- Exchange Traded Derivatives User Guide

- Define Deal Products

- Process ET Deal

- Process Long and Short Deals

6.3.1 Process Long and Short Deals

It is necessary to maintain a mandatory program, to Margin Product Definition screen.

- On Homepage, enter EDDLSONL in the text box, and then click next arrow.

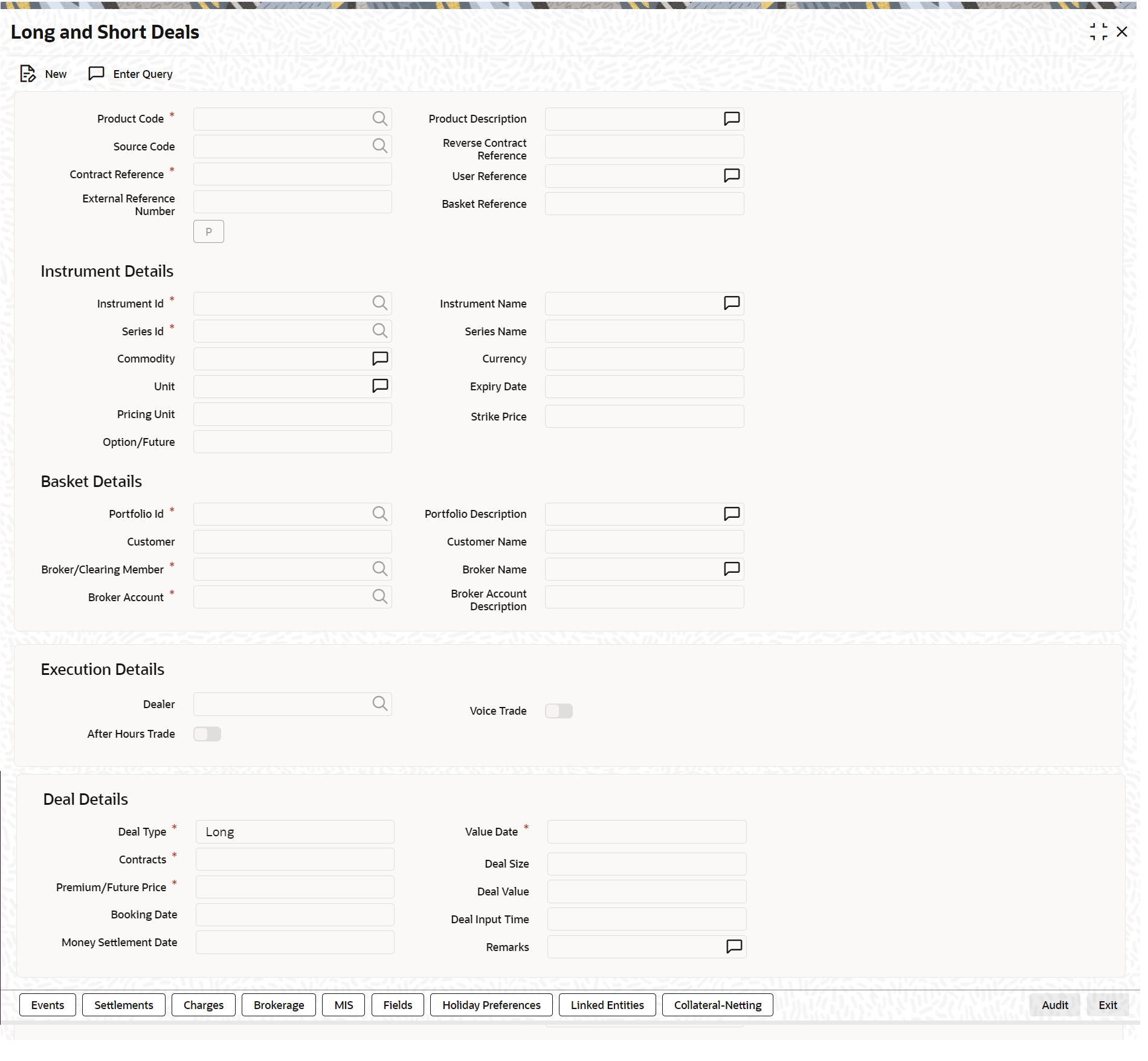

The Long and Short Deals screen is displayed.

You can choose to enter the details of a deal either by using a deal product. You should necessarily use a Long and Short deal product that has already been created to enter the details of a Long and Short deal. Based on the type of deal you are entering, you can select a product from the list of options positioned next to the Product field.

- On the Long and Short Deals screen, click New.

- On the Long and Short Deals screen, specify the following deal details,.

For more information on the fields, refer to the below Field Description table.

Table 6-8 Long and Short Deals - Field Description

Field Description Contract Reference In Oracle Banking Treasury Management, reference numbers are generated automatically and sequentially by the system. This number tag is used to identify the deal you are entering, it is also used in all the accounting entries and transactions related to this deal. Hence the system generates a unique number for each deal.

User Reference Enter a reference number for the deal. A deal is identified by this number in addition to the Deal Reference Number generated by the system. This number should be unique and cannot be used to identify any other deal. By default, the Deal Reference Number generated by the system will be taken as the User Reference Number.

External Ref No If the transaction is being uploaded from an external source, specify the identification for the deal in the external source, as the external reference number.

Reversed Reference The reference number of the contract that is being reversed and re-booked is displayed here.

Source Specify the source from which deal is to be uploaded.

Remarks Type a remark.

Option/Future Specify the deal as an Option or Future.

Clearing House The system defaults the clearing house maintained at the Instruments level.

Instrument Identification and Series Identification Indicate the instrument and series that the deal involves.

You have already restricted specific instruments from trading in the deal product in the Instrument Restriction screen of the Deal Product screen. When you associate a product with the deal, the restrictions defined for the particular product are made applicable to the deal.

Select the Instrument Identification which is to be associated with the deal. A list of all the Allowed instruments is available alongside. As you have already maintained the instrument, all the attributes of the deal like the contract size, unit, underlying details, pricing details, initial margin per contract, and days of settlement will be processed based on these details.

Contracts Indicate the number of contracts that are to be traded. The system multiplies the Number of Contracts and the Contract Size to arrive at the quantity of the actual underlying that is involved in the trade.

Based on the number that you specify, the system calculates the quantity of the actual underlying that is involved in the trade and displays it in the adjacent field.

For example, refer Table 6-9.

Execution Broker Specify the execution broker for the deal. The adjoining option list displays the brokers maintained for the portfolio. You can choose the appropriate one.

Execution Broker Name The system displays the name of the execution broker selected.

Dealer Specify the dealer involved for the deal. The adjoining option list displays all valid dealers maintained in the system. You can choose the appropriate one.

Trading Venue Specify the trading venue for the deal.

After Hour Trade Check this box to indicate that after hour trade or day time for the deal is allowed for this deal.

Voice Trade Check this box to indicate that voice trade is allowed for this deal.

Deal Type While capturing the details of a specific deal you have to indicate whether it is a Buy (Long) or Sell (Short) type of deal.

Select the appropriate preference from the available list.

Premium/Future Price For Options, the Option Premium is the price at which an option is bought or sold excluding any commissions, trading fees, and applicable levies.

For index-based options, the price has to be specified in index points per contract. For non-index-based options, the premium has to be expressed in terms of the Instrument Pricing Unit specified at the time of defining the instrument.

While capturing future deals you will have to indicate the Future Price. For index-based futures, the price has to be specified in index points per contract. For non-index-based futures, the price has to be expressed in terms of the Instrument Pricing Unit, indicated at the time of instrument definition.

For Example, refer Table 6-10.

Value Date Specify the Value Date here. The Value Date represents the date from which the obligation or the right on the underlying asset takes effect on the parties involved in the deal.

The Value Date you specify can be one of the following:

- Today’s date

- Past Date

Time Stamp and Transaction Date The Time Stamp is the exact time at which the deal transaction took place in the exchange. You have to specify the time at which the deal transaction took place.

The transaction date is the date on which you entered the deal into Oracle Banking Treasury Management. The system gives the present date as the transaction date. You cannot change it.

Money Settlement Date The Money Settlement Date (or the MSTL Date) represents the Value Date of the Money Settlement of the Premium Amount in a Long and Short option deal.

If there is any money settlement involved in the deal you are processing, you can indicate the date on which the money settlement for the Premium Amount in a Long and Short option should be done.

Portfolio Identification Every deal that you capture in Oracle Banking Treasury Management should be associated with the respective portfolio. For instance, if you are capturing the details of a deal on behalf of your bank’s customer, you must link it to the relevant customer portfolio. Similarly, while entering the details of a deal on behalf of your bank, you have to link it to the appropriate bank portfolio.

While defining a deal product, you would have established certain controls over the portfolios that your branches can deal with by defining restrictions for the product. The list provided alongside this field contains all the ‘allowed’ portfolios for this product. Select the appropriate portfolio form this list.

Note:

If you are capturing the details of a deal on behalf of your customer’s portfolio, then the CIF ID and the Name of the customer involved in the portfolio default in the respective fields.Broker/Clearing Member Specify the Broker ID of the broker through whom the deal was brokered. You can select a Broker ID from the available list. The available list contains the codes assigned to brokers with whom you can enter deals.

Broker Account Description Select the Broker Account from the adjoining list. This account represents the actual account where the positions will be updated.

Deal Input time This field captures the deal execution time at the time of deal booking received from front office.

Format: YYYY-MM-DD HH:MM:SS:SSS (Default).

Here SSS is milliseconds.

Note:

The above format can be changed in the user setting option based on requirement.

System throws an error when you give the wrong date or time format on modification.

Basket Reference The Basket Reference number is the unique reference number or identifier that the system assigns, each time you process a deal with the following combination:

Portfolio ID + Instrument ID + Series ID + Broker + Broker Account

The reference number is referred to as the Basket Reference.

Once generated, all subsequent deals in the same combination will be referenced with this ID. Life cycle processing for all events in the basket will be carried out based on the basket reference number.

Other Details These details of the instrument involved in the deal are displayed in the respective fields. These details include:

- Strike Price (if any) of the instrument series).

- Expiry date of the instrument series.

- Underlying Asset associated with the instrument involved in the deal.

- Contract Standard or any additional details of the instrument involved in the deal.

Let us assume, you are processing a contract with the following details:

Table 6-9 Field Value

Field Value Deal Reference

000DP01003260006

User Reference

LDeal001

Product

Long Short deals for Portfolio Customers.

Instrument ID

CME90DTB-PUTE-OP.

Description

Chicago Mercantile Exchange – 90 Day T-bill Put Option

Series

96-NOV-2000

Contract

15

Deal Type

Long

Where the Long holder, for each long contract held, has the right to sell hundred units of the T-bill. Consequently, a deal involving 15 Contracts translates to 1500 (15 x 100) units of the T-bill involved in the trade.

For Premium/Future Price instance, let us assume that you are capturing the details of a commodity Option. The commodity involved in the instrument is Wheat and the Option Premium is quoted in the market in terms of kilograms.

Accordingly you have priced the instrument as described in the below table.

Table 6-10 Field Value

Field Value Instrument Pricing Size

1

Instrument Pricing Size Unit

Kilo-grams

The system calculates and displays the Deal Value of the contract in the adjacent field, based on your entry in this field. The Deal Value is calculated in the following manner:

Example: Futures Price/Option Premium X Number of Contracts X Instrument Pricing Multiple

You are capturing the details of a Short type of deal with the following details:

Table 6-11 Field Value

Field Value Instrument Pricing Size

1

Instrument Pricing Size Unit

Kilo-grams

The Instrument Details, which will be taken into account for processing, are:

- The Contract Size – 10 Kilograms.

- The Asset Currency - USD.

- The Pricing Currency - USD.

- The Pricing Multiple = 10.

Since the Number of Contracts involved is 12, the quantity of the actual commodity involved in the trade will be calculated as follows:

12 (Number of Contracts) X10 (Contract Size) = 120 KGs.

The Option Premium is 0.25 USD Per Kilogram. Therefore the Deal Value will be calculated as follows:

0.25 (Option Premium) X 12 (Number of Contracts) X 10 (Pricing Multiple).

The Deal Value will be displayed as 30 USD

- On the Long and Short Deals screen, click Charges.

- On the Charge Details screen, specify charge details.

You can specify the charges that should be levied on every deal that is booked in the ETD module. The charge components linked to the deal product default to the deal.

You can choose to recover the charges either from the Broker or the Portfolio Customer.

When a charge component that is applied to a deal is liquidated, the relevant accounting entries are passed based on the accounting entry set-up for the deal product.

- On the Long and Short Deals screen, click Events.

- On the Event Details screen, specify event details.

As stated earlier, in the ETD module you can collect charges for booking the deal in Oracle Banking Treasury Management. You have already associated the required charge components at the time of defining the product. Additionally, you have also identified the GL/SLs that ought to be impacted when accounting entries are posted for these charges.

You can view the accounting entries for the deal-booking (EBOK) event through the Events Accounting Entry and Overrides screen. All the accounting entries that were passed for the booking event will be displayed.

The following information is provided for each event:

- Branch

- Account

- The currency of the Account

- The amount tag

- he transaction code associated with the deal

- Dr/Cr indicator

- Value Date

- The Charge Amount in the Currency of the Account, when the currency is a foreign currency.

- The exchange rate that was used for the conversion, if the Account is a foreign currency account.

- Amount in local currency

- All the overrides that were encountered for the event will also be displayed.

- The date and time on which the entry was entered in Oracle Banking Treasury Management.

- On the Long and Short Deals screen, click Settlements.

- On the Settlements screen, specify settlement details.

Along with other charge related details of a deal, you have to specify the accounts that have to be debited or credited depending on whether the charges are to be collected or paid. The Debit and Credit accounts and the amount indicate the accounting entry that has to be passed at your bank to affect the deal.

Apart from the details of accounts that have to be debited and credited for the charge amount you will have to capture the following details to effect a deal successfully:

- Details about the route through which the money settlement should take place.

- Indicate whether a payment message needs to be generated.

- On the Long and Short Deals screen, click Advices.

- On the Advice Details screen, specify settlement details.

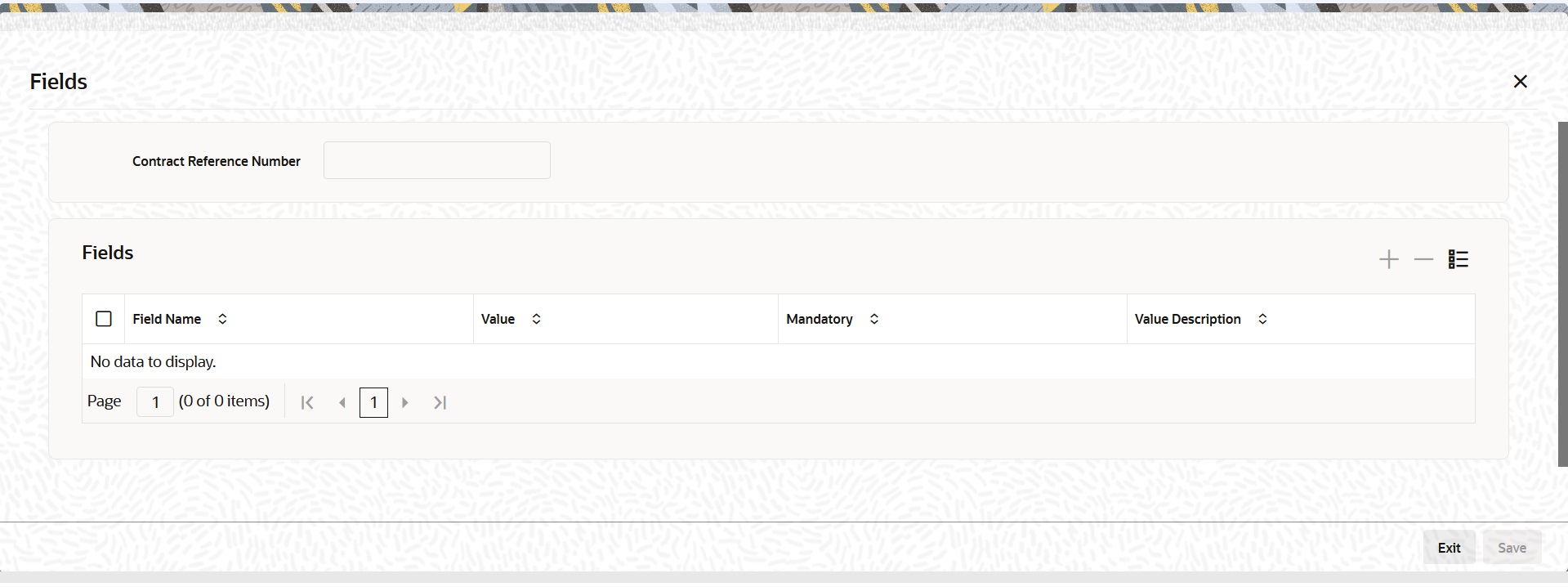

- In the Long and Short Deals screen, click the Fields tab.The Fields screen is displayed.

You can add to the list of fields defaulted from the product but you will not be allowed to remove a field from the defaulted list.

You can change the values defaulted from the product to suit the deal you are processing.

For more details on defining custom fields in Oracle Banking Treasury Management, refer the ‘User Defined Fields’ User Manual.

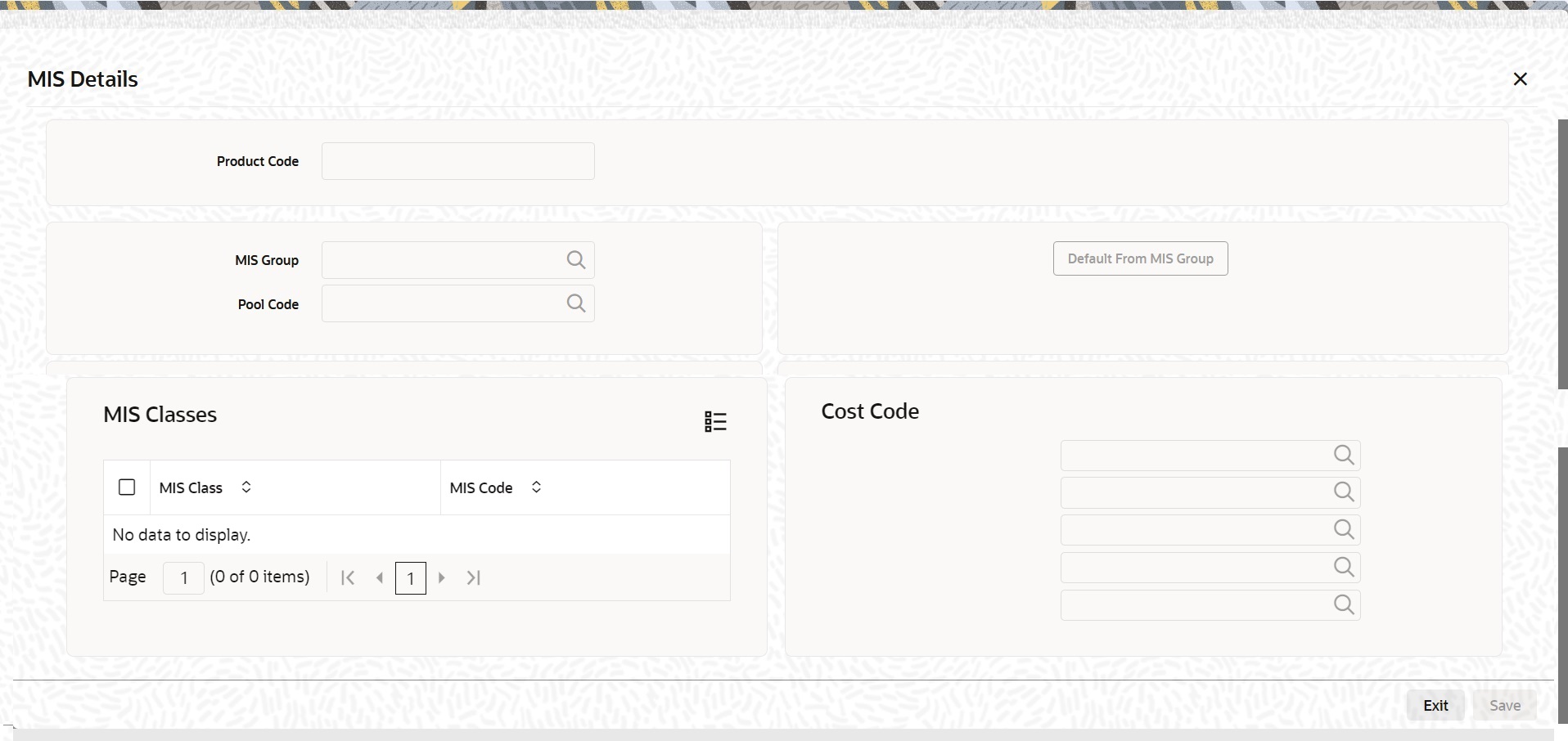

- In the Long and Short Deals screen, click the MIS tab.

The MIS Details screen is displayed.

You can choose to perform MIS Refinancing on a daily basis for all bill contracts, only if this option has been enabled in the Bank-wide Preferences screen. If the MIS refinancing has been set to a daily frequency, you have to indicate the refinance rate pick up specification through the transaction MIS sub-screen while processing the contract.

In this screen, the transaction type of MIS class, the cost code, and pool code will be picked up from the product under which the deal is processed. The composite MIS code will be picked up from the definition made for the customer, on behalf of whom the deal is being processed.

You have to indicate whether the system should pick up the MIS Rate associated with the pool linked to the contract or whether you would like to maintain a rate specific to the contract. You can indicate your choice by selecting any one of the following options:

- Pool Code – indicating that the MIS Rate maintained for the pool code should be used for refinancing.

- Contract Level – indicating that you would like to maintain a specific MIS Rate for the particular contract.

Refer the MIS User Manual for more details on maintaining MIS related information for a product and contract.

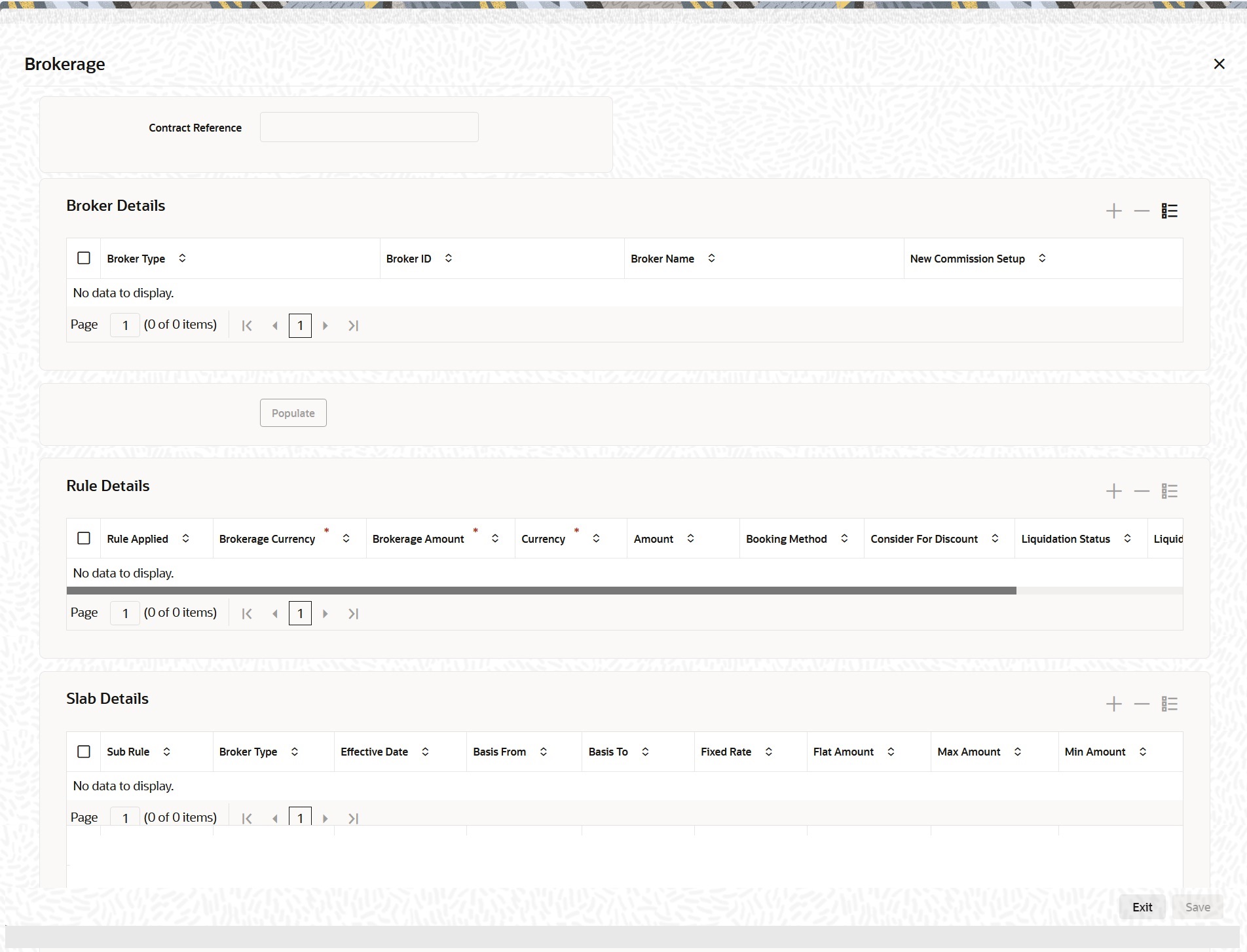

- On the Long and Short Deals screen, click Brokerage.The Brokerage screen is displayed.

- On the Brokerage screen, you can view the below details of the brokerage.

Table 6-12 Brokerage - Field Description

Field Description Broker Type

The system displays the Broker type

Broker ID

The system displays the Broker ID

Broker Name

The system displays the name of the Broker

New Commission Setup

The system displays the new commission setup

Rule Applied

The system displays the Rule that has been applied

Brokerage Currency

The system displays the Broker currency

Brokerage Amount

The system displays the brokerage amount

Currency

The system displays the currency

Amount

The system displays the amount

Booking Method

The system displays the booking method

Consider For Discount

The system displays the preference for the broker being considered for discounts

Liquidation Status

The system displays the liquidation status

LIQ Reference Number

The system displays the liquidation reference number

Sub Rule

The system displays the Sub-rule

Effective Date

The system displays the effective date for the slab rule

Basis From

The system displays the basis (from) detail for the slab rule

Basis To

The system displays the basis (to) detail for the slab rule

Fixed Rate

The system displays the fixed rate for the slab rule

Flat Amount

The system displays the basis detail for the slab rule

Max Amount

The system displays the maximum amount for the slab rule. While booking deal in these screen, Max amount is considered for Fixed rate +Flat amount.

Min Amount

The system displays the minimum amount for the slab rule. While booking deal in these screen, Min amount is considered for Fixed rate +Flat amount.

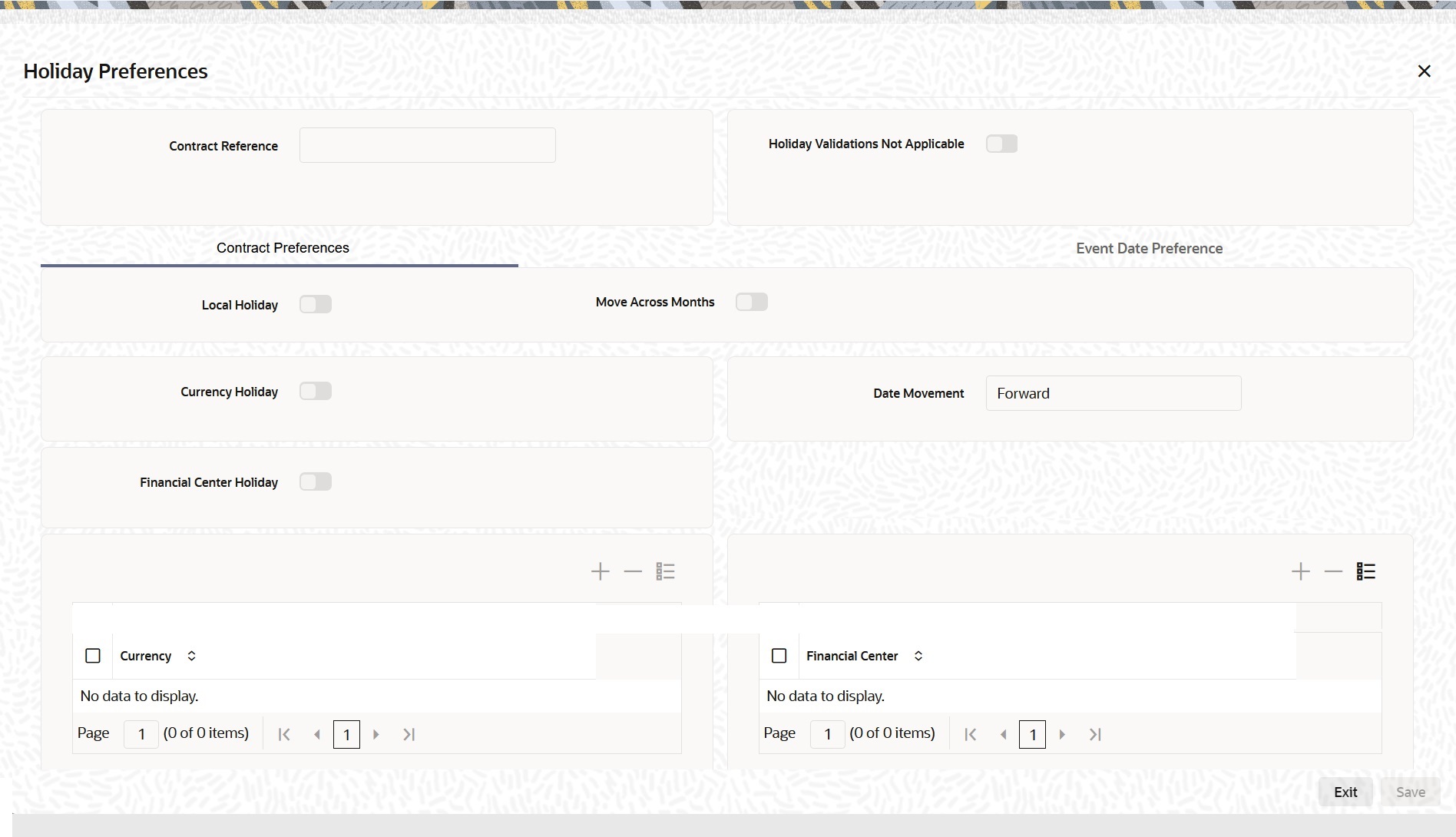

- On the Long and Short Deals screen, click Holiday Preferences.

Financial center holidays are validated during contract input for ETD transactions. Users should modify the dates appropriately during deal input.

Financial center holidays are validated during contract input for transactions received through interface. Appropriate validation message(s) are returned to the interface.

Holiday Preferences screen is displayed. - On the Holiday Preferences screen, Specify the details as required.

See the below table for field descriptions:

Table 6-13 Field screen- Field Description

Field Description Contract Reference The Contract Reference number from the main screen is displayed here.

Holiday Validations Not Applicable Check this box to indicate that the holiday calendar validation must not be performed.

Contract Level Local Holiday Select this check box, if the local holiday calendar validation of dates is required.

Currency Holiday Select this check box, if the currency holiday calendar validation of dates is required.

Financial Center Holiday Select this check box, if the financial center holiday calendar validation of dates is required.

Move Across Months This is not applicable for ETD module.

Date Movement This is not applicable for ETD module.

Currency Specify the currency from the adjoining option list for which Currency Holiday Calendar validation is required. The list displays all currencies maintained in the system. You can choose the appropriate one.

This field is mandatory if the Currency Holiday checkbox is checked in Contract Preferences tab.

Financial Center Specify the financial center from the adjoining option list for which Financial Center Holiday Calendar validation is required. The list displays all active financial centers maintained in the system. You can choose the appropriate one.

This field is mandatory if the Financial Center Holiday checkbox is selected in Contract Preferences tab.

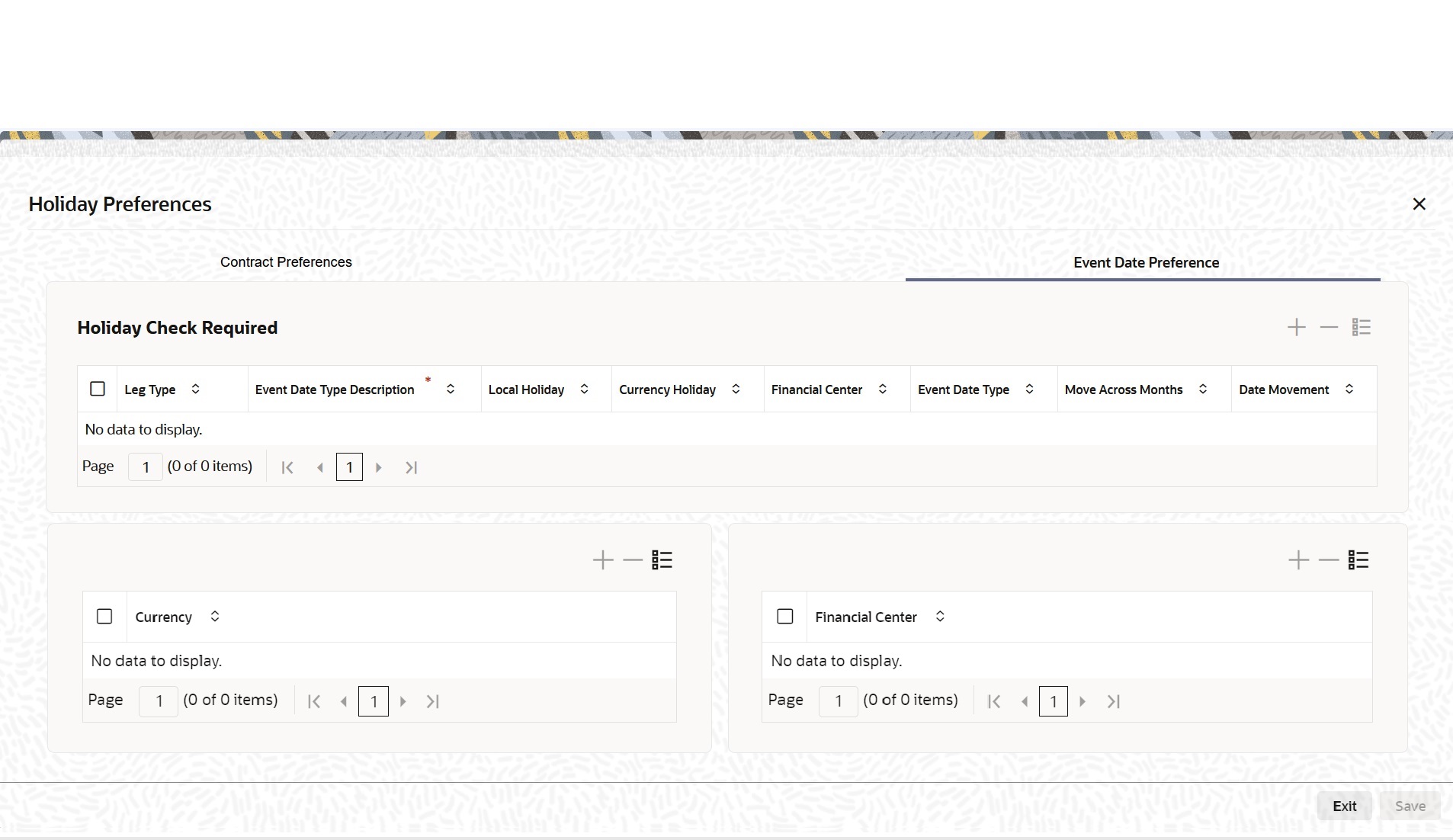

- On the Holiday Preferences screen, click Event Date Preference

Holiday Preferences with Event Date tab details is displayed.

Figure 6-10 Holiday Preferences screen with the Event Date Tab

Description of "Figure 6-10 Holiday Preferences screen with the Event Date Tab" - On the Event Date Preference tab, specify the details as required.

The following are the field descriptions:

Table 6-14 Field Description

Field Description Leg Type This is not applicable for ETD module.

Event Date Type Description Specify the description of event date type for which the holiday calendar validations must be performed. The adjoining option list displays all valid event description maintained in the system. You can choose the appropriate one.

Local Holiday Select this check box if the local holiday calendar validation of the event date is required.

Currency Holiday Select this check box if the currency holiday calendar validation of the event date is required.

Financial Center Select this check box if the financial center holiday calendar validation of the event date is required.

Event Date Type The code of the event date type is displayed in this field.

Move Across Months This is not applicable for ETD module.

Date Movement This is not applicable for ETD module.

Currency Specify the currency from the adjoining option list for which Currency Holiday Calendar validation is required. The list displays all valid currencies maintained in the system. You can choose the appropriate one.

This field is mandatory if the Currency Holiday checkbox is checked in Event Date Preference tab.

Financial Center Specify the financial center from the adjoining option list for which Financial Center Holiday Calendar validation is required. The list displays all active financial centers maintained in the system. You can choose the appropriate one.

This field is mandatory if the Financial Center Holiday checkbox is checked in Event Date Preference tab.

Note:

Based on the requirement you can choose more than one holiday check at the same time. - In ETD, local holiday, currency holiday and financial

center holiday validations is applicable for:

- Value Date and Money Settlement Date in Long and Short Deals screen.

- Value Date, Transaction Date, Settlement Date and Money Settlement Date in Liquidation Deals screen.

The system displays an applicable override message if these dates fall on holiday and configured for holiday validation. You can ignore the override message or change the respective date as deemed appropriate.

Also, the system validates the local, currency and financial center holidays during deal input for transactions received through the interface. Appropriate validation message(s) are returned to the interface.

Parent topic: Process ET Deal