2.1.11 Fund Load

This topic provides information on fund load button.

This fund rule enables you to designate different fees or incentives that are levied during the processing of transactions, as applicable for transactions in specific funds. A simple mapping can be done where the appropriate fees or incentives, called loads in the system, may be tagged as applicable to the appropriate transaction types for the appropriate funds.

You can also designate the loads as applicable to certain reference types of transactions, such as standing instructions, policy transactions and so on.

The load details maintained will be attached to the funds using this maintenance screen. Only authorized loads can be attached to a fund, whose fund rules are not authorized. Transfer Switch for fund load mapping will be done using this screen.

To map loads to a fund, use the Fund Load Setup screen.

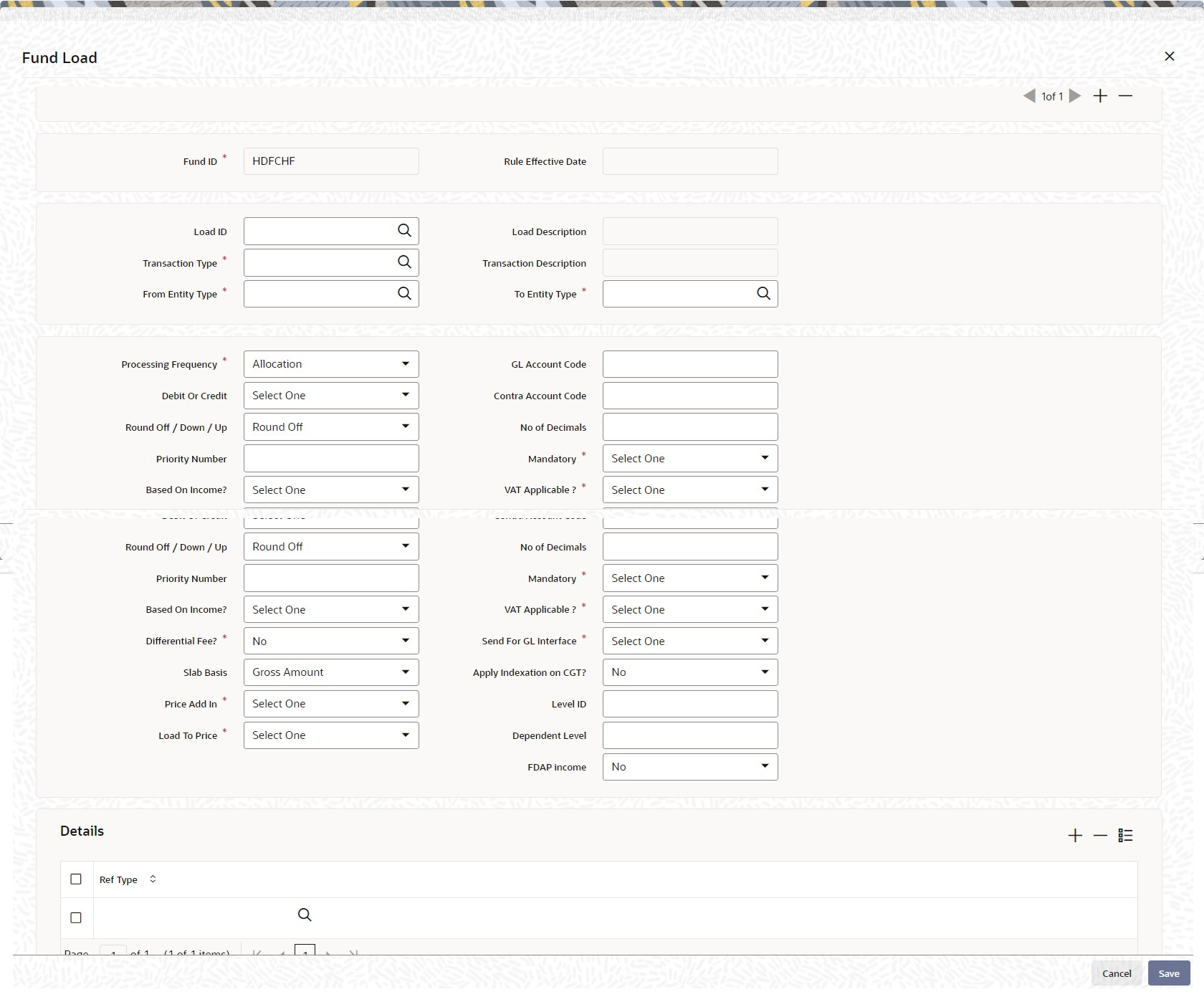

- Click Fund Load button from the Fund Rules Detail screen.The Fund Load screen is displayed.

Before you set up a Fund Load mapping profile record for a fund, it is desirable to ensure that the following information is already setup in the system:

- The fund already has an existing, unauthorized Fund Demographics profile record.

- The fund already has an existing, unauthorized Shares Characteristics profile record.

- The fund already has an existing, unauthorized Transaction Processing Rules profile record for the appropriate Transaction Type.

- The fees/incentives (Loads) that are to be applied must already have been identified in the system and have existing, authorized profiles as maintained in the Loads Maintenance.

- The system does not support the mapping of the Ref Type 68 (Funding Repayment) to any load.

- On Fund Load screen, specify the fields.For more information on fields in the screen, refer the below table.

Table 2-49 Fund Load

Fields Description Fund ID Display This field indicates the ID fund for which you are setting up the Fund Load Setup profile. This information is defaulted from the Fund Demographics screen.

Rule Effective Date Display The Rule Effective Date for the fund, which you specified in the Fund Demographics screen, is displayed here.

Load ID Numeric; 5 Characters; Mandatory Specify the name of the Load (fee/incentive) that must be applied for the selected Fund. You may make your choice from the options provided in the drop-down list.

Note:- Loads defined as price basis loads cannot be mapped to a fund in the Fund Load Setup.

- Load should be maintained as period based ageing Load (in percentage).

Load Description Display The system displays the description for the selected load ID.

Transaction Type Alphanumeric; 2 Characters; Mandatory Specify the transaction type for which the loads are being defined. The adjoining option list displays all valid transaction type codes along with their description. You can choose the appropriate one.

Transaction Description Display The system displays the description for the selected transaction type.

From Entity Type Alphanumeric; 1 Character; Mandatory Specify the entity that bears this load. Alternatively, you can select From Entity Type from the option list. The list displays all valid entity types maintained in the system.

To Entity Type Alphanumeric; 1 Character; Mandatory Specify the entity that will be recipients of the load. Alternatively, you can select To Entity Type from the option list. The list displays all valid entity types maintained in the system.

Processing Frequency Mandatory Select the frequency at which this load is to be applied from the drop-down list. The list displays the following values:

- Allocation: This will mean that you will be charging the investor a fee or giving an incentive at the time of allocation of units. Allocation time loads cannot be designated for any transaction types other than IPO, subscription, redemption, and switch.

- Transaction: The charge (fee) or incentive will be applied at the time the transaction request is accepted from the investor.

- Post Allocation: This frequency is applicable typically to the Capital Gains Tax, which may be applied after allocation, on the gross amount. If indexation is applicable to capital gains tax computation based on this load, then you must select this frequency.

Note: Capital Gains Tax may also be designated as an allocation time load.

GL Account Code Alphanumeric; 10 Characters; Optional Specify the code that will be used to map this load to its corresponding charge code in the external system.

When transaction information is exported to an external system, if separate books of accounts are to be posted for different loads, this code will be used to identify this load information in the export data.

Debit or Credit Optional Indicate whether the applied load would result in a debit or credit for the fund from the drop down list. The list displays the following values:

- Debit

- Credit

This data is captured for information purposes only and has no processing implications in the system database

Contra Account Code Alphanumeric; 10 Characters; Optional Specify the code that will be used to identify the second leg of accounting entries for any transaction, in the event of exporting of transaction information to an external system.

Round Off / Down / Up Optional Indicate the rounding options for the load amount for the selected transaction type, for the fund.

- Round Off - Choose Round Off to indicate normal rounding at the precision decimal.

- Round Up - Choose Round Up to indicate rounding the value at the precision decimal place to the next higher numeral.

- Round Down - Choose Round Down to indicate truncation of the value at the precision decimal place.

Example

Let us suppose that the load amount computed for a subscription transaction is 10.561234, and that this value must be rounded to the 3rd decimal place.

If you indicate rounding up, then the value reckoned would be 10.562.

If you indicate rounding off, then, applying normal rounding off rules, the value reckoned would be 10.561.

If you indicate rounding down or truncation, then the value would be truncated as it is, in the 3rd decimal place, and it would be reckoned as 10.561.

No. of Decimals Numeric; 1 Character; Mandatory Indicate the maximum number of decimals that would be reckoned for rounding precision, for the load amount.

Priority Number Numeric; 22 Characters; Mandatory Enter a value to specify the priority number in case of optional loads.

For a mandatory load, the priority number is set to 0 and for an optional load the priority number should be unique, i.e., for a given fund, no more than one load can have the same priority number.

Mandatory Mandatory Select Mandatory or Optional from drop-down list to specify whether the load is mandatory or optional.

Based on Income? Optional Select the based on income details from the drop-down list. The list displays the following values:

- Capital Gains - Gross

- Non Capital Gains - Net

- Capital Gains

- CDSC

- Performance Based

- IOF

- Default IRRF

- Optional IRRF

- Dilution Levy

- Short Trade Period

- Short Trade Units

If the load is a Capital Gains Tax, and it is to be applied based on the gross amount after allocation, choose the Capital Gains – Gross option in this field, for such a load.

If indexation is being applied for capital gains tax computation, choose the Capital Gains – Indexation option in this field. The capital gains load is then applied using appropriate indexation, according to the option chosen by the investor.

If Contingent Deferred Sales Charge (CDSC) is applicable for transactions in this fund, choose the option CDSC option in this field to identify the CDSC load. This option will be available only when Fund chosen is CDSC applicable Fund.

If the ageing policy for the fund has been specified as IOF/IRRF optimization in the General Operating Rules screen, then the following additional options are available:

- IOF

- Default IRRF

- Optional IRRF

If Dilution Levy is selected, then the system applies the load only if the sum of transactions for the combination of unit holder, fund, and transaction type exceeds the breach factor (inflow/ outflow) for the corpus, even though all other criteria are satisfied. An EOD batch computes the aggregated net transaction amount at unit holder, fund, and transaction type level for dilution levy enabled fund. If dilution levy limit of a fund is breached, then the system applies the dilution levy load is applied for specific or all transactions for that unit holder, fund and transaction type combination based on the parameter set.

A system parameter DILUTIONLEVY governs whether Dilution Levy needs to be applied for specific or all Unit Holder (for Unit Holder, Fund, Transaction Type combination) transactions. The parameter value S indicates that Dilution Levy is applicable for specific transactions only whereas parameter value A indicates that Dilution Levy is applicable for all transactions for Unit Holder, Fund, and Transaction Type combination.

The above options are provided under the criterion that the transaction type is redemption and price to load is set to No. These options are applicable only for normal and systematic withdrawal ref types.

Note:- Optional IRRF can be maintained only for pension funds.

- IOF load is applicable up to one year for pension funds and up to 30 days for non pension funds.

You can select the load with Short Trade Units option to calculate penalty charge for outflow transactions with short trade units, i.e., in case of outflow transaction captured with Nominee Account and Short Trade Units Details are entered.

You can select the load with Short Trade Period option to calculate penalty charge for outflow transactions when the transaction is captured for other than Nominee account.

The system will identify Off-Shore/ On-Shore fund based on the Installed entity country and Fund country.

If Installed entity country and Fund country are same, then the system will classify the fund as Off-Shore fund.

If Installed entity country and Fund country are not same, then the system will classify the fund as On-Shore fund.

Refer the Table 2-50 and Table 2-51 for more details.

VAT Applicable? Mandatory Select Yes from drop-down list to indicate that the Load to Price is applicable. Therefore VAT Load to Price is dependent on Load to Price.

Differential Fee? Mandatory Select Yes from drop-down list to indicate that the differential fee in the case of switch transactions for any fund is to be applicable.

Send for GL Interface Mandatory Select Yes from drop-down list to indicate that accounting entries due only to the selected load must be posted to the external asset management system, for the fund.

Slab Basis Optional Select the basis on which the slabs will be reckoned for an amount-based load that you are designating as applicable for the fund from the drop-down list. The list displays the following values:

- Gross Amount

- Net Amount

- Average Cost

- Weighted Average Cost

Apply Indexation on CGT? Optional If the load is a capital gains tax load, you can use this field to indicate whether indexation is to be applied on capital gains tax computation, for transactions in this fund. Select Yes from drop-down list to indicate application of indexation. Else select No.

Price Add In Mandatory Select Yes from drop-down list to indicate that the add-in factor is to be applicable for computing the return value for the load, for the selected transaction type. The add-in factor is used to arrive at the return value for a load, at the time of allocation.

Level ID Numeric; 22 Characters; Optional Indicate the order in which the load is to be applied. Load is computed based on the fund transaction amount and applied in the order of level id specified.

Note: Level ID is not applicable for LTP loads.

Load To Price Mandatory Select Yes from drop-down list to indicate that this load is to be loaded to the base price.

Note: Load To Price to be set to No at fund load level.

Dependent Level Numeric; 22 Characters; Optional Indicate the dependent level for the selected load, if any.

In case the load has a dependent level, then load will be applied on the difference between the transaction amount and the sum of all dependent level load amounts, without considering all recursive levels.

Note: The dependent level Id must be less than the Level Id. The dependent level Id is not applicable for LTP loads.

FDAP Income Optional Select Yes from drop-down list to indicate the load maintenance is a FDAP income.

This field is applicable only when To Entity is Broker/Agent/Agency Branch/AO/IFA and From Entity is fund/AMC/Unit holder. For other cases, if you check this field, then the system will display the warning message. However, if you wish to continue, then the system will do the WHT deductions and processes.

Table 2-50 Entity

Installed EntityID Installed EntityID Country TWDDISTE TWD Table 2-51 Fund

Fund ID Fund Country Classification OFFSHR HKG OFFSHORE ONSHR TWD ONSHORE Table 2-52 Fund Load

Field Description Ref Type Alphanumeric; 4 Characters; Optional To designate a load as being applicable for a reference transaction type for the selected fund, select the load reference type from the Available Reference Types box and move it to the Mapped Reference Types box, using the arrows.

If loads are to be designated applicable to reference types for a fund, you must set up an individual fund-load mapping record in this screen for each reference type for the fund, just as you do for each transaction type.

Example

If the AMC wants a fee to be charged on subscription transaction but not on reinvestment transaction, it can map only subscription transaction in the Ref Type field and not the reinvestment.

Note: It must be remembered that, while mapping a load to a reference transaction type, the system does not support the mapping of the Ref Type 68 (Funding Repayment) to any load.

For more information, refer the chapter The Allocation Process in the Fund Manager User Manual.

Parent topic: Fund Rule