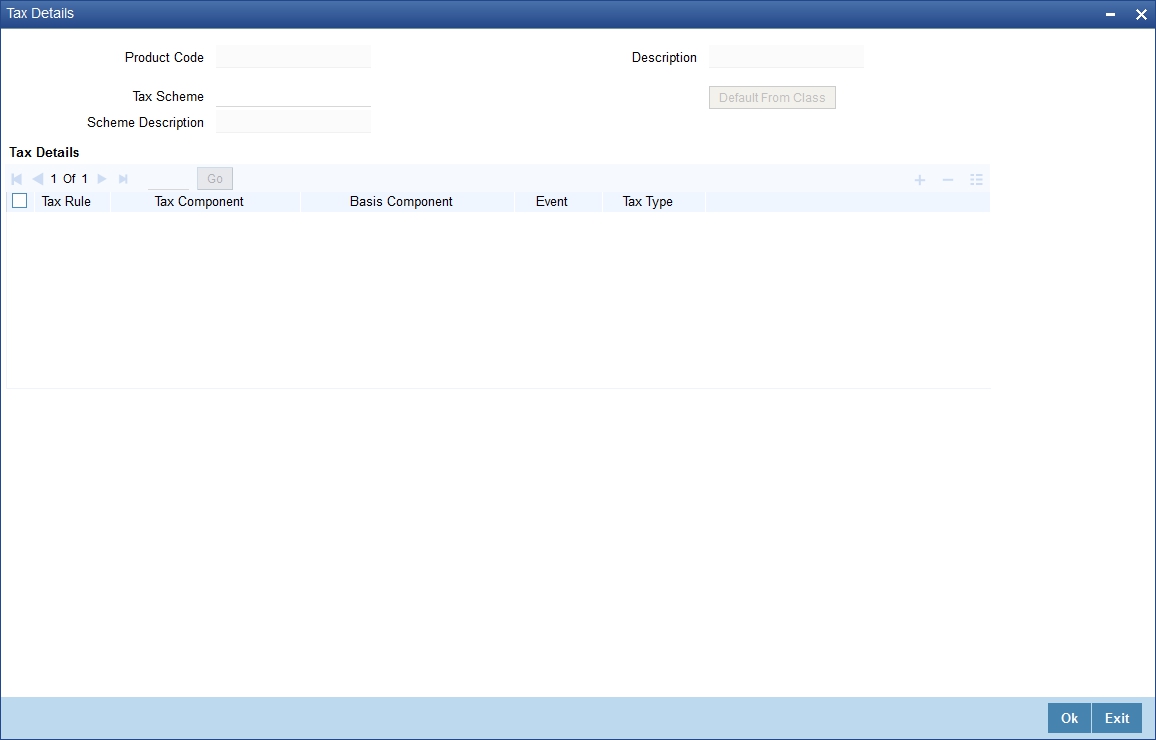

1.2.5 Tax Details

Use the Tax Details to define the Tax Details.

In Oracle Banking Treasury Management, you can compute the tax that applies on a contract or deal by:

- Setting up a tax rule

- Linking tax rules to create a tax scheme

- Associating a product with a tax scheme. The rules that are part of the scheme will apply on all contracts processed under the product

- Amending, if required, certain tax details that a contract acquires from the product under which it is processed

You can identify the tax components for a product in the Tax Details screen.

Parent topic: Product Definition