2.1.11 Annuity Details Button

This topic explains the Annuity Details button of Policy Maintenance Detail screen.

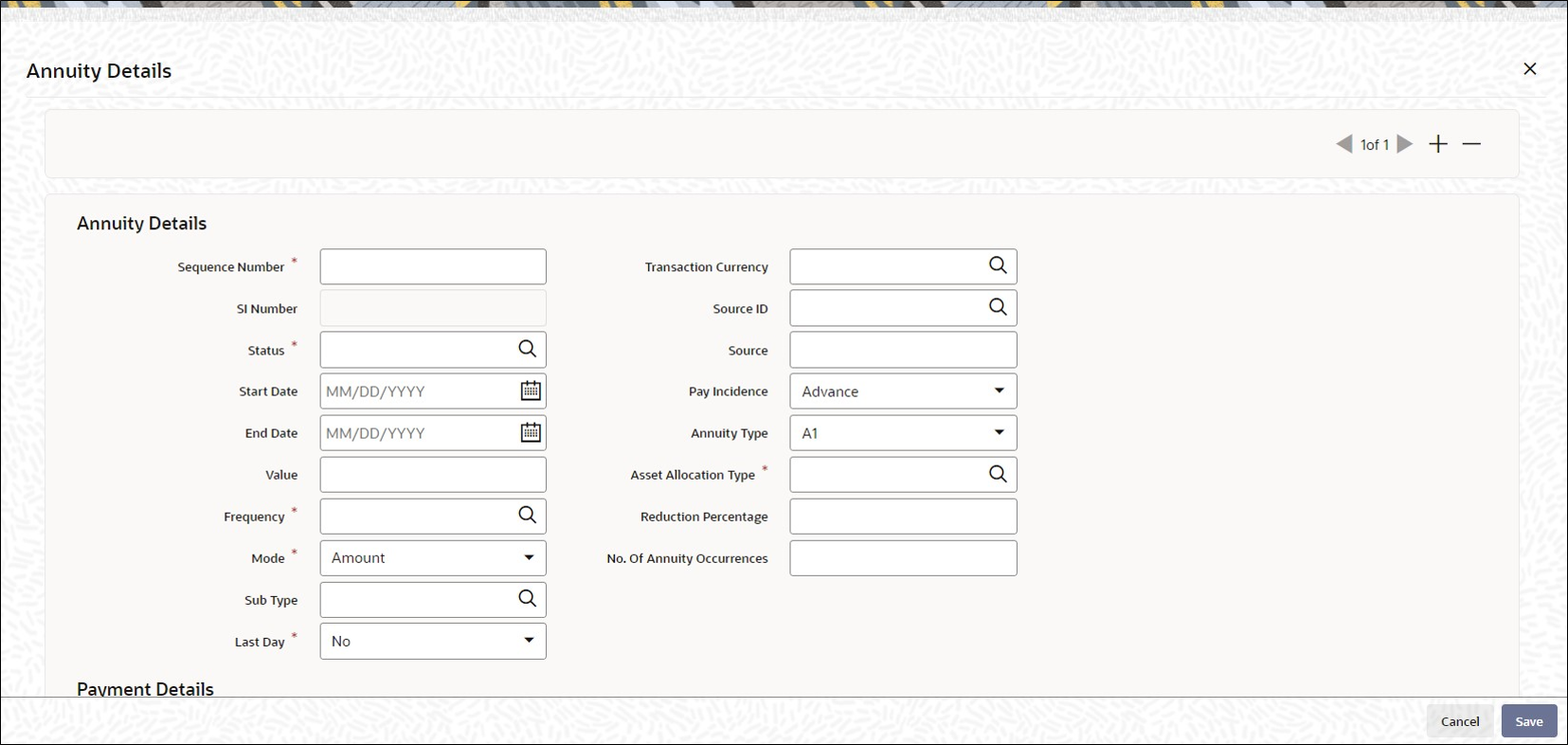

- On Policy Maintenance Detail screen, click Annuity Details button to enter the details.The Annuity Details screen is displayed.

Figure 2-12 Policy Maintenance Detail_Annuity Details Button

- On Annuity Details screen, specify the fields.For more information on fields, refer to the field description table.

Table 2-15 Annuity Details - Field Description

Field Description Annuity Details This section displays the following details.

Sequence Number Numeric; 22 Characters; Optional

Specify the sequence number.

SI Number Display

When you save the details of the Policy you are entering, the Standing Instructions or SI Number will be generated by the system and displayed.

Status Alphanumeric; 1 Character; Mandatory

Select the status of the standing instruction of the annuity payment from the option list. The options are:- A-Active

- C-Cancel

- N-Not Started

- P-Pause

- S-Stop

Note:

If you select the status STOP, escalation will not be applied on the annuity.

Transactions will not be generated for SIs on annuities whose status is STOP. It is possible for you to change the status of such SIs to ACTIVE during amendment of the policy.

During amendment of a policy, you can change the status of an active SI, to Paused, Stopped or Cancelled. However, if you have checked the box Phase-In, you will not be allowed to select the options Paused and Stopped.

During amendment of an SI marked Not Started, you can change all details except the status of the SI. You will be allowed to delete the SI.

During amendment of an active SI:- Escalation End Date can be amended only it is greater than the System Date

- Escalation Start Date and Escalation Frequency can be amended only if escalation has not been applied on the policy

Start Date Date Format, Mandatory

Specify the date, beginning from which, the annuity payment is to be made for this Policy. Subsequent to this payment, annuity payments will be made according to the annuity frequency specified for the Policy.

Note: The Annuity Start Date must not be equal to and earlier than the Policy Start Date.

End Date Date Format, Optional

Specify the date on which the last annuity payment is to be made for this Policy. This date must not be the same as the Annuity Start Date.

Note: The annuity period for annuity SIs cannot overlap.

Value Numeric, 30 Characters; Optional

The amount that is to be paid as annuity to the Policy Holder over a time period in definite intervals / frequencies against the initial investment towards this Policy in this Product is displayed here. You can change this amount at this stage.

Note: The is not applicable if the type of policy is Accelerated Annuity.

If the value specified here is a percentage, it must be within the Annuity Minimum Ratio and the Annuity Maximum Ratio specified at product level.

Note: If you have selected the option Amount against the field Mode, the value you enter will be the annuity amount to be paid in the frequency specified. If you have selected the option Percentage, the percentage value of the policy annuity amount will be calculated and paid in the frequency specified.

The same is illustrated with the following example:

Case 1

The Mode is Amount. Value is 1000 currency units. Frequency is Monthly. In this case, 1000 currency units will be paid to the policy holder every month.

Case 2

The Mode is Percentage. Value is 10%. Frequency is Monthly. In this case, 10% of the policy anniversary amount will be paid to the policy holder in that year.

Frequency Alphanumeric; 1 Character; Mandatory

Specify the frequency at which annuity payments must be made for this Policy.

Mode Mandatory

Annuity payments can be made either as a percentage of the net investment amount or as a flat amount. Accordingly, select the appropriate mode from the drop-down list. The options are as follows:- Amount

- Annual %

Note: This is not applicable if the type of policy is Accelerated Annuity.

Sub Type Alphanumeric; 3 Characters; Optional

Specify the sub type.

Last Day Mandatory

Select Yes to maintain annuity details to the last day of a month from the drop-down list. The list displays the following values:- Yes

- No

If you select Yes, then the system will process the transaction on the last day of the month irrespective of dates mentioned.

If you select No, then the system will consider SI date maintained.

If SI date happens on a holiday, then the system considers the next working day for LEP.

For non-leap year, the system will consider 28th as the last day of the month for February. For leap year, the system will consider 29th as the last day of the month for February.

Transaction Currency Alphanumeric; 3 Characters; Optional

Specify the code of the transaction currency. The adjoining option list displays all valid currency codes along with their description. You can choose the appropriate one.

Source ID Alphanumeric; 6 Characters; Optional

Specify the source ID.

Source Alphanumeric; 20 Characters; Optional

Specify the source details.

Pay Incidence Optional

The payment incidence for an annuity payment sets up the actual payout incidence within the specified frequency for the annuity payment. Select the pay incidence from the drop-down list. The list displays the following values:- Advance

- Arrear

Annuity Type Optional

Select the desired annuity type that is to be applicable for this Policy, from the options provided in the drop-down list.

For information purposes only, the annuitant has the option of specifying the type of annuity that should accrue. The four types provided are as follows:- A1: In this type, the annuity is a single life annuity payable until the death of the annuitant.

- A2: In this type, the annuity is a joint life and last survivor annuity and is payable until the last death of both annuity and spouse, that is, while at least one of the annuitant or spouse is alive.

- A3: The annuity is a joint life and last survivor annuity where the amount of the annuity reduces on the first death of annuitant or spouse. The percentage reduction is specified by the annuitant at the outset.

- A4: The annuity is a joint life and last survivor annuity where the amount of the annuity reduces on the male death. The percentage reduction is specified by the annuitant at the outset.

Asset Allocation Type Alphanumeric; 1 Character; Mandatory

Select the type of asset allocation from the drop-down list provided. The options available are:- User Input

- Policy Portfolio

If the option selected is User Input, then you need to specify the annuity asset allocation.

If the option selected is Policy Portfolio, then you will not be allowed to capture the ratio of funds for annuity or override the load details during policy maintenance. In this case the ratio of funds will be calculated based on policy portfolio.

If the type of asset allocation is specified as Policy Portfolio, then you will not be allowed to pass policy journal entries for such transactions.

Reduction Percentage Numeric; 22 Characters; Optional

Specify the reduction in the annuity in the case of death of one or more of the annuitants, or the primary annuitant, as is applicable.

Note: This field is only applicable for Annuity Types 3 and 4.

No Of Annuity Occurrences Numeric; 22 Characters; Optional

Enter the number of annuity occurrences. This is applicable only for accelerated annuity policies.

Payment Details This section displays the following details.

Payment Mode Optional

Select the mode of the annuity payment from the drop-down list. The list displays the following values:- Transfer

Bank Code Alphanumeric; 12 Characters; Optional

Specify the bank code from which the transfer of payment is being made. The adjoining option list displays all valid bank codes maintained in the system. You can choose the appropriate one.

Payment Branch Code Alphanumeric; 12 Characters; Optional

Specify the branch from which the transfer of payment is being made.

Bank Name Display

The system displays the bank name for the selected bank code.

Branch Name Display

The system displays the branch name for the selected payment branch code.

Account Holder Name Alphanumeric; 100 Characters; Optional

Specify the account holder name.

Account Type Alphanumeric; 1 Character; Optional

Specify the account type from which the transfer of payment is being made.

Account Number Alphanumeric; 34 Characters; Optional

Specify the account number from which the transfer of payment is being made.

Transfer Account Currency Display

The system displays the account currency of the account number from which the transfer of payment is being made.

IBAN Alphanumeric; 40 Characters; Optional

Specify IBAN details.

Escalation Details This section displays the following details.

Escalation Start Date Date Format, Optional

Specify the date from which escalation will commence. This date must be earlier than the End Date of the Policy, and must be later than the Annuity Start Date.

Escalation End Date Date Format, Optional

Specify the date from which the escalation must cease to be applied on the annuity. This date must be later than the Annuity Start Date, If the Annuity Escalation Start Date has been specified, then the End Date is mandatory and must be specified.

Escalation Mode Optional

Annuity payments can be escalated periodically as a pre-defined percentage, amount or market value. Select the mode from the drop-down list.

Escalation Frequency Alphanumeric; 1 Character; Optional

Select the frequency at which the escalation is to be applied, from the values in the drop-down list. If the Start Date has been specified, the frequency is mandatory and must be specified.

Description Display

The system displays the description for the selected escalation frequency.

Escalation Value Numeric; 22 Characters; Optional

Specify the escalation amount that is to be applied.

Asset Allocation Details: Enter the following asset allocation details for the annuity details.

Fund ID Alphanumeric; 6 Characters; Mandatory

All the funds mapped for the selected product are displayed in the option list. Against each of these funds, you can specify the investment ratio and the annuity ratio.

Fund Name Display

The system displays the fund name for the selected fund ID.

Ratio Numeric; 9 Characters; Mandatory

For each fund that is displayed, specify the ratio of annuity payment to be made from the fund, to the total annuity payment from the Policy. The sum total of the annuity ratio should add up to 100.

Parent topic: Process Policy Maintenance Detail