5.3 Process Margin Settlement

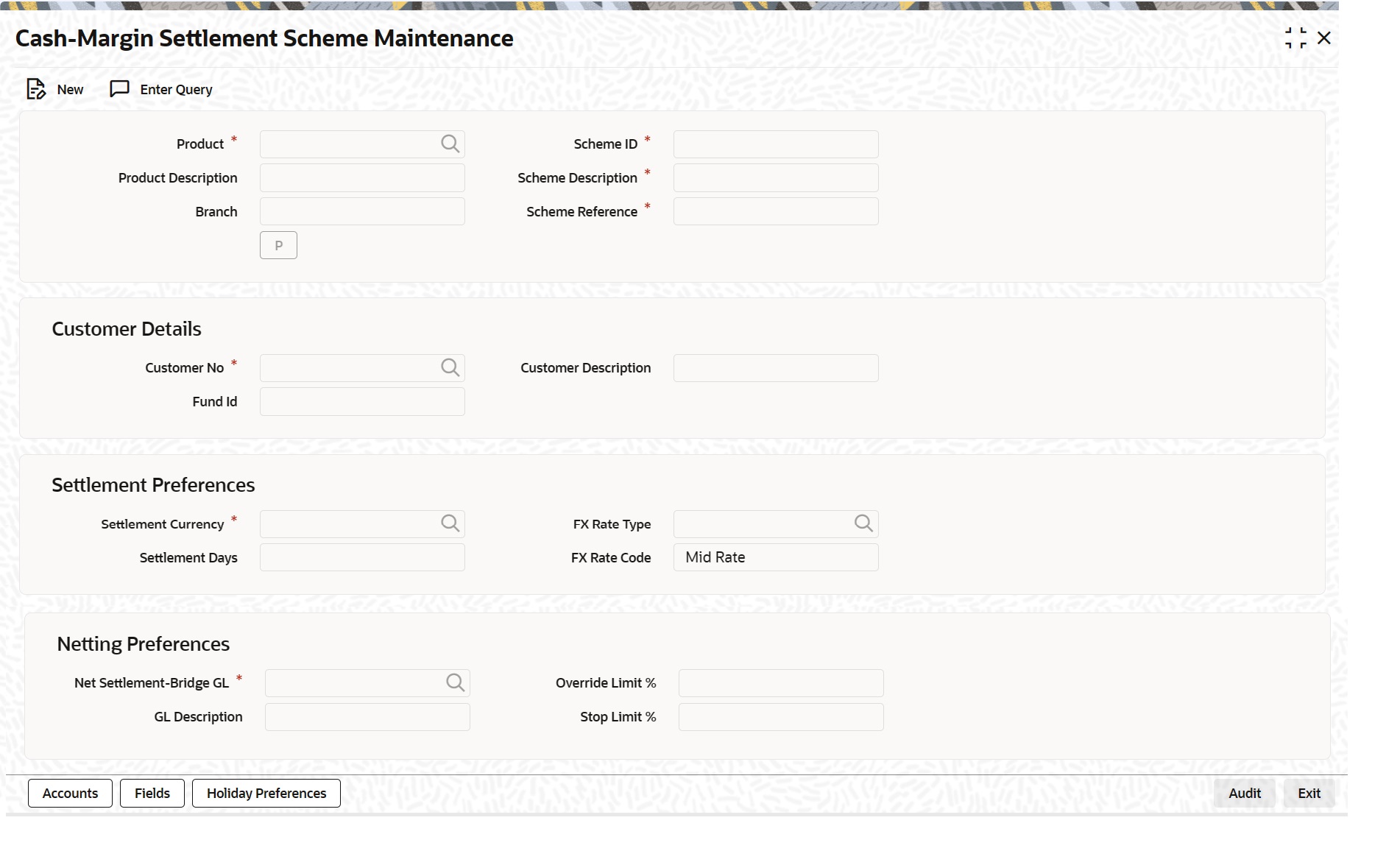

This topic describes the systematic instruction to process Margin Settlement screen.

Settlement transactions may be in the form of initial margin collected or paid to a customer or broker or the liquidation of a net receivable or payable position of a scheme. You can capture settlement details through the Margin Settlement screen.

Parent topic: Portfolio Products and Portfolios Creation