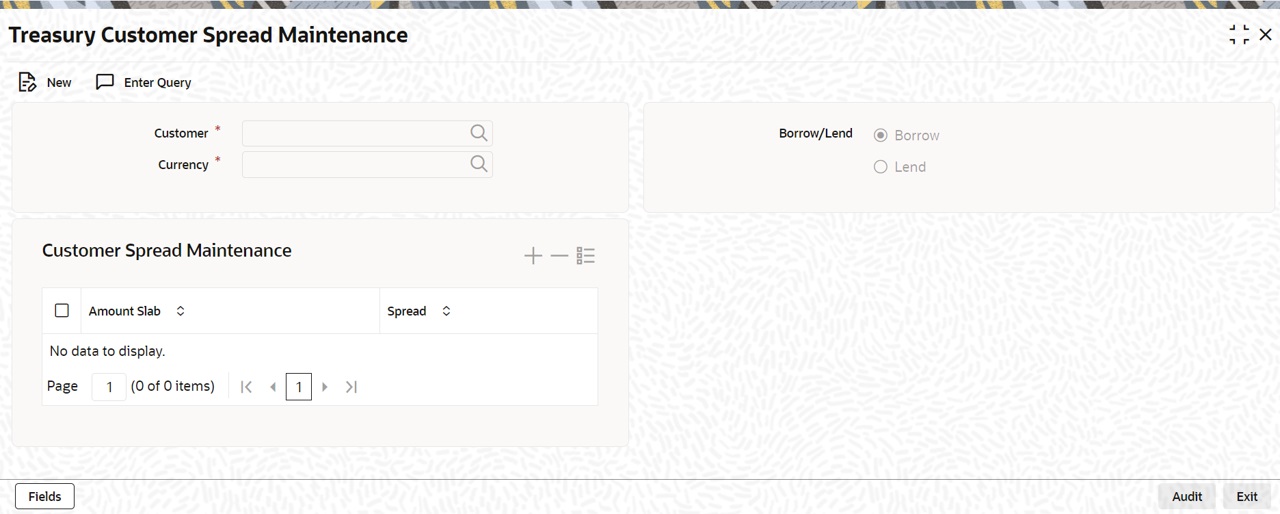

1.13 Treasury Customer Spread Maintenance

This topic describes the systematic instructions to maintain customer spread.

For each customer of your bank you can define buy and sell margins for a specific currency. This spread is applied to floating interest components that involve the customer and currency combination. The margin that you define is appropriately picked up and applied to arrive at the final rate that is applied to floating components of contracts that involve the customer- currency combination.

The buy and sell margins that you define are for a customer and currency combination. You can select the customer and currency combination from the option lists available. For the selected currency– customer combination, you can define amount slabs and specify a Borrow and Lend margin for each slab. To add a slab to the list click add icon and enter the slab details.

To remove a slab from the list, highlight it and click delete icon. Whenever you enter a contract in Treasury that involves the customer and currency combination, the appropriate spread is applied to arrive at the floating rate to be charged. The slab is selected based on the contract amount and depending on the nature of the contract, the Borrow or Lend spread is applied.

Parent topic: Core Maintenance