3.1.2 Reinvestment Details Tab

This topic explains the reinvestment details tab of Income Distribution Setup Detail screen.

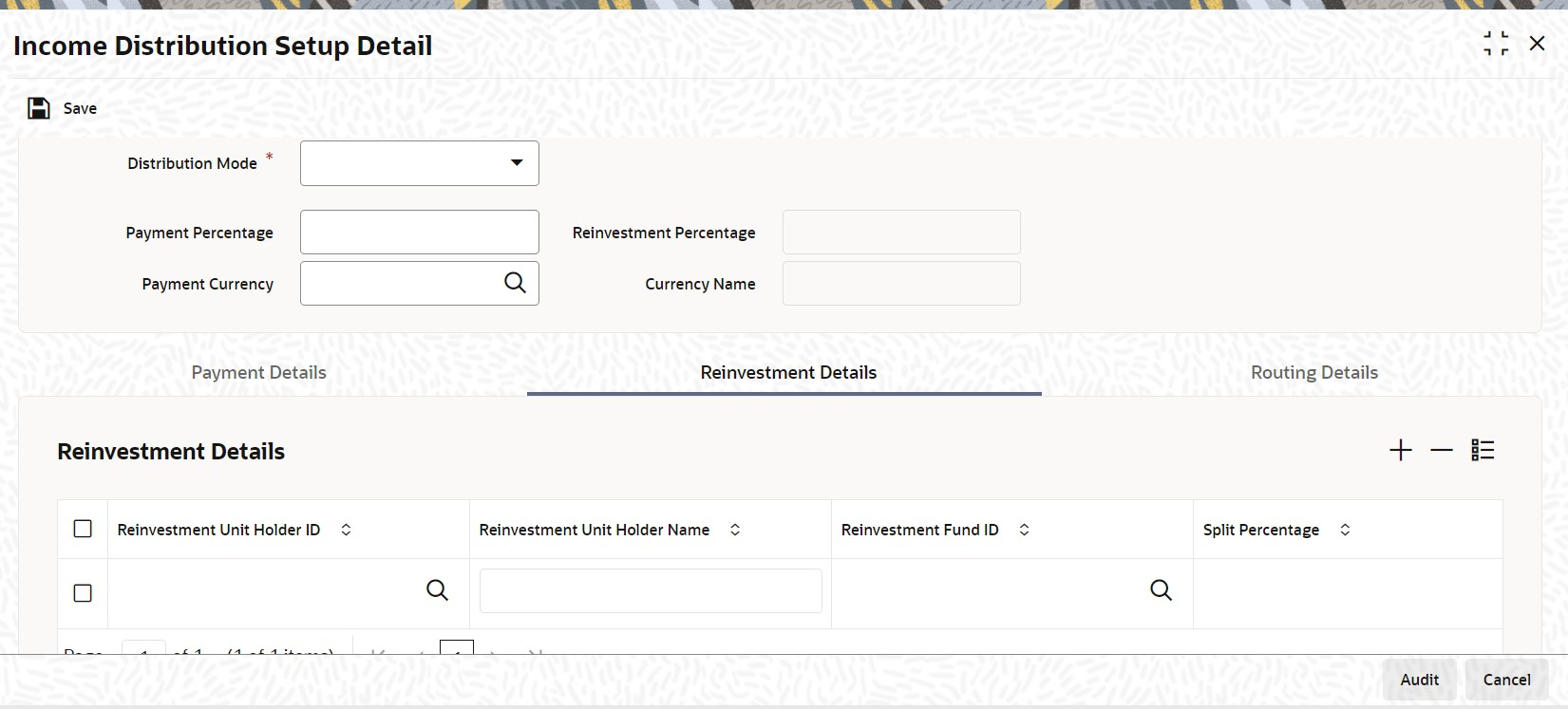

- On Income Distribution Setup Detail screen, click Reinvestment Details tab.The Reinvestment Details are displayed.

Figure 3-3 Income Distribution Setup Detail_Reinvestment Details Tab

- On the Reinvestment Details tab, specify the fields.For more information on fields, refer to the field description table.

Table 3-3 Reinvestment Details - Field Description

Field Description Reinvestment Unit Holder ID Alphanumeric; 12 Characters; Mandatory

Specify the ID of the unit holder in whose account the income is to be reinvested. When you select the ID of the reinvestment unit holder, the name of the unit holder is displayed in the Reinvestment Unit Holder Name field.

Reinvestment Unit Holder Name Display

The system displays the reinvestment unit holder name for the selected reinvestment unit holder ID.

Reinvestment Fund ID Alphanumeric; 6 Characters; Mandatory

Select the ID of the fund in which the income is to be reinvested. The fund that you select here should be part of the same fund family as the fund from which the income was derived.

Split Percentage Numeric; 5 Characters; Mandatory

Specify the percentage of the derived income that is to be reinvested in the specified reinvestment unit holder's account, in the specified reinvestment fund. You can make any number of such entries, specifying a percentage for each combination. The sum total of all split percentages for all reinvestment unit holder – reinvestment fund ID combinations you have specified must be equal to one hundred percent.

In this section, you can define the option in which the investor can reinvest income earnings from the selected fund. The investor can reinvest earned income in any of the following ways:- Reinvest either in the investor’s own unit holder account, or another investor’s account. In the latter case, the investor in whose account the reinvestment is proposed (that is, the Reinvestment Unit Holder) must belong to the same AMC as the source investor.

- Reinvest the income in any other fund. If the investor desires to do this, the reinvestment fund must belong to the same fund family as the fund from which the income is derived.

- Reinvest the income in as many target fund/unit holder combinations, subject to the constraints expressed above. This is again subject to the consideration that the sum of the percentages of reinvestment in all these combinations must be equal to 100.

Note: The payment of income to a third party (i.e. a bank account that is not the investor account or a check that is not in favor of the investor) can be made only if such an installation level option is available.

If you have chosen either Both or Full Reinvestment as the Distribution Mode, you must specify all information that is mandatory in this section.

Note: In GTA setup and in Reinvestment Case:- In AGY without cross branching, Fund ID and Reinvestment Fund ID fields can have funds selected only within same segment. Unitholder ID and Reinvestment Unitholder ID fields can have UH selected only within same segment.

- In AGY with cross branching, Fund ID and Reinvestment Fund ID fields can have funds selected across segments. Unitholder ID and Reinvestment Unitholder ID fields can have UH selected only within same segment.

Parent topic: Process Income Distribution Setup Detail