- Securities User Guide

- Maintain Portfolio Preference Class

- Specify Portfolio Preference Class

10.1 Specify Portfolio Preference Class

This topic describes the systematic procedure to specify portfolio preference class.

- On the Home page, specify SEDXPFCL

in the text box and click next arrow.

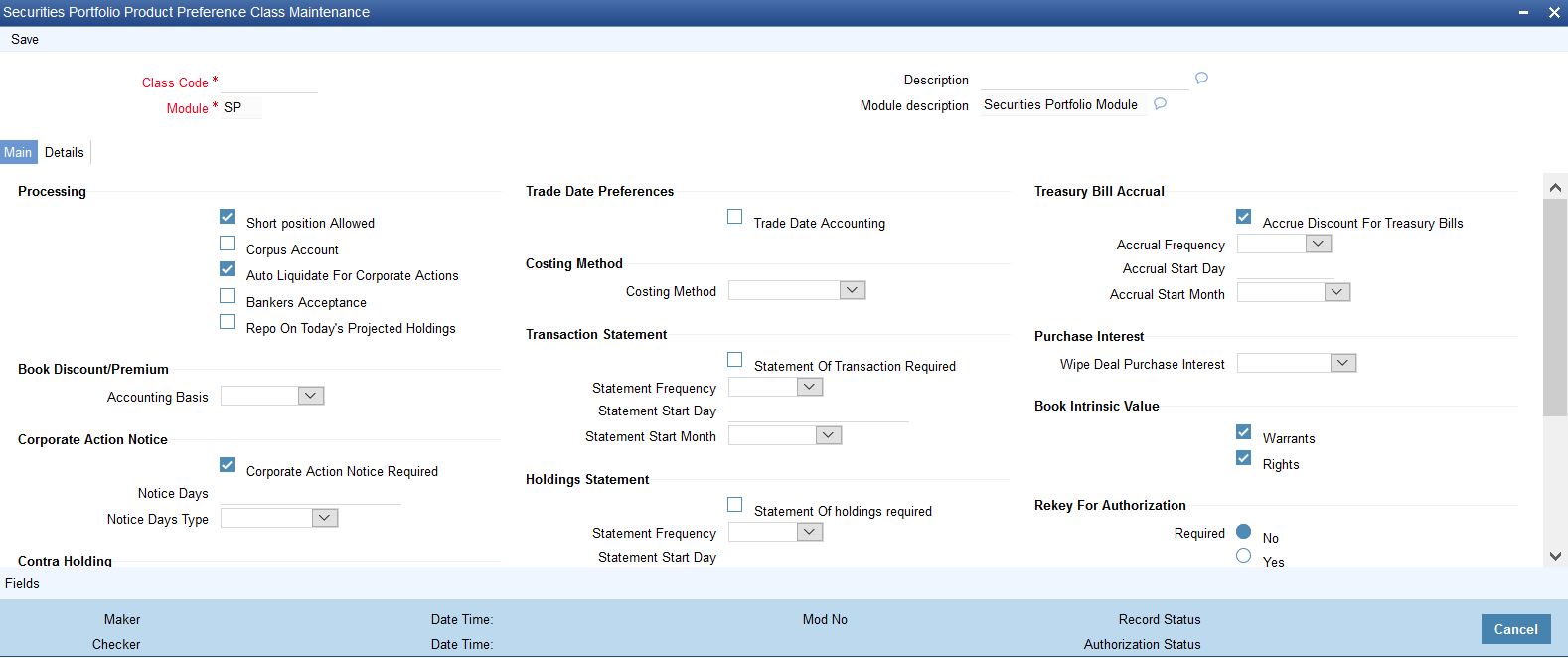

Securities Portfolio Product Preference screen is displayed.

Figure 10-1 Securities Portfolio Product Preference

Description of "Figure 10-1 Securities Portfolio Product Preference" - On the Securities Portfolio Product Preference screen,

specify the fields.

Table 10-1 Securities Portfolio Product Preference - Field Description

Field Description Class Code

Specify a code to identify a class. In Oracle Banking Treasury Management, each portfolio preference class that you maintain is identified by a unique ten-character code called a Class Code. One of the characters of the code should necessarily be a letter of the English alphabet. You can follow your own convention for devising this code.

Description

Specify a short description that will enable you to identify the portfolio preference class quickly. The short description that you specify is for information purposes only and will not be printed on any customer correspondence.

Portfolio Type

An important detail in defining a portfolio class is to specify the type of portfolio for which you are defining preferences. The portfolio type identifies the basic nature of a portfolio. In Oracle Banking Treasury Management you can set up the following type of portfolios:

- A bank Portfolio

- A customer portfolio

- Issuer portfolio

- Collateral Portfolio

This is the basic feature of a portfolio and will determine the subsequent entries that you make. This preference will be defaulted to a portfolio product and subsequently to thesecurities portfolios to which the product is associated.

Note:

Bank can create a Collateral Portfolio to hold security (pledged and received) as a part of Repo or a Reverse Repo transaction. Also, All Bank Portfolio Validations are applicable to Collateral portfolio.

Trade Date Accounting

Check this box to indicate that the accounting events for Securities position movement (SPLP, SSLP, SPSP or SSSP) should be triggered on the trade date itself for the portfolios defined using the preference class.

Costing Method

A costing method is used to determine your holding cost in a portfolio. While trading in the securities that constitute a portfolio, you can arrive at the profitable price at which you can trade, using one of the costing methods. You can indicate a costing method only if you are setting preferences for a bank type of portfolio. This is because you maintain the books of accounts only for a bank portfolio. Based on the preference of your bank you can select an option from the pick list.

The costing method includes:

- Weighted Average Cost (WAC)

- Last in first out (LIFO)

- First in first out (FIFO)

- Deal matching

For an Issuer type of portfolio, the Weighted Average Cost (WAC) method will be applicable. The costing method preference does not apply to a customer portfolio as you merely perform a custodial function and are not involved with maintaining a book of accounts for the customer. To understand the accounting methods mentioned above we will examine an example and apply all the costing methods to it. The following deals have been struck for a bank portfolio: Table 10-2

Weighted Average Cost (WAC)

The acquired cost of each security in a portfolio is maintained as an average cost. So the realized profit in this case would be computed as follows:Table 10-3

The remaining 150 securities would be held at an average cost of $95.83

Last in first out (LIFO)

In this method of cost accounting, the securities that have been bought last by a portfolio would be sold first. In this case the cost of the securities that have been sold would be $96.Table 10-4

The remaining securities would be held at:

- 50 remaining out of deal B @ $96

- 100 remaining out of deal A @ $95

First in first out

In this case the securities that have been bought first by a portfolio would be sold first. In this case the computation of accrued interest would remain the same but the cost of the securities that have been sold would be $96.Table 10-4

Deal matching

In the case of deal matching you can indicate against which of the earlier buy deals the sell deal is to be matched. Thus the realized profit would change depending on the deals selected s the matched deals. We will consider one possibility, but in reality the number of combinations is infinite.

The remaining securities would be held as

- 50 remaining out of deal A @ $95

- 50 remaining out of deal B @ $96

- 50 remaining out of deal C @ $96.5

Processing

Processing preferences refer to specifications that you indicate for the functioning of Oracle Banking Treasury Management. Based on the preferences that you indicate, Oracle Banking Treasury Management will validate or perform functions. The processing preferences that you can specify include:

Automatic Liquidation of Corporate Actions

The corporate actions that are applicable for securities in the portfolio can be liquidated on the Event date (the date on which the corporate action is due). Check against this option to indicate that the corporate actions applicable to securities in a portfolio should be automatically liquidated on the due date. Leave it unchecked to indicate that it should be manually liquidated. If you select the automatic option, the corporate action will be automatically liquidated on the liquidation date as part of the automatic processes run as part of beginning of day (BOD) or End of day (EOD).

Short Positions Allowed

A short position is selling a security without sufficient holdings. As a preference you can indicate whether while trading in securities of a portfolio you can have a short position. Check against the option 'short positions allowed' to allow short positions for the portfolio. This check box works in combination with the value in the field ‘Contra Holdings Validation’. If you check this box, you have to select a value for ‘Contra Holding Validation’. While creating a Repo deal in a portfolio, you should uncheck this box. If ‘Repo on Today’s Projected Holdings’ is checked, you should not check this box.

Contra Holdings

Contra Holdings is value dated projected holdings based on the unsettled deals.

Contra Holdings Validation

Select the method of validating the position. The drop-down list displays the following options:

- Online - Select ‘Online’ to validate the position online. If you select this, the system will allow you to create securities deal with value dated projected holdings.

- EOTI - Select ‘EOTI’ to validate the position during EOTI (End of Transaction Input) stage. If you select this, the system will allow you to create a securities deal without sufficient position. The position will be validated during EOTI stage.

- No Check - Unlimited - the system will allow you to sell more than the holdings in a portfolio for a security without restrictions on quantity and value date

It is mandatory to specify the validation method if you have checked the box ‘Short Position Allowed’. If that check box is not checked, then you need not specify the validation method If Short Position Allowed is unchecked, then the value of this field has to be null.

Note:

For a contract with the sell quantity greater than the value dated holdings for a particular security code, if you check ‘Short Position Allowed’ and set ‘Contra Holding Validation’ to ‘No Check - Unlimited’ or ‘EOTI’, then the system will display an override message when you save or modify the contract

Banker’s Acceptance

indicate whether or not the portfolio that is defined under the product, which is based on this class, can be used for a Banker’s Acceptance deal. You will be allowed to select this option only for ‘Issuer’ type portfolios. Refer to the Deal Online chapter of this User Manual for details on processing Banker’s Acceptances. Select the method of validating the position. The drop-down list displays the following options:

Repo on Today’s Projected Holdings

Check this box to enable Repo on projected holdings for the day. If you check this, the system will allow you to create a Repo deal based on the projected holdings for the day. However, this option does not allow you to create a Repo deal based on future dated projected holdings. If you check this box, you should leave the box ‘Short Positions allowed’ unchecked.

Book Discount Premium

Indicate how an asset belonging to a portfolio should be booked. In other words, the basis for asset accounting in a portfolio.

In Oracle Banking Treasury Management an asset can be booked on the following basis:- Non-accrual basis

- Accrual basis

To understand these asset accounting methods, we will examine an example and apply each basis method to it. You have purchased a USD 10 bond for USD 15 on 1 January from a customer portfolio. You have paid a premium of USD 5 for the bond. On 30 January, you sell the bond for USD 20.

Non-accrual basis

Using the non-accrual basis, the following accounting entries will need to be passed: Table 10-7

Accrual basis

select this accrual basis for asset accounting, then on 1 January you would: Table 10-8

On 30 January the amount to be accrued is USD 1. The following entries will need to be passed: Table 10-9

When you sell the unit at USD 20 Table 10-11

Book Intrinsic Value

A warrant or right attached to security entitles the holder to convert it into common stock at a set price during a specified period. Thus rights and warrants attached to security have a hidden or intrinsic value. To recall, you have already defined the intrinsic value of a right or warrant in the Securities Warrants Definition screen. As a portfolio preference, you can choose to book or ignore the intrinsic value of rights and warrants for asset accounting purposes.

Rekey for Authorization

Authorization is a way of checking the entries made by a user. All operations on a portfolio, except placing it on hold, should be authorized before the end-of-day operation is begun. When a portfolio is invoked for authorization - as a cross-checking mechanism, to ensure that you are calling the right portfolio you can specify that the values of certain fields should be entered before the other details are displayed. The complete details of the portfolio will be displayed only after the values to these fields are entered. The fields for which the values have to be given are called the “re-key” fields.

Rekey Fields

You can specify any or all of the following as re-key fields:- Portfolio ID

- Portfolio customer

- Portfolio currency

If no re-key fields have been defined, the details of the portfolio will be displayed immediately when the authorizer calls the portfolio for authorization. The re-key option also serves as a means of ensuring the accuracy of inputs. For example, suppose that you define a customer portfolio in the currency INR. The portfolio involves a product for which the re-key fields assigned are the portfolio customer and currency. By mistake, the portfolio currency is entered as USD instead of INR. When the authorizer selects the portfolio for authorization and indicates the re-key fields of portfolio currency asINR, the details of the portfolio will not be displayed. The portfolio details will not be displayed if:- The value in the field that has to be re-keyed has been entered wrongly at the time of portfolio definition, or

- The re-key value is input wrongly at the time of authorization.

When you have correctly captured the currency of the portfolio as INR and the authorizer makes an error while entering the re-key value. In such a case also, the details of the portfolio will not be displayed for authorization.

Corporate Action Notice

When you have correctly captured the currency of the portfolio as INR and the authorizer makes an error while entering the re-key value. In such a case also, the details of the portfolio will not be displayed for authorization.

Notice Days

indicate the number of days before a corporate action is due on which the corporateaction notice should be generated.

Notice Days Type

Further indicate whether the number of days that you specified was expressed in calendar or working days. For example, you have specified that a Corporate Action Notice should be generated ten days before a corporate action is due for securities in a portfolio. Today's date is 15 December; a corporate action is due for a security that is part of this portfolio on 30 December. Your bank closes for a Christmas vacation on 25 and 26 December.

For calendar days:

A Corporate Action Notice will be generated on 20 December. Ten calendar days before the corporate action is due. For working days: Going by the calendar of the bank, the Corporate Action Notice will be generated on 18 December, ten working days before the corporate action is due.

Accrue Discount for Treasury Bills

The discount or premium on Zero-Coupon Bonds or T-Bills can be accrued over its tenure. If you indicate that accrual of discountor premium applies to a portfolio preference class you can indicate accrual preferences. For example, you have purchased a 90-day T-Bill having a face value of USD 100,000 for USD 98,000. The difference between the purchase price and the face value of USD 2000 can be accrued over the 90-day tenor of the T-Bill or can be realized on its maturity. Check against the 'Accrue discount for Treasury bills' option to indicate that the discount on zero-coupon bonds and T-Bills that form part of the portfolio should be accrued. In this case, you can indicate accrual preferences like the:- Accrual frequency

- Accrual start day

- Accrual start month

The accrual preferences that you specify will be made applicable to all portfolio products to which the class is associated.

Accrual Frequency

The discount or premium on T-Bills can be accrued over the tenor of the T-Bill. The frequency at which the discount or premium has to be accrued is specified as a portfolio preference. Thus, the discount components of all T-Bill in a portfolio will be accrued at the same frequency. The frequency can be one of the following:

- Daily

- Monthly

- Quarterly

- Half yearly

- Yearly

Accrual Start Day

In the case of monthly, quarterly, half-yearly or yearly accruals, you should specify the date on which the accruals have to be done during the month. For example, if you specify the date as “30”, accruals will be carried out on that day of the month, depending on the frequency. If you want to fix the accrual date for the last working day of the month, you should specify the date as “31“a indicate the frequency. If you indicate the frequency as monthly, the accruals will be done at the end of every month -- that is, on 31st for months with 31 days, on 30th for months with 30 days and on 28th or 29th, as the case may be, for February. If you specify the frequency as quarterly and fix the accrual date as 31, the accruals will be done on the last day of the month at the end of every quarter. It works similarly for the half-yearly and yearly accrual frequency.

Accrual Start Month

If you set the accrual frequency as quarterly, half-yearly or yearly, you have to specify the month in which the first accrual has to begin, besides the date on which the accruals should be done. For example, you have selected the half-yearly option and specified the start date as 31 and the start month as of June. The first accrual will be done on 30 June for the period from January 1 to June 30 and the second one on 31 December for the period from 1 July to 31 December. If the accrual date falls on a holiday, the accruals are done as per your holiday handling specifications in the Branch Parameters screen.

Purchase Interest

While defining non-WAC portfolios you can indicate the point at which Purchase Interest is to be adjusted. (For portfolios with WAC as the costing method, this option is always set to Sale and Coupon and the purchase interest is taken into accruals and not tracked separately). The options are:

- Sale and Coupon - indicates that the purchase (acquired) interest is to be netted during any sale in the first coupon of the purchase or on the first Coupon of Purchase (during Coupon liquidation against the coupon amount).

- Sale - indicates that purchase interest is to be held till redemption. When a sale is made, purchase interest is reduced proportionately during partial sale/ full sale/ redemption. If you select this option purchase interest is not netted during coupon liquidation.

This option can be overwritten at the product level.

Note:

The option of adjusting purchase interest at Sale is applicable only for purchase interest in the CUM period. You must handle adjustments for interest exchanged in the EX period operationally.

Coupon liquidation takes place for a Portfolio + Security + SK Location combination. Therefore, for adjusting deal level purchase interest at the event CPLQ, the purchase interest of all deals contributing to the position are considered proportionately.

For Capitalized Bonds, purchase interest is wiped-off at the time of coupon liquidation as part of the SPLP (Security Purchase) event. You will need to maintain accounting entries for the same.

Note:

Maintain the accounting entries for the CPLQ and SSLP events keeping in mind whether you have set the Wipe Deal Purchase Event as Sale and Coupon or Sale.

Statement of Holdings required

Indicate whether a statement of holding should be generated for portfolios associated with the portfolio preference class. Check against this option to indicate that it is applicable to the class. Leave it unchecked to indicate otherwise. If it is applicable to the class, you can indicate preferences for its generation.

Statement Frequency

Indicate the frequency, with which a statement of holdings should be generated.

The frequency that you specify can be:

- Daily

- Monthly

- Quarterly

- Half yearly

- Yearly

Statement Start Day

Based on the frequency that you specify you can indicate the start date for the generation of the statement. The system generates a statement of holding automatically, as part of the end of cycle processing based on the preferences that you specified here. If the statement generation date falls on a holiday, the accruals are done as per your holiday handling specifications in the Branch Parameters screen.

Statement Start Month

Indicate the start month for the generation of the statement

Transaction Statement

Specify the fields.

Statement of Transactions Required

Indicate whether a transaction statement should be generated for portfolios associated with the class. Check against this option to indicate that it applies to the class. If it applies to the class, you can indicate preferences for its generation.

Statement Frequency

Indicate the frequency, with which a transaction statement should be generated. The frequency that you specify can be:- Daily

- Monthly

- Quarterly

- Half yearly

- Yearly

Statement Start Day

Based on the frequency that you specify you can indicate the start date for the generation of the statement. The system generates transaction statements for the portfolio, automatically as part of the end of cycle processing based on the preferences that you specified here. If the statement generation date falls on a holiday, the accruals are done as per your holiday handling specifications in the Branch Parameters screen.

Statement Start Month

indicate the start month for the generation of the statement

Contra Holding

A contra (short for Customer and Bank/long for Issuer) holding is when you sell more than your holdings in security (buy back more than the issued quantity in case of issuer portfolios). As a preference, you can indicate whether while trading in securities of a portfolio you can have a contra holding (negative projected holdings for bank portfolios and positive projected holdings for issuer portfolios).

Contra Holding

Contra holding is the value dated projected holdings based on the unsettled deals.

Contra Holding Validation

While saving a securities dealer, the system checks the holdings on the basis of the settlement date.

You can choose to allow the holdings in a portfolio to go negative based on the projected holdings as per the Settlement Date by enabling the Contra Holdings validation option. You need to indicate whether the projected holding can go negative for the portfolio. Select the Online option if you don’t want the position to go negative at any point in time. If you have selected the EOTI option, you will not be allowed to mark the EOTI stage if the projected holding in the portfolio is negative on any given settlement date. In case of Buy Deals viz. Bank Buys, Customer Buys or Reversal of Sell Deals, the positions are updated on authorization of the respective buy deals. In case of Sale Deals viz. Bank Sells, Customer Sells or Reversal of Buy Deals, the positions are updated on saving the respective Sell deals.

The settlement dated position checks are done for Sell Deals and Reversal of Buy Deals at the time of saving the deal and also during authorization of the deal. For contra holdings of type ‘Online’, if the projected holdings on the settlement date are going short, then an error message will be displayed while saving a Sell deal or while reversing a Buy deal.

If the contra holding is of type ‘EOTI’, if the projected holdings on the settlement date are going short, then the system throws up an override while saving a Sell deal or while reversing a Buy deal

The projected settlement date holdings are checked again at the time of marking EOTI for the branch. If the projected holdings have gone short for any of the settlement dates,

the system displays an error message and stops any further processing. You are not allowed to configure this error message as an override.

Table 10-2 Deals table

Sequence Purchase date Deal Asset Cost Number of Units Proceeds A

1 January

Buy

$95

100

$9500

B

1 January

Buy

$95

100

$9600

C

15 January

Buy

$96.5

100

$9650

D

1 February

Sell

$97

150

$14550

Table 10-3 Weighted Average Cost

Cost Details Descriptions Total Cost of the securities

$28750 for 300 units

Average cost

$95.83

Total cost price of the securities sold

$14374.5 for 150 units

Total sale proceeds

$14550 for 150 units

Realized profit

$175.5

Table 10-4 Cost Accounting Table

Cost Details Description Total cost price of the securities sold

$96 arrived at thus:

$9650 for 100 units and

$4800 for 50 units

Total sale proceeds

$14550 for 150 units

Realized profit

$100

Table 10-5 Cost Details

Cost Details Description Total cost of the securities sold

$96 arrived at thus:

$9500 for 100 units

$4800 for 50 units

Total sale proceeds

$14550 for 150 units

Realized profit

$205

Table 10-6 Entries

Content Description Value Dr

Premium to be accrued

USD 5

Cr

Customer

USD 15

Dr

Asset

USD 10

Table 10-7 March 1 Entries

Content Description Value Dr

Customer

USD 20

Cr

Asset

USD 10

Cr

Premium

USD 5

Cr

Profit and Loss

USD 5

Table 10-8 Accrual Basis - January 1

Content Description Value Dr

Premium to be accrued

USD 5

Dr

Asset

USD 10

Cr

Customer

USD 15

Table 10-9 Accrual Basis - January 30

Content Description Value Dr

Premium to be accrued

USD 5

Dr

Asset

USD 10

Cr

Customer

USD 15

Table 10-10 USD 1 Entries

Content Description Value Cr

PTBA

USD 1

Dr

Expense

USD 1

Table 10-11 USD 20 entries

Content Description Value Dr

Customer

USD 20

Cr

Asset

USD 10

Cr

PTBA

USD 4

DR

Customer

USD 20

Cr

Profit and Loss

USD 6s

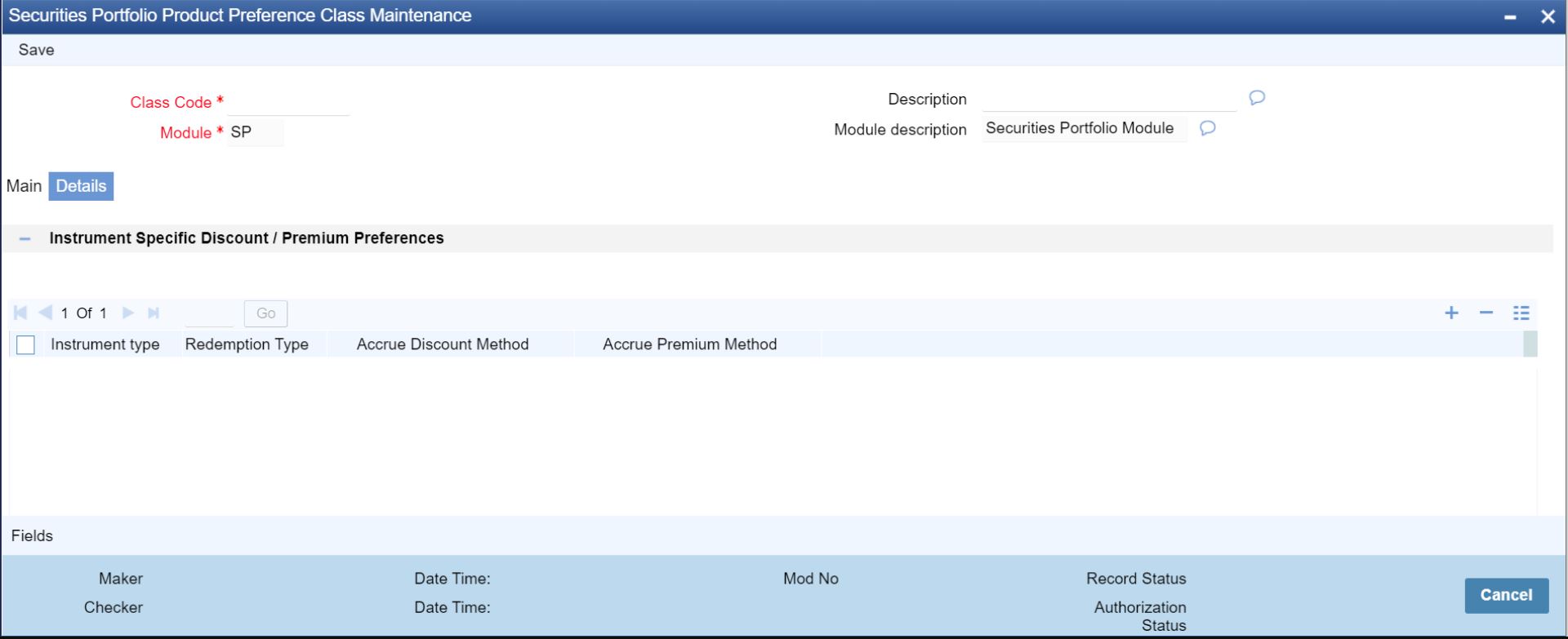

- On Security Portfolio product Preference Class Maintenance screen, click

Details.

Security Portfolio product Preference Class Maintenance Details screen is displayed.

Figure 10-2 Security Portfolio product Preference Class Maintenance Details screen

Description of "Figure 10-2 Security Portfolio product Preference Class Maintenance Details screen" - On the Security Portfolio product Preference Class Maintenance

Details screen, specify the fields.

For more information on field, refer to the below table.

You can maintain portfolio preference classes in the Portfolio Product Preference Class Definition screen

If you are calling a portfolio restriction class record that has already been defined, choose the Summary option.

Table 10-12 Details Tab - Field Description

Field Description Instrument Type

Select the instrument type from the adjoining drop-down list. The list displays the following options:

- Bonds

- Treasury Bills

- All

Redemption Type

Select the redemption type from the adjoining drop-down list. The list displays the following options:

- Bullet

- Quantity

- Series

- All

Accrue Discount Method

Specify the accrue discount method. If you select the redemption type as bullet, then the system will allow you to select the discount method as constant yield /exponential / straight line/ weighted moving average. However, for any other type of redemption, you can select only the type as constant yield.

Accrue Premium Method

Specify the accrue premium method. If you select the redemption type as bullet, then the system will allow you to select the discount method as constant yield /exponential / straight line/ weighted moving average. However, for any other type of redemption, you can select only the type as constant yield.

Premium/Discount Accrual

The premium or discount on coupon-bearing instruments can be accrued over a period. If you indicate that accrual of discount or premium applies to a portfolio product preference class, you can indicate accrual preferences. For example, you have purchased a USD1000 bond for USD 1200 and hold it for 5 years to maturity. You have paid a premium of USD 200 for the security.

Choose to accrue the premium of USD 200 over the tenure of the bond or book it as a loss when the bond matures.

Accrue Premium

Check against this option to indicate that premium should be accrued.

Accrue Discount

Check against this option to indicate that discounts should be accrued.

Also, you should ensure that accrual of both discount and premium is based on the same method i.e. either Straight Line or Constant Yield method. Yield for deals involving WAC portfolios with Constant Yield method of premium/discount accrual will not be calculated at deal input. Instead, it will be calculated on deal settlement as a part of the EOD batch process. This yield will be updated for all the deals in the particular holding. Yield for the holding will be calculated on the settlement of Bank Buy deals for all WAC portfolios other than Issuer portfolios wherein the yield will be calculated on the settlement of Bank Sell deals. The computed yield will be stored at the branch + portfolio + security level.

Note:

The yield computation for WAC portfolio will be triggered for the following events:

- Buy Deal (Sell for Issuer)

- Reversal of a buy deal (Reversal of Sell for Issuer)

- Back dated Buy (Back dated Sell for Issuer)

- Reversal of Back dated buy (Reversal of Back dated Sell for Issuer)

Maturity Date Extension

If you have chosen to accrue premium or discount, you need to specify the following accrual preferences also:

- Accrual method

- Accrual Frequency

- Accrual start day

- Accrual start month

The accrual preferences that you specify will be made applicable to all portfolio products to which the class is associated.

Accrual Method

Select the method to be used to calculate the amount of premium or discount to be accrued from the adjoining drop-down list. This list displays the following values:

- 30 (Euro) / 360

- 30 (US) / 360

- Actual / 360

- 30 (Euro) / 365

- 30 (US) / 365

- Actual / 365

- 30 (Euro) / Actual

- 30 (US) / Actual

- Actual / Actual

- 30 (Euro) / 364

- 30 (US) / 364

- Actual / 364

Accrual Frequency

The premium or discount on securities can be accrued over the tenor for which you hold the security. The frequency at which these components have to be accrued has to be specified as a Portfolio product preference. Thus, the premium or discount components of all securities in a portfolio will be accrued at the same frequency.

- Daily

- Monthly

- Quarterly

- Half yearly

- Yearly

If the ‘Accrue Premium Method’ or the ‘Accrue Discount Method’ selected is ‘Weighted Moving Average’, then the ‘Accrual Frequency’ cannot be ‘Daily’.

Accrual Start Day

In the case of monthly, quarterly, half-yearly or yearly accruals, you should specify the date on which the accruals have to be done during the month. For example, if you specify the date as ‘30’, accruals will be carried out on that day of the month, depending on the frequency. If you want to fix the accrual date for the last working day of the month, you should specify the date as ‘31’ and indicate the frequency. If you indicate the frequency as monthly, the accruals will be done at the end of every month -- that is, on 31st for months with 31 days, on 30th for months with 30 days and on 28th or 29th, as the case may be, for February. If you specify the frequency as quarterly and fix the accrual date as 31, the accruals will be done on the last day of the month at the end of every quarter. It works similarly for half-yearly and yearly accrual frequency.

Accrual Start Month

If you set the accrual frequency as quarterly, half-yearly or yearly, you have to specify the month in which the first accrual has to begin, besides the date on which the accruals should be done. For example, you have selected the half-yearly option and specified the start date as 31 and the start month like June. The system will do the first accrual on 30 June for the period from January 1 to June 30, and the second one on 31 December for the period from 1 July to 31 December. If the accrual date falls on a holiday, the accruals are done as per your holiday handling specifications in the Branch Parameters screen.

Reversal of Disc/Prem Accr

Check this box to indicate that the premium or discount that has been accrued using the ‘Weighted Moving Average’ method should be reversed.

If this is checked, the amortization accrual done using the ‘Weighted Moving Average’ method is reversed on the following BOD. During EOY, discount/premium accrual will be realized, that is, accrual will not be reversed as part of the same EOD/BOD batch (SEAUTDLY).

This value is defaulted from the portfolio class level to the portfolio product level, where you can amend it. From the portfolio product level, it is defaulted to the portfolio definition level. Here too, you can amend it. The value at the portfolio definition level is considered as the final value and the reversal is determined by it.

Limit Tracking

Your liability in holding security is tracked under a Credit Line. You have already specified security limits, which indicate the maximum limit up to, which you can trade in security. For limit tracking purpose you can indicate the basis on which your liability to the security should be determined. In Oracle Banking Treasury Management you can use one of the following options:

- Face-value

- Market price

- Book price

If you indicate face value, then the face value of the instrument will be used to track your liability in holding the security. Your liability using the face value is calculated thus:

Liability = Face Value * Number of units held

The market price indicates the price at which the security is currently quoted in the market. Your liability to the security is calculated by using the current market value of the security; multiplied by the number of units held.

Liability = Face Value * Number of units held

The book price refers to the price at which you hold a security. The book price of a security is derived using the costing method that you specified for the portfolio.

Your liability is the book price multiplied by the total number of units held.

Liability = Book Price * Number of units held

For example, you enter a deal in Oracle Banking Treasury Management to buy 100 units of equity for a bank portfolio. The face value of the equity is USD 10. Currently the equity is quoted in the market for USD 15. The book price of the security using the Weighted Average Costing method is USD 12.For simplicity, assume that you have set up your exposure limit to the equity as USD 1200.You have indicated that an exposure beyond this amount is an exception and further processing of the deal should be stalled. If your exposure to the security reaches USD 1200 an override should be sought. Face value Your liability in holding 100 units of the security is:Face Value * Number of Units = LiabilityUSD 10 * 100 = USD 1000The deal will go through smoothly as it is below the security limit that you set up.Market ValueYour liability in holding 100 units of the security is:Market Value * Number of Units = LiabilityUSD 15 * 100 = 1500In this case, Oracle Banking Treasury Management will not allow you to process the deal as you have exceeded the security limit that was set up.Book valueYour liability in holding 100 units of the security is: Book Price * Number of Units = Liability USD 12 * 100 = USD 1200

Liability = Book Price * Number of units held

For example, you enter a deal in Oracle Banking Treasury Management to buy 100 units of equity for a bank portfolio. The face value of the equity is USD 10. Currently the equity is quoted in the market for USD 15. The book price of the security using the Weighted Average Costing method is USD 12.For simplicity, assume that you have set up your exposure limit to the equity as USD 1200.You have indicated that an exposure beyond this amount is an exception and furtherprocessing of the deal should be stalled. If your exposure to the security reaches USD 1200 an override should be sought.Face valueYour liability in holding 100 units of the security is:Face Value * Number of Units = LiabilityUSD 10 * 100 = USD 1000The deal will go through smoothly as it is below the security limit that you set up.Market ValueYour liability in holding 100 units of the security is:Market Value * Number of Units = LiabilityUSD 15 * 100 = 1500In this case, Oracle Banking Treasury Management will not allow you to process the deal as you have exceeded the security limit that was set up.Book valueYour liability in holding 100 units of the security is: Book Price * Number of Units = Liability USD 12 * 100 = USD 1200

Forward Profit and Loss Accrual

Specify the fields.

Forward PL Accrual

The forward profit or loss on a deal can be accrued over a period starting from the deal spot date to the settlement date of the deal. As a preference for a portfolio, you can indicate whether the forward profit or loss should be accrued. Your profit or loss in a deal is determined thus:For a Buy deal if strike price is greater than spot price then it is a loss. For a Buy deal if strike price is less than spot price then it is a profit. For a Sell deal if strike price is greater than spot price then it is a profit. For a Sell deal if strike price is less than spot price then it is a loss.

Check against the Forward profit and loss accrual option to indicate that the forward profit or loss should be accrued. Example: You strike a forward deal on 1 January to buy 100 units of security. The settlement date of the deal is 10 January. Your deal strike rate is USD 100 and the market price of the security stands at USD 120.Market Value (120) - Strike Rate (100) x No of units (100)= USD 2000 Profit You have made a profit of USD 2000.

You can choose to accrue the USD 2000 over the 10 days or realize it as a profit on the settlement date of the deal. If you indicate that accrual of profit or loss applies to a portfolio class you can indicate accrual preferences like the:

- Accrual method

- Accrual frequency

- Accrual start day

- Accrual start month

The accrual preferences that you specify will be made applicable to all portfolio products to which the preference class is associated.

Note:

note: The forward profit or loss amount is accrued over the period starting from the deal spot date to the deal settlement date. We will call this the regular accrual cycle.

However, based on the accrual frequency preferences that you specify, the accrual start date can fall before or between the regular accrual cycle. If the accrual start date that you specify falls before the spot date of the deal, no accrual will be carried out until the spot date. If the accrual start date that you define falls between the spot date and the settlement date, accrual will begin on the start date that you specify. On the accrual, start date accrual entries will be passed even for the lapsed period between the spot and the accrual start date.

Example

You strike a forward deal on 1 January to buy 100 units of a security. The settlement date of the deal is 20 January and the Spot date is 01 January. You have specified the following accrual preferences:

Start date: 10th.

Start month: January.

Based on the regular accrual cycle, accrual can start any time between 1 January and 20 January. Based on the accrual preferences that you specify accrual can start only on 10 January. However when accrual is done on the 10 January it will be done also for the elapsed period (01 to 10January).

Accrual Method

Select the method to be used to calculate the amount of forward profit or loss that is to be accrued from the adjoining drop-down list. This list displays the following values:

- 30 (Euro) / 360

- 30 (US) / 360

- Actual / 360

- 30 (Euro) / 365

- 30 (US) / 365

- Actual / 365

- 30 (Euro) / Actual

- 30 (US) / Actual

- Actual / Actual

- 30 (Euro) / 364

- 30 (US) / 364

- Actual / 364

Accrual Frequency

The forward profit that you make or the loss that you incur while trading in securities of a portfolio can be accrued until the settlement date of the deal. The frequency with which these components have to be accrued has to be specified as a portfolio preference. Thus, the forward profit or loss will be accrued at the same frequency for all securities in the portfolio.

The frequency can be one of the following:

- Daily

- Monthly

- Quarterly

- Half yearly

- Yearly

Accrual Start Day

In the case of monthly, quarterly, half yearly or yearly accruals, you should specify the date, on which the accruals have to be done during the month. For example, if you specify the date as 30, accruals will be carried out on that day of the month, depending on the frequency. If you want to fix the accrual date for the last working day of the month, you should specify the date as “31“and indicate the frequency. If you indicate the frequency as monthly, the accruals will be done at the end of every month - that is, on 31st for months with 31 days, on 30th for months with 30 days and 28th or 29th, as the case may be, for February. If you specify the frequency as quarterly and fix the accrual date as 31, the accruals will be done on the last day of the month at the end of every quarter. It works similarly for half-yearly and yearly accrual frequency.

Accrual Start Month

If you set the accrual frequency as quarterly, half-yearly or yearly, you have to specify the month in which the first accrual has to begin, besides the date on which the accruals should be done.

You have selected the half-yearly option and specified the start date as 31 and the start month as of June. The system will do the first accrual on 30 June for the period from January 1 to June 30, and the second one on 31 December for the period from 1 July to 31 December. If the accrual date falls on a holiday, the accruals are done as per your holiday handling specifications in the Branch Parameters screen.

Redemption Premium Accrual

Specify the fields.

Accrual Redemption Premium

For instruments like bonds, which bear a redemption premium, you can choose to accrue the redemption premium due to the security over its tenor. Check against the 'Accrue redemption premium' option to indicate that the premium on redemption premium bearing instruments in the portfolio should be accrued.

Example

You have purchased a USD 1000 bond with a redemption value of USD 1100. You hold it for 5 years to maturity. At the end of five years, you are paid USD 1100, USD 100 more than what you paid for it. You can choose to accrue this USD 100 over its 5 year tenor or realize it as a whole on the redemption of the bond.

If you specified that redemption premium should be accrued you can indicate accrual preferences like the:

- Accrual method

- Accrual frequency

- Accrual start day

- Accrual start month

The accrual preferences that you specify will be made applicable to all portfolio products to which the preference class is associated.

Accrual Frequency

The redemption premium can be accrued over the tenor of security. The frequency at which it has to be accrued has to be specified as a Portfolio Preference. Thus, the redemption premium of all redemption premium-bearing instruments in a portfolio will be accrued at the same frequency.

The frequency can be one of the following:

- Daily

- Monthly

- Quarterly

- Half yearly

- Yearly

Revaluation of Positions

Market-based securities are driven by market forces of demand and supply, the price of such securities tends to rise or fall in value. These fluctuations have a direct effect on the value of the portfolios to which security belongs. Oracle Banking Treasury Management provides a feature to revalue a portfolio based on settled (Holdings) or unsettled positions (Positions). You can specify the revaluation method and the frequency at which the settled and unsettled positions of the portfolio should be revalued. Further, for settled positions, you can indicate whether realized revaluation should take place.

It is important to note that revaluation entries will be passed only for portfolios belonging to the bank. For customer portfolios, however, revaluation is done solely for reporting the performance of the portfolio.

Indicating the Basis for Revaluation

In Oracle Banking Treasury Management, portfolio revaluation can be done based on the settled, unsettled position or both. However, while specifying revaluation preferences, you can choose to revalue only the settled positions or settled and unsettled positions in a portfolio. You will not be allowed to specify revaluation of only the unsettled positions in a portfolio.

Revaluation of settled positions in a portfolio can be of two types:- Realized

- Unrealized

In the case of realized revaluation, the profit, or loss entries passed after the revaluation would be posted to the relevant GL. The next revaluation will pass entries based on the market price as of the last time the revaluation was done. In the case of unrealized revaluation, the profit and loss entries passed after the revaluation will also be posted to the relevant GLs. The only difference is, that when the next revaluation entries are passed, profit or loss entries are based on the original value of the portfolio. Let us take the example of a portfolio with a holding of 100 units of security. Each unit was bought at the rate of USD 10 on 1 January 2000. The value of the holding in the portfolio is USD 1000. The portfolio is defined with realized revaluation of settled positions. We will examine a case where the revaluation for the portfolio is done daily.

Unrealized revaluation:

On 2 January the value a unit of the security falls to USD 9. Consequently, the value of the portfolio is reduced to USD 900. The revaluation will post a loss to the tune of USD 100 to the relevant profit and loss GLs. On 3 January the value of a unit of the security increases to USD 11.

The value of the portfolio now stands at USD 1100. When the revaluation is run again, the loss of USD 100 that was registered on 2 January is reversed and profit entries for USD 100 are passed to profit GLs.

Realized revaluation:

On 2 January the value a unit of the security falls to USD 9. Consequently, the value of the portfolio is reduced to USD 900. When the revaluation is done the profit and loss GLs will reflect the loss of USD 100. On 3 January the value of securities increases to USD 11. The value of the portfolio now stands at USD 1100. When the revaluation is run again, the loss of USD 100 that was registered is not reversed but the profit GLs will record an increase of USD 200. The profit as of 3 January is calculated based on the revalued portfolio value of USD 900 arrived at on 2 January.

Revaluation Method

After you indicate the basis for revaluation, you can indicate the revaluation method to be used and the frequency with which revaluation should be carried out. The options available are:LOCOM (lower of cost or market) — This method can be used for realized and unrealized revaluation. MTM (marked to market) — This method can be used for realized and unrealized revaluation. MTM revaluation can be based on either the Book Value (MTM-BV) method or the Effective Interest method (MTM-EIM).MTMLOCOM — This is a combination of the two methods LOCOM and MTM and can be used only for realized revaluation. Portfolios marked with this revaluation method will be revalued only if they register a loss. Revaluation entries are passed at the portfolio level.

The revaluation basis and method that you specify will determine how a portfolio is revalued. Select MTM – EIM method of revaluation for the portfolio that you are defining only if the following conditions are satisfied:The portfolio costing method is not WAC;Revaluation happens at the Deal level;The asset (security) is accounted for on accrual basis;The accrual method for Discount, Premium and Redemption Premium is Constant Yield; andNo Short position is allowed.

Specifying the Revaluation Basis if the Revaluation Method is LOCOM

For portfolios in respect of which you have opted for realized revaluation, and the revaluation method is ‘LOCOM’ and the costing method is ‘WAC’, you have two options about revaluation basis (the basis for LOCOM):

If you choose the LOCOM basis as ‘Acquisition Cost ‘, the revaluation profit is realized only to the extent of the accumulated realized loss – that is, revaluation profit goes towards offsetting accumulating revaluation loss.

If you choose the LOCOM basis as ‘Holding Cost’, revaluation profit is not recognized, only the revaluation loss, if any, is realized.

If a portfolio product uses a preference class for which this specification has been made, the specification defaults from the class; you can change the default. If you do so, your specification here is defaulted to any portfolios using the product. Realized revaluation using the LOCOM method, with the basis as ‘Acquisition Cost’ is done only for settled deals.

Revaluation Frequency

The frequency with which a portfolio should be revalued is specified as a portfolio preference. Once you have indicated the basis and method for revaluation, you can specify the frequency with which a portfolio should be revalued. The revaluation frequency can be one of the following:

- Daily

- Monthly

- Quarterly

- Half yearly

- Yearly

Revaluation Start Day

In the case of monthly, quarterly, half-yearly or yearly revaluation, you should specify the date on which the revaluation should be done during the month. For example, if you specify the date as “30”, the revaluation will be carried out on that day of the month, depending on the frequency.

If you want to fix the revaluation date for the last working day of the month, you should specify the date as “31” and indicate the frequency. If you indicate the frequency as monthly, the revaluation will be done at the end of every month -- that is, on 31st for months with 31 days, on 30th for months with 30 days and on 28th or 29th, as the case may be, for February. If you specify the frequency as quarterly and fix the revaluation date as 31, the revaluation will be done on the last day of the month at the end of every quarter. It works similarly for half-yearly and yearly revaluation frequency.

Parent topic: Maintain Portfolio Preference Class