- Securities User Guide

- Maintain and Process Corporate Actions

- Rights and Warrants

- Process Security Redemption Details

19.2.7 Process Security Redemption Details

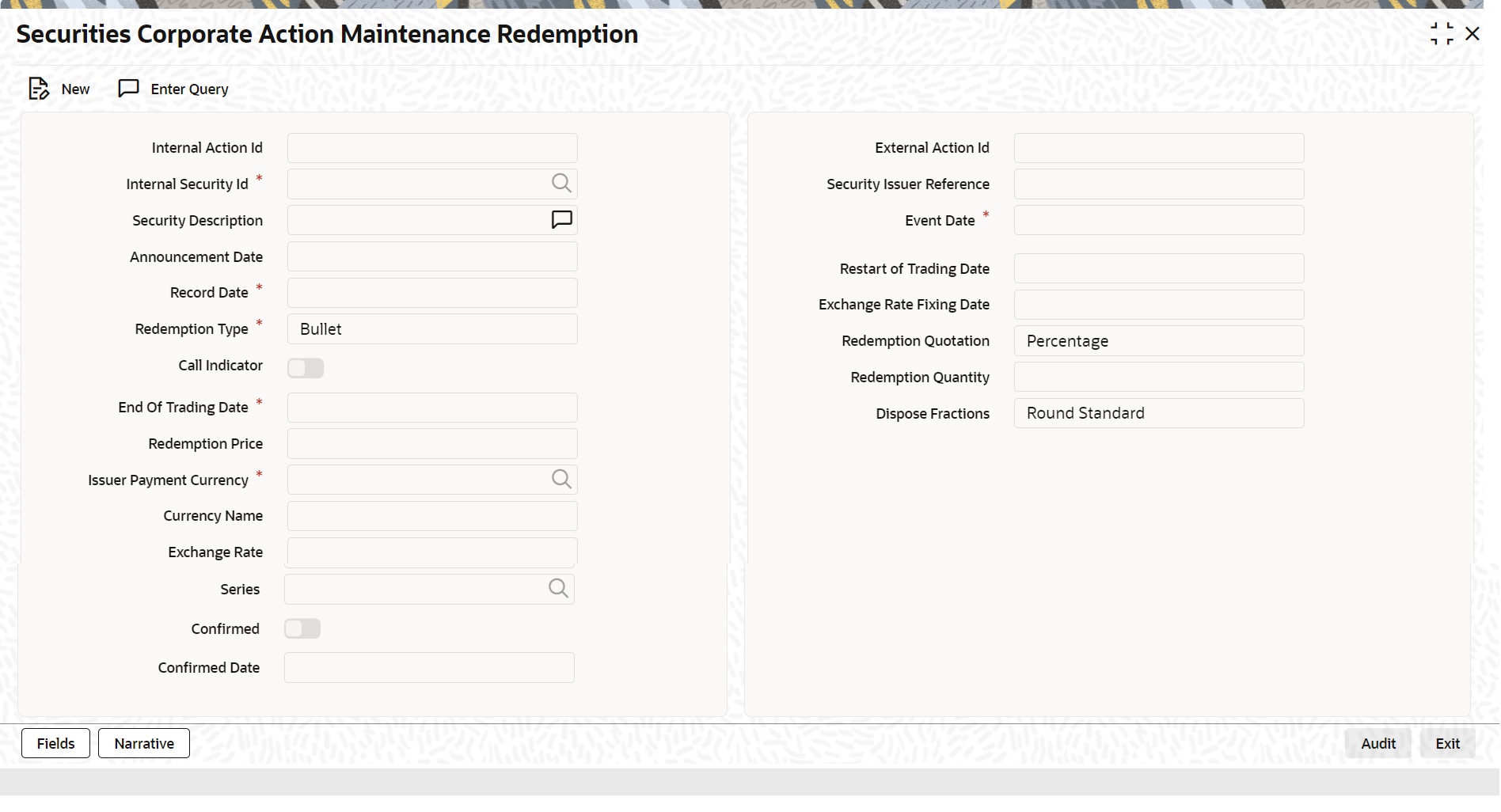

One of the methods of retiring a bond is to redeem it. The Securities Corporate Action Event Maintenance - Redemption screen, allows us to define, and maintain details of redeemable securities.

- On the Home page, specify SEDXREDF in the text box, and click next arrow.

Securities Corporate Action Maintenance Redemption screen is displayed.

Figure 19-4 Securities Corporate Action Maintenance Redemption

Description of "Figure 19-4 Securities Corporate Action Maintenance Redemption" - On the Securities Corporate Action Maintenance Redemption screen, specify the fields.

If you are defining details of new redeemable security, click new icon from the toolbar. The Corporate Action Maintenance Redemption detailed screen will be displayed, without any details. If you are calling a redeemable security record that has already been created, click on the Summary view. The details of existing records will be displayed in a tabular form. From the Summary, the screen chooses an existing record to open it.

Table 19-5 Securities Corporate Action Maintenance Redemption

Field Description Redemption Type

The Redemption type for security will default as defined at the Security Instrument. While defining redeemable securities you can specify the method in which the security is to be redeemed. You can indicate whether the redemption type is to be Bullet, Quantity or Series.

In a bullet type of redemption, all the holdings in the security will be redeemed on maturity. For quantity redemption, the nominal held in the security is redeemed by a specific percentage on a date different from the maturity date.

While redeeming the security either the face value of the security or the number of units held in the security will be reduced by the percentage you specify. In a series type of redemption, the holdings in the specified security pertaining to the specified list will be redeemed on a date other than the maturity date.

Specifying Redemption Schedules

For securities that are redeemable on call and with redemption type Quantity, you can choose to redeem a specific amount of the face value by entering the requisite percentage/ factor or cash flow amount in the ‘Redemption Quantity’ field.

In the case of quantity redemption, the nominal value held in security is redeemed by a specific percentage on a date different from the maturity date. The face value of the security is reduced by the percentage you specify. The total number of units held in the security remains unchanged. For example, if you are holding 10 units of security of face value 1000 USD, then, after a quantity redemption of 30%, your holdings will become 10 units at a face value of 700 USD each. When you insert a redemption schedule, the redemption price of the last schedule is adjusted. For example, you have initially set up security for 100% redemption on maturity at a price of 1,200 USD. The face value of the security is 1,000 USD. Now, you specify a 30% redemption schedule at 360 USD. The system changes the redemption schedule:

FROM the original 100% at 1,200 USD

TO 30% at 360 USD and 70% at 700 USD.

You will have to unlock the Securities Corporate Action Maintenance – Redemption screen and amend the redemption price for the last schedule – in this case, to 840 USD, if you wish to maintain the same total redemption premium. You can, however, change the redemption price of the last schedule to any value that you desire. When a new redemption schedule is maintained, discount/premium accruals are completed up to the event date using the old yield. The YTM re-computation is done as of the event date.

Specifying Back-dated Redemption Schedules

You can insert backdated redemptions for security, provided the back-dated redemption does not go beyond the previous coupon payment date.

For specifying backdated redemptions, the quantity quotation for the security has to be ‘Nominal’. Also, you should have maintained the security as a callable one is the Security Definition screen. However, the effective date cannot be before the last coupon date. Amendment is allowed only for unconfirmed schedules.

Secondly, the back-dated amendment will not be allowed if the DSTL date falls on or after the event date of the redemption schedule.

In the case of the back-dated amendment, corporate action for redemption is processed during End Of Day (EOD) processing. In the case of the insertion of the back-dated schedule, the redemption processing is done during the Beginning Of Day (BOD) processing of the next working day.

A back-dated amendment or insertion of redemption schedules cannot be done beyond the last coupon date. For example, if the system date is January 18, 2003, and the last coupon payment happened on January 01, 2003, then a backdated redemption schedule can go only as far back as January 01, 2003. Also, an inserted redemption schedule date must correspond with a coupon payment date. If it does not, then a coupon schedule will automatically be inserted by the system. For example, suppose that a security has a coupon period from January 01, 2003, to July 01, 2003. The system date is June 15, 2003, and the redemption schedule was inserted on March 31, 2003.

The system breaks the existing coupon period into two:

- January 01, 2003 to March 31, 2003; and

- March 31, 2003 to July 01, 2003

Note:

Any deals booked after the Record Date of the inserted redemption schedule will have to be manually reversed and then re-booked by you after authorizing the inserted redemption schedule. This is because the status of these deals will change from ‘Cum’ to ‘Ex’ due to the insertion of the coupon/redemption schedule.

Following the insertion of the redemption schedule, the system will automatically adjust the ALPL and DPRP events of all deals and rebook them.

End and Restart of trading period

Indicate the date on which trading in the security will be suspended and the date on which the trading will be resumed. This is done by way of specifying the End of Trading Date and the Restart of Trading Date.

Exchange Rate and the Exchange Rate Fixing Date

If the issuer payment currency is different from the security currency then specify the exchange rate between the security currency and the issuer payment currency can be specified. In addition you can also indicate the date on which the exchange rate between the security currency and the issuer payment currency will be announced.

Redemption Price

For securities having ‘Factor’ or ‘Cash flow’ redemption quotation, the redemption price is calculated automatically. For securities having ‘Percentage’ as the redemption quotation, you need to specify the price at which they can be redeemed.

Redemption Quotation

The system displays the redemption quotation selected in the ‘Securities Instrument Definition’ screen. You will not be able to change it.

Redemption Quantity

If the redemption quotation is ‘Factor’, specify the redemption factor. If the redemption quotation is ‘Cash flow’, specify the actual cash flow.

Whenever you modify this value, the system calculates the redemption price upon saving. In the case of factor quotation, whenever the redemption factor is modified for the existing redemption schedules, the redemption price is recalculated on saving. The redemption factor and the price for future schedules are also adjusted.

However, the factor for the last redemption is not adjusted. It remains 0. Similarly, whenever a call redemption schedule is maintained with redemption quotation as ‘Factor’ or ‘Cash flow’, the system calculates the redemption price upon saving. For factor-based redemption schedules, the factor and redemption price is adjusted for future redemption schedules. The factor for the last redemption is not adjusted.

Parent topic: Rights and Warrants