20.3 Define Preference for a Portfolio

This topic describes preference definition for a portfolio product.

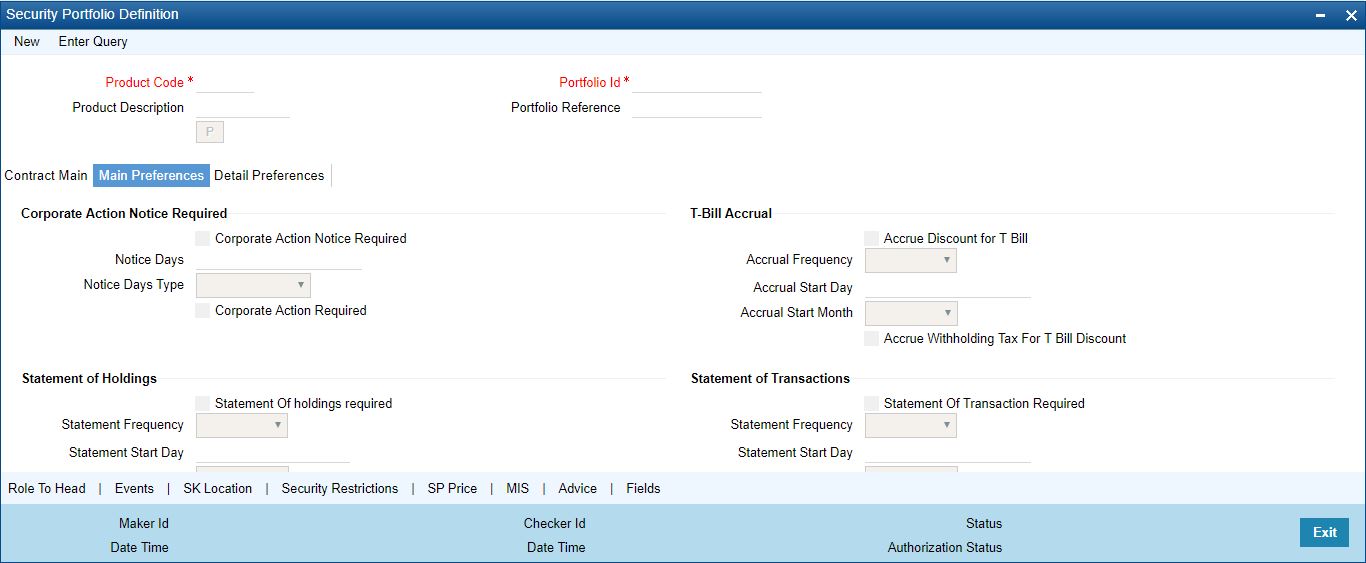

While defining a portfolio, you can indicate preferences for the portfolio. The preferences defined for the portfolio product to which the portfolio is associated defaults. You have the option to change some of the defaults, but certain details that are characteristic of the product type to which the portfolio belongs cannot be changed. The preferences that you can specify are spread over two screens:

- The Main Preference screen

- The Detail Preferences screen

Preferences (that involve accounting entries) defined for the product cannot be changed while creating a Securities Portfolio that involves it. These include:

- The asset accounting basis

- The portfolio costing method

- Whether the intrinsic value of rights and warrants needs to be booked

- Accrual preferences like

- Whether withholding tax should be accrued

- Whether the discount for T-Bills should be accrued

- Whether withholding tax for discounted T-Bills should be accrued

- Whether premium or discount should be accrued

- Whether redemption premium should be accrued

- Whether interest should be accrued

- Whether forward profit or loss should be accrued

- Revaluation preferences, such as the revaluation basis, LOCOM basis, method, frequency, and start date)

The LOCOM basis is defaulted from the Portfolio Product and can be changed. Subsequently, an amendment of the LOCOM basis specified in the Portfolio Definition screen is not possible. For details about the LOCOM basis, refer to the chapter Maintaining a Portfolio Preference Class’ of this User Manual. Further, you can specify the following preferences, for the components that can be accrued:

- The accrual method

- Accrual frequency

- Start days

- Start month

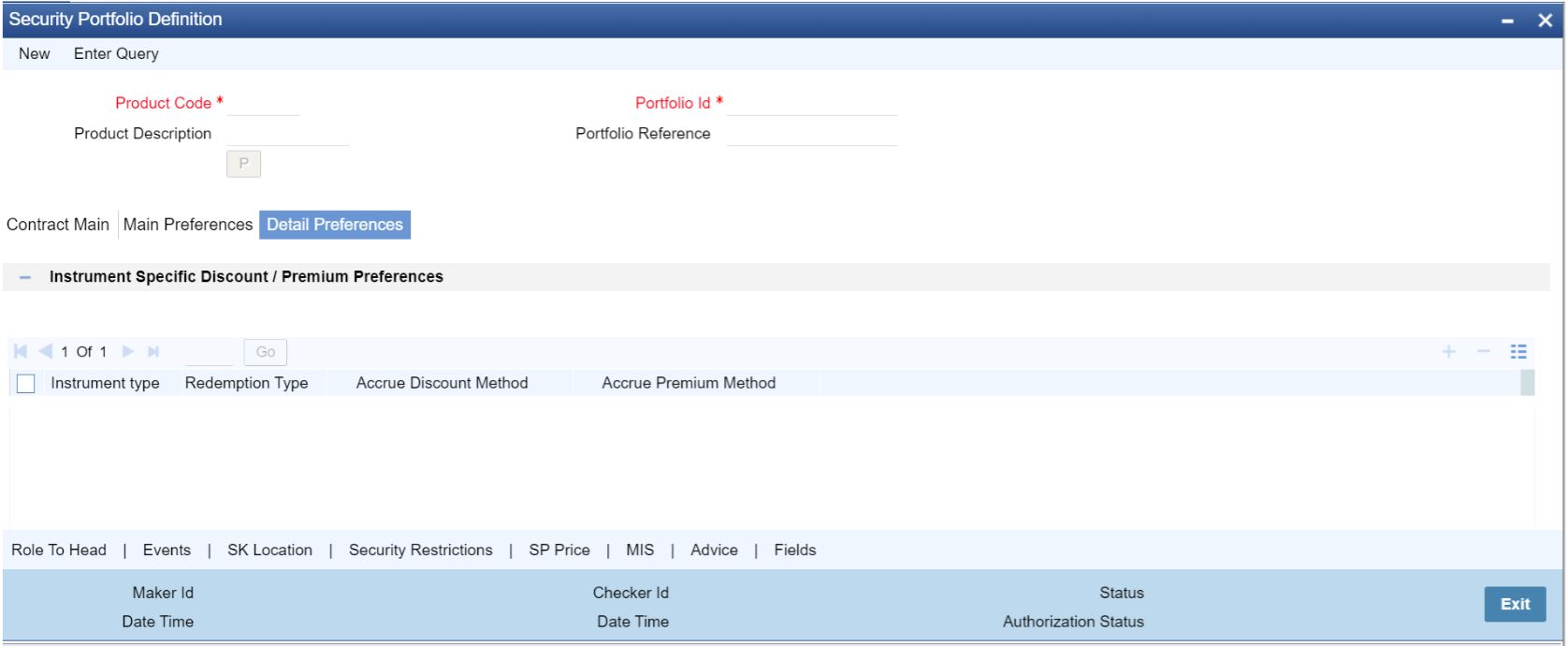

Instrument Specific Discount / Premium Preferences

This topic describes about the overview of instrument specific discount/premium preference.

Instrument Type

Select the instrument type from the adjoining drop-down list. The list displays the following options:

- Bonds

- Treasury Bills

- All

Redemption Type

Select the redemption type from the adjoining drop-down list. The list displays the following options:

- Bullet

- Quantity

- Series

- All

Accrue Discount Method

Specify the accrue discount method. If you select the redemption type as bullet, then the system will allow you to select the discount method as constant yield /exponential / straight line/ weighted moving average. However, for any other type of redemption, you can select only the type as constant yield,

Accrue Premium Method

Specify the accrue premium method. If you select the redemption type as bullet, then the system will allow you to select the discount method as constant yield /exponential / straight line/ weighted moving average. However, for any other type of redemption, you can select only the type as constant yield,

Accrual Method

The accrual method refers to the method to be used to calculate the amount of premium or discount to be accrued. You can select one of the following options from the drop-down list:

- 30 (Euro) / 360

- 30 (US) / 360

- Actual / 360

- 30 (Euro) / 365

- 30 (US) / 365

- Actual / 365

- 30 (Euro) / Actual

- 30 (US) / Actual

- Actual / Actual

- 30 (Euro) / 364

- 30 (US) / 364

- Actual / 364

If the ‘Accrue Premium Method’ or the ‘Accrue Discount Method’ selected is ‘Weighted Moving Average’, then the ‘Accrual Frequency’ cannot be ‘Daily’.

Reversal of Disc/Prem Accr

Check this box to indicate that the premium or discount that has been accrued using the ‘Weighted Moving Average’ method should be reversed.

f this is checked, the amortization accrual done using he ‘Weighted Moving Average’ method will be reversed on the following BOD. During EOY, discount/premium accrual will be realized, that is, accrual will not be reversed as part of the same EOD/BOD batch (SEAUTDLY).

This value is defaulted from the portfolio class level to the portfolio product level, where you can amend it. From the portfolio product level, it is defaulted to the portfolio definition level. Here too, you can amend it. The value at the portfolio definition level is considered as the final value and the reversal is determined by it.

Forward PL Accrual

Specify the following details:

Accrual Method

The accrual method refers to the method to be used to calculate the amount of forward profit or loss that is to be accrued. Select one of the following options from the drop-down list:

- 30 (Euro) / 360

- 30 (US) / 360

- Actual / 360

- 30 (Euro) / 365

- 30 (US) / 365

- Actual / 365

- 30 (Euro) / Actual

- 30 (US) / Actual

- Actual / Actual

- 30 (Euro) / 364

- 30 (US) / 364

- Actual / 364

Redemption Premium

Specify the following details:

Accrual Method

The accrual method refers to the method to be used to calculate the amount of premium that is due to you for holding the bond. You can select one of the following options from the drop-down list:

- 30 (Euro) / 360

- 30 (US) / 360

- Actual / 360

- 30 (Euro) / 365

- 30 (US) / 365

- Actual / 365

- 30 (Euro) / Actual

- 30 (US) / Actual

- Actual / Actual

- 30 (Euro) / 364

- 30 (US) / 364

- Actual / 364

Note:

The value of the accrual method maintained in the ‘Security Portfolio Definition’ screen is used for calculating the accrual interest for a given portfolio.

Indicating the Revaluation Level

As a branch parameter, if you have indicated that revaluation should be performed at the Holdings level, you have the option of selecting between Deal level revaluation and Position level revaluation for a specific portfolio. This option will not be made available if, as a branch parameter, you have indicated that the revaluation should be performed at the Portfolio level. You will not be allowed to revalue a portfolio at the deal level if the Costing Method for the portfolio is WAC. The default level positions and that cannot be changed. The entries passed for deal level revaluation at the event BRVL (Securities Revaluation of Positions/Deals) are:

Table 20-3 Accounting table

| Debit/Credit | Accounting Role and Description | Amount Tag and Description |

|---|---|---|

|

Debit |

MTM_EXP - Expense GL for Revaluation (MTM Method) |

MTM_EXP - Revaluation Expense(MTM Method) |

|

Credit |

MTM_LBY - Liability GL for Revaluation (MTM Method). |

MTM_EXP - Revaluation Expense(MTM Method) |

|

Debit |

MTM_ASS - Asset GL for Revaluation (MTM Method). |

MTM_INC - Revaluation Income(MTM Method) |

|

Credit |

MTM_INC - Income GL for Revaluation (MTM Method). |

MTM_INC - Revaluation Income(MTM Method) |

|

Debit |

LOCOM_REVAL_EXP - Expense GLfor Revaluation (LOCOM Method). |

LOCOM_REVAL_EXP - RevaluationExpense (LOCOM Method) |

|

Credit |

LOCOM_REVAL_LBY - Liability GL for Revaluation (LOCOM Method). |

LOCOM_REVAL_EXP - RevaluationExpense (LOCOM Method) |

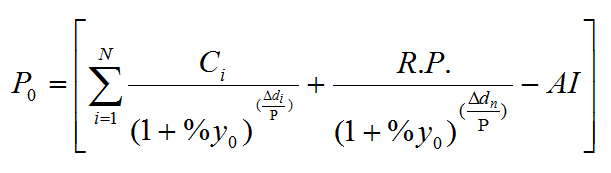

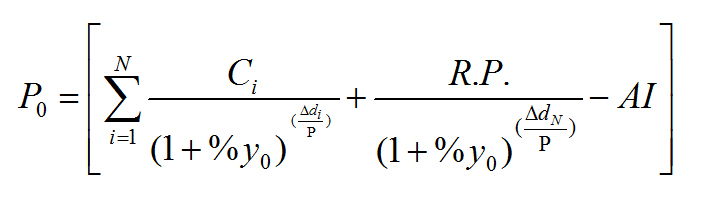

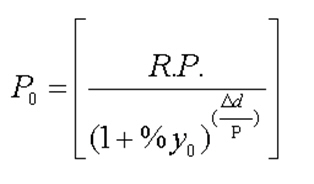

A note on Processing Bonds and T-bill based on the YTM parameters

While processing a Bond or a T-Bills, if the Price quote is not by ‘Yield to Maturity’, the YTM is computed based on the formula given below:

P0 is the Purchase price of the Bond

- P0 is the Purchase price of the Bond

- P is the Price of the Bond.

- N is the Total number of coupons

- Ci is the Coupon payment for coupon i

- y0 is the Deal YTM (Periodic)

- Y0 is the Deal YTM

- A is the Day Count Method – Denominator

- n is the Coupons in a Year

- P is the Period of Reinvestment. If Null, defaulted to A/n

- R.P. is the Redemption Price

- AI is the Accrued Interest

- Δ d i is the Coupon Date ¡V Value Date

- Δ d N is the Redemption Date – Value Date

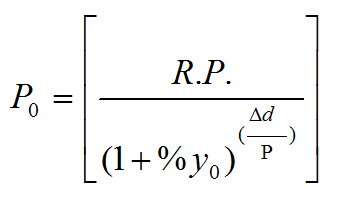

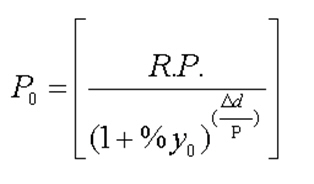

The formula used to calculate the yield given price – for T-Bills, will be

- P0 is the Purchase price of the Bond

- R.P. is the Redemption Price

- Y0 is the Deal YTM

- Δ d is the Redemption Date – Value Date

- A is the Day Count Method - Denominator

End-of-Day processing – accrual by the straight line method

During EOD processing on each day, the system picks up all deals in Bonds and T-Bills marked for DPRP accrual – based on Constant Yield Basis. ‘DPRP’ stands for Discount, Premium and Redemption Premium. In the case of Bonds, from the formula mentioned below, the YTM computed and stored at the time of saving the deal, is used to arrive at the price of the deal for the current working day (P2).

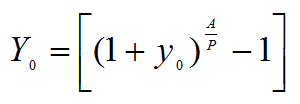

If the Annualizing method is Compound, the deal YTM is computed as follows:

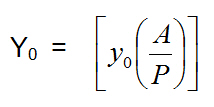

If the Annualizing method is Simple, the deal YTM is computed as follows:

If case of EX Deal, first coupon amount will be 0 (C1 = 0).

Where

- P is the Price of the Bond.

- N is the Total number of coupons.

- Ci is the Coupon payment for coupon i

- y0 is the Deal YTM (Periodic).

- Y0 is the Deal YTM.

- A is the Day Count Method – Denominator.

- n is the Coupons in a Year.

- P is the Period of Reinvestment. If Null, defaulted to A/n.

- R.P. is the Redemption Price

- AI is the Accrued Interest

- di is the Coupon Date – Application Date

- dN is the Redemption Date – Application Date

The price obtained for the current working day is then compared with the price obtained during the previous day’s EOD processing (P1). The difference between the price of the deal on the current working day and the previous day (P2 – P1) is the amount for which accrual entries will be passed, on the current working day. In the case of T-Bills, from the formula mentioned below, the YTM computed and stored at the time of saving the deal, is used to arrive at the price of the deal for the current working day (P2).

Where

- P is the Price of the T-Bill

- R.P. is the Redemption Price

- AI is the Accrued Interest

- di is the Coupon Date – Value Date

- dN is the Redemption Date – Value Date

The formula used to calculate the yield given price – for T-Bills, will be

- P0 is the Purchase price of the T-Bill

- R.P. is the Redemption Price

- Y0 is the Deal YTM

- d is the Redemption Date – Value Date

- A is the Day Count Method - Denominator

The price obtained for the current day is compared with the price obtained during the previous day’s EOD processing (P1). The difference between the price of the deal on the current day and the previous day (P2 – P1) is the amount for which accrual entries will be passed, on the current working day. For example, let us assume, in your country all Securities (Bonds, T-bills, Cps) are quoted in the market on a yield basis. Additionally, no tax is levied on any capital gains (to encourage trading) but 35% tax is charged on the Discount Amount. Accrual in a straight-line method would divide the discount amount equal to the number of days to mature. But your bank would like to calculate the present value on the Security on a daily basis and the difference will be booked as Discount Earned. In this method, the present holding cost will be always lesser than the straight line revaluation (if it is bought in discount) and hence capital gain will be higher during the sell. A T Bill worth 50,000,000.00 (FV) is Bought on 1-Sep-2002 Maturing on 08-Aug-2003 at Annual Yield rate of 13%.

Table 20-4 Buy

| Buy Date | 01-SEP-2002 | Description |

|---|---|---|

|

Redemption Date |

08-Aug-2003 |

|

|

YTM Price |

13% |

B3 |

|

Quantity (Nominal) |

50,000,000.00 |

B4 |

|

Days to Mature |

341 |

B5 |

|

Price |

89.1701 |

B6 = ROUND(100/(1+(B3*B5)/365),4)) |

|

Net Consideration |

44,585,050.00 |

|

|

Discount |

5,414,950.00 |

B14 |

On A later date (10-Sep-02)

Table 20-5 Table

| Yield | 13% | D3 |

|---|---|---|

|

Holding Quantity |

50,000,000.00 |

|

|

Days to Mature |

332 |

D5 |

|

Present Cost |

89.4257 |

D6 = ROUND(100/(1+(D3*D5)/365),4) |

|

Present Value |

44,712,85000 D7=D4*D6/100 |

|

|

Present Discount |

5,287,150.00 D14 |

|

|

Discount to Be Amortized |

127,800 |

D15 = B14- D14 |

DPRP Accrual for Bonds with quantity redemption schedules

For securities which are redeemable on call and with redemption type Quantity, you can choose to redeem a specific amount of the face value by entering the requisite percentage in the Redemption Percent field in the Securities Corporate Action Maintenance – Redemption screen. Refer to the chapter on Maintaining and Processing Corporate Actions in this manual. For such securities, the DPRP accrual takes into account the weighted average of the days to redemption.

Accrual by the exponential method

In the exponential method of DPRP accrual, the amount accrued is not the same each day, but rises exponentially with each passing day of the accrual period. The amount accrued at the end of each day is given by the following formula:

W = PP * (FV/PP)(n1/n2)

Where

W = Value of the Bond on accrual date;

PP = Purchase Price of the Bond;

FV = Face Value of the Bond;

n1 = Number of days from purchase till the date of accrual;

n2 = Number of days from purchase till maturity.

For example, consider a Bond with the following basic details:

Purchase Price = PP = 80 USD

Face Value (Nominal) = FV = 100 USD

n2 = 10

The value of the bond and the amount accrued each day till maturity is given in the table below. For comparison, the accrued amount each day, as obtained by the straight line method of accrual, is given in the last column. All figures are in USD:

Table 20-6 Bond

| n1 | Value of Bond | Value of Bond in excess of Purchase Price | Discount Accrual by exponential method | Discount Accrual by straight line method |

|---|---|---|---|---|

|

1 |

81.805 |

81.805 |

81.805 |

2.000 |

|

2 |

83.651 |

3.651 |

1.846 |

2.000 |

|

3 |

85.539 |

5.539 |

1.888 |

2.000 |

|

n1 |

Value of Bond |

Value of Bond in excess of PurchasePrice |

Discount Accrual by exponential method |

Discount Accrual by straight line method |

|

4 |

87.469 |

7.469 |

1.930 |

2.000 |

|

5 |

89.443 |

9.443 |

1.974 |

2.000 |

|

6 |

91.461 |

11.461 |

2.018 |

2.000 |

|

7 |

93.525 |

13.525 |

2.064 |

2.000 |

|

8 |

95.635 |

15.635 |

2.110 |

2.000 |

|

9 |

97.793 |

17.793 |

2.158 |

2.000 |

|

10 |

100.000 |

20.000 |

2.207 |

2.000 |

| - |

20.000 |

20.000 |

In case the redemption date is extended, the system recomputes the DPRP amounts irrespective of the accrual method maintained for DPRP. Discount/Premium accrual will be completed till the extension date (using the old redemption date). However, all the unaccrued Discount/Premium will be accrued from the transaction date of the redemption date extension. Subsequently, YTM for all the deals will also be recomputed.

Parent topic: Define Portfolio