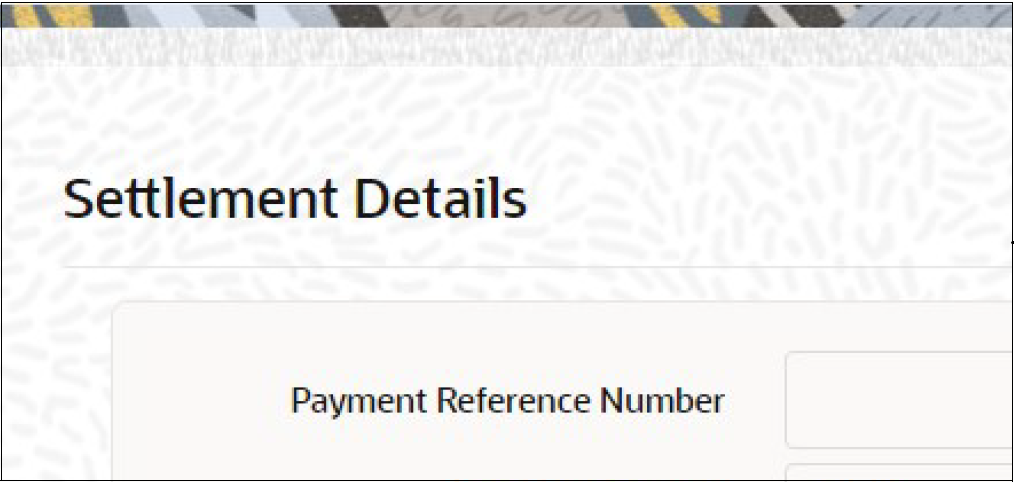

1.58.5 Settlement Details Button

This topic explains the Settlement Details of Investment Detail screen.

Table 1-80 Settlement Details - Field Description.

| Field | Description |

|---|---|

| Payment Reference Number | Display The system displays the payment reference number. |

| Payment Currency | Display The system displays the payment currency code. |

| Payment Amount | Numeric; 18 Characters; Optional Specify the payment amount. |

| Bank Reference Number | Alphanumeric; 16 Characters; Optional Specify the bank reference number. Alternatively, you can select bank reference number from the option list. The list displays all valid bank reference number maintained in the system. |

| Auto Settle | Optional Select Yes from drop-down list to enable auto clearing of pension orders. Else select No. The system defaults this field based on Mode of Payment Detail (PADMPAYS) screen maintenance (PADMPAYS). However, you can amend this field till the order is settled. Derivation of Settlement due date if Auto Settle field is selected as Yes The system will default settlement due date to order date + maximum clearing period in case of money transfer. The system will default settlement due date to cheque date + maximum clearing period in case of cheque. If settlement due date is specified by the user, system will validate whether the settlement due date is less than or equal to maximum clearing date. Settlement due date should be between minimum clearing date and maximum clearing date. Derivation of Settlement due date if Auto Settle field is selected as No The system will default settlement due to order date for money transfer and cheque date in case of cheque payment. Settlement due date cannot be lesser than order date for money transfer and cheque date in case of cheque being payment instrument. |

| Settled | Optional Select the status from the drop-down list. The list displays the following values:

|

| Paid Date | Date Format; Optional Select the paid date from the adjoining calendar. Paid date can be back dated, but should be greater than order date/ cheque date + minimum clearing period in calendar days. |

| Cheque Number | Alphanumeric; 20 Characters; Optional Specify the cheque number. |

| Cheque Date | Date Format; Optional Select the date to be mentioned in the cheque from the adjoining calendar. |

| Settlement Due Date | Date Format; Optional Select the date when the settlement is expected to be settled from the adjoining calendar. If you leave this field blank, then the system will derive this during the order capture. Post settlement of an order, you cannot change the settlement details. Post save, if payment mode is changed, system will clear the settlement details and user needs to re-input the settlement detail. This will be allowed till the order is settled. Settlement due date for Withdrawal will be the day when the order is completed. This will be updated when confirmation of order completion is received from TA. Bulk order amendment/settlement (Orders generated through CFU or PAPDIS) You cannot amend order value and settlement details for bulk order investments You cannot settle bulk orders using Investment Detail(PADINVDE) screen. The same needs to be done from Payment Clearing Detail (PADPYCLR) screen. Bulk investment orders can be settled/rejected from payment clearing screen only. |

- Bank Details Button

This topic explains the Bank Details Button of Settlement Details button.

Parent topic: Process Investment Detail

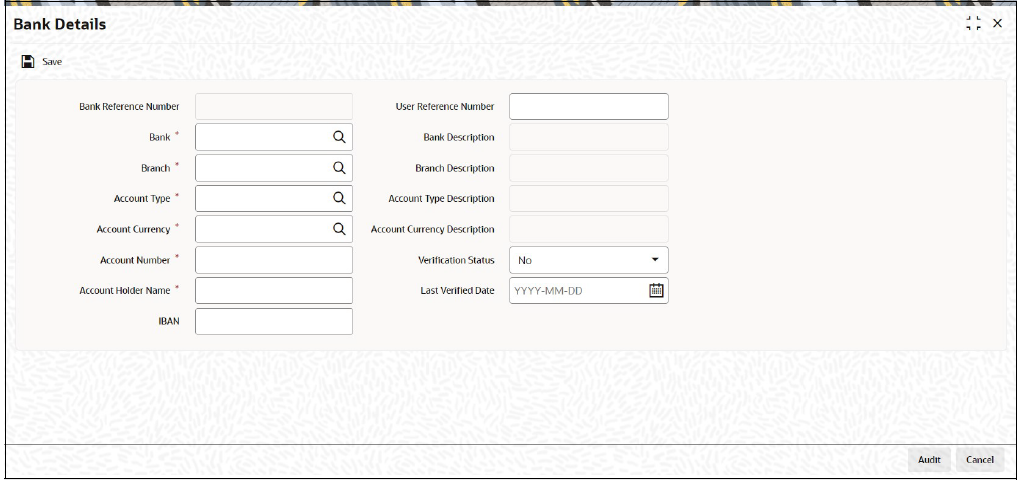

1.58.5.1 Bank Details Button

This topic explains the Bank Details Button of Settlement Details button.

- Bank Reference Number

- Bank

- Branch

- Account Type

- Account Currency

- Account Number

- Account Holder Name

- IBAN

- User Reference Number

- Bank description

- Branch Description

- Account Type Description

- Account Currency Description

- Verification Status

- Last Verified Date

You can amend all the details except in the header post authorization prior to order hand-off to TA.

Parent topic: Settlement Details Button