18.2.11 Specify Interest Details for a Bond

When maintaining a bond, you must define its interest details.

- Flat

- Plus Accrued

When the interest component is included in the market price of a security, the quotation method is referred to as Flat. A flat price of a security is also referred to as the Dirty Price. When the interest component is excluded from the market price of a security, the quotation method is referred to as Plus Accrued.

Specify Coupon Frequency

You can indicate if the coupons due for a bond are periodic. Choose the Periodic option, to indicate that the coupon is periodic. Coupons for a bond will be calculated according to the periodicity that you specify. For an interest-bearing bond, with a periodic coupon, you must indicate the Coupon Frequency. The coupon frequency can be:

- Weekly

- Monthly

- Once in two months

- Quarterly

- Once in four months

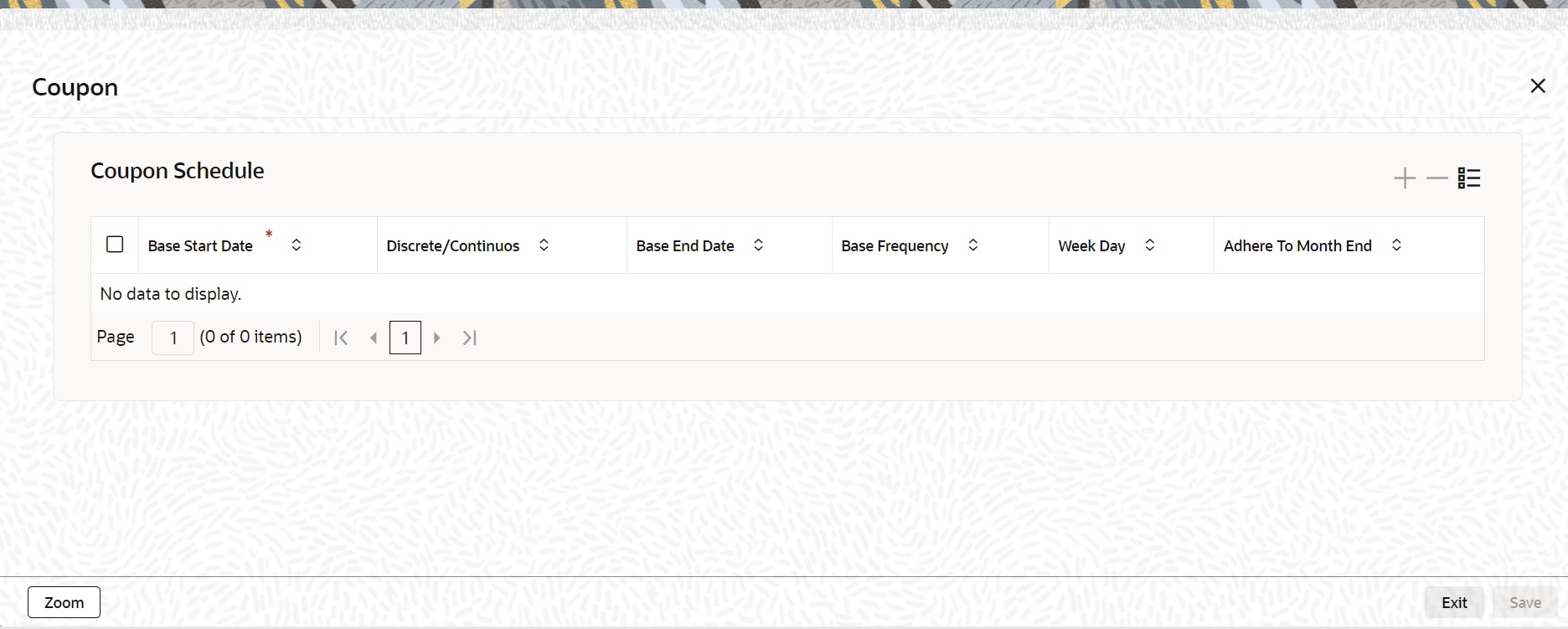

If you indicate that the coupon frequency is weekly, you should also indicate the day on which the coupon is due. For instance, you can have a bond with a weekly coupon that is due on Wednesdays. If the coupon frequency is in terms of a month, you can indicate that the coupon days should adhere to Month-Ends. You can define the actual coupon schedules in the Securities Definition – Coupon Schedules screen. You can process this screen by clicking Coupon.

In this screen, you can specify the first coupon due date (Base Start Date) and the last coupon due date (Base End Date). If you choose the Continuous option, the system calculates all intermediate coupon due dates, based on the frequency specified. If you specify a weekly frequency, you must also specify the Week Day. You can also choose to adhere to month ends. For the Discrete / Irregular coupon schedule definition, you will have to set the coupon dates. For continuous coupon schedules, to introduce an intermediate coupon date, click add icon. Enter the intermediary Coupon Date, in the Base Start Date field, and choose the Discrete option. Even if the coupon schedules are defined to be continuous, you have the flexibility to amend the coupon payment dates.

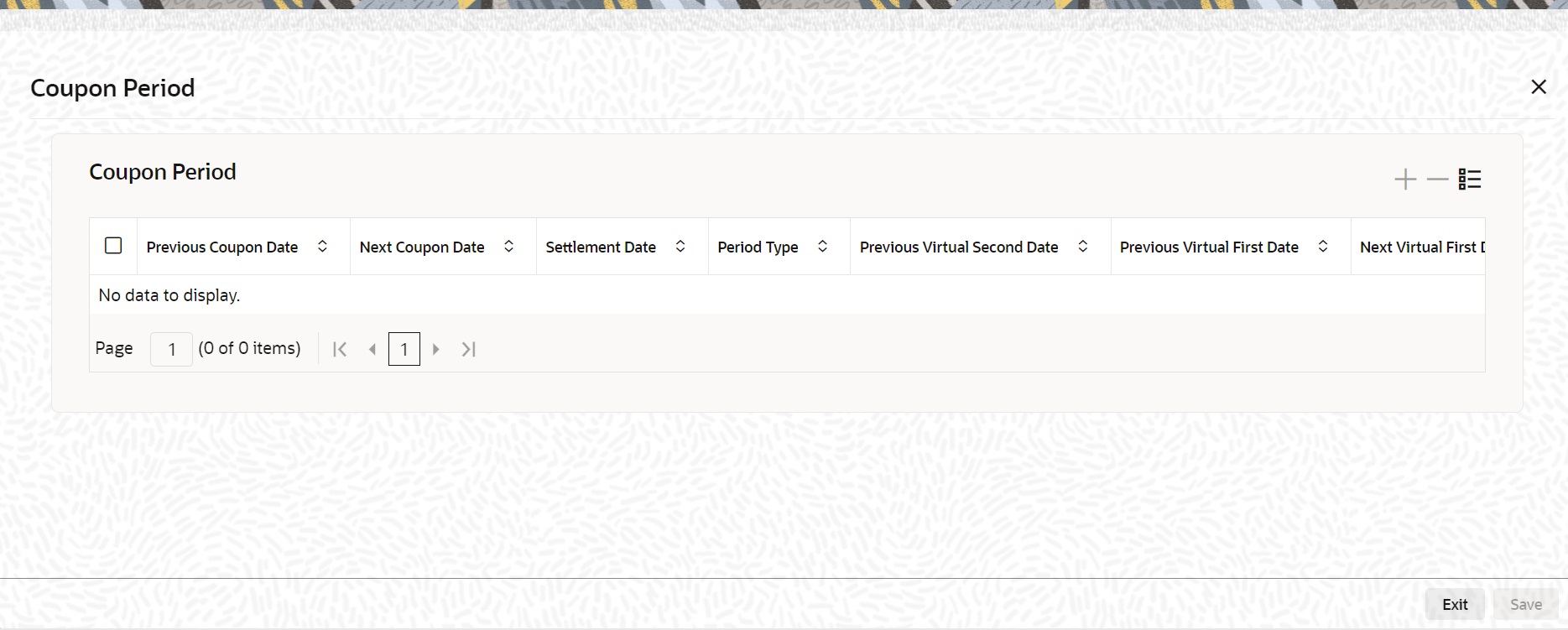

Click Zoom in the Coupon Schedule screen to invoke details of the coupon periods:

You can enter your coupon date amendments on this screen, provided the amended dates do not violate the limit set at the product level. The system computes and displays the settlement date by adding next coupon date + payment delay. During coupon date amendment, if you change the NCD (next coupon date) of one schedule, then you should also change the PCD (previous coupon date) of the next schedule accordingly. If you do not, the system will prompt you with a warning, but will not automatically update the PCD of a schedule when the NCD of the previous schedule is changed. After authorization, coupon dates can only be amended under the following conditions:

- You can amend only the NCD for the current period, provided that there are no active deals after the record date;

- For future periods, you can amend both the NCD and the PCD, provided that there are no active deals in that period.

Any such amendment of PCD/NCD will be subject to the validations as mentioned above.

Interest Rate

Specify the Interest Rate.

Specifying Holiday Treatment for Coupon Payments

The holiday treatment that you have specified as part of Product Preferences is inherited by the security. You can change this treatment for the particular security that you are defining. You can also amend it at any point in time – the amended parameters will take effect for subsequent coupon events. Irrespective of the holiday treatment specified by you, the system will not perform any holiday adjustment if, in the Product Event Accounting Entries Maintenance, you select ‘No’ as the Holiday Treatment parameter. A more detailed explanation is available in the Products manual. For details of holiday treatment of coupon payments, refer to the chapter on Securities Products in this manual.

Using the Holiday Calendar Currency list

If the issuer currency and the security currency are not the same, then you might wish to have coupon events fall on days which are common working days for both currencies. For example, the bank (issuer currency = EUR) issues a USD-denominated bond (security currency = USD), for which one of the coupon payments falls due on a Saturday (a holiday for both EUR and USD). In addition, the following Monday is a holiday for USD.

You have chosen ‘Forward’ as the holiday treatment option for processing of coupon events. Then, subject to the holiday treatment preferences that you maintain the coupon payment is processed with a value date of the following Tuesday, which is the next common working day for both currencies. For any security, you can maintain a list of currencies whose holiday calendars are to be consulted by the system in determining common working days. Click ‘H’ button to invoke the following list:

Use the options list against each field to select a currency whose holiday calendar you wish to be included in the computation of common working days. If one of the currencies maintained in this list is the local currency of the branch, then the system will use the branch holiday calendar to determine the common working days. For example, suppose that the branch currency is GBP and the security issuer currency is USD. You have maintained both GBP and USD in the holiday calendar currency list. Oracle Banking Treasury Management will use the USD holiday calendar and the holiday calendar of the branch for determining the common working day.

Specify the Interest Rate Revision Frequency

Revise the interest rates for bonds with floating interest. This revision frequency can be different from the coupon frequency. This is referred to as Asynchronous (interest rate) Revision. Asynchronous revision can be:

- Periodic

- Non-Periodic

As part of interest specifications, you can indicate Interest Rate Revision details. By default, interest rates will be revised according to the coupon frequency, defined for a bond. To revise interest rates at a different frequency, choose the Allow Asynchronous Revision option. If the asynchronous revision of rates is periodic, click on the Periodic Revision option, and specify the Revision Frequency. For a frequency that is weekly, you should indicate the day on which the revision is due. (For instance, you could indicate that the interest rates for securities should be revised every Monday.) If the revision frequency is in terms of a month, you can indicate that the revision days should adhere to Month-Ends. The implication of this option is explained in the following example. Assume the Issue Date of the security (with floating interest and an asynchronous rate revision) is 01 January 2000 and the Maturity Date is 31 December 2000. You have specified that the interest rate revision frequency is quarterly. If you choose the Adhere to Month End option: The rate revisions for this security would be due on the following dates:

- 31 March 2000

- 30 June 2000

- 30 September 2000

- 31 December 2000

If you do not choose the Adhere to Month End option:

The rate revisions for this security would be due on the following dates:

- 31 March 2000

- 30 June 2000

- 30 September 2000

- 31 December 2000

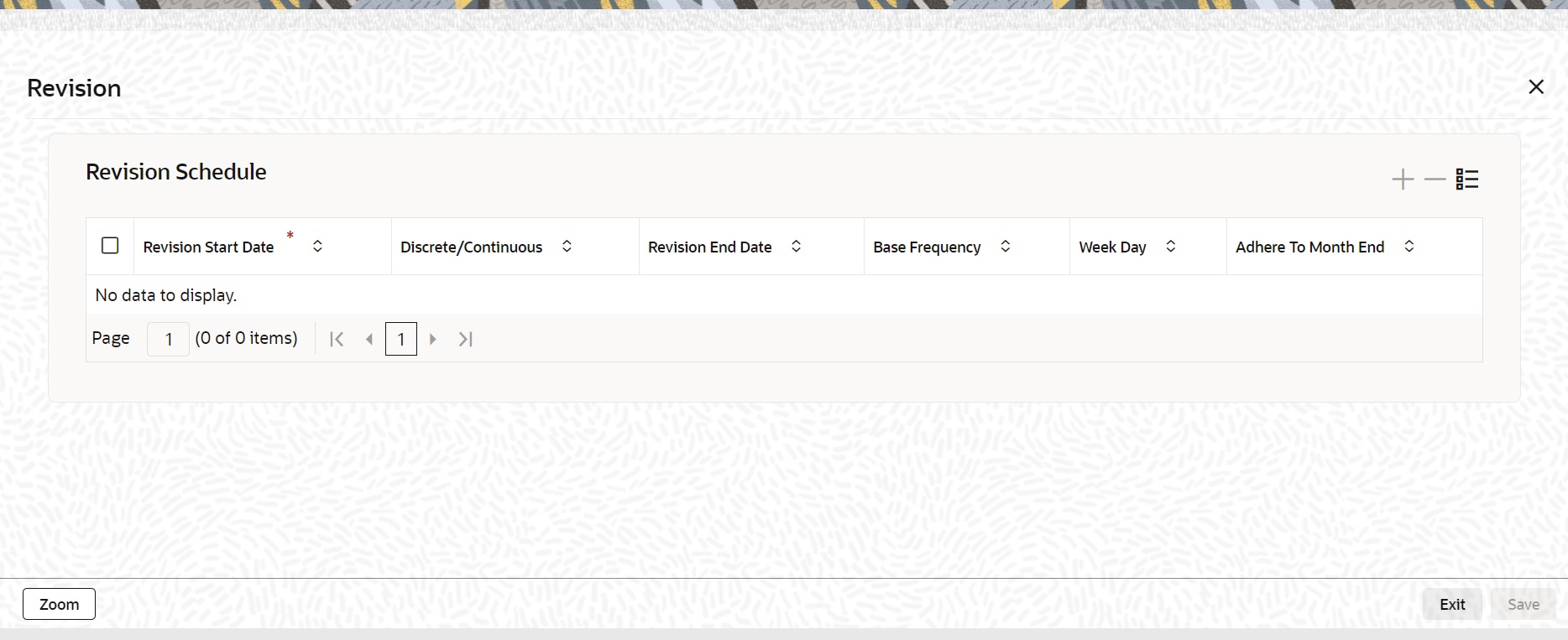

If the interest rates for a security should be revised on a non-periodic basis, you should leavethe Periodic Revision option blank. You can capture the actual revision details for a security, with non-periodic rate revision, in the Security Definition – Revision Schedules screen.

In this screen, specify the first revision due date (Base Start Date) and the last revision due date (Base End Date). If you choose the Continuous option, the system calculates all.

The base start date can be equal to or greater than the start of interest date, but not less than the start of interest date.

Intermediate revision due dates, based on the frequency specified. If you specify a weekly frequency, you must also specify the Week Day. You can also choose to adhere to month ends. To introduce an intermediate revision date, click the add icon. Enter the intermediary Revision Date in the Base Start Date field and choose the Discrete option.

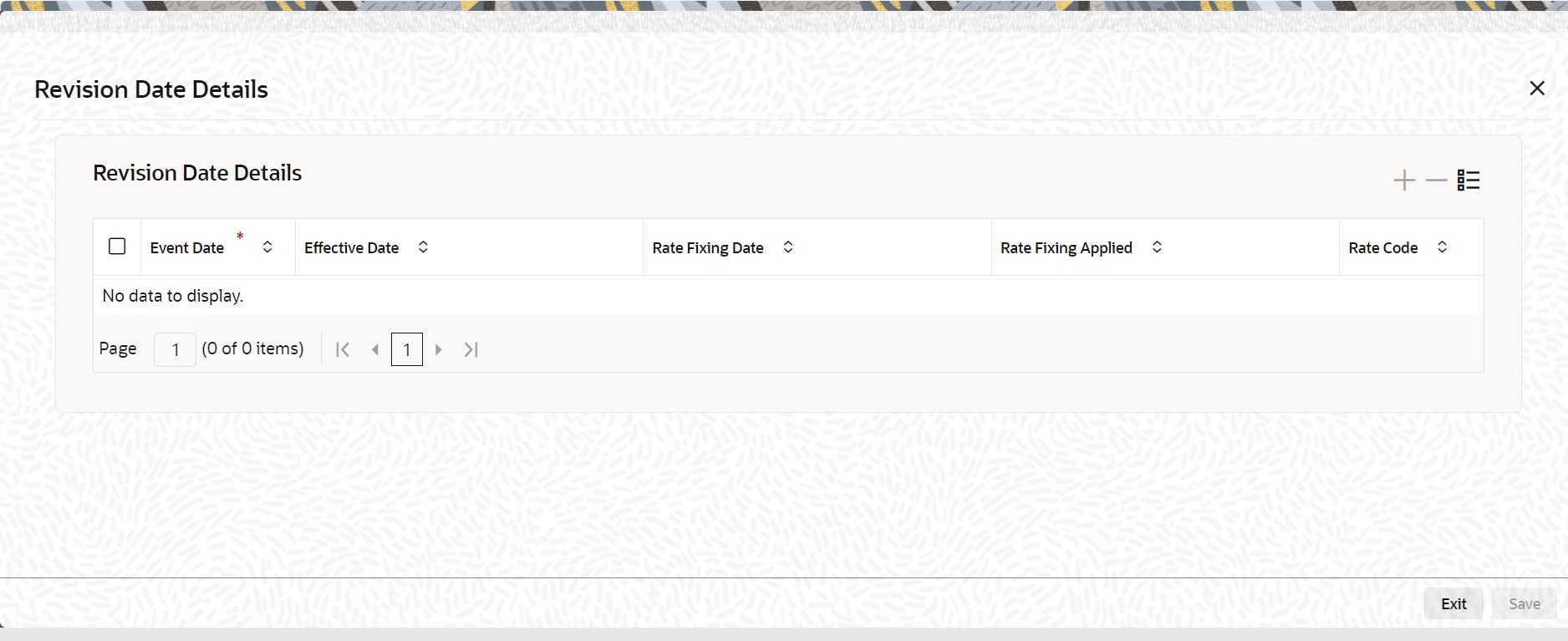

Click Zoom button in the Revision screen and the system displays the revision date details for the coupons.

Build Rate Fixing Schedules

On saving the SE Instrument, the system builds rate fixing schedules based on the rate revision dates, rate fixing days and fixing date movement. Derived Rate fixing date is viewed from the revision schedule details screen after save of Instrument. If there are no revision schedules defined for a contract then rate fixing is not applicable.

For every revision schedule, which applies a rate fixing from an external system or in OBTR via online screen or EOD processing, a new event rate fixing event RFIX will trigger and the rate fixing applied field will be updated automatically to Y. The effective rate will resolve after considering the spread and is displayed with other rate related details in the Revision date details screen of SEDTRONL.

Rate fixing is not applied on back dated contracts having past revision schedules. For future dated rate fixing date that is when the fixing date movement is forward rate revision event will not fire on schedule date. Once rate fixing is done the rate revision event will trigger.

Table 18-4 Rate Fix Forward Example - 2 days forward (Rate fixing is applied 2 days after the revision schedules and adjustment entries are posted)

| Revision Schedule Date | Rate Fixing Date |

|---|---|

|

12/11/2019 |

12/13/2019 |

|

12/18/2019 |

12/20/2019 |

|

12/25/2019 |

12/27/2019 |

|

1/1/2020 |

1/3/2020 |

|

1/10/2020 |

1/12/2020 |

Table 18-5 Rate Fix Backward Example - 2 days Backward (Rate fixing is applied 2 days before the revision schedules)

| Revision Schedule Date | Fixing Date | Weekend Holiday |

|---|---|---|

|

12/17/2019 |

12/13/2019 |

14th & 15th Weekend holiday |

|

12/24/2019 |

12/20/2019 |

21st& 22nd Weekend holiday |

|

12/31/2019 |

12/23/2019 |

28th 29th Weekend holiday |

|

1/7/2020 |

1/3/2020 |

4th & 5th Weekend holiday |

|

1/14/2020 |

1/10/2020 |

11th &12th Weekend holiday |

Table 18-6 Rate Fix Example

| Revision Schedule Date | Fixing Date |

|---|---|

|

12/17/2019 |

12/17/2019 |

|

12/24/2019 |

12/24/2019 |

|

12/31/2019 |

12/31/2019 |

|

1/7/2020 |

1/7/2020 |

|

1/14/2020 |

1/14/2020 |

Exempting interest for the ex-period

For Purchase Deals and Sell Deals booked in the Ex-Period, you can specify whether you want to calculate the interest. If you check this box, the system will not apply interest for such deals. In addition, the system accrues the holdings as of the ex date and will not pass any interest related accounting entries related to the deals booked in the Ex period. In case you do not opt for zero interest facility, the system accrues the actual holdings during the accrual period including the buy/sell deals booked in the Ex period. The system defaults the value maintained in the Market Definition screen. You can choose to change this value, if required. However, you will not be allowed to change this value if the security is already authorized.

Parent topic: Details of a Security