- Exchange Traded Derivatives User Guide

- Portfolio Products and Portfolios Creation

- Create Portfolio Product

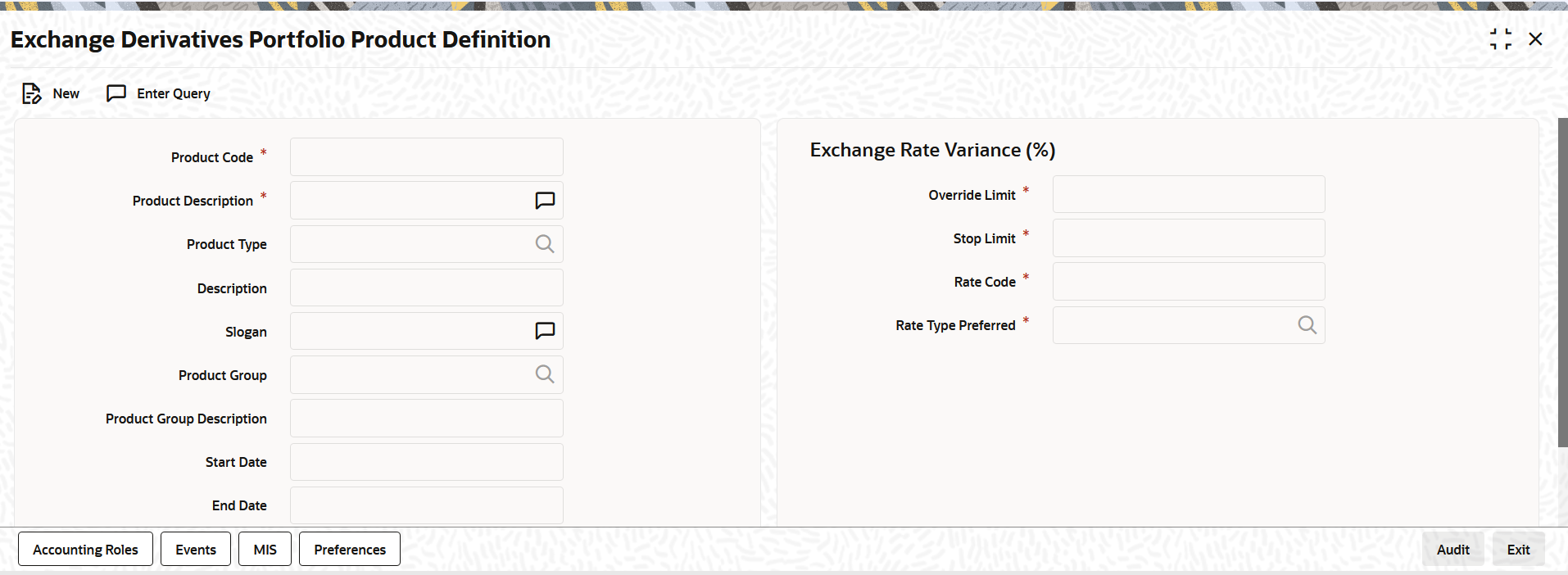

- Process Exchange Derivatives Portfolio Product Definition

5.1.1 Process Exchange Derivatives Portfolio Product Definition

This topic describes the systematic instruction to process Exchange Derivatives Portfolio Product Definition screen.

You can capture information pertaining to a portfolio product through the Exchange Derivatives Portfolio Product Definition screen.

- On the Home page, enter EDDPFPRD

in the text box, and then click next arrow.

The Exchange Derivatives Portfolio Product Definition screen is displayed.

Figure 5-1 Exchange Derivatives Portfolio Product Definition

Description of "Figure 5-1 Exchange Derivatives Portfolio Product Definition" - On the Instrument Definition screen, click New.

- On Instrument Definition screen, specify the following

Instrument Details, and then click Enter Query.

For more information on the fields, refer to the below Field Description table.

Table 5-1 Instrument Definition - Field Description

Field Description Product Code and Product Description You can identify a product that you maintain with a unique Product Code, and a brief description.

In the Product Code field, you must assign the product a unique code (which is unique across all the modules of Oracle Banking Treasury Management). This code helps in identifying the product. You can briefly describe a product that you create in the Description field.

Product Module The services that you offer in a module will be specific to the module. For example, a portfolio maintenance scheme is specific to the ETD (Portfolio) module. To view the module in which you are creating a product in the Product Module field.

Product Type The first attribute that you define for a portfolio product is its type. You can broadly classify portfolio products into two types:

- Customer Portfolio (C) – the definition and maintenance of customer portfolio products help you manage your customer’s trades and investments.

- Own Portfolio (O) – the definition and maintenance of Own portfolio products help you manage your banks own trades and investments.

Under each type you can create multiple portfolio products.

Product Slogan Type a slogan for the product that you are creating. In the Slogan field enter a slogan that suitably announces the product to your customers.

If you are creating your own portfolio, you can identify it with an appropriate slogan for your bank’s internal reference purposes.

Product Group Grouping products according to the common features they share, helps you organize information relating to the services you provide. This helps you retrieve information easily.

You can invoke a list of all the product groups that you have maintained in your bank. Choose the product group to which the product you are creating belongs.

Product Start Date and End Date When you create a product, you must also specify a date from which it can be offered. You may also specify the date up to which you would like to offer the product. Enter these dates in the Start Date and End Date fields.

Note:

You cannot offer a product beyond the specified end date. If you do not specify an end date for a product, you can offer it for an indefinite period.

Remarks If you want to enter any remarks regarding the product, do so in the Remarks field.

- On the Exchange Derivatives Portfolio Product Definition

screen, specify the other Details for the Portfolio Product

Every product that you maintain in Oracle Banking Treasury Management, will impact specific accounting heads (GLs). When you build a Class of Accounting Roles and Heads, you will have to identify all heads specific to a service and indicate their roles, individually.

The different stages in the life cycle of a portfolio are referred to as events. After identifying accounting roles and mapping them with account heads, you will have to identify the accounting entries, which ought to be posted when individual events are triggered in Oracle Banking Treasury Management. For instance, the opening of long and short positions will be recorded as two separate events in Oracle Banking Treasury Management.

The mapping of accounting roles to respective account heads and the identification of life-cycle events at which they ought to be triggered automates the process of posting accounting entries.

A single portfolio product can have multiple portfolios within it. Although, the various events that are likely to occur in a portfolio can be defined under a single product, you can choose to post accounting entries to specific GLs for the different portfolios and Instruments within a portfolio product.

Assume this scenario: Your bank is trading in a variety of Currency, Index Options and in Commodity, Index and Interest Rate Futures.

Typically on a daily basis you would like to process the following activities or events for all types of Options and Futures:

- Open Long / Short Positions

- Revalue Long/Short Positions

- Close Long /Short positions

- Process expiry of Long/Short positions

- Exercise Long positions

- Assign Short positions

- Exchange for physicals in Long / Short positions

When each of these events is triggered in Oracle Banking Treasury Management, appropriate accounting entries need to be posted to a variety of GLs.

Besides, you would also like to perform notional revaluation for the open positions on a daily basis.

To cater to these diverse requirements you would need to set-up portfolio products, wherein for each product you have to:

- Identify the GL types and GLs that would be impacted

- Define life-cycle events

- Create role to head mappings

In addition to identifying the accounting entries, you would also need to identify the MIS Heads under which you would like to report the portfolio

To eliminate the process of defining multiple portfolio products, and to restrict portfolios within a product from holding specific instrument products, you need to follow a preferential hierarchy while defining accounting roles and account heads. The order in which you would need to define Role to Head mappings is as follows:

- A portfolio and the Instrument involved in the portfolio.

- A portfolio and the Instrument Product involved in the portfolio.

- A specific portfolio.

- A portfolio product as a whole.

By defining role to head mappings at the four hierarchical levels you can maintain a single, comprehensive portfolio product, which can be used to process all possible events for options as well as futures for all portfolios.

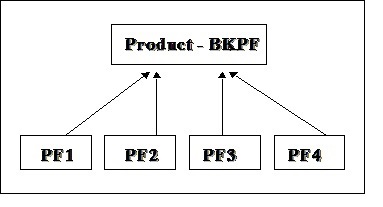

Let us assume that your bank has maintained a portfolio product titled BKPF. Since a product can have multiple portfolios, you have maintained several portfolios within BKPF. Each of these portfolios will cater to specific instrument types.

Figure 5-2 Portfolio Product – Portfolio Relationship Diagram

The portfolio PF1 is meant for deals involving Currency and Index Options

As per the preferential hierarchy method, the role to head mappings specified for this product is as follows:

Table 5-2 Preference I - Portfolio ID + Instrument ID

Portfolio ID Instrument ID Accounting Class PF1

DEM_OPTION_LIFFE

ACR01

Table 5-3 Preference II – Portfolio ID + Instrument Product

Portfolio ID Instrument ID Accounting Class PF1

CCYO

ACR02

Table 5-4 Preference III – Portfolio ID

Portfolio ID Accounting Class PF1

ACR03

Table 5-5 Preference IV – Portfolio Product

Portfolio Product Accounting Class BKPF

ACR04

Table 5-6 AR01

Accounting Role Account Head BOT_ASSET

CA001

SOLD_CCY_EQ

CL001

Table 5-7 AR02

Accounting Role Account Head BOT_ASSET

CA002

SOLD_CCY_EQ

CL002

Table 5-8 AR03

Accounting Role Account Head BOT_ASSET

CA003

SOLD_CCY_EQ

CL003

Table 5-9 AR04

Accounting Role Account Head BOT_ASSET

CA004

SOLD_CCY_EQ

CL004

Scenario I

You want to Open a Long Position (EOLG), in the Currency Option – USD_Options_CME in PF1

Table 5-10 Accounting Entries

Accounting Role Description Dr./Cr. Indicator Contingent Asset

Asset Value

Debit

Contingent Asset

Asset Value

Credit

When this event is triggered, the system posts the relevant accounting entries only after identifying the respective Role to Head mapping based on the preferential hierarchy that we have set up.

Since we have not associated an accounting class with the PF1+ USD_Options_CME (Portfolio ID+ Instrument ID) combination, it will move to the next level and search for the class associated with the PF1 + CCYO (Portfolio ID + Instrument Product) combination.

We have already associated the accounting class ACR02 with this combination; therefore the relevant accounting entries are posted to GLs maintained within this class:

Table 5-11 AR04

Accounting Role Account Head BOT_ASSET

CA004

SOLD_CCY_EQ

CL004

Scenario II

Similarly, assume you want to Open a Long Position in the Index Option – DAX_OPTION_FSE in PFI. As in the previous case, the Contingent Asset is to be debited and the Offset account is to be credited.

Since the system has to pick up the relevant accounting entries based on the hierarchical preference, it will search for the accounting class associated with the:

- PF1 + DAX_OPTION_FSE (Portfolio ID + Instrument ID) combination.

- PF1+INDO (Portfolio ID + Instrument Product) combination.

- PF1 (Portfolio ID)

Table 5-12 Accounting Entries

Accounting Role Description Account Head Dr./Cr. Indicator BOT_ASSET

Option Strike Price

CA003

Debit

SOLD_CCY_EQ

Option Strike Price

CA003

Credit

Note:

Therefore, to open a long position for both Index and Currency options within the portfolio PF1, the accounting treatment remains the same. However, the Account Heads (GLs) that are impacted (debited/credited) while posting the entries differ.

For the Currency Option, in P F1 the account heads that are impacted are:

- CA002 (Contingent Asset)

- CL002 (Contingent Asset Offset)

For the Index Option, in PF1 the account heads that are impacted are:

- CA003 (Contingent Asset)

- CL003 (Contingent Asset Offset)

Scenario III

Assume, you have not maintained the first three hierarchical preferences. When the search results prove unsuccessful, the accounting entries will be posted directly to the default GLs maintained at the portfolio product level.

Table 5-13 Accounting Entries

Accounting Role Description Account Head Dr./Cr. Indicator BOT_ASSET

Option Strike Price

CA004

Debit

SOLD_CCY_EQ

Option Strike Price

CA004

Credit

- On the Exchange Derivatives Portfolio Product Definition

screen, click the Accounting Roles tab.

The Accounting Role screen is displayed.

You can map appropriate Accounting Roles to Account Heads for the portfolio product through the Role to Head mapping screen.

For a detailed procedure on how to map Accounting Roles to Account Heads, refer to the Common Procedures User Manual of Oracle Banking Treasury Management.

Note:

The Role to Head mapping definition for the following hierarchical levels:

- Portfolio + Instrument ID

- Portfolio + Instrument Product

- Portfolio ID

- On Exchange Derivatives Portfolio Product Definition

screen, click the Events tab.

The Events Details screen is displayed.

After mapping accounting roles to specific heads you have to define life-cycle events for deals involving this product and identify the accounting entries which ought to be posted when individual events are triggered in Oracle Banking Treasury Management.

For a detailed procedure on how to map Accounting Roles to Account Heads, refer to the Common Procedures User Manual of Oracle Banking Treasury Management.

The following is the list of events for a portfolio, which you can maintain in Oracle Banking Treasury Management:

- Assignment of Exercise

- Closing of Long /Short positions

- Exchange of physicals - Take /Make delivery

- Opening of Long /Short positions

- Revaluation of Long / Short positions

- Expiry of Long / Short options

- Exercise of Options

- Reversal – Assignment of Exercise

- Reversal – Closing of Long / Short position

- Reversal Exchange of Physicals – Take /Make delivery

- Reversal – Opening of Long / Short positions

- Reversal – Reversal of Long position

- Reversal – Reval of Short positions

- Reversal – Expiry of Long / Short positions

- Reversal Exercise of Options

You have to identify the life-cycle events which need to be associated with the portfolio product you are setting up.

When each of these events is triggered in Oracle Banking Treasury Management, appropriate accounting entries need to be posted. For instance, while ‘Opening a Long Position’ you will:

- Debit the Contingent Asset

- Credit the Contingent Asset Offset

Therefore you need to associate every event with appropriate accounting entries. You can define the accounting entries that have to be passed for a set of events, as an ‘Event Accounting Entries and Advices Class’. You can associate event-wise accounting entries through The Event Accounting Entry and Advice definition of the Product Definition screen. To do this, click ‘Events’ button from the Portfolio Product screen.

Note:

Refer to the Common Procedures User Manual of Oracle Banking Treasury Management for a detailed procedure on how to associate accounting entries with events.

For further details on maintaining Accounting Entries and Advices, refer Product Definition User Manual under Modularity.

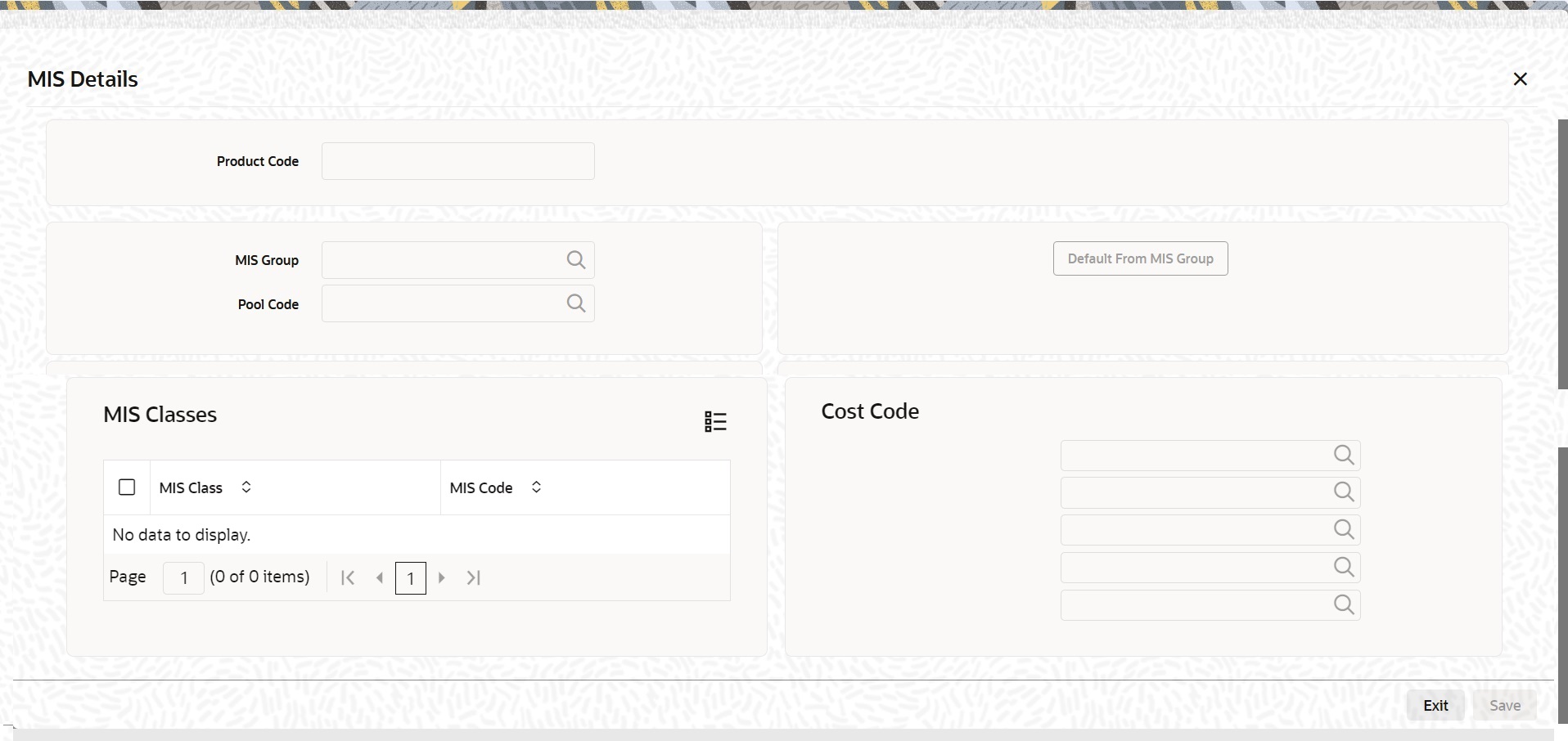

- On Exchange Derivatives Portfolio Product Definition

screen, click the MIS tab.

The MIS Details screen is displayed.

Through the MIS product details screen you can link the product to transaction MIS codes. The transaction codes linked to the portfolio product are defaulted to all the portfolios involving the product.

For more details on MIS Details screen, refer MIS User Manual.

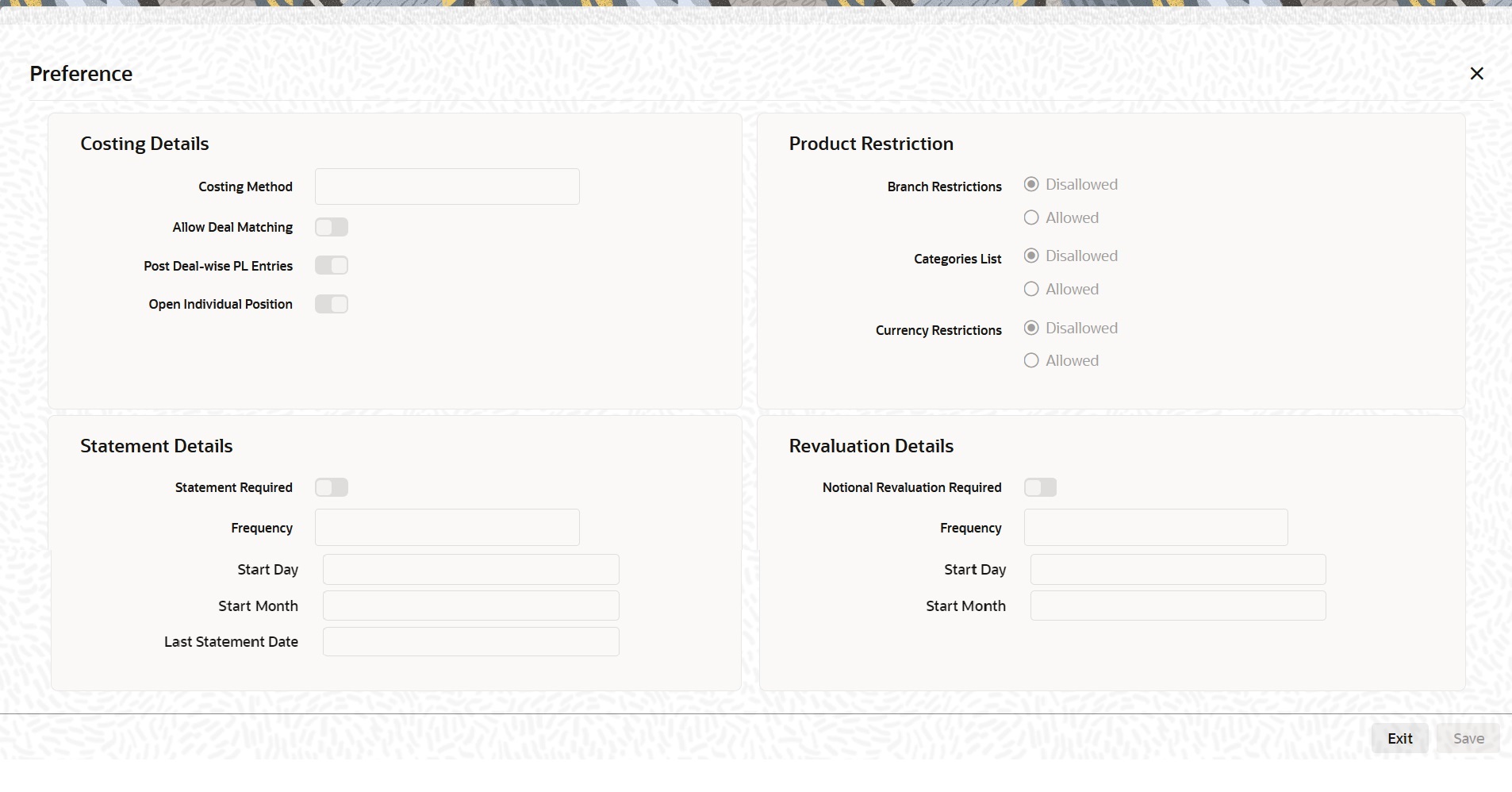

- On the Exchange Derivatives Portfolio Product Definition

screen, click the Preferences tab.The Preferences screen is displayed.

Table 5-14 Preferences - Field Description

Field Description Costing Method costing method is used to determine your holding cost in a portfolio. Based on the preference of your bank you can select an option from the option list: The costing methods are as given below:- Weighted Average Cost (WAC)

- Last in first out (LIFO)

- First in first out (FIFO)

- Deal matching (DMAT)

Note:

In Oracle Banking Treasury Management profit and loss calculations are maintained only for the bank’s own portfolio. Therefore, you can specify this preference only while setting up your own portfolios.Allow Deal Matching Select this box to indicate that intra-day manual matching should be allowed, even though the costing method selected is FIFO or LIFO.

This check box is enabled only when costing method selected is ‘FIFO/LIFO’. For any other costing method, this is disabled.

Open Individual Position Select this box to indicate that accounting entries for opening and closing of positions should be posted individually for each deal, when the costing method is DMAT.

This checkbox is enabled only when costing method selected is ‘DMAT’. For any other costing method, this is disabled.

Post Deal -wise PL Entries Select this box to indicate that accounting entries for realized PL should be posted individually for each pair of deals matched, when the costing method is FIFO, LIFO or DMAT.

This checkbox is enabled only when costing method selected is ‘FIFO/LIFO/DMAT’.

Parent topic: Create Portfolio Product