- Foreign Exchange User Guide

- Processing of Contract

- FX Deal

- Foreign Exchange Contract Input

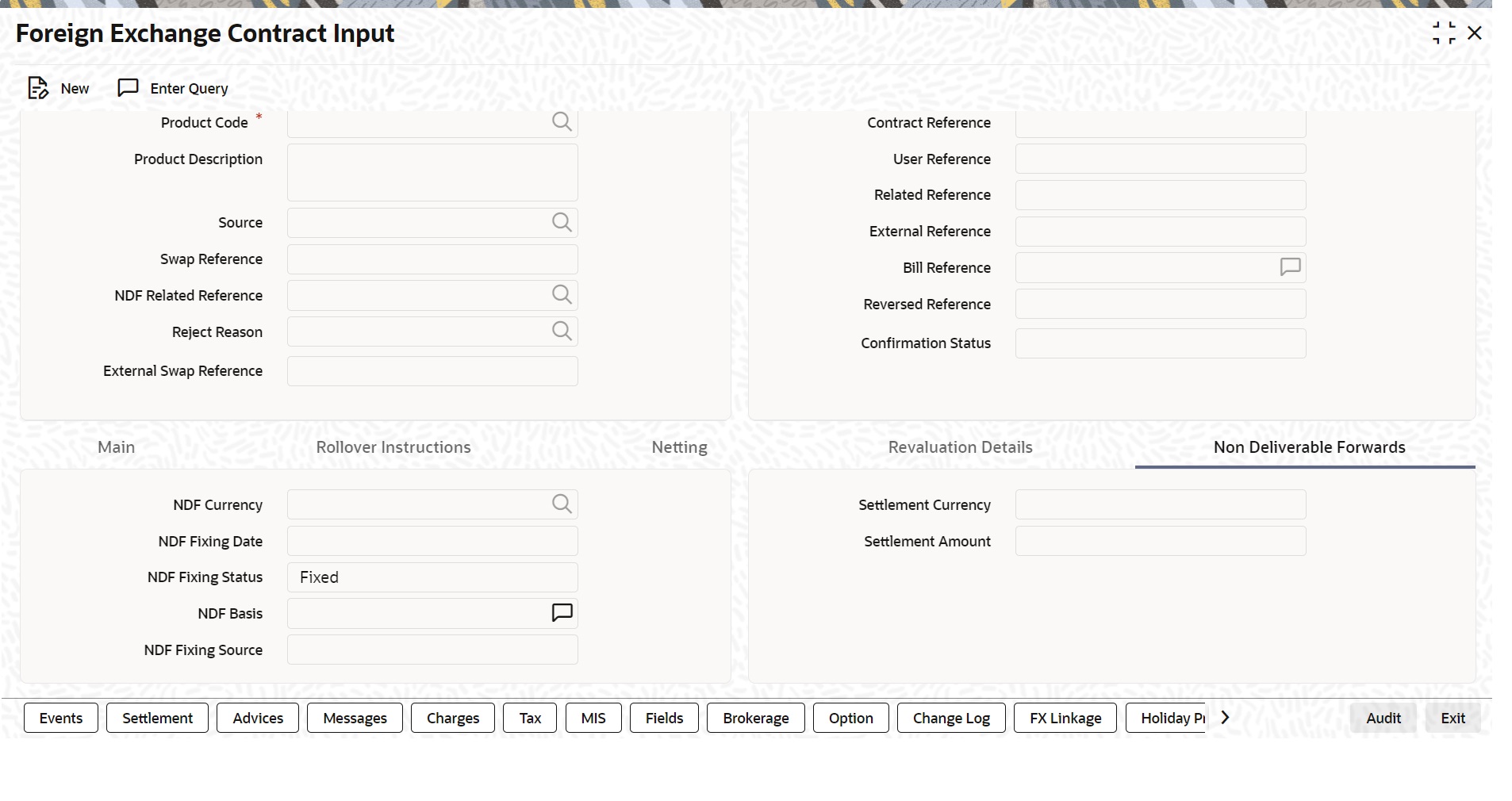

5.1.2 Foreign Exchange Contract Input

- On the Home page, type FXDTRONL in the text box, and click next arrow.

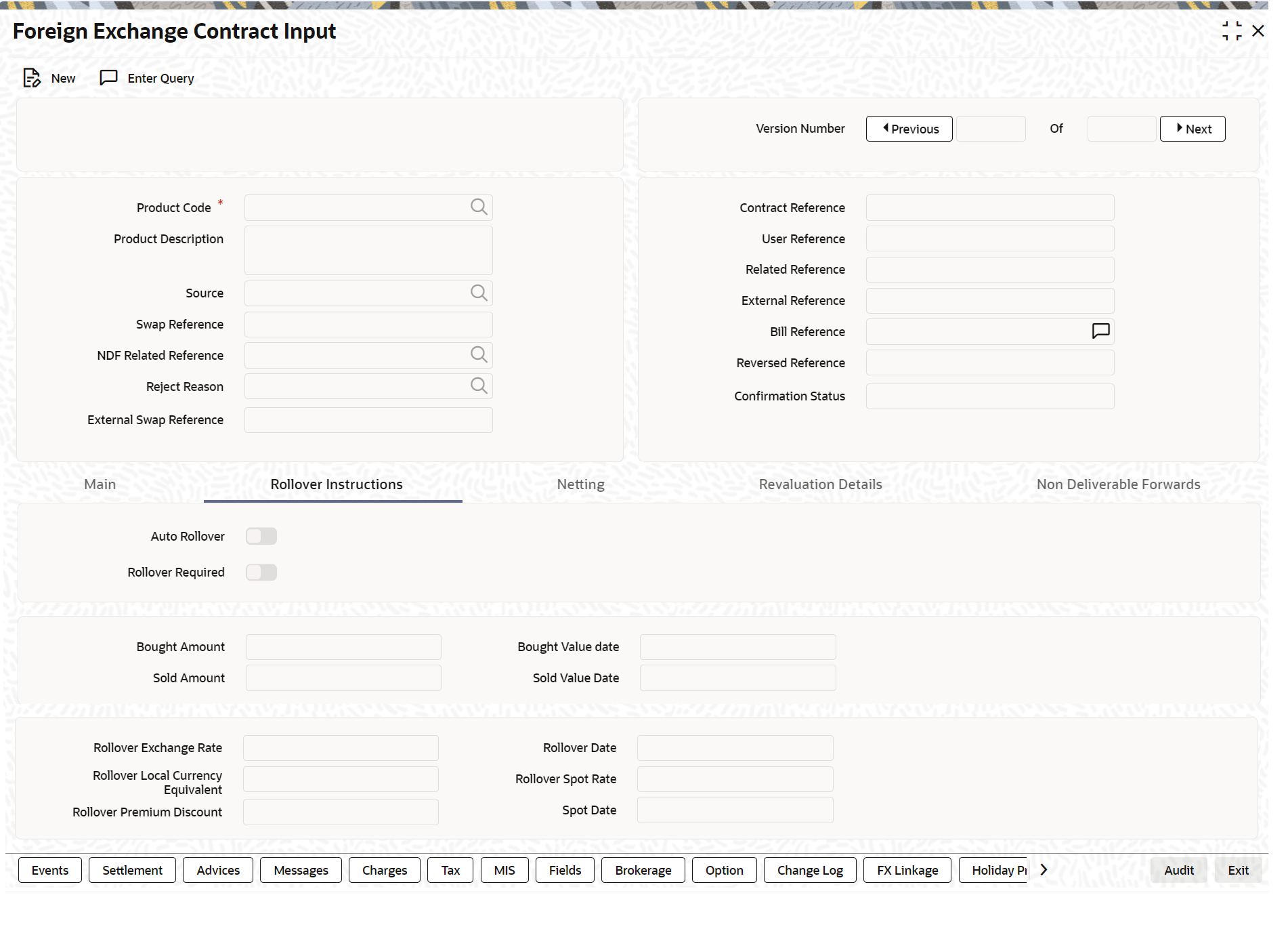

The Foreign Exchange Contract Input screen is displayed.

Figure 5-1 Foreign Exchange Contract Input

Description of "Figure 5-1 Foreign Exchange Contract Input" - Enter the details of the contract as per requirement, and click Ok.

Following are the ways to enter the details of a contract.

- Copy the details from another contract and change the details that are different for the contract.

- Enter all the details of the new contract in the contract input form.

- For information on fields, refer to the below table.

Table 5-1 Foreign Exchange Contract Input - Field Description

Field Description Product Code

Based on the type of contract, you are entering, select the product or a product combination that you have maintained in the branch.

To select a product, click on option list icon in the Product Code field. A list of products maintained in the branch is displayed. Click on the product which you would like to offer the counterparty.

When you select a product, the transaction acquires the attributes that you defined for the product. On entering the Product code and tabbing-out, the product details get populated.

Product Description

The description of the selected FX product is defaulted here.

Source

This indicates the name of a registered external system in Oracle Banking Treasury Management.

External Swap Reference Number

This is the swap reference number generated by the external system for the FX Swap deal. In case of the amendment (by reversal of parent and rebooking) while booking a child contract, the system nullifies the External swap reference of the parent and copy the external swap reference number to the child contract. Both the legs of the swap contract will have the same reference number.

Note:

The Swap reference number is only for information purpose, and no process is executed based on this in Oracle Banking Treasury Management.

The External Swap reference number can be viewed in the Foreign Exchange Contract Summary screen.

NDF Related Reference Number

Select the NDF Related reference number from the option list. The list displays all unfixed authorized NDF Forward contracts.

All contracts that are entered into the system are assigned a unique identification number known as the Contract Reference number.

The reference number for a contract is based on the Branch Code, the Product Code, the date on which the contract is entered (in the Julian Date format) and a running serial number for the day.

The Julian Date is of the following format:

“YYDDD”

Here, YY stands for the last two digits of the year and DDD for the number of day(s) that has/have elapsed in the year.

Reject Reason

The system displays the reject reason.

Contract Reference

Select the contract reference number of the check for the required financing from the adjoining option list. The system displays the contract reference numbers which has Active status Once you have specified the above details, click 'P' button to populate the details of the contract.

User Reference

In addition to the automatically generated Reference Number; Identify the contract you are processing with the unique reference number.

Typically, you would use this field to capture the reference number assigned to a contract by the counterparty.

Related Reference

Specify the related reference number for the contracts. For an NDF Forward Contract, this field indicates the reference number of the corresponding NDF Fixing Contract. For an NDF Fixing Contract, it indicates the NDF Forward Contract reference number.

It is a mandatory field for the NDF Fixing Contract. It is NULL while booking the NDF Forward Contract, and while booking the NDF Fixing Contract, set to NDF Fixing Contract.

External Reference

This is the reference number sent from the external system. This is a mandatory field during upload from an external system.

Bill Reference

This is the reference number of the bill contract in the BC module.

Confirmation Status

The system displays the confirmation status.

Confirmation status is ‘Unconfirmed’ for a contract at the time of booking or after any amendment. The status moves to ‘Confirmed’ when the confirmation is done for the contract by auto/manual matching or manually. A deal which is already confirmed by message matching can be marked as unconfirmed manually from the Manual Matching screen and the confirmation status will be changed to Unconfirmed.

If the affirmation for an FX contract with an Affirmation Type for which the field for ‘Consider for contract confirmation’ is checked, then also the contract status moves to ‘Confirmed’. If after such an affirmation, unaffirm action is done for the contract, then confirmation status will change back to unconfirmed.

Entering the Confirmation waiver changes the confirmation status of the deal as ‘Waived’. If the confirmation is un-waived for such a deal, then confirmation status moves back as ‘Unconfirmed’. Confirmation can be unwaived for a deal with confirmation status as ‘Waived ‘only. The system will validate the same.

If the confirmation received or affirmation received with affirmation type is checked for ‘Consider for Contract Confirmation’, then Confirmation Status is ‘Confirmed’ for the deal.’

If confirmation status of a deal is ‘unconfirmed’ and confirmation waiver is not marked for a deal then related payment messages will be generated in ‘Confirmation Pending’ status.

Reversed Reference

The reference number of the contract that is being reversed and re-booked is displayed here.

Note:

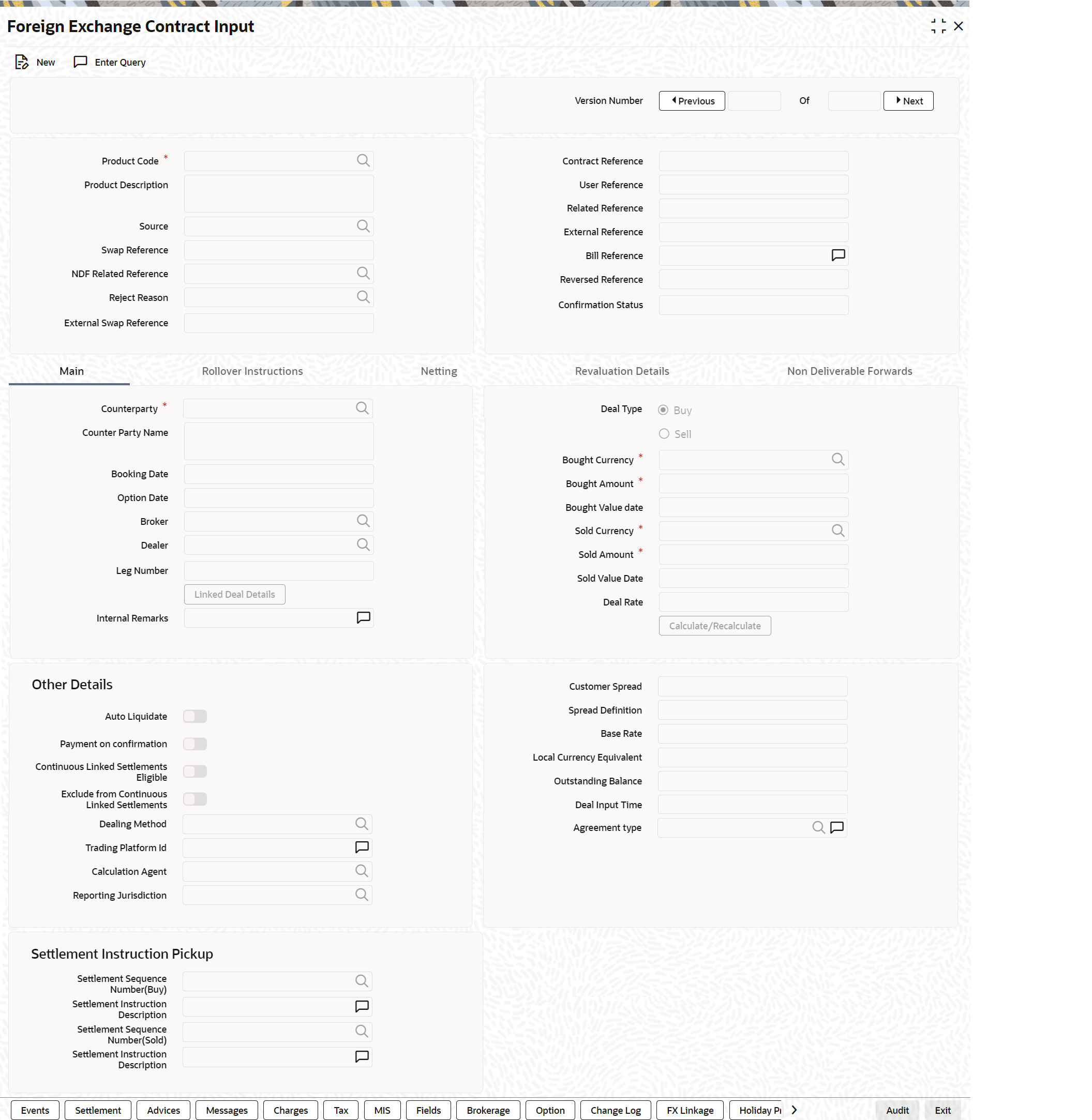

For further details on reversing and rebooking of a contract, refer the topic titled Reversing and Rebooking a Contract of this user manual. - On the Foreign Exchange Contract Input screen, click Main.

For information on fields, refer to the below table.

Table 5-2 Main Tab - Field Description

Field Description Counterparty

Select the counterparty who is involved in the foreign exchange deal that you are entering.

The adjoining option list displays a list of all the customers allowed for the product (that you have chosen in the product field). Double click on the ID of the customer to choose it.

Counterparty Name

The name of the selected counterparty is defaulted here.

Booking Date This is the date on which the contract begins. The system defaults to today’s date, which you can change.

- This date cannot be earlier than the Start Date or later than the End Date of the product.

- This date should be earlier than or the same as the Value Date of the contract.

Option Date

You can specify an option date for forward deals if it has been allowed for the product it involves.

If a value date is specified then the maturity date of the deal can be changed to any day on or before the option date.

Broker

Specify the broker involved in an FX deal in this field. The adjoining option list displays a list of the brokers that you have maintained in your bank. Choose the broker involved in the deal by double-clicking on the ID of the broker.

If brokers have been disallowed for the product that you chose in the Product Code field, you cannot specify a broker for the deal.

When a deal involving a broker is processed, the brokerage applicable to the broker is picked up, and the necessary accounting entries passed.

Dealer

Enter the code of the foreign exchange dealer in your bank who entered into this deal. From a list of dealers available, choose the dealer. Double click on the ID of the dealer who entered into the deal.

Linked Deal Details

After entering the combination deal and clicking on Linked Deal, the system displays an information message “Only 1st leg request processed successfully” and defaults the second.

Deal Type

In a Foreign Exchange deal, you would either buy or sell currency. Indicate if the contract that you are entering is a Buy deal or a Sell deal.

To indicate that the deal is a Buy deal, click on the button against Buy. Indicate that a deal is a Sell deal by clicking on the button against it.

Bought Currency

Indicate the currency that you are buying. The adjoining option list displays all the currencies that are allowed for the product. Choose the appropriate one.

Note:

Note: For MT300/304 messages, the system restricts the display of the following currency codes in the options list.For information on ISO 4217 Currency Code, refer to Table 5-3

Bought Amount

Adjacent to the Currency field is the Amount field. You must enter the bought amount of the bought currency here.

Against the Bought currency, enter the bought amount in the Amount column. Enter the amount in numerals and then enter.

- ‘T’ - to indicate that the amount is in thousands

- ‘M’ - to indicate that the amount is in millions

- ‘B’ - to indicate that the amount is in billions

On saving the transaction after entering all the required details in the system, the system validates the value of the bought amount against the following:

- Product transaction limit.

- User Input limit

If the transaction currency and the limit currency are different, then the system converts the amount financed to limit currency and checks if the same is in excess of the product transaction limit and user input limit. If this holds true, the system indicates the same with below override/error messages:

- Number of levels required for authorizing the transaction

- The Transaction amount is in excess of the input limit of the user

Bought Value Date Enter the value date for the bought leg of the contract in the Value date column. Against the bought currency and bought amount, indicate the value date for the bought leg in the Value Date column.

Sold Currency

Indicates the currency that you are selling.

The adjoining option list displays a list of all the currencies that are allowed for the product. Choose the appropriate one.

Note: For MT300/MT304 messages, the system restricts the displays of the following currency codes in the option list

For information on ISO 4217 Currency Code, refer to Table 5-3

Sold Amount Adjacent to the Currency field is the Amount field. You must enter the sold amount of the sold currency here.

Against the Sold currency, enter the sold amount in the Amount column. Enter the amount in numerals and then enter

- T - to indicate that the amount is in thousands

- M - to indicate that the amount is in millions

- B - to indicate that the amount is in billions

On saving the transaction after entering all the required details in the system, the system validates the value of the bought amount against the following:

- Product transaction limit

- User Input limit

If the transaction currency and the limit currency are different, then the system converts the amount financed to limit currency and checks if the same is in excess of the product transaction limit and user input limit. If this holds true, the system indicates the same with below override/error messages:

- The number of levels required for authorizing the transaction.

- The transaction amount is in excess of the input limit of the user

Sold Value Date

Enter the value date for the sold leg of the contract in the Value date column.

Similarly, against the sold currency and sold amount indicate the value date of the sold leg of the contract.

The Value Date is the same except in the case of Split Value Date deals.

Deal Rate

Based on the counterparty, the Currency Pair and the Value Date for the transaction, the System automatically assigns the deal rate that is to be used for the funds’ transfer deal, if currency conversion is involved.

The Deal Rate applicable for the transaction = Base Rate +/- Customer Spread (depending on whether it is a Buy or a Sell).

Customer Spread

Similarly, the spread that you have maintained for the specified Counterparty, Currency Pair and Tenor combination in the ‘Customer Spread Maintenance’ screen is picked up and applied for the customer involved in the deal.

While picking up the Customer Spread, the System ascertains the tenor of the contract according to the following logic:

Buy Tenor = Buy value date – (System date + Spot date):

Sell Tenor = Sell value date – (System date + Spot date)

Note:

If spread details for a specific counterparty (for the currency pair) are unavailable, the System looks for the customer spread maintained for the wild-card ALL entry. If even that is not available, then the Customer Spread defaults to zero.

Spread Definition

The spread definition which indicates whether spread is calculated in percentage or points is displayed here.

Base Rate

Base Rate is derived from the Mid Rate and the Buy/Sell Spreads that you maintain for the currency pair in the exchange rate maintenance table.

Local Currency Equivalent

The local currency equivalent of the contract amount is displayed in this field. The local currency amount is calculated as follows:

In case of a direct quote currency:

LCY = FCY x Rate

In case of indirect quote currency:

LCY = FCY / Rate

Outstanding Balance

The outstanding balance for a particular contract is displayed here. This is the amount which is not yet Canceled or Liquidated.

Deal Input time

This field captures the deal execution time at the time of deal booking received from front office.

Format: YYYY-MM-DD HH:MM:SS:SSS (Default).

Here SSS is milliseconds.

Note:

The above format can be changed in the user setting option based on requirement.

System throws an error when you give the wrong date or time format on modification.

Internal Remarks

Enter remarks about the contract.

Fund Identity

Select the fund id from the adjoining option list.

Auto Liquidate

Foreign exchange deals liquidate automatically or manually.

Deals for which you have specified the automatic mode of liquidation automatically liquidates on the Value Date during the beginning-of-day processing (by the Automatic Contract Update function).

If you do not specify auto liquidation for a product, you have to give specific instructions for liquidation, through the ‘Manual Liquidation’ screen, on the day you want to liquidate a deal.

If the Value Date of a deal is a holiday, the deal liquidates depending on your specifications in the Branch Parameters table. In this table:

- If you have specified that processing has to be done on the last working day (before the holiday), for automatic events, the deal falling on the holiday liquidates during the beginning-of-day processing on the last working day before the holiday.

- If you have specified that processing has to be done only on the system date, for automatic events, the deal falling on a holiday is processed the next working day after the holiday

If you have specified that processing has to be done only on the system date, for automatic events, process the deal falling on a holiday the next working day after the holiday, during beginning-of-day processing.

To indicate that you would like to liquidate a contract automatically on the value date, click on the box adjacent to Auto Liquidation.

Continuous Linked Settlements Eligible

System automatically updates this field based on certain criteria. Only if the conditions are satisfied, the deal is processed via the ‘CLS Bank’. Otherwise, it will be considered as a normal FX transaction.

Payment on Confirmation

Check this box to confirm the payment, Payment messages are sent only in the following conditions

- If Confirmation Status is ‘Confirmed’ for the deal. This status is the result of either confirmation received or affirmation received with affirmation type checked for ‘Consider for Contract Confirmation’.

- If Confirmation waiver is marked for the contract.The linked payment messages for an event is generated only if ‘Payment on confirmation’ is checked for the contract. Otherwise message will be held in ‘Pending for Confirmation’ status.

Exclude From Continuous Linked Settlements

This option enables you to process a CLS eligible deal as a non-CLS deal. You have to select the ‘Exclude From CLS’ option to process a CLS deal as a normal FX transaction.

Refer the Continuous Linked Settlements chapter of the Foreign Exchange User Manual for details on the maintenance required for CLS deals and processing the same in Oracle Banking Treasury Management.

Agreement Type

Select the agreement type from the displayed list of values or enter the type of agreement directly in the field.

This field specifies the type of the agreement covering the transaction

Calculation Agent

Select the Calculation agent for a cash-settled trade from the displayed list of values.

This field specifies the party that acts as calculation agent for a cash-settled trade. The calculation agent is allowed only for the NDF opening deals.

Reporting jurisdiction

Select the supervisory party from the displayed list of values. This field specifies the supervisory party to which the trade needs to be reported.Note:

If Reporting jurisdiction is selected as OTHR, the Additional Reporting Details are required by the regulator. For more information, refer to Step 6 in section 2.5.1 Settlement details of Settlement User Guide.Limit/Risk Tracking

By default this field is checked.

Check this option to specify that limit tracking for settlement risk, pre-settlement risk and weighted risk should be done for FX contracts. When this option is checked, the risk tracking option will also be enabled.

Risk Percentage

The risk percentage for the contract is displayed here.

The risk percent is fetched from risk percent maintenance for combination of risk category+ ‘FX’+ product combination or risk category+ ‘FX’+ ‘ALL’ combination using original tenor of the contract.

Risk Weighted Amount

The risk-weighted amount is displayed here.

The risk percent is applied on the bought amount to arrive at risk weighted amount.

Note:

When a contract is copied, the limit tracking, risk tracking options and credit lines are copied from the contract. The risk percent and risk weighted amount will be zero.

Whenever the counterparty is changed, the credit lines are made NULL as the credit lines are dependent on the counterparty.

If credit lines are changed during amendment then the existing utilization is transferred to the new credit line and the utilization for the old credit line will be made Zero. If limits tracking option is unchecked during amendment, the utilization will be nullified for the credit lines.

The tenor for calculation of risk weighted amount will be calculated based on tenor type (‘Fixed’ or ‘Rolling’) maintained at the product.

Tenor of FX contract

Tenor of an FX contract is calculated as follows:

Fixed: Bought value date – booking date

Rolling: Bought value date – Branch date.

During the rollover event, the tenor of the rollover version of FX contract is arrived as follows:

Fixed: Rollover Bought value date – original booking date (the tenor is calculated from the original booking date).

Rolling: Rollover Bought value date – Branch date (the tenor is calculated from the rollover date).

Track Settlement Risk

This option will be enabled only when the Limits Tracking option is checked.

Check this option to specify that limit tracking should be done on bought amount of FX Contracts.

Track Pre-Settlement Risk

Set the revaluation to Y at the product level and check the limits tracking option to enable this option.

Check this option if limit tracking on the revaluation gain for FX contracts is required.

Track Weighted Risk

Check the Limits Tracking option to enable this option.

Check this option to specify that limit tracking on the risk-weighted amount for FX contracts under this product.

Settlement Risk Credit Line Settlement risk is the risk that one party fails to deliver the terms of a contract with another party at the time of settlement. Select the credit line to be used for netted settlement risk tracking from the option list. The list displays all valid credit lines applicable for the counterparty.

Pre-Settlement Risk Credit Line

Pre-settlement risk is the risk that one party of a contract fails to meet the terms of the contract and default before the contract's settlement date, prematurely ending the contract. This field is enabled only if the Limits Tracking option and Risk Tracking option is selected else it is made NULL and disabled.

Select the Credit line to be used for tracking revaluation gain/ loss from the option list. The list displays all valid credit lines applicable for the counterparty and product

Weighted Risk Credit Line Select the credit line that should be used for netted risk weighted limit tracking from the option list. The list displays all valid credit lines applicable for the counterparty.

Dealing Method

Identifies the method by which the deal got initiated

Trading Platform ID

Identifies the trading platform if dealing method is ELEC

Settlement Sequence Number (Buy)

Specify the settlement sequence number of the settlement instruction. Alternatively, select the settlement sequence number from the option list. The list displays all the available settlement instruction.

Settlement Instruction Description

The system displays the description of the selected Settlement Instruction.

Settlement Sequence Number (Sold) Choose a settlement instruction by specifying a settlement sequence number. Skip this field if any default settlement instruction is specified.

Settlement Sequence Description

The system displays the description of the selected Settlement Instruction.

For MT300/304 messages, the system restricts the display of the following currency codes in the option list.

Changing the Exchange Rate

You can change the exchange rate that is maintained for the currency in the currency table. Only, the changed value should be within a certain range. This range is referred to as the Exchange Rate Variance.

The exchange rate variance is specified while creating a product. Oracle FLEXCUBE will carry out the following validations while saving a Contract:

- Ensure that Credit lines are different for each limit tracking.

- Checks for the existence of risk category in the Customer maintenance if risk weighted limit tracking is set at the contract level.

- Ensure that Credit lines are different for each limit tracking.

- Checks for the existence of risk category in the Customer maintenance if risk weighted limit tracking is set at the contract level.

- Checks for the existence of risk percent maintenance for risk category + ‘FX’+ (‘ALL’/ product) combination if risk weighted limit tracking is set at the contract level.

- Checks for the presence of credit lines if risk tracking options are set at the contract level.

- Displays an error message if pre settlement risk option credit line is maintained and ifthe product is not set for revaluation

- Displays an error message if limits tracking required is ‘N’ and risk tracking options are ‘Y’

Table 5-3 ISO 4217 Currency Code

ISO 4217 Currency Code Currency XAU

Gold (one troy ounce)

XAG

Silver (one troy ounce)

XPD

Palladium (one troy ounce)

XPT

Platinum (one troy ounce)

- On the Foreign Exchange Contract Input screen, select the Rollover Instructions tab.

By default, a forward contract that is marked for roll-over will be rolled-over with the terms of the original contract. The terms can be changed certain terms by specifying them in the Roll-over Instructions tab screen.

Foreign Exchange Contract Input screen with Rollover Instructions tab details is displayed.

- Roll-over instructions (for forward contracts) can be input only through the Unlock

operation. You cannot input them when you are entering the contract details through

the New or Copy operation

For information on the fields, refer to the below table.

Table 5-4 Rollover instructions - Field Description

Field Description Auto Rollover

While setting up a product, you should specify whether contracts involving the product should be rolled over on the maturity date. If rollover is applicable, specify in this field whether contracts involving this product should be rolled over automatically or manually.

If you want the contract to be automatically rolled over, click on the check box against this field. The contract will be automatically rolled over on its Value Date (settlement date).

If you do not click on the check box, you should manually roll over the contract. To manually roll over a contract, enter the date on which the contract should be rolled over in the Rollover Date field.

Rollover Required

In this field, specify whether rollover is required or not, for contracts involving this product.

If you check this box, rollover is allowed for contracts involving this product. During contract processing, specify whether such contracts should be automatically or manually rolled over.

If you do not check this box, rollover is not allowed for contracts involving this product.

Note:

If you have selected Yes in the Auto Liquidation field, the Rollover Allowed field should be set to No. In other words, if contracts involving this product are to be automatically liquidated on the maturity date, these contracts cannot be automatically rolled over.

Sold Amount

This is the Sold amount of the new contract. The Sold amount of the old contract defaults here if the Deal Type is Sell.

Sold Value Date

This is the settlement date of the Sell contract as specified in the Contract Details table.

If Split Value Dates are allowed for the contract, the Bought and Sold legs of the contract have different settlement dates

Bought Amount This is the Bought Amount of the new contract. The Bought Amount of the original contract defaults here if the Deal Type is Buy.

Bought Value Date

This is the settlement date of the new contract. Enter a date that is later than the Value Date of the original contract.

For forward contracts, enter a date that is later than the Spot Date of the currency. If an Option Date is allowed for the product involving the contract, enter a date that is later than the Transaction Date and earlier than the Value Date of the contract.

Rollover Exchange Rate

The Exchange Rate between the currency pair involved in the contract is displayed here.

You can change the Exchange Rate that is displayed here. Since the rate that you enter here would be different from the Standard Exchange Rate it is referred to as a Exchange Rate Variance.

You cannot enter a rate that exceeds the Maximum Exchange Rate Variance that you have defined for the product (in the Product Preferences screen).

- If the variance is less than the Normal Exchange Rate Variance defined for the product, the contract stores the details without any override.

- If the variance is greater than the Normal Exchange Rate Variance and less than the Maximum Exchange Rate Variance, the system prompts an override. The contract is stored only if the override is accepted.

- If the variance is higher than the Maximum Exchange Rate Variance With Override, the contract is not stored. You have to change the Exchange Rate before storing the contract.

Rollover Spot Rate

For contracts involving local currency, the Spot Rate of the foreign currency is the default Spot Rate.

For cross currency contracts, the rate between the two currencies as maintained in the Currency table is taken as the default Spot Rate. If the rate between the two currencies has NOT been maintained, the Spot Rate of the P & L Currency against the local currency is taken as the default Spot Rate.

Change the Spot Rate displayed in this field.

Rollover Date This is the date on which the contract is to be rolled over.

Spot Date

For contracts involving the local currency, the Spot Date of the foreign currency in the pair is taken as the default Spot Date.

For cross currency contracts, the Spot Date of the P & L Currency is taken as the default Spot Date. For example, if the currency pair involved is GBP/USD and if you are buying GBP, the Spot Date of GBP is displayed here.

You can change the Spot Date displayed in this field

Rollover Local Currency Equivalent

The local currency equivalent of the amount involved in the contract is displayed here. This amount can be changed. This is calculated according to the rate maintained in the Currency table. For cross currency contracts, this amount is calculated as:

(Bought Amount * Spot LCY Rate for Bought CCY) * (Sold Amount * Spot LCY rate for Sold CCY)/2

Rollover Premium Discount

For forward contracts, this is the Premium or Discount Amount that is applicable as on the date of initiation of the contract. It is calculated as the difference between the amount in Term Currency (as on the Transaction Date) and the amount in Term Currency (as on the Value Date).

The following terms are different for the new contract:

- Amount

- Value Date

- Roll-over Date

- Roll-over Spot Rate

After you enter the details click Yes. If you do not want to save the details you entered, click No.

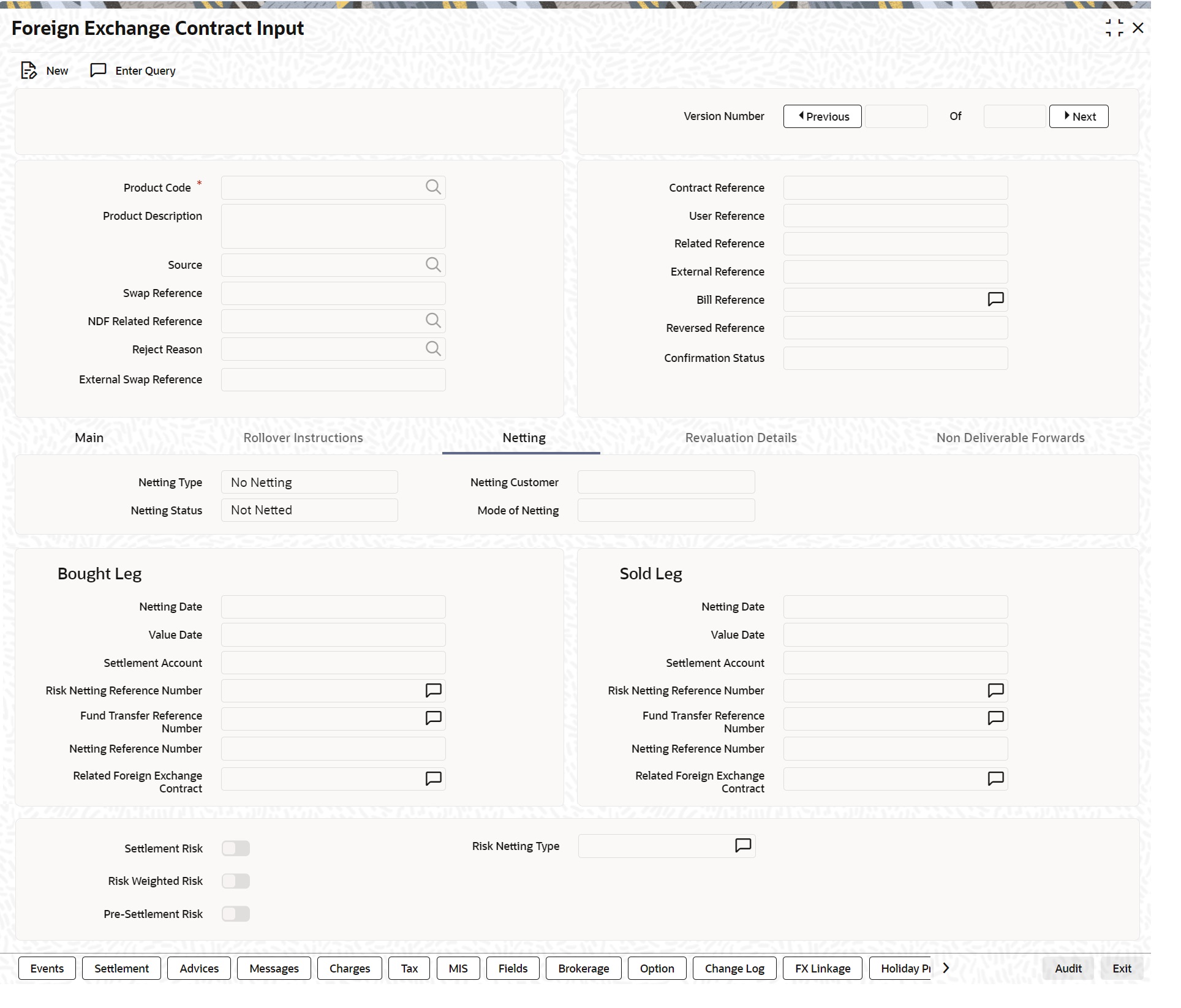

- Click the Netting tab on the FX Contract Input screen and specify the netting preferences in the Netting tab of the FX Contract Input screen.

FX Contract Input screen with the Netting tab details is displayed.

Figure 5-3 FX contract screen with Netting tab details

Description of "Figure 5-3 FX contract screen with Netting tab details" - On the FX contract screen with Netting tab, specify the details as per requirement.

For information on the fields, refer to the below table.

Table 5-5 Netting Tab - Field Description

Field Description Netting Type

In this field, you must first indicate the type of netting. You can net the contracts involving a customer in two different ways. Contracts can either be netted

- Pair wise

- Currency wise

If you choose to net contracts pair wise, the system selects all contracts that have been specified for pair wise netting, for the counterparty. Contracts that have the same currency pair, irrespective of whether they are bought or sold, will be netted.

If you choose to net contracts currency wise, the system selects all contracts that have been specified for currency wise netting, for the counterparty. The value date of the bought currency leg and that of the sold currency leg are considered individually to arrive at the netting date.

Netting Customer

The FX netting customer of the contracts’ counterparty is displayed here. This would default from the FX Netting Customer which you have specified for the Counterparty in Customer Information maintenance. A reference is made to the Treasury Customer Additional Details Maintenance while entering a new contract or amending an existing one.

For every customer, FX contracts are collated based on the FX Netting Customer during the Netting Process-Automatic and Manual.

Netting Status

The status of netting is displayed in this field. Depending on whether the netting type is currency-wise or currency pair-wise, the status will be displayed as any of the following:

- Not Netted

- Bought Leg Netted

- Sold Leg Netted

- Fully Netted

Mode of Netting

Mode of netting is defaulted from the netting agreement maintenance of the FX Netting customer. You cannot override the value of this field for the specific contract. But by changing the value of ‘Netting Type’, Mode of Netting undergoes specific alterations.

If you choose Currency Wise or Pairwise netting as the ‘Netting Type’, a reference is made in the netting agreement maintenance of the counterparty and the corresponding mode is reflected here also.

If you choose ‘No Netting’ as the Netting Type, Mode of Netting resets as a blank value.

Netting date

Specify the date on which you want to net the bought leg of the deal.

Value Date

This is the date on which the bought leg of the contract is to be settled.

Settlement Account

Specify the settlement account to use while netting the Bought leg of the deal.

Risk Netting Reference Number

The reference number used to utilize the limit for the netted amount for the bought leg is displays here.

Fund Transfer Reference Number

The reference number of the funds transfer used for netting the bought leg is displayed here.

Netting Reference Number

The netting reference number of the bought leg is displayed here.

Related Foreign Exchange Contract

Specify the related FX contract for netting.

Netting Date

Specify the date on which you want to net the sold leg of the deal.

Value Date

This is the date on which the sold leg of the contract is to be settled.

Settlement Account

Specify the settlement account used while netting the sold leg of the deal.

Risk Netting Reference Number

The reference number used to utilize the limit for the netted amount for the sold leg is displayed here.

Fund Transfer Reference Number

The reference number of the funds transfer used for netting the bought leg is displayed here.

Settlement Risk

You can specify whether settlement risk tracking should be done on the netted amount for all FX being netted for the customer. This will be defaulted from the Limits netting agreement.

Risk Weighted Risk

You can specify whether risk weighted limit tracking should be done on the netted amount for all FX being netted for the customer. This will be defaulted from the Limits netting agreement

Pre-Settlement Risk

You can specify whether pre-settlement risk tracking should be done on the netted amount (net of revaluation gain/ loss) for all FX being netted for the customer. This will be defaulted from the Limits netting agreement.

Risk Netting Type

The netting type displayed here, defaults from the limits netting agreement of the counterparty or FX netting group customer.

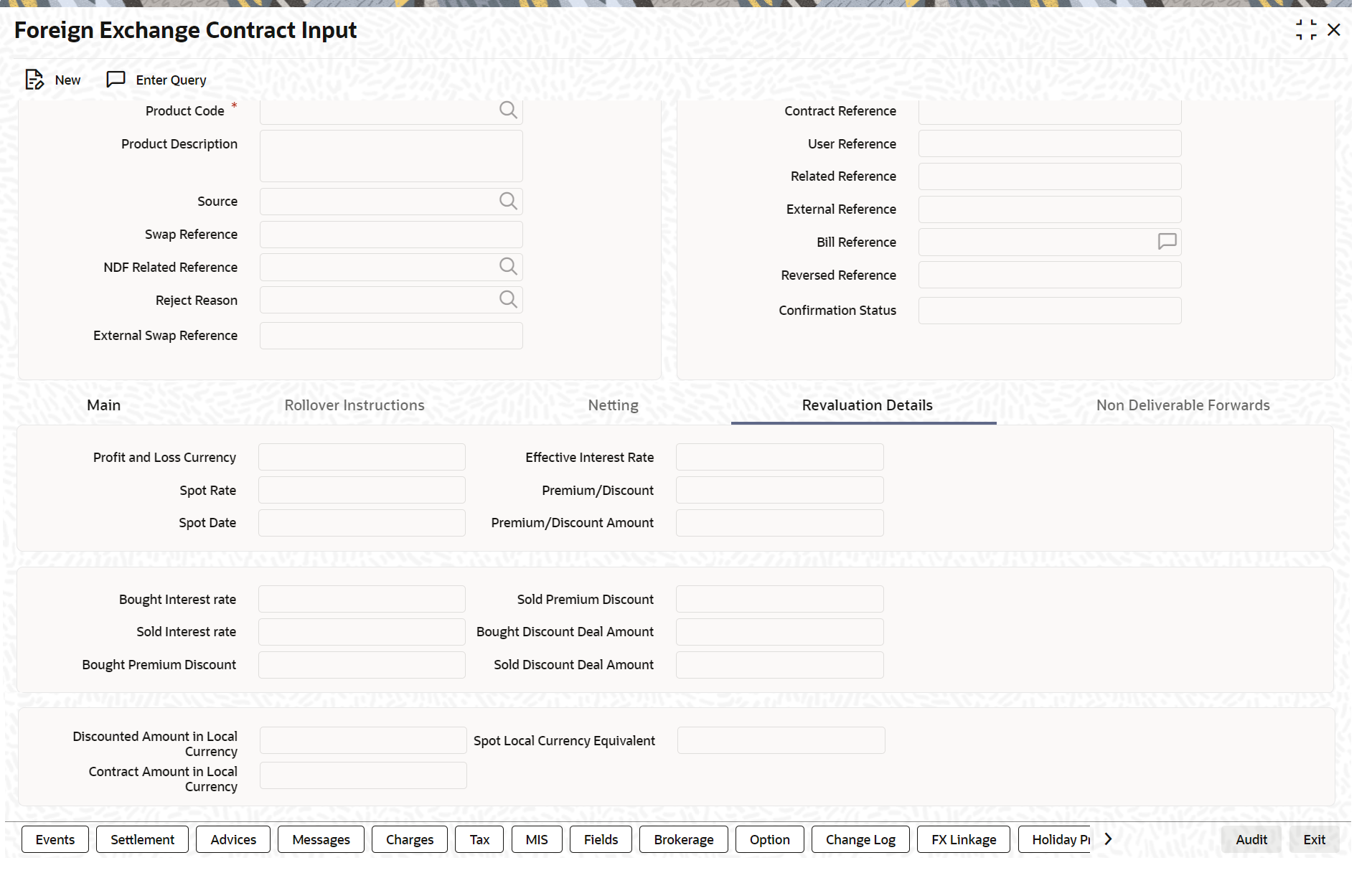

- On the Foreign Exchange Contract Input screen, select the Revaluation details tab.

The Foreign Exchange Contract Input screen with Revaluation details tab is displayed as below:

Figure 5-4 Foreign Exchange Contract Input Screen with revaluation tab

Description of "Figure 5-4 Foreign Exchange Contract Input Screen with revaluation tab" - Specify the details as per requirement.

For information on Field, refer to the below table.

Table 5-6 Revaluation Details - Field Description

Field Description Profit and Loss Currency

If a forward contract is being revalued using the Straight-Line Revaluation method, the revaluation details should be specified in this screen.

For contracts involving the local currency, the local currency is taken to be the P & L Currency. You cannot change the P & L currency to any other currency.

For cross currency contracts, the P & L currency will be derived based on the Buy/Sell indicator of the contract.

Spot Date

For contracts involving the local currency, the Spot Date of the foreign currency in the pair is taken as the default Spot Date.

For cross currency contracts, the Spot Date of the P & L Currency is taken as the default Spot Date. For example, if the currency pair involved is GBP/USD and if you are buying GBP, the Spot Date of GBP is displayed here.

You can change the Spot Date displayed in this field.

Spot Rate

For contracts involving local currency, the Spot Rate of the foreign currency is taken as the default Spot Rate.

For cross currency contracts, the rate between the two currencies as maintained in the Currency table is taken as the default Spot Rate. If the rate between the two currencies has NOT been maintained, the Spot Rate of the P & L Currency against the local currency is taken as the default Spot Rate.

You can change the Spot Rate displayed in this field.

Revaluation Rate Type

This field displays the rate type defined for the respective product.

Effective Interest Rate This field represents the interest rate, which the system computes after considering the spot date and spot rate entered.

To check if the interest rates of both the bought and sold currencies have been quoted reasonably, the premium paid or discount received for that contract is projected into an annualized effective interest rate.

This rate is calculated by the system based on the total profit or loss for the period from the spot date to maturity date or option date (in case an option date is used) using the formula:

Rate = P X Considered Year Days X 100 / S X N

where:

- P = the profit or loss on the contract

- Considered Year Days = number of year days considered for calculation of effective interest rate.

- S = spot equivalent

- For non-arbitrage contracts:

- S = FCY amount X spot rate

- For arbitrage contracts:

- S = FCY amount X spot rate

- (FCY amt identified in P/L CY.)

N = the number of days for the profit or loss to be apportioned on a straight-line basis. It is calculated from the spot date to the maturity date (or option date) minus 1. This rate is compared to the difference between the two rates that are entered in “Interest Rate Bought Ccy.” and “Interest Rate Sold Ccy.” If it does not match, the system will display an error message and ask for an override.

Premium/Discount

This indicates whether the contract results in a premium or a discount.

Premium /Discount Amount

The difference between the Spot Equivalent in LCY and the Contract Amount in LCY is the Premium or Discount Amount. A minus sign indicates that the contract is at a discount.

For contracts involving the local currency, the local currency is taken as the P & L Currency. When such a contract is revalued, the Spot Rate (of the P & L Currency as on the revaluation date) is applied on the contract amount to calculate the Spot Equivalent in LCY. The difference between the Contract Amount in LCY and the Spot Equivalent in LCY is the Premium or Discount Amount. A minus sign indicates that the contract is at a discount.

For cross currency contracts, the Spot Rate of the P & L Currency, as against the other currency, is used to calculate the amount in terms of the P & L Currency. The local currency equivalent of this amount is calculated as the Spot Equivalent in LCY. The difference between the Contract Amount in LCY and the Spot Equivalent in LCY is the Premium or Discount Amount.

If the cross currency rate has NOT been maintained, the Spot Rate of the P & L Currency is applied on the contract amount to calculate the amount in terms of the P & L Currency. The local currency equivalent of this amount is calculated as the Spot Equivalent in LCY. The difference between the Contract Amount in LCY and the Spot Equivalent in LCY is the Premium or Discount Amount.

Interest Rate Bought Leg

This is the Interest rate applicable to the Bought leg of the contract.

Interest Rate Sold Leg

This is the Interest rate applicable to the Sold leg of the contract.

Discount Bought Leg

Specify the (notional) interest that you will earn on the bought currency (interest receivable) when a forward deal is settled. On the booking date, the buy deal amount is reduced by the discount amount and contingent entries are passed for the discounted bought amount. Accrual entries are passed for the discount amount till the maturity date, depending on the accrual frequency.

Note:

Specify the ‘Discount Bot Leg’ and ‘Discount Sold Leg’ only if the product involved in the deal is associated with the ‘Discounted Straight Line’ method of revaluation.

Discounted Deal Amount Bought Leg

This is populated only in case of Discounted Straight Line method of Revaluation. This is just a display field. This will be the result of:

Bought Amount – Revalued Discount amount for Bought Leg

Discounted Deal Amount Sold Leg

This is populated only in case of Discounted Straight Line method of Revaluation. This is just a display field. This will be the result of:

Sold Amount – Revalued Discount amount for Sold Leg

Spot Local Currency Equivalent

When the contract is revalued, this information will be used.

Discounted Amount in Local Currency

For an LCY-FCY deal, the discounted amount of the LCY leg is displayed in this field.

For an FCY-FCY deal, the local currency equivalent of the discounted amount of the non-deal currency (calculated at the prevailing exchange rate) is displayed.

Note:

Partial payments/cancellations and rollover are not allowed for products with ‘Discounted Straight Line’ method of revaluation

Contract Amount in Local Currency

The local currency equivalent of the contract amount (as specified in the LCY Equivalent field of the ‘Contract Details’ screen) is displayed here.

- On the Foreign Exchange Contract Input screen, select the Non-Deliverable Forwards tab.

Non Deliverable Forwards tab is enabled only if you select an FX product for which NDF indicator is checked. In other cases NDF tab is disabled

Foreign Exchange Contract Input screen with Non-Deliverable Forwards tab details is displayed.

Figure 5-5 Foreign Exchange Contract Input Screen with Non- deliverable forward tab.

Description of "Figure 5-5 Foreign Exchange Contract Input Screen with Non- deliverable forward tab." - Specify the details as required.

For more information on fields, refer to the below table.

Table 5-7 Non- deliverable forward- Field Description

Field Description NDF Currency

The NDF currency is one among the Bought and Sold currency of the NDF Forward contract. For an NDF Forward Contract, this field is defaulted from product selected, but change it based on the requirement. For an NDF Fixing Contract, NDF currency is defaulted from NDF Forward Contract, and it cannot be changed.

NDF Fixing Status

Indicate the fixing status of the NDF Forward Contract. It is applicable only for NDF Forward Contract. The values of the field are ‘Fixed’ and ‘Not Fixed’.

NDF Fixing Date

Indicate the date on which the difference between the existing market exchange rate and the agreed upon exchange rate is calculated. This date is the settlement days (which are maintained for the settlement currency) before the maturity date of NDF Forward Contract. This field is applicable only for the NDF Forward Contract.

NDF Basis

Indicate the NDF Basis value. This value is used to generate the NDF advices for the NDF Forward contract.

NDF Fixing Source

Indicates the Source system for NDF fixing.

Settlement Currency

Specify the settlement currency other than the NDF currency involved in the deal.

Settlement Amount

Indicate the net settlement amount of the NDF Forward Contract. The net settlement amount is the difference between the settlement currency amount of the NDF Forward Contract and the NDF Fixing Contract. The value of this field is computed after booking the NDF Fixing Contract.

Parent topic: FX Deal