- Securities Repo User Guide

- Overview of Repo

- Securities Repo Payment Input

Securities Repo Payment Input

Use the Securities Repo Payment Input to process the payment method.

- On the Home page, type SRDPAMIN in the text box, and click the next arrow.

The Securities Repo Payment Input screen is displayed.

- On the Securities Repo Payment Input screen, specify the details as required.

For RFR contract on payment delay method, no penalty is charged for payment after actual due date and within payment delay days.

For information on fields, see the below table

Table 3-73 Securities Repo Payment Input - Field Description

Field Description Contract Reference Number Specify Contract reference number

Syndication Reference Number Displays syndication reference number

Counterparty Displays contract counterparty ID

Counterparty Name Displays counterparty name

Status Displays status of payment

Reject Reason Specify the Reject reason Code for payment reversal message. The option list displays all valid code maintained in the system. Choose the appropriate one.

Outstanding Amount Currency Displays outstanding amount currency

Outstanding Principal Amount Displays the outstanding balance amount.

Outstanding Amount Repayment Displays the outstanding amount repayment.

Effective From Enter the date for which the rate must become applicable. Each rate that is defined for a Rate Code and Currency combination must have an Effective Date associated with it. This is the date on which the rate comes into effect. Once a rate comes into effect, it will be applicable till a rate with another Effective Date is given for the same Rate Code and Currency combination

Date and Amounts for Population of Components Due Specify the below fields. Value Date Specify the value date.

Limit Date Enter here the Limit Date for prepayments. If the user has given a payment limit date, the system shows all the components, which are due till the limit date.

Limit Amount Enter the Limit amount for prepayment. If the user has given the amount limit in the Amount field, it shows all the schedules for the limit amount.

Local Currency Equivalent Specify the local currency equivalent for the limit amount. The local currency equivalent is calculated using the standard rate in case of cross currency transactions.

Net Amount Settled Enter the amount being paid for a particular component. This must be less than or equal to the total amount due for the component.

If there are both positive and negative amounts are to be settled, then specify the net amount in this field.

Negative Amount Settled The system displays the total negative amount that should be settled. Partial settlement of negative amount is restricted.

Back dated payment of interest amount is allowed till last payment or amendment date whichever is later.

Local Currency Equivalent Specify the local currency equivalent for the total paid amount. The local currency equivalent is calculated using the standard rate in case of cross currency transactions.

Total Pre-paid Specify the prepaid amount.

Local Currency Equivalent Specify the local currency equivalent for the total prepaid amount. The local currency equivalent is calculated using the standard rate in case of cross currency transactions.

Liquidated Nominal Specify the Liquidated Nominal amount which is the amount that the user receives, when the user redeem a T-Bill on the maturity date.

This is also known as the face value of the T-Bill. The discount rate is used to calculate the Net Present Value (NPV) of a T-Bill when it is liquidated before the liquidation date i.e. the actual value obtained on the T-Bill when the user redeem it prior to the maturity date.

Local Currency Equivalent Specify the local currency equivalent for the liquidated nominal value of the amount. The local currency equivalent is calculated using the standard rate in case of cross currency transactions.

Discount Rate Enter the discount rate.

If the discount rate basis is Direct Input then the user has to enter the rate at which interest is to be discounted in this field.

Component Displays the Component for which payment is done

Amount Due Displays the amount due for the component that the user has to repay

Overdue Displays the overdue amount

Amount Paid Specify the paid amount.

Interest Specify the interest prepaid for the component.

Tax Specify the amount paid in tax.

Prepayment Penalty Rate Displays the Prepayment penalty rate

Penalty Amount Displays the penalty amount

Adjustment Amount Displays the Adjustment amount

Additional Adjustment Amount Displays the additional adjustment amount

Payment Remarks Specify the payment remarks

- The system validates that ,if there are outstanding positive or negative interest amounts related to multiple schedules, earlier schedules are fully paid before settling subsequent schedules.

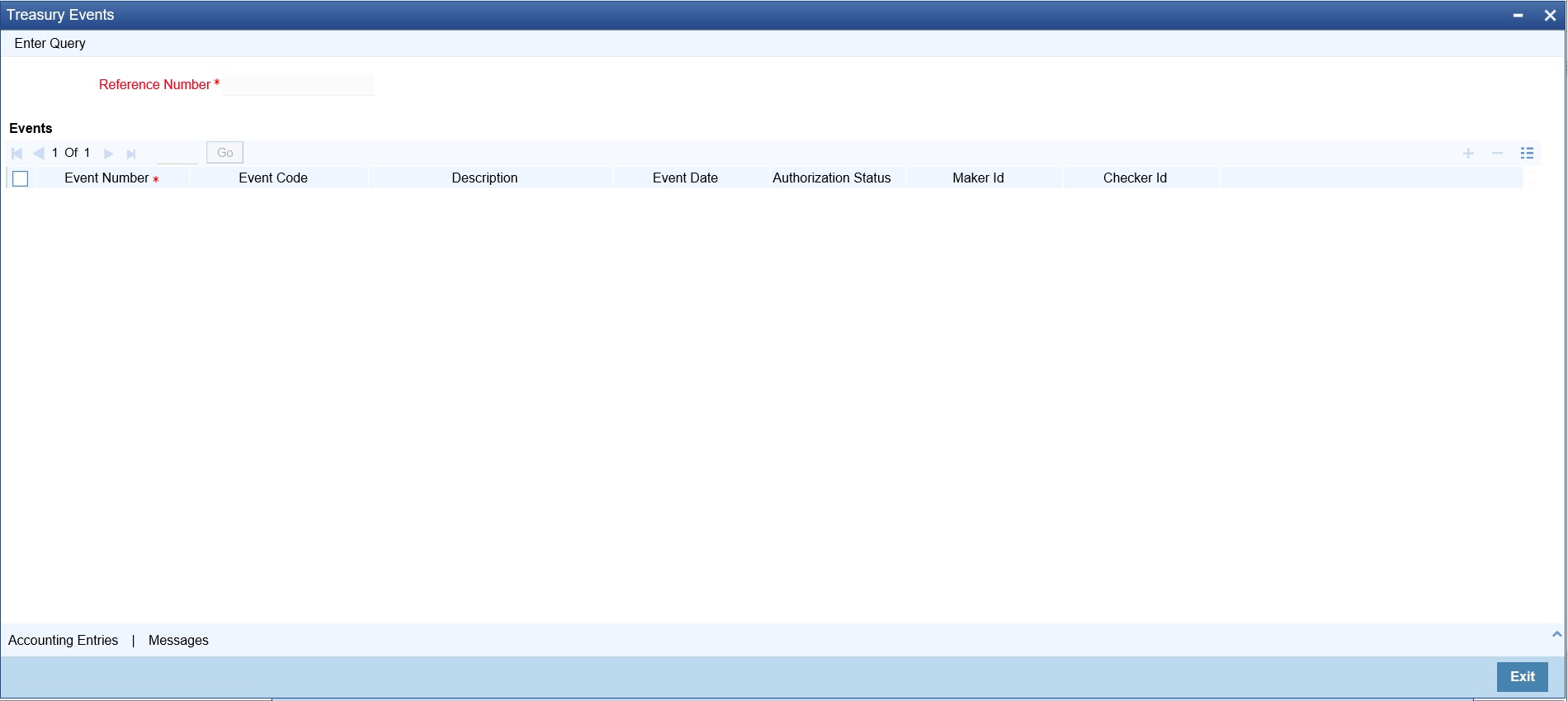

- On the Securities Repo Payment Input screen, click Events.

The Treasury Events screen is displayed.

Figure 3-80 Treasury Events

- On the Treasury Events screen, specify the details as required.

For information on fields, see the below table:

Table 3-74 Treasury Events - Field Description

Field Description Reference Number Payment reference number automatically gets defaulted for the current payment.

Events Event Number This is a Mandatory field.

Displays the event sequence number

Event Code Displays the event code

Description Displays the event code description

Event Date Displays the event date

Authorization Status Displays the event authorization status

Maker Id Displays the payment marker ID

Checker Id Displays the payment checker ID

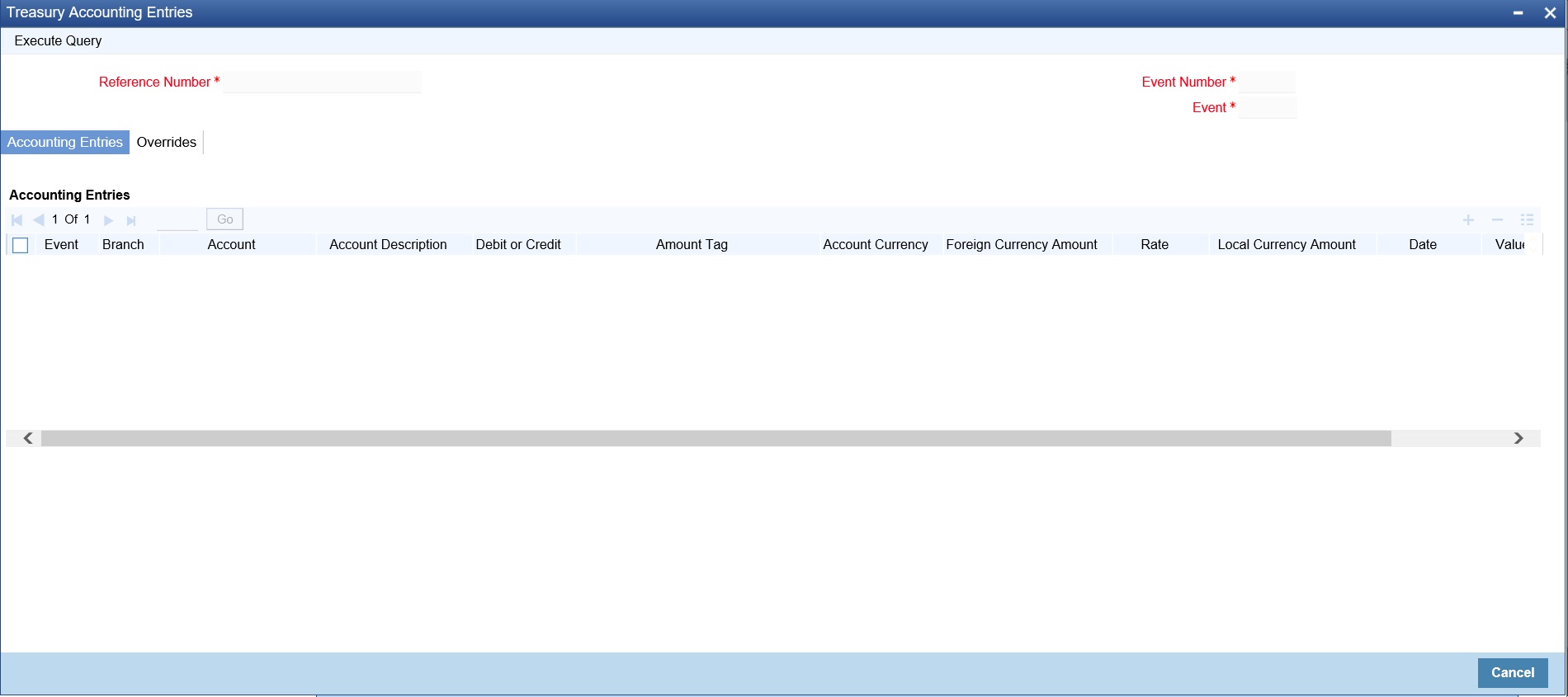

- On the Treasury Events screen, click Accounting Entries.

The Treasury Accounting Entries screen is displayed.

Figure 3-81 Treasury Accounting Entries

- On the Treasury Accounting Entries screen, specify the details as required.

For information on fields, see the below table:

Table 3-75 Treasury Accounting Entries - Field Description

Field Description Reference Number Displays the contract reference number

Event Number Displays the event number

Event Displays the event

Accounting Entries Specidy the Accounting Entries fields.

Event Displays the event

Branch Displays the account branch

Account Displays the account number

Account Description Displays the account description

Debit or Credit Displays whether account is debited or credited

Amount Tag Displays the related amount tag

Account Currency Displays the account currency

Foreign Currency Amount Displays the FCY amount

Rate Displays the exchange rate

Local Currency Amount Displays the local currency equivalent amount for a foreign currency payment

Date Displays the event date

Value Date Displays the event value date

Txn Code Displays the transaction code

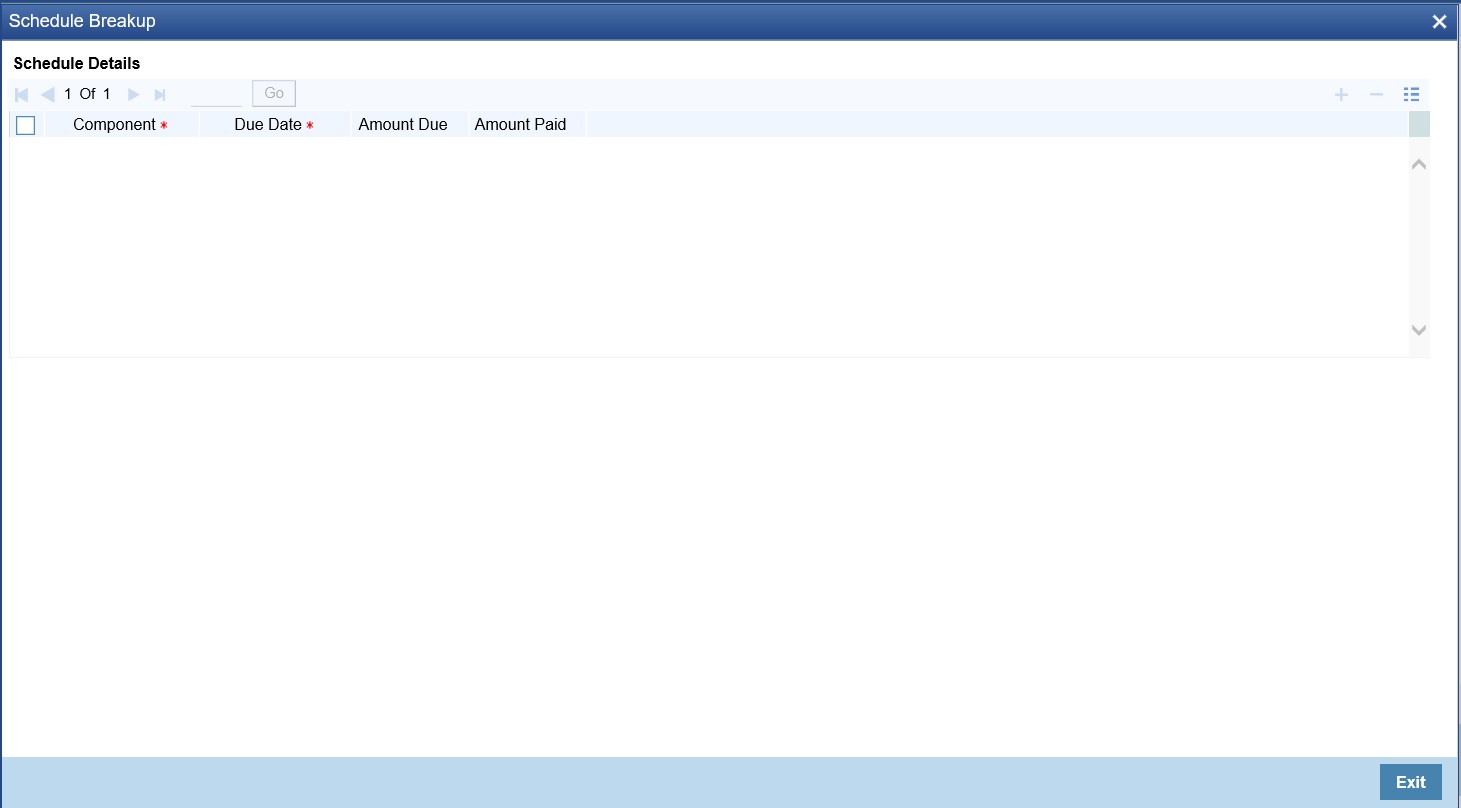

- On the Securities Repo Payment Input screen, Click Breakup

The Schedule Breakup screen is displayed.

- On the Schedule Breakup screen, specify the details as required.

For information on fields, see the below table:

Table 3-76 Schedule Breakup - Field Description

Field Description Component The component getting paid is displayed.

Due Date The due date of the component liquidated is displayed.

Amount Due The amount outstanding for the liquidated component is displayed here.

Amount Paid The user can see here the amount paid for the component as of the value date (the current system date).

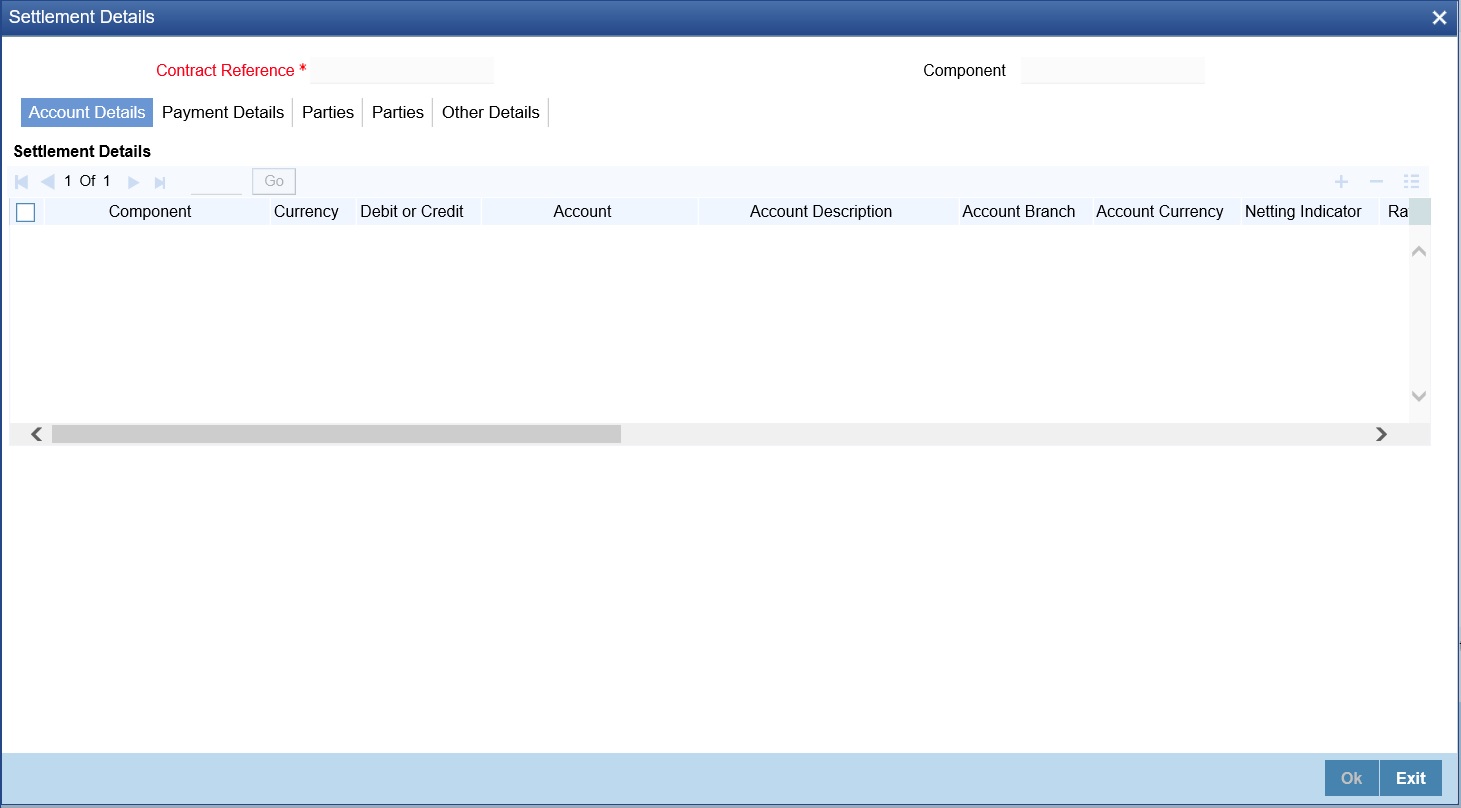

- On the Securities Repo Payment Input screen, click Settlement.

The Settlement Details screen is displayed.

Figure 3-83 Settlement Details

- On the Settlement Details screen, specify the details as required.

For more information, refer settlement guide for settlement processing.

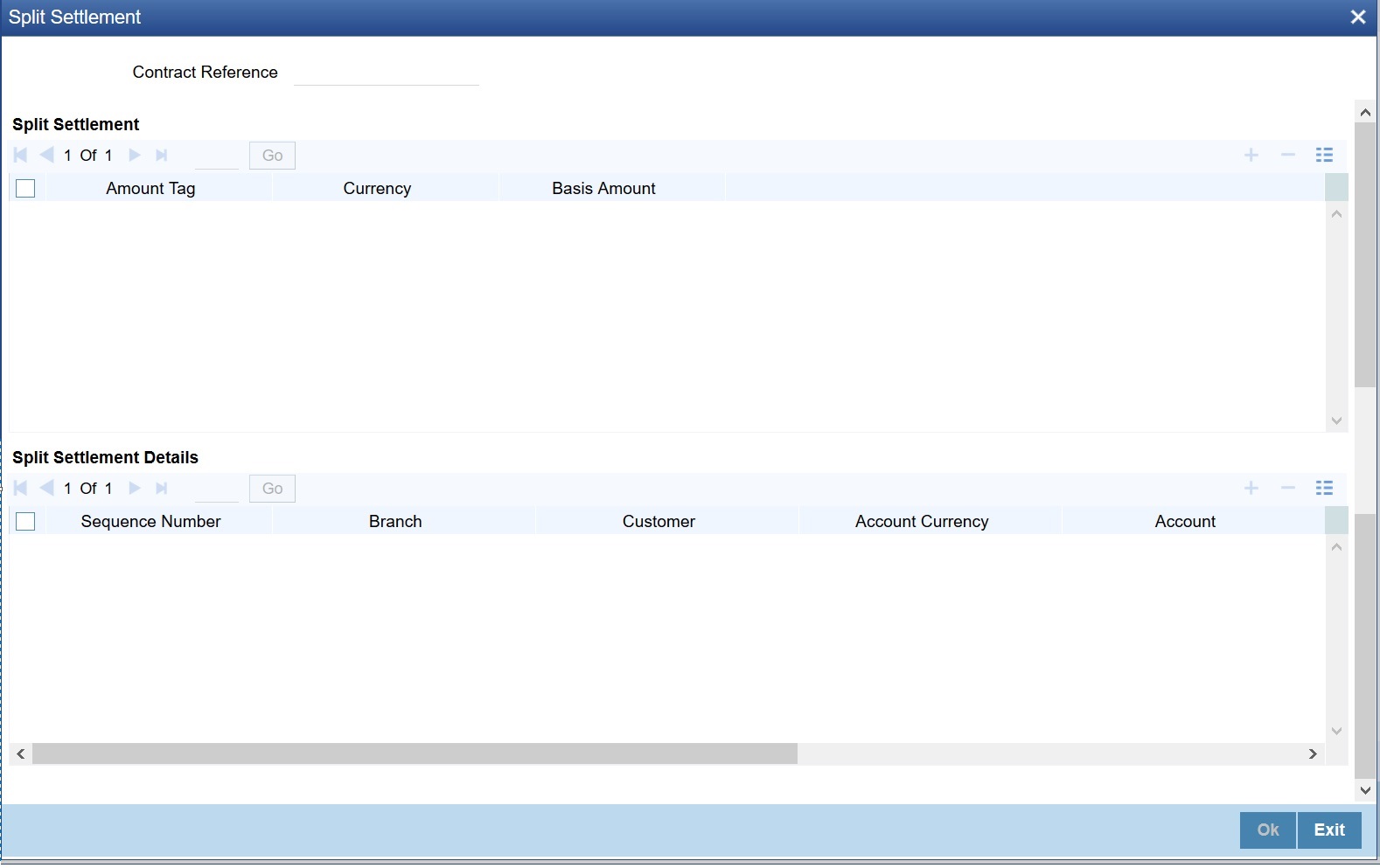

- On the Security Repo Payment Input screen, click Split Settlement.

The Split Settlement screen is displayed.

Figure 3-84 Split Settlement

- On the Split Settlement screen, specify the details as required.

For more information Step 7. Split Settlement

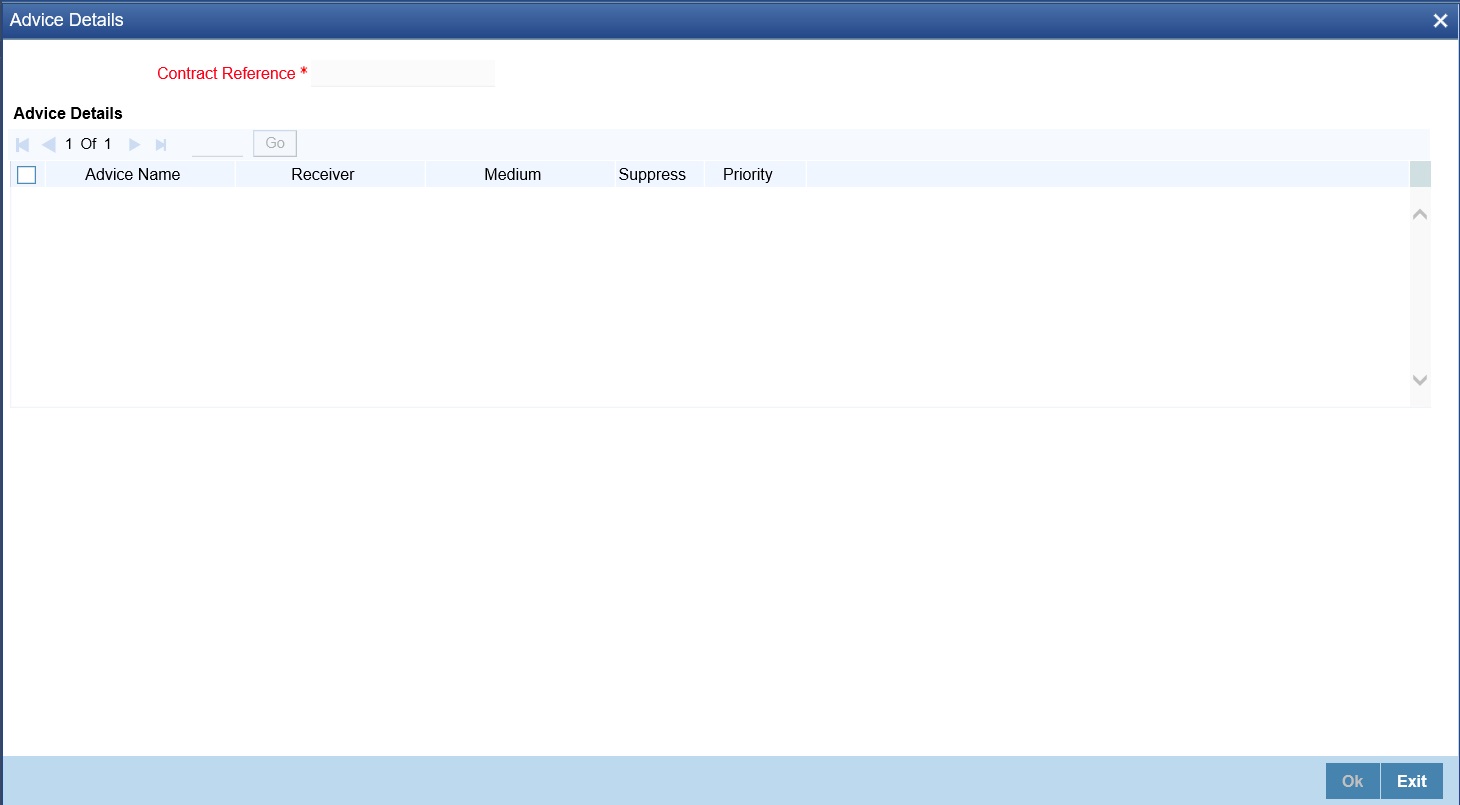

- On the Security Repo Payment Input screen, click Advice.

The Advice Details screen is displayed.

Figure 3-85 Advice Details

- On the Advices screen, specify the details as required.

For information on fields, see the below table

Table 3-77 Advices- Field Description

Field Description Contract Reference Displays contract reference number

Advice Name Displays the advice name

Receiver Displays the receiver name

Medium Displays the medium details

Suppress Displays the suppress details

Priority Displays the Priority details

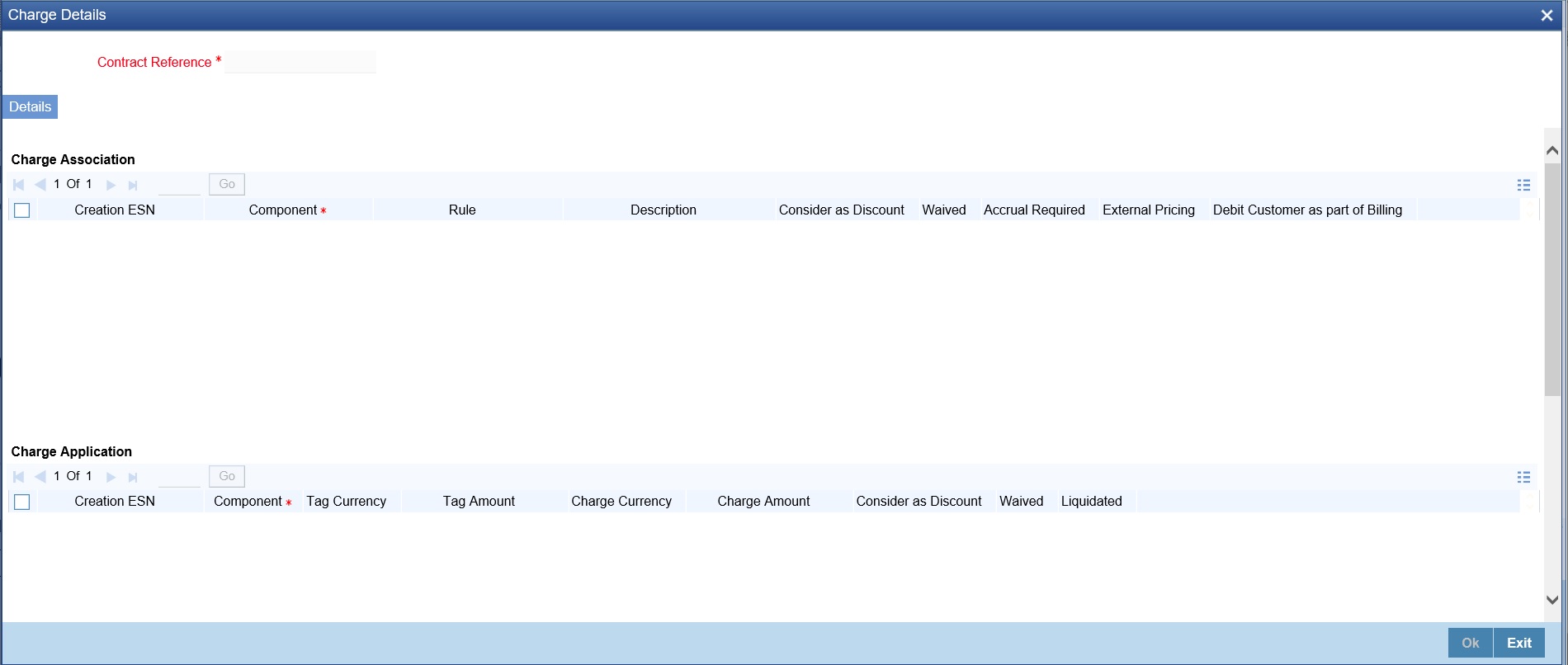

- On the Security Repo Payment Input screen, click Charges.

The Charge Details screen is displayed.

Figure 3-86 Charge Details

- On the Charge Details screen, specify the details as required.

For more information on fields, see the below table:

Table 3-78 Charges Details- Field Description

Field Description Contract Reference Displays the contract reference number

Charge Association Specify the below fields.

Creation ESN Displays the Event Sequence number

Component Displays the charge component

Rule Displays the Charge Rule ID

Description Displays the Charge Rule description

Consider as Discount Displays whether Charge component must be considered for IRR calculation

Waived Specify if user wants to waive the charge associated to the event

Accrual Required Displays if charge must be accrued or not

External Pricing Displays if charge is priced externally

Debit Customer as part of Billing Displays if charge id debited from customer

Charge Application Specify the below fields.

Creation ESN Displays Event sequence number

Component

Displays Charge component

Tag Currency

Displays tag currency

Tag Amount

Displays tag amount

Charge Currency Displays charge currency

Charge Amount Displays charge amount

Consider as Discount Displays if charge component is considered for IRR calculation

Waived Specify if the charge applied for the contract must be waived

Liquidated Displays if charge is liquidated

Charge Liquidation Specify the below fields. Event Sequence Number

Displays event sequence number.

Component Displays charge component

Charge Currency Displays charge currency

Charge Amount Displays the charge amount

Liquidated

Displays if charge is liquidate for the contract

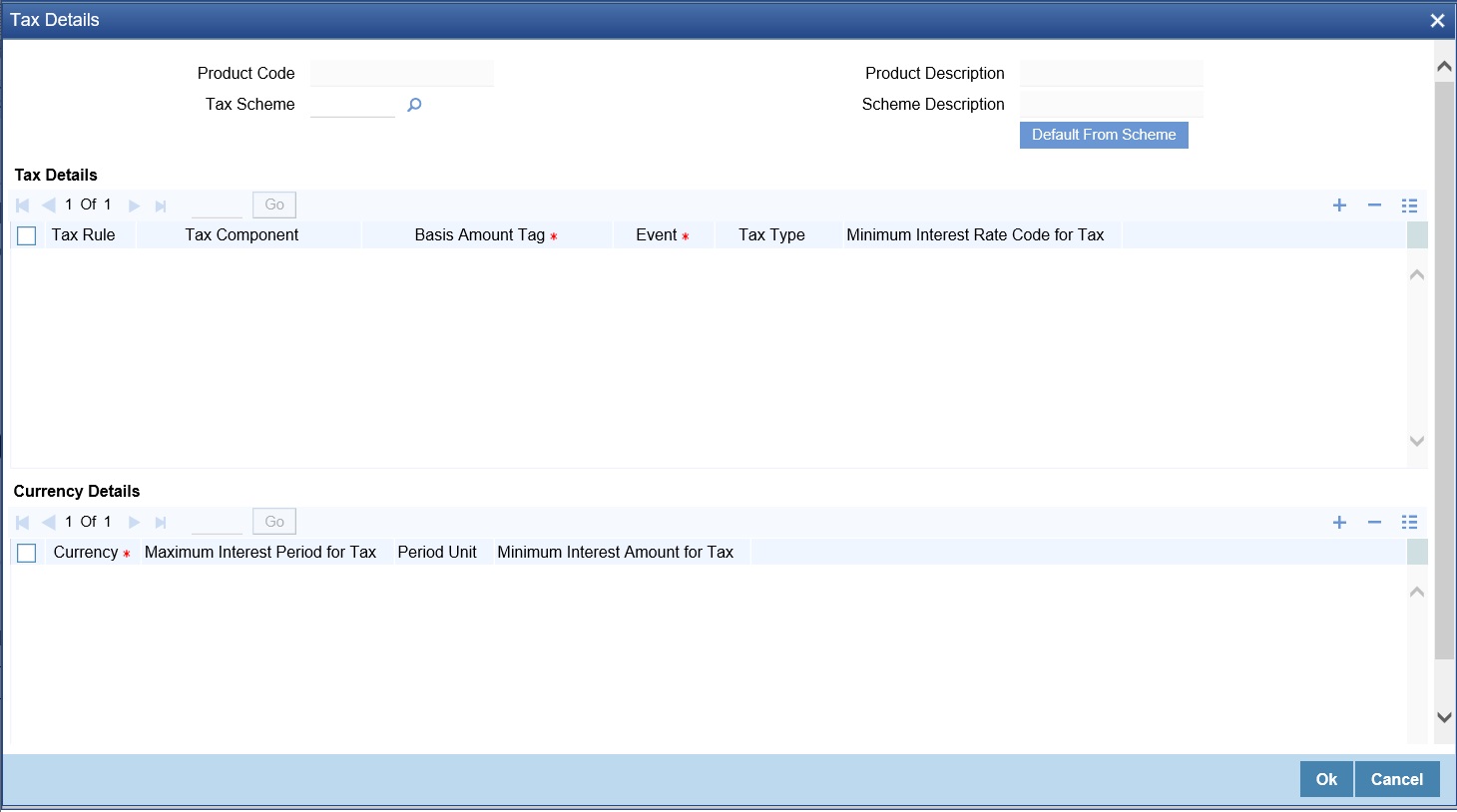

- On the Security Payment Repo Input screen, click Tax.

The Tax Details screen is displayed.

Figure 3-87 Tax Details

- On the Tax Details screen, specify the details as required.

For information on fields, see the below table

Table 3-79 Tax Details - Description

Field Description Tax Scheme Choose A Tax Scheme from the Option list

Product Description Add Product code and its description like other sub system

Scheme Description System defaults scheme description

Tax Details Specify the below fields. Tax Rule System defaults the Tax Rule mapped to the scheme for Tax computation

Tax Component The method of tax application defined for the Tax Rule will be applied on this component

Basis Amount Tag Amount tag on which Tax is computed

Event Specify the event for which the tax is applicable.

Tax type The type of tax, decides the bearer the tax. It could be the bank or the customer.

A customer bears withholding type of tax and the tax component is debited to the customer’s account. The bank bears an expense type of tax and the tax component is booked to a tax expense account.

Minimum Interest Rate Code for Tax

Specify the rate code for Tax

Currency Details Specify the below fields.

Currency Specify the currency from the list of option

Maximum Interest Period for Tax Specify the maximum interest period for the tax

Period Unit Specify the period as

- Days

- Months

- Year

Minimum Interest Amount for Tax Specify the minimum Interest amount for the tax

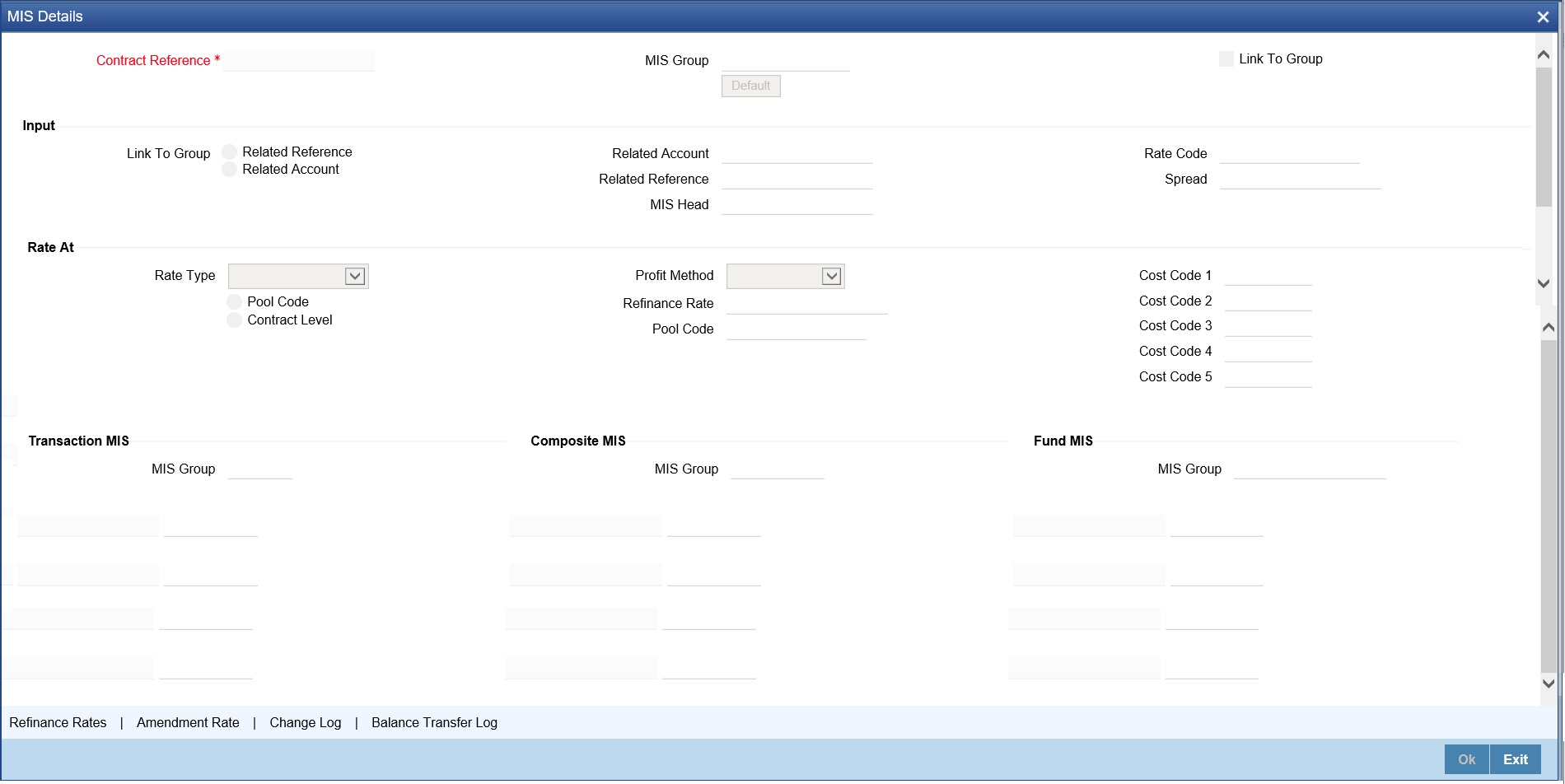

- On the Securities Repo Payment Input screen, click MIS.

The MIS Details screen is displayed.

Figure 3-88 MIS Details

- On the MIS Details screen, specify the details as required.

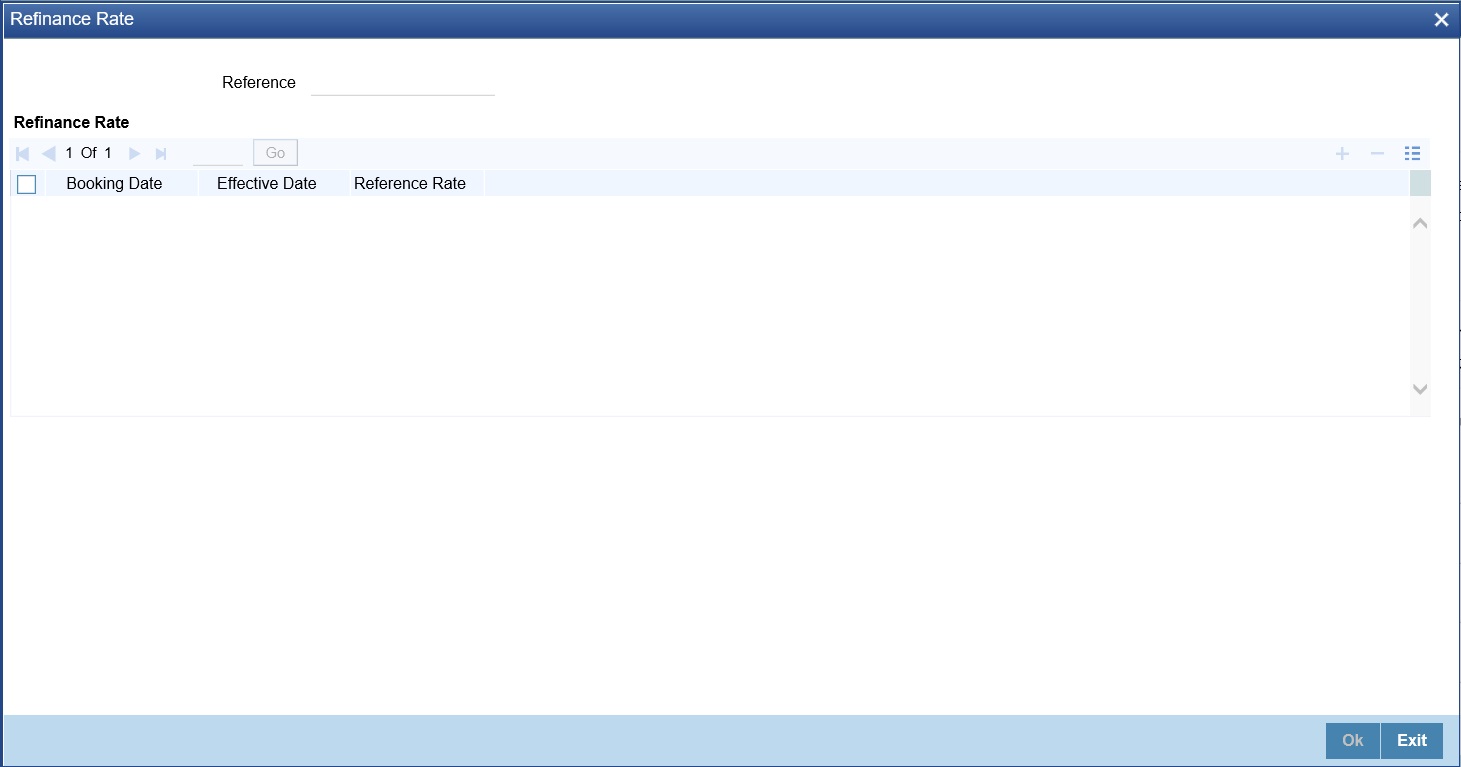

- On the MIS Details screen, click Refinance Rate.

The Refinance Rate screen is displayed.

Figure 3-89 Refinance Rate

- On the Refinance Rate screen, specify the details as required.

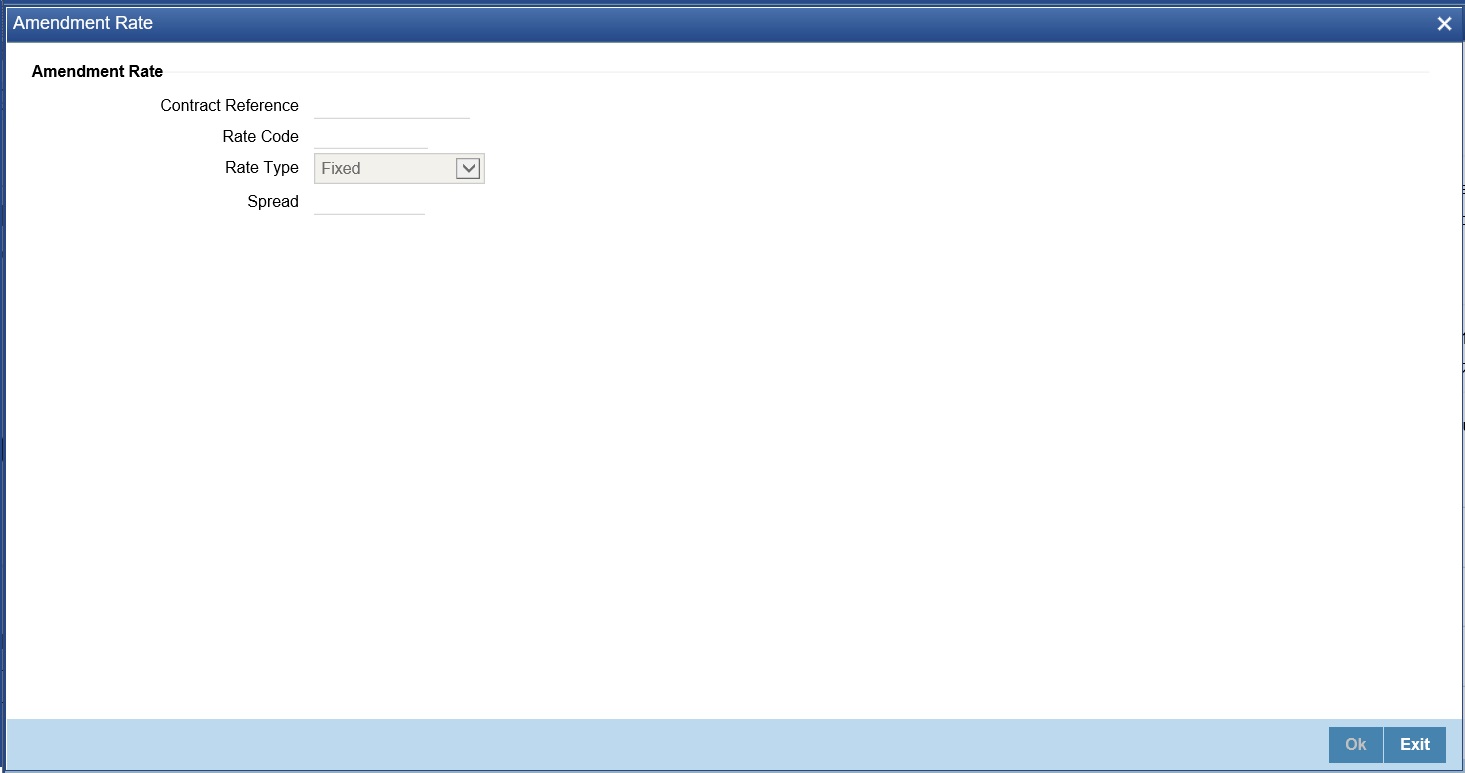

- On the MIS Details screen, click Amendment Rate.

The Amendment Rate screen is displayed.

Figure 3-90 Amendment Rate

- On the MIS Details screen, click Change Log.

The Change Log screen is displayed.

Figure 3-91 Change Log

- On the Change Log screen, specify the details as required.

- On the MIS Details screen, click Balance Transfer Log.

The Balance Transfer Log screen is displayed.

Figure 3-92 Balance Transfer Log

- On the Balance Transfer Log screen, specify the details as required.

- On the Securities Repo Payment Input screen, click Fields.

The Fields screen is displayed.

Figure 3-93 Fields

- On the Fields screen, specify the details as required.

For information on fields, see the below table

Table 3-80 Fields - Field Description

Field Description Contract Reference Number Displays contract reference number

Field Name Defaults user defined field name mapped to the product

Value Specify the UDF value

Mandatory Defaults the mandatory flag from user defined maintenance screen

Value Description Displays the user defined value description

Parent topic: Overview of Repo