- Core Entities and Services User Guide

- Core Maintenance

- Treasury MIS Head Maintenance

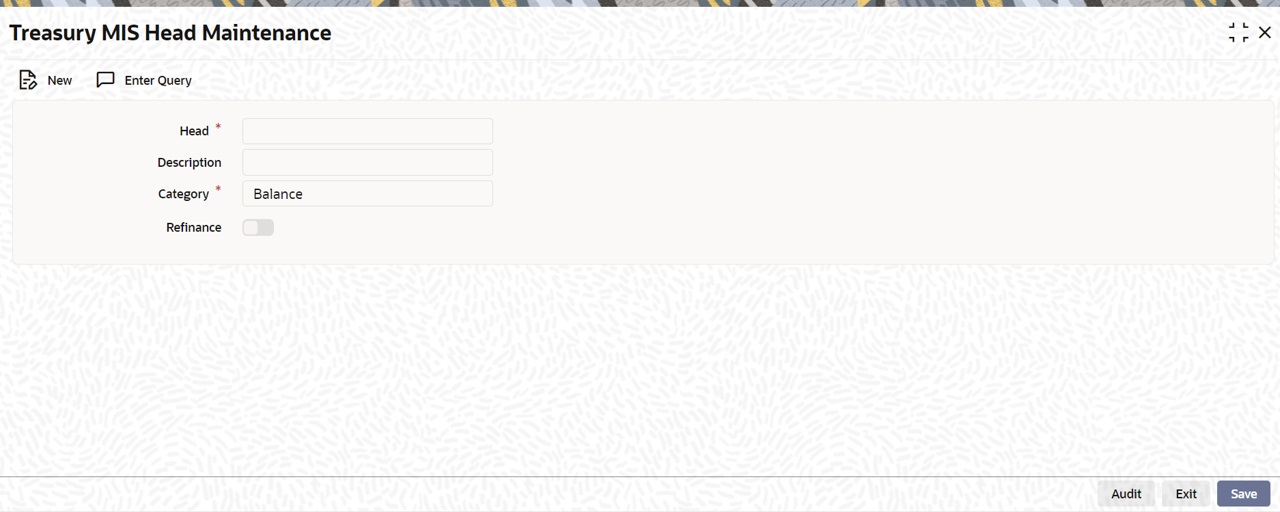

1.14 Treasury MIS Head Maintenance

This topic describes the systematic instructions to maintain MIS Head.

Each accounting entry that is generated can be linked to an MIS Head. An MIS Head indicates the manner in which the type of entry should be considered for profitability reporting purposes.

- On the Home page, specify MIDTRHED in the text box, and click next arrow.The Treasury MIS Head Maintenance screen is displayed.

- On the Treasury MIS Head Maintenance screen, specify the fields. If you are calling an MIS Head that has already been defined, double-click an MIS Head from the summary screen.

For more information on fields, refer to the below table.

Table 1-16 Treasury MIS Head Maintenance- Field Description

Field Description Head Specify the head.

Description Specify the description.

Category

Select the category from the drop-down list. The available options are:

- Balance- Indicates that the accounting entry should be considered for calculating the Cumulative Average Balance. Typically, an asset entry would be classified under the balance type MIS Head. The GL entry leg of a loan disbursement transaction, would typically be classified under a Balance type of MIS Head

- Income- Indicates that the accounting entry should be considered as an income for the purpose of profitability reporting. Clearly, any interest or charge income would be classified under an Income type of MIS Head

- Expense- Indicates that the accounting entry should be considered as an expense for the purpose of profitability reporting. Any interest, or tax expense would be classified under an expense type of MIS Head

- Contingent- Indicates that the accounting entry should be considered as a contingent entry for the purpose of profitability reporting. The issue of an import Letter of Credit, etc., are examples of contingent type of entries. You can generate a report that gives the balances due to such contingent type of entries. Under each type of MIS Head, you may define additional MIS Heads, as per your reporting requirement. For example, you can have an MIS Head for each loan product, so that you can have the cumulative average balance due to all the loans disbursed under the product

The MIS Head Category classification indicates the method in which the accounting entry can be reported in the profitability report.

Refinance

Select the refinance option for marking MIS Heads for refinancing.

For MIS Heads that are marked for refinancing, the refinancing income or expense would be calculated, on the cumulative average balance, for the reporting period. You would typically mark a balance type of MIS Head for refinancing. This option is provided because not all the balance type of entries would come under the umbrella of refinancing.

Parent topic: Core Maintenance