4.1.1 Price Quotation Method

specify the price quotation method to be used, for the security for which you are defining the price. The details that you maintain here are specific to the price quotation method used for the particular security. You can choose any of the following methods for calculating the price:

Table 4-3 Price Calculation table

| Term | Definition |

|---|---|

|

Absolute price |

Here the market value of the security is quoted as the actual price of the security. |

|

%Price |

Here the security price is quoted as,% Price = (Market price / Facevalue) x 100 |

For example, the Face value of security A is USD1000. The market value of the same security is USD900. If the price quotation method specified is Absolute Price, then the price of the security will be quoted as USD900.

For the same security, if you choose to apply the% Price method, then the price of the security will be: 900 / 1000) x 100 =90% You will quote the% price of the security as 90. Premium/Discount is the differential between the face value of the bond and the price at which it is sold. If you were to specify the Discount/Premium method then the security would be quoted at a discount of USD100 (USD1000 – USD900 = USD100). If the market price of the security were to be USD1100 then the security would be quoting at a premium of USD100.

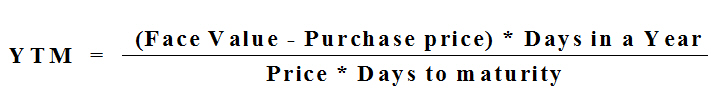

In the% Discount/% Premium method, the percentage of the discounted price is quoted. In the case of the above example, it would be a 10% discount or a 10% premium.The YTM price is quoted on the basis of its yield to maturity. This price quotation method is applicable only for Zero-coupon bonds.The yield on discounted instruments is measured by the yield to maturity (YTM) which is the return on security bought at the current market price for the remaining time to maturity of the security. The YTM would keep changing with the market price, in case the market price increases above the straight discounted price YTM would decrease and vice versa. In the Yield to Maturity quotation method the price is calculated as follows:

Interest Quotation Method

For interest-bearing instruments, the price at which the instrument is quoted can include the accrued interest or can be calculated separately. Indicate the interest quotation method for the security price code you are defining. The interest quotation method could be either:

- Flat or

- Plus accrued

In the former method, the price is quoted as inclusive of the interest. This is also called the Dirty price. In the latter method, the accrued interest is quoted separately; i.e., the price quoted is exclusive of the interest component. This is also referred to as the clean price.

Parent topic: Maintain Price Details