2.1.10 Corporate Actions

This topic provides information on corporate actions button.

This fund rule facilitates the definition of the guidelines that will govern the distribution of income derived from the fund by the unit holders that subscribe to the fund. You can define the framework according to which corporate actions such as dividend declaration and processing must be performed for a fund. Through this screen the system can also process multiple distributions of a fund on the same day and process the distribution on the same day.

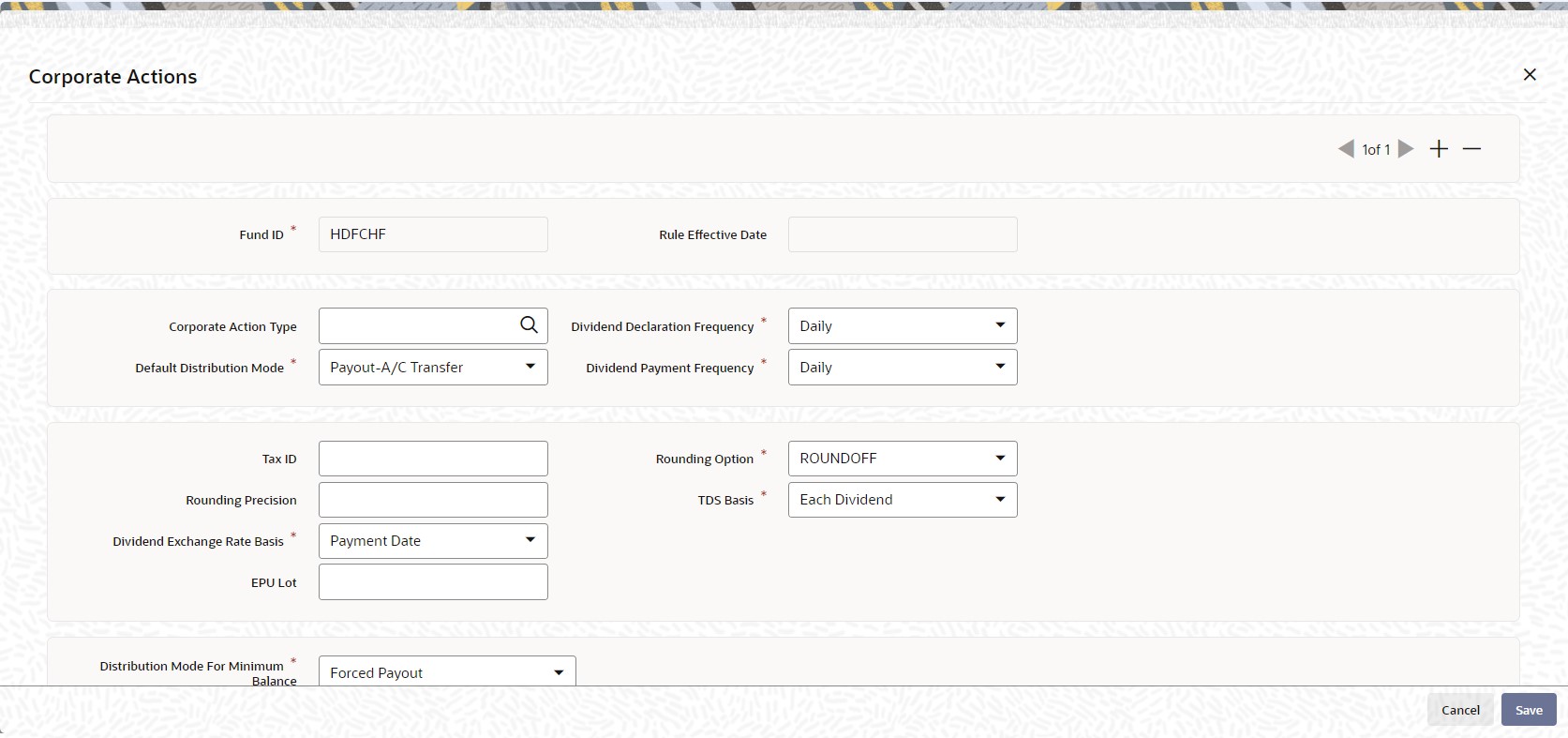

To set up the Corporate Action rules for a fund, use the Corporate Actions screen.

- Click Corporate Actions button from the Fund Rules Detail

screen.The Corporate Actions screen is displayed.

Note:

This screen cannot be used to maintain parameters for corporate actions such as liquidation, split, reverse split and merger. To maintain these, you must use the Corporate Actions Maintenance screen, which you may invoke by clicking on Corporate Actions in the Maintenance menu, and Detail under it. - On Fund Transaction Currencies screen, specify the fields.

For more information on these corporate actions and the Corporate Actions Maintenance screen, refer the topic Other Fund Activities in this user manual.

Note:

Before you set up a Corporate Actions profile record for a fund, it is desirable to ensure that the fund already has an existing, unauthorized profile record.For more information on fields in the screen, refer the below table.

Table 2-42 Corporate Actions

Field Description Fund ID Display This field indicates the ID fund for which you are setting up the Corporate Actions profile. This information is defaulted from the Fund Demographics screen.

Rule Effective Date Display The Rule Effective Date for the fund, which you specified in the Fund Demographics screen, is displayed here.

Corporate Action Type Alphanumeric; 1 Character; Optional Select the type of corporate action for which this rule is being set up. It could be either a cash dividend or a stock dividend. It could be either a cash dividend for income, or capital gains earnings.

For stock dividends, the following information is accepted by default:

- The TDS Basis field has a default specification, Tax-exempt, and the field is locked for data entry

- The option Restrict IDS for Unit Holder is selected and cannot be changed

- The Default Distribution Mode field has the option Reinvestment selected, and is locked for data entry.

Dividend Declaration Frequency Mandatory Select the frequency with which the dividend is to be declared from the drop-down list. The list displays the following values:

- Daily

- Bi-Weekly

- Half-Yearly

- Monthly

- Quarterly

- Weekly

- Yearly

Default Distribution Mode Mandatory If the Income Distribution Setup for the unit holder has not yet been specified, the fund level default Unit Holder Distribution Mode to be considered for the unit holder can be specified here. Any one of the options from the drop-down list may be chosen. The following values may be entered:

- Full Payout-A/C Transfer

- Full Payout-Check

- Full Reinvestment

If the rules are being setup for a share class fund for which reinvestment is mandatory, then this field is defaulted to Full Reinvestment and locked for data entry.

For stock dividends, the option Full Reinvestment is selected here by default, and cannot be changed.

Dividend Payment Frequency Mandatory Select the frequency with which the declared dividends are to be paid from the drop-down list. The list displays the following values:

- Daily

- Bi-Weekly

- Half-Yearly

- Monthly

- Quarterly

- Weekly

- Yearly

As the system supports accumulation of dividends, the payment could be for any dividend that has been declared earlier.

The Dividend Payment Frequency must not be less than Dividend Declaration Frequency.

Tax ID Alphanumeric; 15 Characters; Optional Enter the tax ID for the fund that is being set up..

Rounding Option Mandatory Select the rounding options for the value of the dividend, designated for the fund from the drop-down list. The list displays the following values:

- Round Up - Choose Round Up to indicate rounding the value at the precision decimal place to the next higher numeral.

- Round Off - Choose Round Off to indicate normal rounding at the precision decimal.

- Round Down - Choose Round Down to indicate truncation of the value at the precision decimal place.

Example

Let us suppose that the dividend earned by an investor, Mrs. Laurie Klein, in the ABC Growth Fund is 700.679263 currency units, and that this value must be rounded to the 3rd decimal place.

If you indicate rounding up, then the value reckoned would be 700.680.

If you indicate rounding off, then, applying normal rounding off rules, the value reckoned would be 700.679.

If you indicate rounding down or truncation, then the value would be truncated as it is, in the 3rd decimal place, and it would be reckoned as 700.679.

Rounding Precision Numeric; 5 Characters; Mandatory Indicate the maximum number of decimals that would be reckoned for rounding precision, for the dividend. You cannot indicate a precision higher than 6 decimal places.

Dividend Exchange Rate Basis Mandatory Select the basis upon which the exchange rate will be applied for dividend processing from the drop-down list. The list displays the following values:

- Payment Date

- Reference Date

TDS Basis Mandatory This is to indicate whether slab should be looked for every dividend payment separately or whether consolidated on a fiscal year basis. Choose one of the options from the drop-down list. The list displays the following values:

- Each Dividend

- Fiscal Year

- Tax Exempt

For stock dividends, the option Tax –Exempt is selected here by default, and cannot be changed.

EPU LOT Numeric; 6 Characters; Mandatory if EPU is applicable Specify the number of units for which the EPU quote is deemed to be applicable, for the fund.

Setting up EPU components is not applicable for stock dividends.

Distribution Mode For Minimum Balance Mandatory Indicate how the income derived from the fund is to be distributed, in respect of unit holders whose holdings balance falls below the minimum holdings specified for the fund.

Select the mode of distribution for minimum balance from the drop-down list. The list displays the following values:

- Forced Payout - the income is paid out, regardless of the default distribution mode or any income distribution options (IDS) set for the unit holder

- According to Unit Holder IDS – the income is distributed based on the Income Distribution (IDS) options set for the unit holder

Units For Freeze Holding Mandatory Select the units for freeze holding from the drop-down list. The list displays the following values:

- All Units As Of Allocation Date

- Confirmed Units As Of Allocation Date

- All Units As Of Price Date

- Confirmed Units As Of Transaction Date

- All Units As Of Transaction Date

- All Units As Of Dealing Date

Table 2-43 Corporate Actions - Preferences

Field Description EPU Based on Components? Mandatory Select Yes from drop-down list if EPU is based on components. Else select No.

Restrict IDS for Unit Holder Mandatory Select Yes from drop-down list to indicate that specific income distribution setups for unit holders may be overridden.

Special Dividend Mandatory Select Yes from drop-down list to indicate that special dividends are applicable for the fund. This feature is only available if your installation has requested for it.

Holiday Rule Mandatory Select the rule to be applied if the dividend processing date falls on a holiday. You can select either the PRIOR rule (the previous working day is considered) or the AFTER rule (the next working day is considered), for the dividend type from the drop-down list.

The holiday rule you select here will be applicable to all dividend-processing dates that have been arrived at using a frequency. They are not applicable to dates arrived at using lead times or lag periods.

Reinvestment Lag Numeric; 22 Characters; Optional Specify the reinvestment lag as the number of days to enable reinvestment on a different date or the same day as the payment date. The default value is 0. If the value is considered as 0, then the reinvestment is made on the same day as the payment date. For a value other than 0, the system calculates the reinvestment date from the payment date. For example: If the number of days entered is 10 and the payment date is 30th June, then the reinvestment date will be 10th July.

Payment Lag (Days) Numeric; 3 Characters; Mandatory Specify a lag period (in days) for the payment of dividend. The lag value is interpreted in calendar days, and is used to arrive at the payment date for the dividend. The payment date is arrived at as follows:

Dividend Payment Date = Dividend Declaration Date + Payment Lag

Reinvestment Price Basis Numeric; 10 Characters; Mandatory only if default distribution mode is Reinvestment. Reinvestment transactions into the fund can be put through either at the NAV for the day or the transaction base price. You can use this field to indicate the price that must be used.

Default EPU to Previous Declared EPU? Optional Specify whether the previous day’s Earning Per Unit (EPU) needs to be defaulted during the generation of a dividend record. You can select either Yes or No from the drop-down list.

If you select the option Yes, the system will default the previous day’s EPU while generating the dividend record at the Beginning of Day (BOD). This record will be an authorized record.

However, you will be able to modify it. If the previous day’s EPU is zero, the system will still default the value and generate an authorized record. You can enter the EPU value for this record.

This field is available only for Money Market funds. Also, if Dividend Declaration Frequency and Dividend Payment Frequency are the same, this field will be disabled.

Action on Minimum Amount Validation Optional Select the options from drop-down list. The list displays the following values:

- Reinvest - Reinvest the dividend if it falls below minimum amount for payment

- Hold - No additional processing is required and Dividend amount is neither be paid out nor reinvested

Auto Reinvestment for Unclaimed Dividend Optional If you select Yes from drop-down list, system will automatically reinvest when dividend is unclaimed, that is dividend check is not encashed within the expiry date.

Note: By default, this option will be No.

Track Dividend for Uncleared Transactions? Optional Indicate whether dividend payment/re-investment should be tracked for an individual uncleared transaction.

If you select Yes from drop-down list, dividend will be held back temporarily for subscription transactions whose cheques are not cleared as on the Dividend Declaration Date. Dividend will be released when the payment is cleared.

Note: By default, this option will be No.

Pay Ungenerated Reinvestments? Optional Select Yes from drop-down list to indicate that in case the re investment results in zero units allotment, the amount should be paid out to the investor.

If you select Yes, then system executes the following steps:

- Converts the amount to be reinvested to the fund base currency

- Divides the amount in fund base currency with the latest NAV for the fund. This will result in the units expected to that could be allotted.

- Applies the rounding rule to the number of units.

If the number of units in the result of step 3 is greater than zero, re-investment transaction will be generated. If the result is zero then the amount should be paid out to the investor in the unit holder preferred currency. In case any specific preference has been set at the unitholder fund level then the respective currency will be used.

Reinvestment Allowed? Mandatory Select Yes from the drop-down list to indicate that reinvestment is allowed for the fund. If the rules are being setup for a share class fund for which reinvestment is mandatory, then this field has a default Yes and locked for data entry.

Look Ahead Processing? Mandatory Select Yes from the drop-down list to indicate that in the event of intervening holidays, the system would obtain the EPU information and process dividends for the holiday period, ahead of the prior business day, for the fund.

First Dividend Declare Date Date Format; Optional Specify the first date for dividend declaration, for the fund. The system considers the first dividend date in arriving at the date for dividend processing, as follows:

First dividend processing = First Dividend Declare Date – Dividend Declaration Frequency + Dividend Payment Frequency.

The system also uses the first dividend declare date to arrive at the next dividend declare date, applying the specified declaration frequency.

If you do not specify the first dividend declare date, the fiscal year specified for the fund is used to determine the next dividend declare date.

Mock Dividend? Mandatory Select Yes from drop-down list to indicate the applicability of mock dividends for the fund. This feature is only available if your installation has requested for it.

Pay Dividends During Redemption? Mandatory Select this option to indicate that dividends may be paid during redemption from the drop down list. The list displays the following values:

- Yes

- No

- 100% Only

Compulsory Reinvestment for Retirement Account? Mandatory You can use this field to indicate that dividend due from the fund on an IRA account must be compulsorily reinvested. Select Yes from drop-down list to indicate compulsory reinvestment.

Interest to be compounded for the payment Period? Optional Indicate whether the dividend interest needs to be compounded for the entire payment period or not. You can select either Yes or No from the drop-down list.

If you select Yes, the system will calculate the dividend on the amount instead of multiplying the units by the EPU. The EPU value maintained as As amount will be directly used in the dividend calculations.

This field is available only for Money Market funds. Also, if Dividend Declaration Frequency and Dividend Payment Frequency are the same, this field will be disabled.

Example

Assume that the EPU is 0.001267. This value will be directly used during dividend processing to calculate the payment amount.

Consider the following case listing the transactions from Jan 1, 2005 to Jan 31, 2005.

Refer the Table 2-44 for more details.

During payment processing at the end of the month (in case the payment frequency is monthly), the EPU entered at the end of the month will be used for all calculations for the payment period. In case the EPU entered at the end of the month is different, then the new EPU will be used to calculate the dividend amount payable for all days in the payment period.

In case the payment date happens to be a holiday, defined in the system calendar, the system will process the dividend on the day preceding the holiday (if the holiday rule is set to prior).

Minimum Amount for Payment Numeric; 30 Characters; Optional Indicate the threshold dividend amount in fund base currency. If Investor has chosen the cash option for dividend payment and the dividend income in the current processing cycle is more than threshold dividend amount, then dividend income can be paid out.

If Unit holder has chosen distribution mode as a combination of cash and reinvestment and the cash portion of dividend amount net of tax is less than Minimum Amount for Payment then system will generate a single reinvestment transaction for the total dividend income.

Override at Pay Time Optional Select Yes option from drop-down list to indicate Minimum Amount for Payment can be overridden during dividend payment processing.

Auto Reinvestment for Unclaimed Dividend When No Balance Left Optional If you select Yes, then system will automatically reinvest when dividend is unclaimed, that is dividend check is not encashed within the expiry date and when the unit holder does not have sufficient balance in the underlying fund.

Note: By default, this option will be No.

Track Dividend for Blocked Transactions? Optional Specify whether dividend payment should be tracked for a blocked transaction, where some or all units are blocked at the time of dividend processing. If you select Yes from drop-down list, system will process the dividend as per the action selected in the Block Transaction Screen.

Note: By default, this option will be No.

TDS Applicable for all UH Optional You can enter a value in this field only if you have selected the Dividend Equalization Applicable option in the General Operating Rules for the fund. The default value is No; if you select Yes from drop-down list, the system will distribute dividend after deducting the tax applicable for all unit holders who are entitled to dividend. This is applicable even for the equalization amount.

Minimum Amount for Reinvestment Numeric; 30 Characters; Optional Specify the minimum amount for reinvestment.

FDAP Income Optional Select Yes from drop-down list to indicate the dividends distributed in this fund are FDAP income.

Note:- The preference that you have maintained at the unit holder level (the Tax Deducted At Source field in the Unit Holder Maintenance screen) will take precedence over the value maintained here. For instance, if you have unchecked the TDS option at the Unit holder level, then all inflows to the unit holder will be done on a gross basis even if you have selected the TDS Applicable for all UH field at the fund level.

- You are required to maintain a single WHT setup (with single slab) for the equalization fund. Tax on the gross dividend amount will be deducted based on this setup.

Table 2-44 Money Market funds

Open Bal InTxns (Bal. sum) Freeze holding balance Div calc base EPU Div Units NAV Div amt Div Sum from the 1st till date(Units) Div Sum from the 1st of the Month till date (Amount) 100000 0 100000 100000.0000 0.000136986 15.07 25.00 376.71 15.07 376.71 100000 0 100000 100015.0685 0.000136986 15.07 25.00 376.75 30.14 753.46 100000 0 100000 100030.1385 0.000136986 15.07 25.00 376.75 45.21 1130.21 100000 0 100000 100045.2085 0.000136986 15.07 25.00 376.75 60.28 1506.96 100000 0 100000 100060.2785 0.000136986 15.07 25.00 376.75 75.35 1883.71 100000 0 100000 100075.3485 0.000136986 15.07 25.00 376.75 90.42 2260.46 100000 0 100000 100090.4185 0.000136986 15.08 25.00 377.00 105.50 2637.46 100000 0 100000 100105.4985 0.000136986 15.08 25.00 377.00 120.58 3014.46 100000 0 100000 100120.5785 0.000136986 15.08 25.00 377.00 135.66 3391.46 100000 0 100000 100135.6585 0.000136986 15.08 25.00 377.00 150.74 3768.46 100000 0 100000 100150.7385 0.000 1369 86 15.0 9 25.00 377.25 165.83 4145.71 100000 0 100000 100165.8285 0.000136986 15.0 9 25.00 377.25 180.92 4522.96 100000 0 100000 100180.9185 0.000136986 15.0 9 25.00 377.25 196.01 4900.21 100000 0 100000 100196.0085 0.000136986 15.0 9 25.00 377.25 211.10 5277.46 105000 5000 105000 105211.0985 0.000136986 15.85 25.00 396.25 226.95 5673.71 105000 0 105000 105226.9485 0.000136986 15.85 25.00 396.25 242.80 6069.96 105000 0 105000 105242.7985 0.000136986 15.85 25.00 396.25 258.65 6466.21 105000 0 105000 105258.6485 0.000136986 15.86 25.00 396.25 274.51 6862.71 105000 0 105000 105274.5085 0.000136986 15.86 25.00 396.50 290.37 7259.21 105000 0 105000 105290.3685 0.000136986 15.86 25.00 396.50 306.23 7655.71 105000 0 105000 105306.2285 0.000136986 15.86 25.00 396.50 322.09 8052.21 105000 0 105000 105322.0885 0.000136986 15.87 25.00 396.75 337.96 8448.96 105000 0 105000 105337.9585 0.000136986 15.87 25.00 396.75 353.83 8845.71 105000 0 105000 105353.8285 0.000136986 15.87 25.00 396.75 369.70 9242.46 105000 0 105000 105385.5685 0.000136986 15.87 25.00 396.75 369.70 9639.21 105000 0 105000 105385.5685 0.000136986 15.88 25.00 397.00 401.45 10036.21 105000 0 105000 105401.4485 0.000136986 15.88 25.00 397.00 417.33 10433.21 105000 0 105000 105417.3285 0.000136986 15.88 25.00 397.00 433.21 10830.21 105000 0 105000 105433.2085 0.000136986 15.88 25.00 397.00 449.09 11227.21 105000 0 105000 105449.0885 0.000136986 15.88 25.00 397.00 464.97 11624.21 105000 0 105000 105464.9685 0.000150685 15.89 25.00 397.25 480.86 12021.46 - - - - Total Dividend - - 120 21.46 - - Lead Times

Table 2-45 Corporate Actions - Lead Times

Field Description Book Closing Numeric; 5 Characters; Optional Enter a lead-time in days. The Registrar must enter the book closing dates within this lead time from the time the dividend information is declared.

The Book Closing From and To Dates together signify the period within which no change will be allowed to a unit holder’s balances in a fund. This means that any transaction that has been entered within these dates will not be allocated for the unit holder.

Freeze Holding Numeric; 5 Characters; Optional Enter a lead-time in days. The Registrar must enter the Freeze Holdings Date within this lead time from the time the dividend information is declared.

The Freeze Holding Date is the date on which the balances held by all unit holders in the fund will be consolidated.

You can specify any of the following options:

- All units (including unconfirmed units) must be considered as on the allocation date

- Only confirmed units are to be considered as on the allocation date

- All units (including unconfirmed units) are to be considered as on the transaction price date

- All units (including unconfirmed units) are to be considered as on the transaction date

- Only confirmed units are to be considered as on the transaction date

- All units (including unconfirmed units) are to be considered as on the dealing date

Note:

If the fund is a dividend equalization fund, i.e. if you have checked the ‘Dividend Equalization Applicable’ option in the General Operating Rules for the fund, you can maintain only the following options here:- All Units as on allocation date

- All units as on confirmed date

- All units as on dealing date

If units for freeze holding is based on transaction/dealing date then all the transactions backdated to the previous dividend cycle would be treated as old units (G1 units).

If units for freeze holding is based on allocation date then all the transactions backdated to the previous dividend cycle would be treated as new units (G2 units).

Example

Consider two dividend cycles - the first from January 01, 2010 to January 31, 2010 and the second from February 01, 2010’ to ‘February 28, 2010. A subscription transaction (S1) is captured on application date, February 15, 2010, with transaction date as January 15, 2010 and allocation date as February 16, 2010. For the second dividend, units allotted in this transaction would be treated as G1 units (if the units for freeze holding is based on transaction/dealing date) or G2 units (if the units for freeze holding is based on allocation date).

Board Meeting Numeric; 5 Characters; Optional Enter a lead-time in days. The Registrar must enter the Board Meeting Date within this lead time, before the time the dividend information is declared. This is captured for information purposes only.

Dividend Payment Numeric; 5 Characters; Optional Enter a lead-time in days. The Registrar must enter the Dividend Payment Date within this lead-time, from the time the dividend information is declared.

Each of the lead times must be less than the Dividend Declaration Frequency. For example, if the Dividend Declaration Frequency is WEEKLY, the Board Meeting Lead Time cannot be 8 days.

NPI Preferences

Table 2-46 Corporate Actions - NPI Preferences

Field Description NPI Applicable Mandatory Select Yes from drop-down list to indicate that non permissible income (NPI) component is allowed for this fund.

NPI Payment Alphanumeric; 3 Characters; Optional If NPI is applicable for this fund, then specify the default payment option from the drop-down list provided.

Override Unitholder Preference? Mandatory if NPI is applicable Select Yes from drop-down list if the fund override the NPI payment preferences maintained for the investor at the unit holder level. However, if the NPI payment preferences are not maintained at the unitholder level, then NPI payment will be made as per the fund preferences.

Force Reinvestment of Uncleared units Numeric; 1 Character; Mandatory if NPI is applicable The system does not consider NPI amount while processing reinvestments, even if it is from un-cleared balances. It should either be paid to a trust or to the unit holder.

However, in case of Permissible income, you can opt to reinvest the Un-cleared Unit balances by choosing the Force reinvestment option. Else, select No preference, which overrides the UH IDS setup.

Multiple Distribution

Table 2-47 Corporate Actions - Multiple Distribution

Field Description Net/Gross Optional Select Net or Gross from the drop-down list.

Multiple Distribution Optional Select if different types of distributions can be processed on the same day or not from the adjoining drop-down list. Following are the options available:

- Yes

- No

Multiple Distribution

Table 2-48 Corporate Actions - Multiple Distribution

Field Description Distribution Type Alphanumeric; 3 Characters; Mandatory (if multiple distribution box is checked.) This field is enabled if the Multiple Distribution is selected as Yes box is selected. Select the appropriate value from the drop-down list. The options available are INT (Interest), DIV (dividend), and PID (Property Income Distribution). This distribution is applicable for corporate action type Cash only.

Distribution Value Display The system displays the description for the selected distribution type.

- Dividend Processing for Fund

This topic provides information on dividend processing for fund details.

Parent topic: Fund Rule