- Securities User Guide

- Define Portfolio

- Process Details of a Portfolio

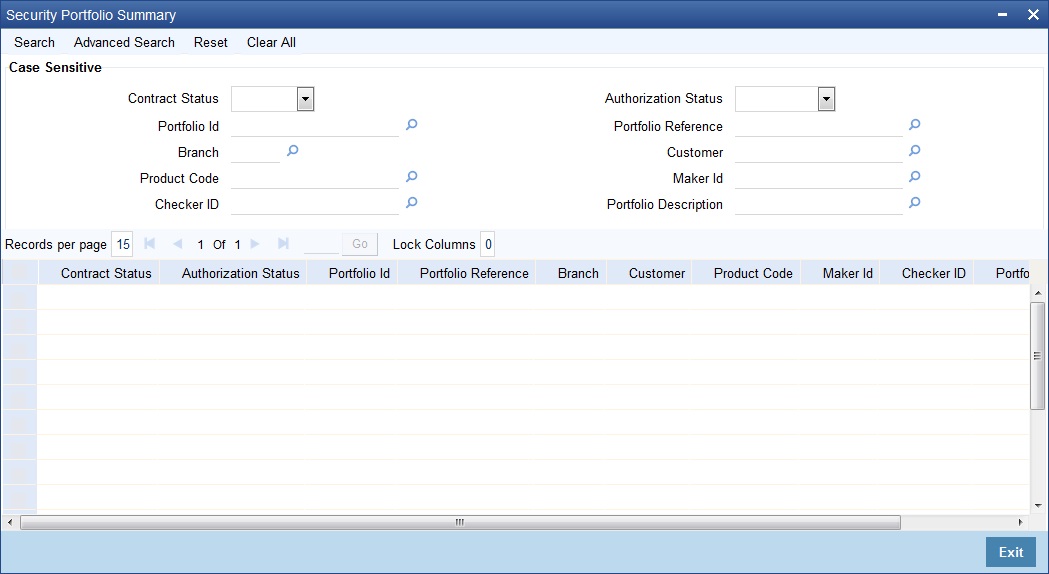

20.2 Process Details of a Portfolio

This topic describes the systematic instruction to process details of a portfolio.

- On the Home page, specify SESXPFNL in the text box, and click next arrow.

Security Portfolio Summary screen is displayed.

- On the Security Portfolio Summary screen, specify the fields.

Click the Search button to view all the pending functions. However, you can to filter your search based on any of the following criteria:

- Contract Status

- Authorization Status

- Portfolio Id

- Portfolio Reference

- Branch

- Customer

- Product Code

- Maker Id

- Checker ID

- Portfolio Description

Click Search button the records matching the specified search criteria are displayed. For each record fetched by the system based on your query criteria, the following details are displayed:

- Contract Status

- Authorization Status

- Portfolio Id

- Portfolio Reference

- Branch

- Customer

- Product Code

- Maker Id

- Checker ID

- Portfolio Description

Table 20-2 Portfolio - Field Description

Field Description Product Code

Use a product that has already been created, to enter the details of a portfolio. Depending on the type of portfolio you are creating, you can select an appropriate product code from the pick list available. A portfolio will inherit all the attributes, defined for the product associated with it. You can also add details that are specific to the portfolio, like the deal amount and details of the buyer and the seller. Some of the defaulted attributes if necessary can be changed. This feature simplified the procedure of setting up a portfolio.

Portfolio Reference Number

In Oracle Banking Treasury Management, reference numbers are generated automatically and sequentially by the system. This number tag is used to identify the portfolio being defined. The system generates a unique number for each portfolio. The portfolio reference number is a combination of a three-digit branch code, a four-character product code, a five-digit Julian Date, and a four-digit serial number. The Julian Date has the following format:

YYDDD

Here, YY stands for the last two digits of the year and DDD for the number of day(s) that have elapsed in the year. For example, January 31, 1998, translates into the Julian date: 98031. Similarly, February 5, 1998, becomes 98036 in Julian format. Here, 036 is arrived at by adding the number of days elapsed in January with those elapsed in February (31+5 = 36).

Portfolio Identification

Enter a unique reference number to identify the portfolio. The portfolio will be identified by this reference in addition to the portfolio reference generated by Oracle Banking Treasury Management. The portfolio reference generated by Oracle Banking Treasury Management is defaulted to this field. You canchoose to change it and indicate a reference of your own. You can query information on the portfolio by using any of the reference IDs.

Portfolio Type

Indicate as to which fund the aggregate account balance of all the customers under this account class will report for the depositor contribution from the option list.

- Bank (B)

- Customer (C)

- Issuer (I)

- Collateral Portfolio (P)

Note:

Collateral Portfolio is not allowed for trading.

Portfolio Description

Enter a brief description of the portfolio you are defining. This description will be associated with the portfolio for information retrieval purposes. You can change or modify the description of a class. All subsequent retrieval of information on the portfolio will contain the modified description.

Branch

In this field when the new button is clicked, the current branch is displayed.

Branch Name

This field is automatically generated. This gives a brief description of the branch.

Currency and Currency Name

Here you can choose the currency applicable for the portfolio from the available options. The currency name will default based on this selection, and it is as per the description given in the Core Module.

Asset Accounting Basis

This indicates how the assets of the portfolio should be accounted for and is applicable only for Bank Portfolios.

Note:

This field is defaulted based on the portfolio product selected and cannot be changed during portfolio definition.

Accrual basis:If you select the accrual basis for asset accounting, then on 1 January you would:Dr. Premium to be accrued USD 5Dr. Asset USD 10Cr. Customer USD 15On 30 January the amount to be accrued is USD 1. The following entries will need to be passed:Cr. Premium to be accrued USD 1Dr. Expense USD 1When you sell the bond at $20Dr. Customer USD 20Cr. Asset USD 10Cr. Premium to be accrued USD 4Cr. Profit and Loss USD 6

Customer

If you are setting up a Customer portfolio, you should indicate the customer for whom you are setting it up. Select a customer code from the list of options available. For a customer portfolio, indicate the default branch of the customer. Also, indicate a default account that should be either debited or credited when an accounting entry involving the portfolio is passed.

Note:

User can set up several portfolios for a customer of the bank, or setting up several portfolios for a customer of the bank is allowed

Customer Name

The customer name is automatically generated based on the customer code selected.

Trade Date Accounting

Check this box to indicate that accounting events for Securities position movement (SPLP, SSLP , SPSP or SSSP) should be triggered on the trade date itself.

Customer Branch

Indicate the default branch in which the customer or issuer maintains accounts with your bank. Select a branch code from the option list. This field is applicable only for customer portfolios.

Customer Account

Indicate the default account that should be used for deals involving the portfolio. This field is applicable only for customer portfolios. Select an account from the option list. The options list will contain a list of all the valid accounts that the customer maintains with your bank.

Description

A brief description about the customer account is displayed.

Portfolio Costing Method

Indicate the method in which the Holding cost of the portfolio should be calculated. These preferences are defaulted from the Portfolio product and cannot be changed during Portfolio definition.

Currency

For all types of portfolios indicate the currency of the portfolio. You can select a currency code from the available option list. The securities that constitute a portfolio can be in currencies other than the portfolio currency. When entering a deal involving the securities of the portfolio, the currency conversion would be done using the standard rate maintained in the Exchange Rate screen. The same will be done when income is earned by the securities that are part of a portfolio.

Book Intrinsic Value

A warrant or right attached to security entitles the holder to convert it into common stock at a set price during a specified period. Thus rights and warrants have a hidden or intrinsic value. The intrinsic value of a right or warrant is the difference between the exercise price of the unit and the market price of the resulting security. For asset accounting purposes, you can choose to book or ignore the intrinsic value of rights and warrants. Check against the field Rights to indicate that the intrinsic value of the rights attached to securities in the portfolio should be included for asset accounting.

Check against the field Warrants to indicate that the intrinsic value of the warrants attached to securities in the portfolio should be included for asset accounting. Leave the fields unchecked to indicate that intrinsic value should be ignored.

Auto Liquidate for Corporate Actions

The corporate actions that are applicable for securities in the portfolio can be automatically liquidated on the Event date (the date on which the corporate action is due). Check against this option to indicate the corporate actions applicable to securities in the portfolio should be automatically liquidated on the due date. Leave it unchecked to indicate that it should be manually liquidated. If you select the automatic option, the corporate action will be automatically liquidated on the liquidation date as part of the automatic processes run as part of the beginning of the day (BOD) or End of day (EOD).

Corpus Account

This field is meant for future use.

Short Positions Allowed

If you check this box, you can select whether the system should do contra holdings validation during save (Online) or at the end of the day (EOTI). If you do not want any validation on contra holdings, then you can select ‘No Check - Unlimited’. If you do not check this box, then contra holding validation has to be null. If you check this box and ‘Contra Holding Validation’ is set to 'No Check - Unlimited' or 'EOTI', then the system will display an override message when you save/modify the contract and the sell quantity is greater than the value dated holdings for a particular security code. If there is an active Repo deal in the portfolio, the system will not allow you to check this box.

You can create portfolio by checking or unchecking 'Short Positions Allowed’ and ‘Repo on Projected Holdings’ boxes.

Accrue Withholding Tax

The withholding tax levied on transactions involving a portfolio can be accrued over the tenure of the security that is traded. Check against this field to indicate that withholding tax should be accrued. Leave it unchecked to indicate otherwise.

Bankers Acceptance

Check this box if you intend the portfolio to be used for a Banker’s Acceptance deal. The value for this field defaults based on your specification in the Portfolio Product Preference screen. If the default value is ‘Yes’, you can change it to ‘No’, but not the other way round. Only those SK locations can be chosen for this portfolio, which has the Banker’s Acceptance option enabled.

Repo on Projected Holdings

Check this box to enable Repo on projected holdings. If you check this, the system will allow you to create a Repo deal based on the projected holdings.

The system allows you to create a future value dated Repo deal if this box is checked for the bank portfolio and there is available holdings. The contract status of the Repo and the linked deal will be in ‘Yet to be Initiated’ status.

If this box is checked and there is no available holdings, the system displays an appropriate override message when you book a future value dated Repo. You can accept the override and proceed to book the Repo.

You can create a portfolio by checking or unchecking 'Short Positions Allowed’ and ‘Repo on Projected Holdings’ boxes.

Collateral Portfolio Preference

Select one of the Portfolio preference from the drop-down list.

- Repo

- Reverse Repo

Allow Auto Coupon Transfer

Check this box to indicate that the coupon transfer should be allowed on the collateral portfolio. If this check box is toggled-on, then the system triggers the coupon transfer on the transaction date..

Coupon Transfer Payment Delay

Specify the number of days before which coupon transfer should not be done. Based on the values specified here, the system derives the date for CPTR processing.

If you have not specified any value, then the system will trigger the coupon transfer on the coupon (collection) event date. If the value is provided, the system will derive the transaction date for coupon transfer by adding that many number of working days (local holiday and currency holiday considered) to the coupon collection event.

Parent topic: Define Portfolio