- Securities User Guide

- Credit Default Index

- CDI Derivative Deal Input

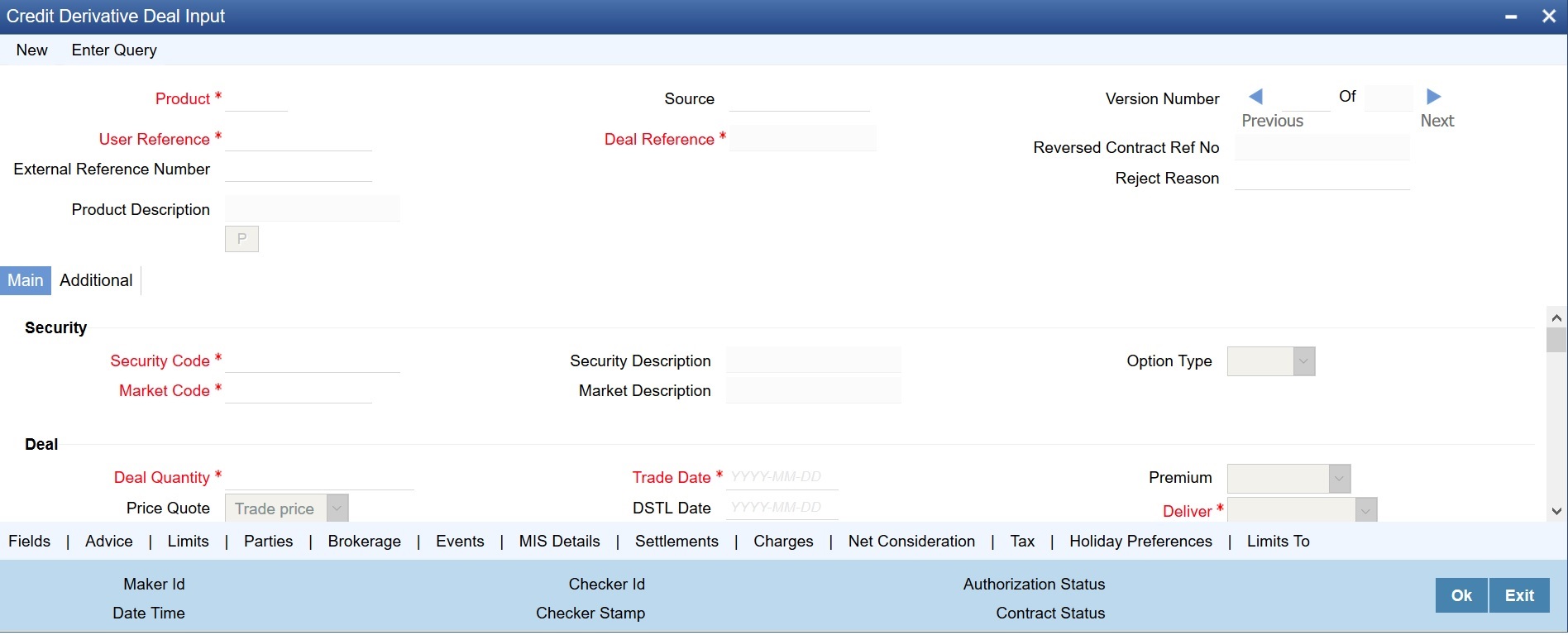

29.9 CDI Derivative Deal Input

This topic describes the systematic instructions for CDI derivative deal input.

- On the Home page, type DCDDLONL in the text box, and click the next arrow.

Credit Derivative Deal Input screen is displayed.

- On the Credit Derivative Deal Input screen, specify the details as required.

For field description, see the below table

Table 29-17 Credit Derivative Deal Input - Field Description

Field Description Nominal amount

Nominal amount of the contract.

Caution:

Ensure to provide this details if the price quote is spread or % spread.

Equivalent Price

Price equivalent for Spread (BPS) or %Spread price quotation.

For more information, see Process Securities Data Input Screen:

- In case of Bank sell, if spread is lesser than (Premium rate of instrument/100) or spread% is lesser than 100 then it is considered as upfront fee income.

- In case of Bank sell, if spread is greater (Premium rate of instrument/100) or spread% is greater 100 then it is considered as upfront fee expense.

- In case of Bank buy, if spread is greater (Premium rate of instrument/100) or spread% is greater than 100 then it is considered as upfront fee income.

- In case of Bank buy, if spread is lesser than (Premium rate of instrument/100) or spread% is lesser than 100 then it is considered as upfront fee expense.

- In case of Bank sell, if Trade price is lesser than Current face value or Trade price% is lesser than 100 then it is considered as upfront fee expense.

- In case of Bank sell, if Trade price is greater than Current face value or Trade price% is greater than 100 then it is considered as upfront fee income.

- In case of Bank buy, if Trade price is lesser than Current face value or Trade price% is lesser than 100 then it is considered as upfront fee income.

- In case of Bank buy, if Trade price is greater than Current face value or Trade price% is greater than 100 then it is considered as upfront fee expense.

- For Bank sell, Deliver label value to be defaulted to against payment and receive label would be defaulted to free. The field would be available for amendment.

- For Bank buy, Receive label value to be defaulted to against payment and deliver label would be defaulted to free. The field would be available for amendment.

- The calculation to be followed for the price quote as trade price quotations is as below (if Nominal amount is not entered)

- Nominal Amount = ((Trade price ~ Current face value)/100) * Deal Quantity*(Current face value/Initial face value).

- Nominal Amount = (((Trade price%/Current face value) ~ Current face value)/100)*Deal quantity* (Current face value/Initial face value)

- Nominal amount has to be optionally entered, if entered the same is used for tag Deal_Nominal Amt to be booked as contingent. It is mandatorily entered if the price quote is spread or % spread.

- In case of Bank sell, if spread < (Premium rate of instrument/100) or spread% < 100 then it is considered as upfront fee income.

- In case of Bank sell, if spread > (Premium rate of instrument/100) or spread% > 100 then it is considered as upfront fee expense

- In case of Bank buy, if spread > (Premium rate of instrument/100) or spread% > 100 then it is considered as upfront fee income.

- In case of Bank buy, if spread < (Premium rate of instrument/100) or spread% < 100 then it is considered as upfront fee expense.

- In case of Bank sell, if Trade price < Current face value or Trade price% < 100 then it is considered as upfront fee expense.

- In case of Bank sell, if Trade price > Current face value or Trade price% >100 then it is considered as upfront fee income.

- In case of Bank buy, if Trade price < Current face value or Trade price% <100 then it is considered as upfront fee income.

- In case of Bank buy, if Trade price > Current face value or Trade price% >100 then it is considered as upfront fee expense.

- For Bank sell, Deliver label value to be defaulted to "against payment" and receive label would be defaulted to "free" and disabled for amendment.

- For Bank buy, Receive label value to be defaulted to "against payment" and deliver label would be defaulted to "free" and disabled for amendment.

This topic has the following sub-topic:

Parent topic: Credit Default Index