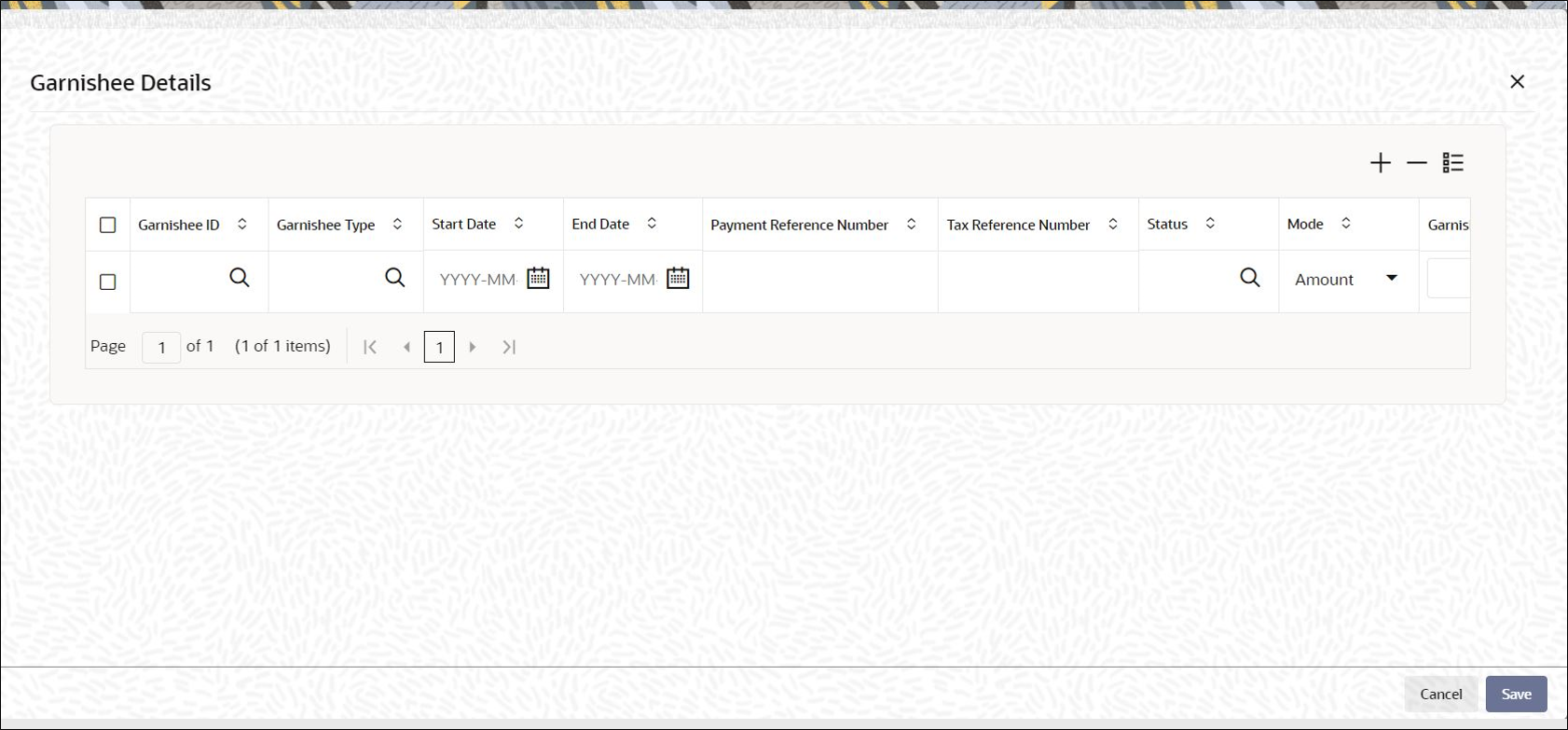

2.1.18 Garnishee Details Button

This topic explains the Garnishee Details button of Policy Maintenance Detail screen.

A garnishment is a means of collecting a monetary judgment against a defendant by ordering a third party (the garnishee) to pay money, otherwise owed to the defendant, directly to the plaintiff. In the case of collecting for taxes, the law of a jurisdiction may allow for collection without a judgment or other court order.

For instance, if (Defendant) A owes (Plaintiff) B a certain sum of money as a judgment in a lawsuit against A that B won, and A does not pay it to B, and (Garnishee) C owes A some money, B may have a court issue a garnishee order to C, and then C has to pay the money directly to B. (C is often A's employer but could be anyone who owes A money, including someone who had borrowed from A).

Multiple garnishee orders are supported in the system.

Garnishee Order can be scheduled like annuity by specifying the start and end date and it will follow the same frequency as annuity. There can be more than one garnishee order running at the same time.

Garnishee Details Button

- Payment Details

This topic explains the payment details of Garnishee Details button in the Policy Maintenance Detail screen. - Create Future-dated Rules for Policies

This topic gives instructions to create Future-dated rules for Policies. - Processing Back Data Propagation for Transactions

This topic provides information on processing Back Data Propagation for transactions.

Parent topic: Process Policy Maintenance Detail