3.36.2 Process Bank Reconciliation Detail

This topic provides the systematic instructions to perform bank reconciliation activity.

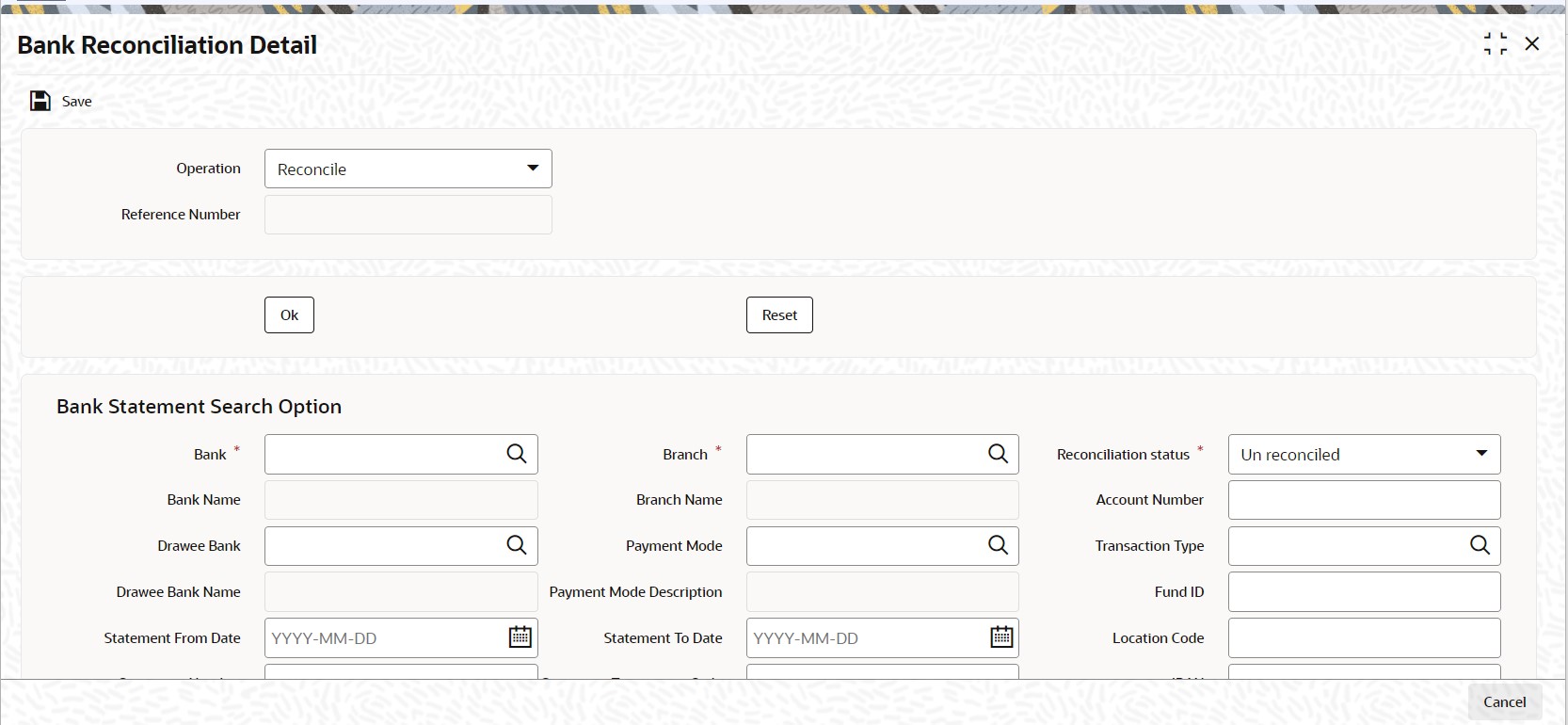

- On Home screen, type UTDBKREC in the text box and click Next.The Bank Reconciliation Detail screen is displayed.

The screen is divided into two frames; Bank Statement Search Option and Trade Search Option. Use the Bank Statement Search Option to specify the search criteria to retrieve the uploaded bank statement entries. Similarly, use the Trade Search Option to specify the search criteria to retrieve the transaction entries that you want to reconcile.

Reconciliation activity can be amended in the same screen, by selecting the Amend option in the Operation field.

- On Bank Reconciliation Detail screen, specify the fields.For information on fields in the screen, refer the below table.

Table 3-73 Bank Reconciliation Detail

Field Description Operation Choose the operation status from the drop-down list. The list displays the following values:

- Reconcile

- Un-Reconcile

Reference Number Display The system displays the Reference Number.

- Click the Ok button after specifying the operation.

Bank Statement Search Option

Table 3-74 Bank Reconciliation Detail

Field Description Bank Alphanumeric; 12 Characters; Mandatory From the option list, select the Bank code in which the fund account is held.

Bank Name Display The system displays the name of the selected Bank Code.

Drawee Bank Alphanumeric; 12 Characters; Optional Specify the drawee bank code where the payment instrument is drawn, if the mode of payment is Check, Credit Card, Debit Card or Draft. In case of Transfer, specify the transfer bank code.

Drawee Bank Name Display The system displays the name of the selected Drawee Bank Code.

Statement From Date Date Format, Optional Specify a date range between which the bank statement records that you want to retrieve was uploaded into the system. The To Date that you specify must be later than the From Date.

Statement Number Alphanumeric; 25 Characters; Optional Enter the number of the statement which you want to retrieve.

Drawee Branch Alphanumeric; 12 Characters; Optional Specify the branch of the selected bank where the payment is drawn, if the mode of payment is Check or Draft. In case of Transfer, specify the transfer branch code.

Drawee Branch Name Display The system displays the name of the selected Drawee Branch Code.

Branch Alphanumeric; 12 Characters; Mandatory From option list, select the name of the branch of the bank in which the fund account is held.

Branch Name Display The system displays the name of the selected Drawee Branch Code.

Payment Mode Alphanumeric; 2 Characters; Optional Enter the mode of payment for the transaction.

Payment Mode Description Display The system displays the description for the selected Payment Mode.

Statement To Date Date Format, Optional Specify a date range between which the bank statement records that you want to retrieve was uploaded into the system. The To Date that you specify must be later than the From Date.

Statement Transaction Code Alphanumeric; 10 Characters; Optional Enter the code of the transaction as printed on the statement.

Statement Ref/Inst Ref Alphanumeric; 100 Characters; Optional If you want to search based on a particular bank entry, enter the statement reference number. Else, if you wish to search based on a particular instrument, enter the instrument reference number.

Reconciliation Status Mandatory Select the Reconciliation Status from the drop-down list. The list displays the following values:

- Un Reconciled

- Partially Reconciled

- Reconciled

Account Number Alphanumeric; 34 Characters; Optional Specify the number of the fund account.

Transaction Type Alphanumeric; 10 Characters; Optional Specify a type of transaction; Pay in, payout, NPI, that you want to retrieve from selected fund bank account records uploaded into the system.

Fund ID Alphanumeric; 6 Characters; Optional Enter the ID of the fund involved in the transaction.

Location Code Alphanumeric; 10 Characters; Optional Enter the Location Code.

IBAN Alphanumeric; 40 Characters; Optional Specify the IBAN Code.

After you have specified the fund account and statement details, click OK. The required bank statement records that are located in the database are displayed in the lower grid.

The following details are displayed for each bank statement record in the Find Results section:

- The statement number

- The date of the transaction

- The reference number of the bank statement as generated by FCIS

- The bank reference number for the statement

- The fund account currency

- The amount to be debited from the account

- The amount to be credited to the account

- Transaction Amount

- The Fund ID

- The Drawee Bank

- The Drawee Branch

- The location code

- Check Status

- Un-Reconciled amount

Journal Entry Optional Select Yes from drop-down list to indicate if a particular bank entry is a journal entry.

For instance, bank entries can contain bank interest details for which there will be no corresponding trade entry to link with in FCIS. In such cases, you need to manually set the status of the entry as journal entry.

Reconciliation Status Display If the operation is NEW, the system derives the status of the bank entry as reconcile (for Un reconciled entries) or partially reconcile (for partially reconciled entries) and displays the appropriate status here.

If the operation is AMEND, the system derives the status of the bank entry as reconcile (for reconciled entries) or partially reconcile (for partially reconciled entries) and displays the appropriate status here.

However, if the bank entry is marked as a journal entry, you are not allowed to indicate the reconciliation status.

Write Off Amount Numeric; 22 Characters; Optional Enter the write off amount to reconcile the bank entry.

Select Optional Check the entry which should be reconciled with the trade side. You can select only one entry for reconciliation with the trade side at a time.

Trade Search Option

Table 3-75 Bank Reconciliation Detail

Field Description Event Code Alphanumeric; 20 Characters; Optional Select the event for which the transaction entry should be retrieved.

Event Name Display The system displays the name of the selected Event Code.

From and To Dates Date Format; Optional Specify a date range between which the transaction entry that you want to retrieve was entered into the system. The To Date that you specify must be later than the From Date.

Reference Number Alphanumeric; 16 Characters; Optional Specify the Reference Number.

Transaction Number Alphanumeric; 16 Characters; Optional Specify the Transaction Number .

Fund ID Alphanumeric; 6 Characters; Optional Specify the Fund ID.

Fund Name Display The system displays the name of the fund for the selected Fund ID.

Entry Type Optional Select the type of entity from the drop-down list. The list displays the following values:

- Normal

- Reversed

Bank Alphanumeric; 12 Characters; Optional Specify the Bank Code. Alternatively, you can select Bank Code from the adjoining option list. The list displays all valid bank code maintained in the system.

Bank Name Display The system displays the name of the bank for the selected Bank Code.

Branch Alphanumeric; 12 Characters; Optional Specify the Branch Code. Alternatively, you can select Branch Code from the adjoining option list. The list displays all valid branch code maintained in the system.

Branch Name Display The system displays the name of the branch for the selectedBranch Code.

Bulk Reconcile Optional Select Yes from drop-down list to generate a single transaction for a selected event for a given period by adding up all the transactions that fall within the search criteria.

Entity Type Alphanumeric; 1 Characters; Optional Specify the Entity Type. Alternatively, you can select Entity Type from the adjoining option list. The list displays all valid entity type maintained in the system.

Entity Name Display The system displays the name of the entity for the selected Entity Type.

Entity ID Alphanumeric; 12 Characters; Optional Specify the Entity ID.

Ref Type Alphanumeric; 2 Characters; Optional Specify the Ref Type.

Ref Type Description Display The system displays the description of the selected Ref Type.

Transaction Sub Type Alphanumeric; 1 Characters; Optional Specify the Transaction Sub Type.

Transaction Sub Type Description Display The system displays the description of the selected Transaction Sub Type.

Payment Mode Alphanumeric; 2 Characters; Optional Specify the Mode of Payment.

Payment Mode Display The system displays the description of the selected Payment Mode.

Remarks Alphanumeric; 255 Characters; Optional Specify remarks, if any.

Fetch Unlinked Trades Only Optional If you select Yes from drop-down list, the system will retrieve only un-reconciled trade entries. If you select No from drop-down list, system will retrieve both un-reconciled and partially reconciled trade entries.

Location Code Alphanumeric; 10 Characters; Optional Specify the Location Code.

IBAN Alphanumeric; 40 Characters; Optional Specify the IBAN Code.

Identification Type Alphanumeric; 3 Characters; Optional Specify the Identification Type.

Identification Name Display The system displays the description of the selected Identification Type.

IdentificationNumber Alphanumeric; 50 Characters; Optional Specify the Identification Number.

Telephone 1 Alphanumeric; 15 Characters; Optional Specify the Telephone Number.

Cellphone Number Alphanumeric; 16 Characters; Optional Specify the Cellphone Number.

Account Number Alphanumeric; 34 Characters; Optional Specify the Account Number.

Match Currency Mandatory Select the Match Currency from the drop-down list. The list displays the following values:

- Fund Currency

- Transaction Currency

After you have specified the search criteria details, click on OK. The required bank statement records that are located in the database are displayed in the lower grid.

The following details are displayed for each transaction entry record:

- The Transaction number

- The Transaction Reference number

- The date of the transaction

- The ID of the fund involved in the transaction

- The ID and Name of the entity involved in the transaction

- The amount reckoned in the match currency

- The Unmatched transaction currency

- The Location Code

- Cheque Status

- The transaction amount

Matched Amount Numeric; 22 Characters; Optional Enter the amount to be matched with the bank side entry. By default, system displays the transaction amount here. However, you can change the amount.

Status Alphanumeric; 8 Characters; Optional Specify the status of the trade record.

Select Optional Check the entry which should be reconciled with the bank side entry. You can select more than one entry for reconciliation with bank side at a time.

On specifying the above details, click the Reconcile button to perform the reconciliation activity and save the reconciled entries.

Once the matching record is retrieved from the database, system will automatically reconcile and take the following actions:

- Clear the matched transaction and confirm the underlying units if Payment Status is marked as Credit Received.

- Reject or Reverse a particular transaction if Payment Status in Bank Feed is marked as Debit Received and existing Payment Status for transaction record is Reject Status Awaited.

- Reject or Reverse a particular transaction if Payment Status in Bank Feed is marked as Reject Status Awaited and existing Payment Status for transaction record is Debit Received.

- If the existing payment status for transaction record is Not Cleared, then the record will not be auto reconciled. System will mark the Status as Debit Received or Reject Status Awaited as supplied in Bank Feed.

If system can not find a matching entry for a record in the Bank Feed, this record will be updated with Reconciliation Status as Unmatched Entry.

If you are performing Amend operation, then click the Un-Reconcile button to de-link the matched entries and save the un-reconciled entries.

Parent topic: Bank Reconciliation