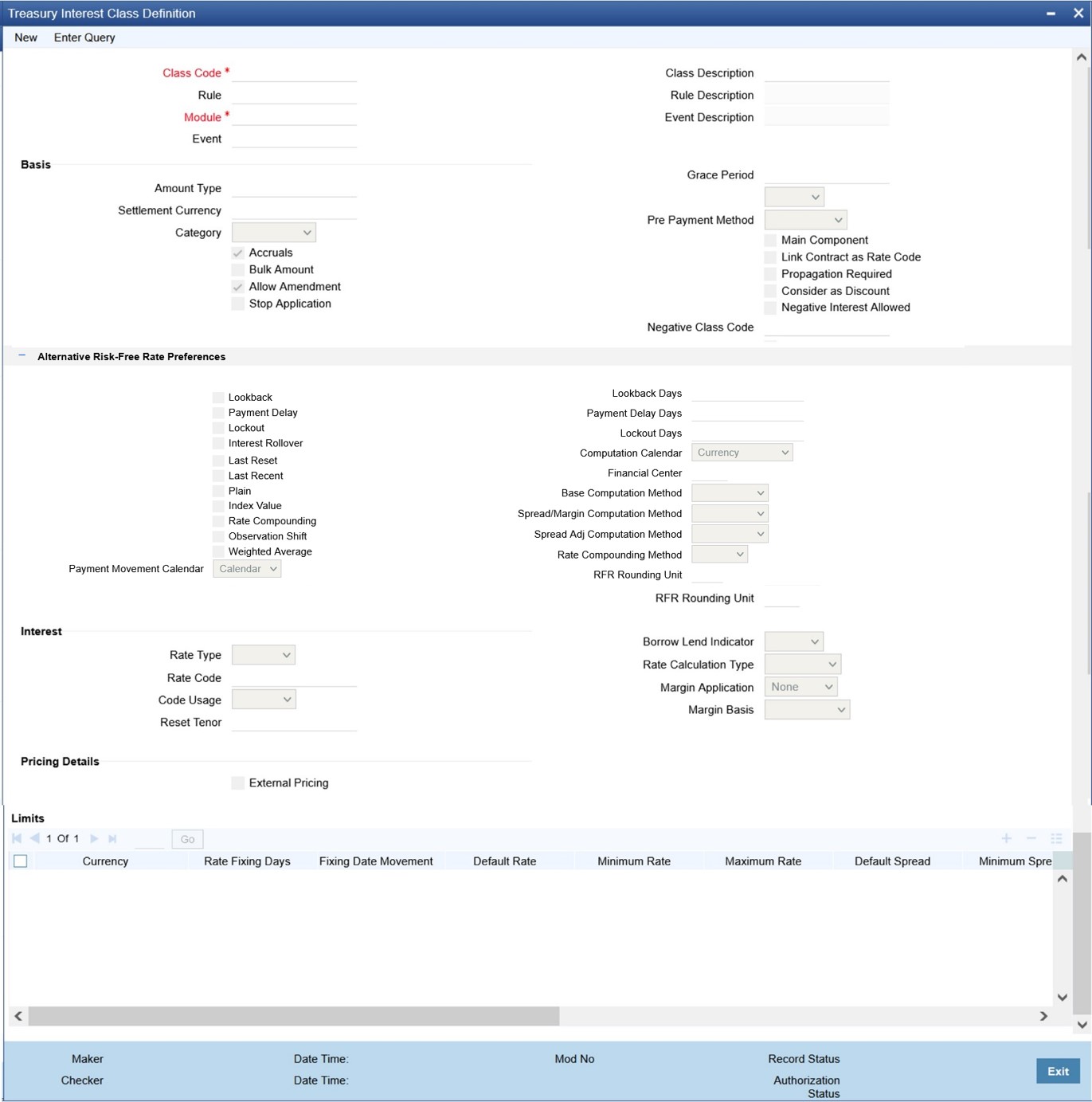

- Treasury Interest Class Definition

9.3 Treasury Interest Class Definition

This topic provides the instructions to capture the Treasury Interest Class Definition details.

Treasury Interest Class Definition supports RFR methods and computation preferences.

- On the Home page, type CFDTRINC in the text box, and click the next arrow.

Treasury Interest Class Definition screen is displayed.

Figure 9-3 Treasury Interest Class Definition

Description of "Figure 9-3 Treasury Interest Class Definition " - On the Treasury Interest Class Definition screen,

specify the details as required.

For information on fields refer to the below table.

Table 9-2 Treasury Interest Class Definition - Field Description

Field Description Alternative Risk Free Rate

Identifies if the interest class is enabled for RFR

Alternative Risk Free Rate Preferences

User can select any one of the below RFR calculation methods:

- Lookback

- Payment delay

- Lockout

- Interest Rollover

- Last reset

- Last recent

- Plain

- Weighted Average

The user can also select the combination of the below RFR methods:

- Lookback and Lockout

- Lookback and Payment Delay

- Lockout and Payment Delay

- Lookback, Lockout, and Payment Delay

Lookback

The user can select Lookback as RFR preference if the Rate Method is In-Arrears.

The observation period for the interest rate calculation starts and endsa certain number of days prior to the Interest period. As a result, youcan choose the interest payment to be calculated prior to the end ofthe interest period.

Lookback Days

This field will only be relevant if 'Rate Method' is 'In-Arrears' or bearing and RFR method is Lookback.

Lockout

The user can select Lockout as RFR preference if the Rate Method is In-Arrears.

Lockout means that the RFR is frozen for a certain number of days prior to the end of an interest period (lockout period).

During this time, the RFR of lockout period days is applied for the remaining days of the interest period. As a result, the averaged RFR can be calculated a couple of days before the end of the Interest period.

Lockout Days

This field will only be relevant if 'Rate Method' is 'In-Arrears' or bearing and RFR method is Lockout.

Payment Delay

The user can select Payment Delay as RFR preference if the Rate Method is In-Arrears.

In this method, Interest payments are delayed by a certain number of days and are thus due a few days after the end of an interest period.

Payment Delay Days

This field is relevant if 'Rate Method' is 'In-Arrears' or bearing and RFR method is Payment delay. Number of days by which the interest (or installment) payments are delayed by a certain number of days and are thus due a few days after the end of an interest period.

Interest Rollover

Check this box to indicate that interest rollover is allowed.

Interest Rollover method can be used as a combined method along with one each of In-arrears & In-advance methods.

Payments are set in advance and any missed interest relative to in arrears is rolled over into the next payment period.

This option combines a first payment (installment payment) known at the beginning of the interest period with an adjustment payment known at the end. The adjustment payment can be made a few days later or at the end of the next accrual period.

Plain

This field is relevant if Rate Method is In-Arrears or bearing and RFR method is Plain. System uses averaged RFR over current interest period, paid on first day of next interest period.

Last Reset

This field is relevant if 'Rate Method' is 'In-Advance' and 'Rate Convention' is Last reset. In this option, interest payments are determined on the basis of the averaged RFR of the previous period.

Last Recent

This field is relevant if 'Rate Method' is 'In-Advance' and 'Rate Convention' is Last recent.

In this option, a single RFR or an averaged RFR for a short number of days, are applied for the entire interest period

Index Value

Select the Index Value check box to use the RFR index rate.

The RFR Index measures the cumulative impact of compounding RFR on a unit of investment over time. Index Value supports below RFR preferences.

- Arrear Method

- Advance Method

- Arrear Method

- Lookback

- Lockout

- Payment Delay

- Plain

- Advance Method

- Last Reset

- Last Recent

For more information on the RFR Index Value, refer to the attached RFR Index Value calculation worksheet.

Observation Shift

Select the Observation Shift check box to apply observation Shift to RFR calculation. The observation shift mechanism provides the rate to be calculated and weighted by reference to the Observation Period rather than the relevant interest period.

Observation Shift Currently supports below RFR Methods and combination.

- Lookback

- Lockout

- Lookback and Lockout combination

For more information on the RFR Observation Shift, refer to the attached RFR Observation Shift calculation worksheet.

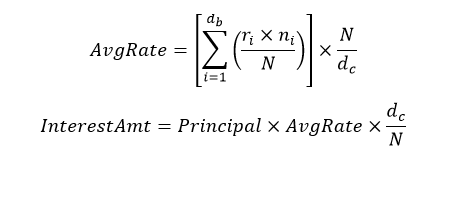

Weighted Average

Select this check box to use weighted average calculation (WAC) as the RFR calculation method.

The WAC here represent the simple average calculation and not compounded. The averaged RFR in this convention is the simple arithmetic mean of the daily RFRs. OBTR supports WAC to calculate base rate (BR), Credit Adjustment Spread (CAS), and Customer Margin. The WAC formula to calculate simple interest is:

Here,

db: the number of business days for the interest calculation period

dc: the number of calendar days for the interest calculation period

ri: reference rate for the day number i within the interest calculation period ni: the number of calendar days for which rate ri applied (on most days, ni will be 1, but on a Friday it will generally be 3, and it will also be larger than 1 on the business day before a holiday

N: the number of calendar days in one year (360 to 365)

For more information, refer to the RFR WAC sheet.

Payment Movement Calendar

Select the payment movement calendar from the drop-down list. The list displays the following values:- Calendar

- Business

If the option Business is selected, it considers holiday treatment specified for schedule as per the Holiday Preferences selected at the contract level.

Computation Calendar

Select the Computation Calendar from the drop-down list, when RFR is selected for interest calculation. The available options are:- Currency

- Financial Calendar

Financial Center

This field is mandatory if the Financial Center is selected as a computation calendar. Select the code of the financial center from the displayed list of values.

Base Computation Method

The Base Computation Method is either simple or compounded.

Spread\ Margin Computation Method

Spread\ Margin computation method can be maintained as either Simple or compounded.

Spread Adjustment Method

Spread adjustment method is kept as either Simple or compounded.

Rate Compounding

This allows enable user to select if rate compounding to be applied for each calculation period. When enabled, system opts for rate compounding instead of amount compounding, amount difference comes into effect only if the pre-payment is done.

For more information on Rate compounding method, refer to the attached Rate Compounding calculation worksheet.

RFR Rounding Unit

Specify the Rounding Units value to round daily index value to the nearest whole number and use it for interest calculation.

It is applicable only when RFR index value is used.

Rate Compounding Method

Select the Rate Compounding Method from the drop-down list. The available options are:

- CCR

- NCCR

This Rate Compounding method produces a rate for a period by applying the RFR compounding formula to the RFR rate and applying the compounded rate to the principal to calculate the interest due. Currently it’s applicable for MM & SR modules.Rate Compounding supports two methods:

1. Cumulative Compounded Rate (CCR)

Calculates the compounded rate at the end of the interest period and it is applied to the whole period. It allows calculation of interest for the whole period using a single compounded rate.

2. Non-Cumulative Compounded Rate (NCCR)

It is derived from Cumulative Compounded Rate i.e., Cumulative rate as of current day minus Cumulative rate as of prior Banking day. This generates a daily compounded rate which allows the calculation of a daily interest amount.Rate Compounding supports below RFR preferences:

Arrear Method

- Lookback

- Lockout

- Payment Delay

- Plain

- On the Treasury Interest Class Definition screen,

specify the details as required.

The following steps are followed:

- Rate code Field will fetch all the rate codes maintained at CFDFLTRI (floating rate code) and CFDRFRRT(RFR codes).

- Having the RFR flag checked, the rate code selected is maintained in CFDRFRRT(RFR codes) screen.

- Selecting the rate code is a mandate when RFR flag is checked.

- Likewise having RFR flag unchecked, select a rate code maintained in CFDFLTRI (floating rate code).

- Under limits multi-block, the system allows the saving of record for RFR mapped rate code currency only. Example for RFR code: RFR only USD currency record is permitted. If in case any other currency is maintained, the system validates accordingly throws an error.

- For an RFR rate code currency, entering min and max rate is allowed.

- There are no restrictions on the interest basis selection for RFR rate code.

- RFR usage is allowed only for the Main interest component.

- The system allows multiple Interest class records for same RFR code and currency but with different preferences.

- After the Interest class maintenance is saved and authorized, the system allows you to unlock the RFR details and modify it based on the requirement.

Parent topic: Risk Free Rates