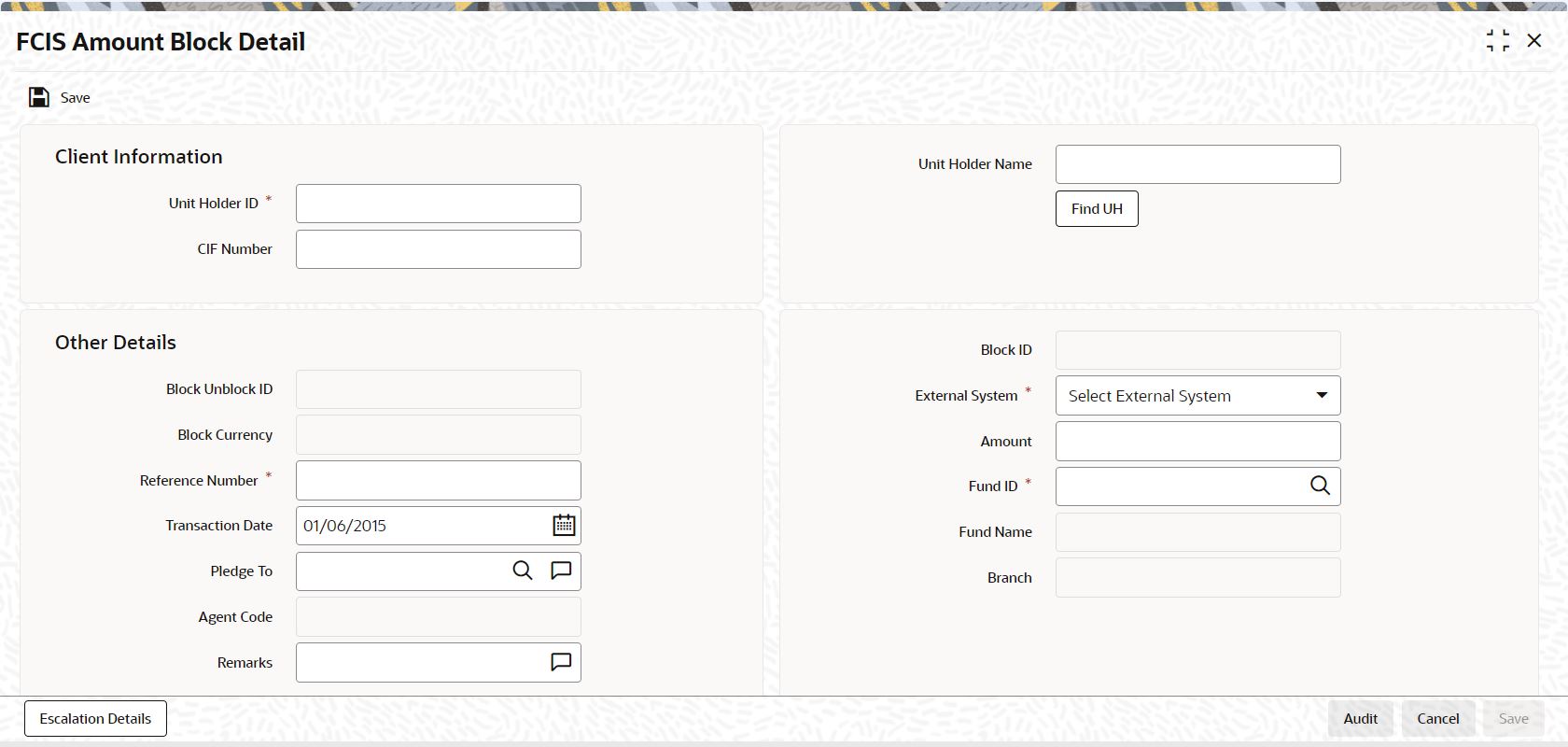

5.5 Process FCIS Amount Block Detail

This topic provides the instructions to process Block Transactions by Amounts.

- On Home screen, type UTDAMT06

in the text box, and click

Next.The FCIS Amount Block Detail screen is displayed.

- On FCIS Amount Block Detail screen, specify the

fields.For more information on fields, refer to field description table.In this section, specify the details of the CIF customer or the investor that has requested for the amount block or unblock transaction.

Table 5-22 FCIS Amount Block Detail - Client Information

Field Description Unit Holder ID Alphanumeric; 12 Characters; Mandatory If the transaction is being entered for a unit holder that is not under a CIF Number, specify the same in this field.

You can also query for unit holder ID by clicking Find UH button.

If you have selected a unit holder using the Find link, the number of the selected unit holder is displayed here.

If you have specified a CIF Number and selected a unit holder for the CIF, then the selected unit holder number is displayed here. It cannot be changed.

The unit holder specified here must belong to the same agency branch from where the adjustment transaction is being entered, if cross branching is not allowed for the agency branch.

Unit Holder Name Display The system displays the name of the unit holder.

CIF Number Alphanumeric; 20 Characters; Mandatory If the unit holder that has requested for the transaction is attached to a CIF Customer, specify the number of the CIF customer in this field. The system retrieves the name of the CIF customer and displays it alongside this field.

If the unit holder ID is specified, then the system displays the CIF number and vice versa.

Table 5-23 FCIS Amount Block Detail - Other Details

Field Description Block Unblock ID Display Each amount block transaction that you enter is also given what is called a Block / Unblock ID, which is used to track any future amount unblock transactions that would be requested against this amount block transaction. At the time of transaction entry of an amount block transaction, it is the same as the Block ID, and is generated using the same logic as the Block ID.

For a single Block ID, multiple unblock transactions can be entered and processed.

At the time of entering an amount unblock transaction, the Block ID will be available for selection in the drop-down (Block ID) after selecting the external system and after the saving of Unblock Transaction, the Unblock ID is generated by the system.

Block ID Display This is a unique number automatically assigned to each amount block transaction by the system. It is internally generated upon successful entry of the transaction and after all validations have been made. Therefore, when you enter a new amount block transaction, this field is disabled.

The transaction number generated by the system is in the format TT-YYYY-JJJ-NNNNNNN

Where,

TT-Transaction type (11 for amount block transactions, 12 for amount unblock transactions)

YYYY-Year of processing

JJJ- Julian date

NNNNNNN-Running sequence number for the day

If an agency branch goes offline during transaction entry, the validations cannot be made and the transaction number cannot be generated. In such a case, the reference number is the identification for the transaction till the system goes online and the validations can be made.

Note: For a single Block ID, multiple unblock transactions can be entered and processed. When you are entering an amount unblock transaction, the Block ID field is enabled and you can select the Block ID against which the unblock transaction is being entered, from the drop down list.

Block Currency Display The system displays the currency of the amount that is allocated for the amount block.

External System Mandatory Select the external system from the drop-down list. The list displays the following values:- Online

- FCC

The option list should be parameterized in the system parameters under Amount Block External System Code.

Reference Number Alphanumeric; 16 Characters; Mandatory Specify a unique reference number that will be used to identify the amount block transaction in the system. Typically, this number is the number of the application that is used to enter this transaction.

It will be the initial identification for the transaction, before the actual Block ID is generated by the system.

If the reference number is designated to be a system-generated number in the Defaults Maintenance, the system will internally generate and display this number when the transaction screen is opened, and this field is disabled.

Amount Alphanumeric; 30 Characters; Mandatory Specify the amount to be blocked against this amount block or unblock transaction. For amount block transactions, this is the amount that will be blocked across all the combination of fund and unit holder, in which the investor retains holdings. For amount unblock transactions, this is the amount that will be unblocked against the selected Block ID.

Transaction Date Date Format; Mandatory This is the date on which you enter the amount block transaction into the system. It is reckoned to be the application date, which is displayed here.

For amount unblock transactions, you can specify either the application date or a future date.

Fund ID Alphanumeric; 6 Characters; Mandatory Select the fund for which the amount needs to be blocked from the list which displays all the funds for which amount blocking is allowed.

This field is only applicable for amount unblock transactions and is not visible in the case of amount block transactions.

Specify the fund from which units must be redeemed (if any) for the selected unit holder when you initiate the amount unblock transaction. You will be allowed to specify only one fund here.

You must specify a fund in which the unit holder will possess holdings to the extent of the unblocked amount, after the unblock transaction has been allocated.

If you do not specify any fund in this field, then no redemption will take place in any fund, against the unblocked amount.

Refer to the topic Redeeming Units for Unblocked Amounts that is found later in this chapter, for a full discussion of the redemption process.

Fund Name Display The system displays the fund name.

Pledged To Alphanumeric; 255 Characters; Mandatory Specify the entity that the blocked amount is pledged to (i.e., the pledgor). This pledgor entity that you specify here must be the same for all amount block transactions that you enter for the unit holder that you have entered in the Unit Holder field. This means that for all amount block transactions entered into by a single unit holder, the pledgor entity specified must be the same.

On the first occasion that you enter an amount block transaction for a unit holder, the pledgor that you specify will be taken as the pledgor for the subsequent amount block transactions for the same unit holder, and will be displayed by default in this field.

When you are entering an amount unblock transaction, the pledgor details that you specified for the selected Block ID are displayed here, and cannot be changed.

Agent Code Display The code of the Agent where the transaction is accepted is displayed here.

Branch Display The name of the Agency Branch where the transaction is accepted is displayed here.

Remarks Alphanumeric; 255 Characters; Mandatory Specify if there are any remarks.

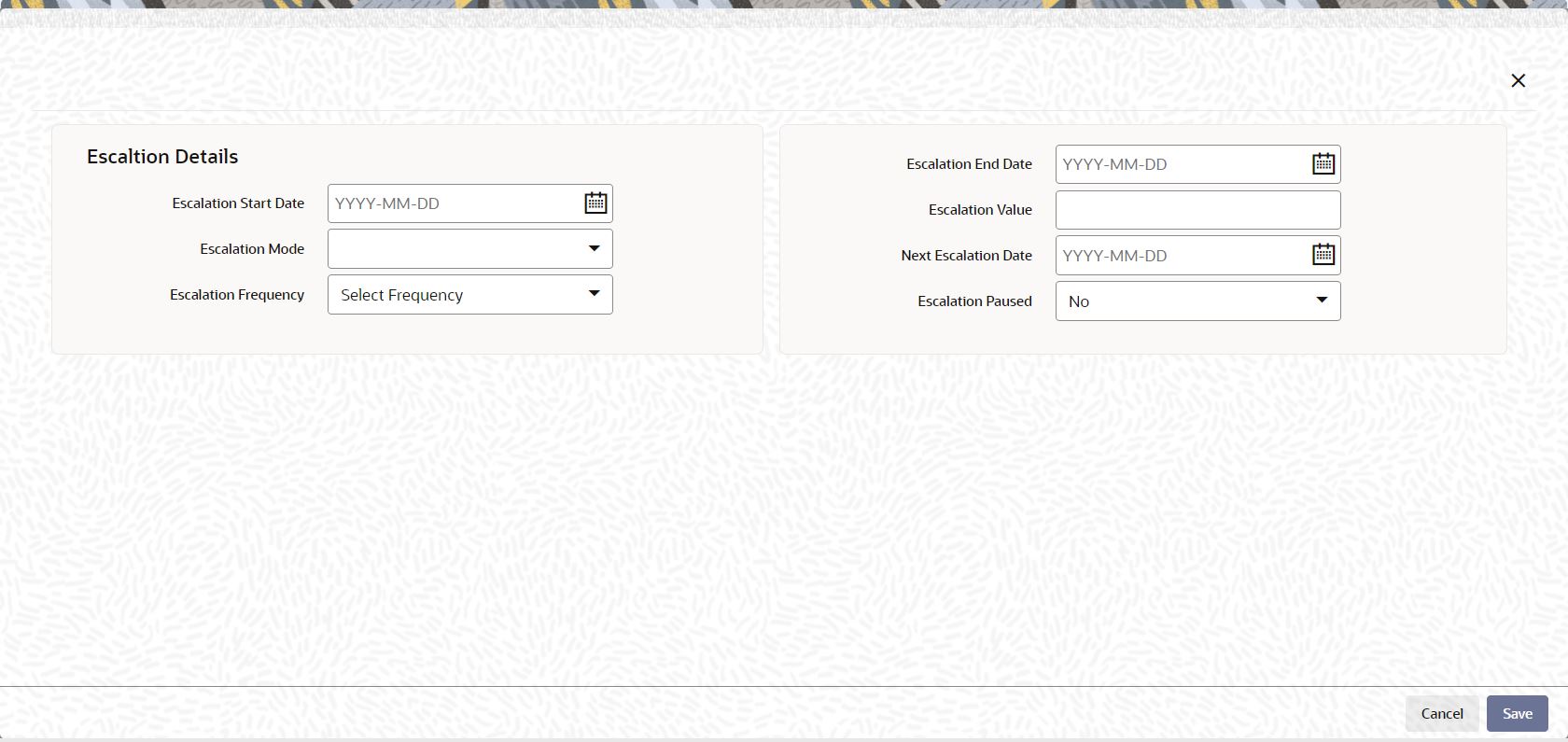

You can view the Escalation Detail Section provided the client country parameter SICREDSPECIFIC is set to False for the installation in your bank.

- On FCIS Amount Block Detail screen, click the

Escalation Details button.The Escalation Details screen is displayed.

Sometimes an investor may instruct the AMC to increase the blocked or unblocked amounts at pre-defined intervals. Such increase patterns are termed as escalation details.

You can maintain the pattern of escalation for the amount block or unblock transaction.Note:

This is optional, but if you make an entry in any field here, then all the other fields will be mandatory and you must then make your specifications in all the fields.

- On the Escalation Details screen, specify the

fields.

For more information on fields, refer to field description table.

Table 5-24 Escalation Details

Field Description Escalation Start Date Date Format; Optional Specify the date on which the first increase or first escalation must occur. Beginning from this date, the blocked (or unblocked) amount will be increased as specified, at intervals determined by the pre-defined frequency that you specify in the Escalation Frequency field.

Escalation End Date Date Format; Optional Specify the date on which the last increase or escalation must occur.

The start date and end date taken together signify a period during which escalation of the blocked (or unblocked) amount will occur at the frequency that you define in the Escalation Frequency field.

Escalation Mode Optional Select whether the increase is an amount-based escalation or percentage escalation the drop-down list. The list displays the following values:- Amount

- Percentage

Escalation Value Numeric; 30 Characters; Optional Enter the value by which the blocked (or unblocked) amount must be increased. At each instance when the escalation comes into effect, the blocked amount will be increased by this value.

Escalation Frequency Optional Select the frequency at which the escalation must occur from the drop down list. The list displays the following values:- Daily

- Weekly

- Bi-Weekly

- Monthly

- Quarterly

- Half-Yearly

- Yearly

Next Escalation Date Date Format; Optional Specify the date on which the next escalation will take place. For records retrieved in the Amend mode, this date may be altered in the amend session.

Escalation Paused Optional If you want the escalation to be halted for a while or a hiatus to occur, then select Yes from the drop-down list. Else select No.

For further details, please refer Process Amount Unblock Detail topic in this User Manual.

Parent topic: Adjustment and Amount Block Transactions