2.5 Maintenance of Forward Exchange Rates

When you revalue a forward FX contract using the rebate (NPV) method of revaluation, an exchange rate referred to as a 'Forward rate' is used for the currencies involved. The forward rate for a currency (for a specific period) is based on the spot rate and the prevailing interest rate.

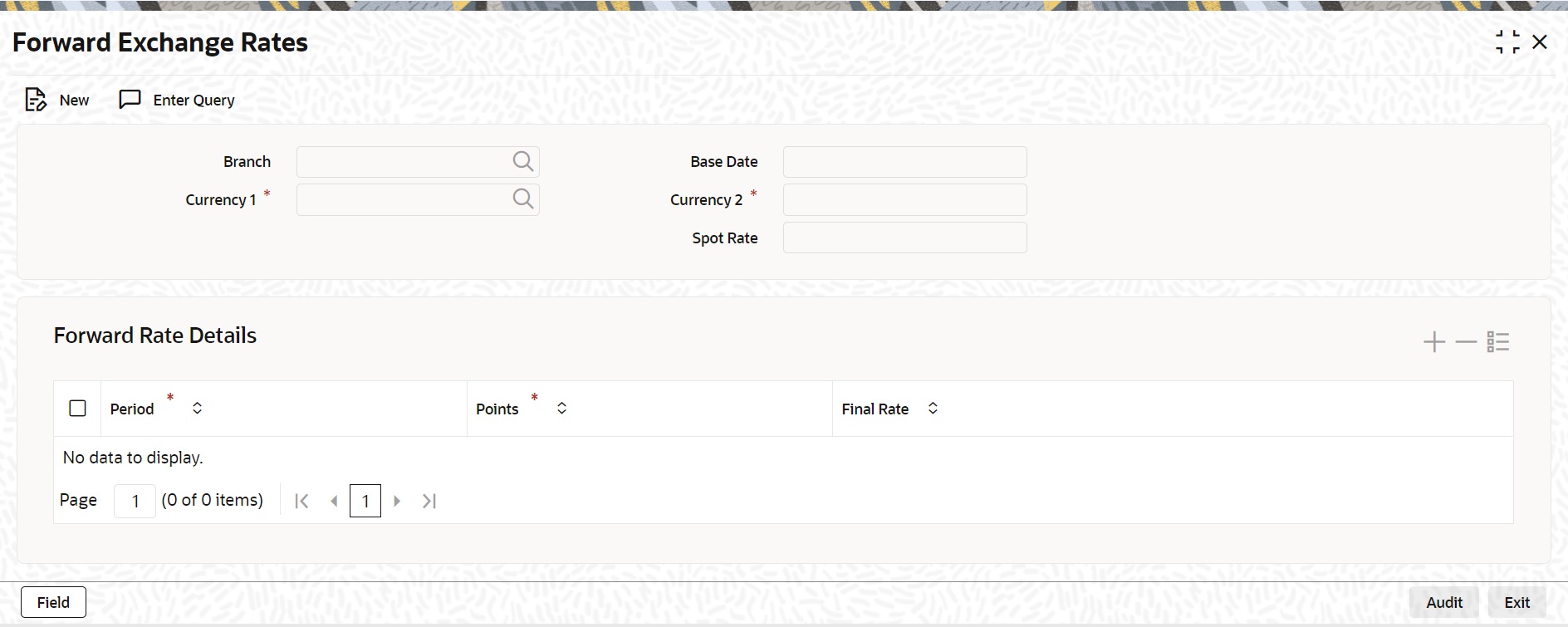

The forward exchange rates for a currency is maintained in the Forward Exchange Rates screen.

Forward exchange rates for a currency is maintained in the Forward Rate Input screen.

Parent topic: Data Maintenance in FX Module