2.1.10 Premium Details Button

This topic explains the Premium Details button of Policy Maintenance Detail screen.

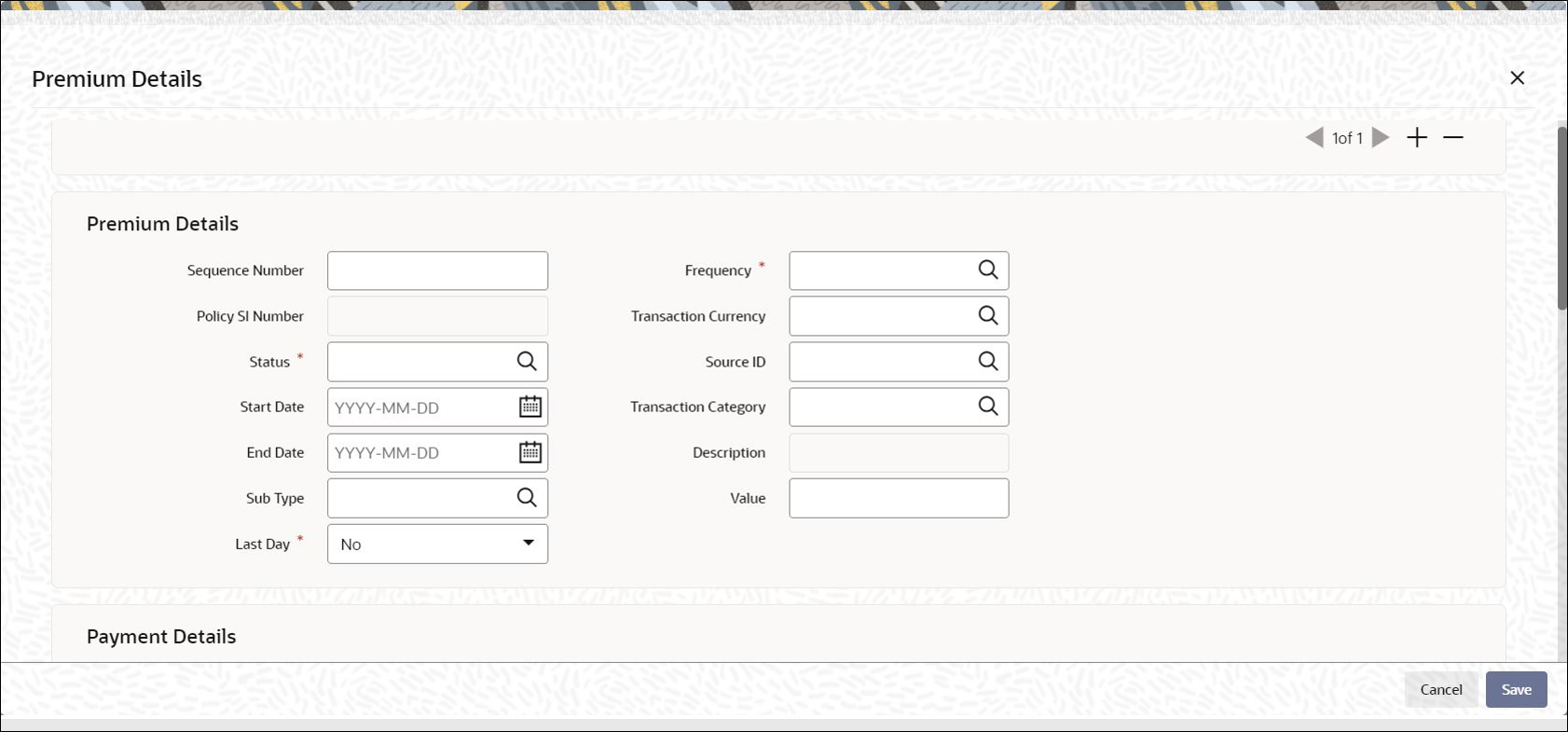

- On Policy Maintenance Detail screen, click Premium Details button to enter the details of the premium payment and the frequency at which the premium payments will be made.You can enter the details for more than one premium.The Premium Details screen is displayed.

Figure 2-11 Policy Maintenance Detail_Premium Details Button

- On Premium Details screen, specify the fields. For more information on fields, refer to the field description table.

Table 2-14 Premium Details - Field Description

Field Description Premium Details This section displays the following details.

Sequence Number Numeric; 3 Characters; Mandatory

Specify the sequence number.

Policy SI Number Display

This number is generated by the system. It represents the number of premium payments between the Start Date and End Date specified for the premium payment.

Status Alphanumeric; 1 Character; Mandatory

Select the status of the standing instruction for premium payment from the option list.

Note: If you select the status STOP, escalation will not be applied on the premium.

Transactions will not be generated for SIs on premiums whose status is STOP. It is possible for you to change the status of such SIs to ACTIVE during amendment of the policy. During amendment of a policy, you can change the status of an active SI, to Paused, Stopped or Cancelled. During amendment of an SI marked Not Started, you can change all details except the status of the SI. You will be allowed to delete the SI. During amendment of an active SI:- Escalation End Date can be amended only it is greater than the System Date

- Escalation Start Date and Escalation Frequency can be amended only if escalation has not been applied on the policy

Start Date Date Format, Mandatory

Specify the date, beginning from which, the first premium payment is to be made for this Policy. Subsequent to this payment, premium payments will be made according to the premium frequency specified for the Policy.

Note: The Premium Start Date must not be equal to and earlier than the Policy Start Date.

End Date Date Format, Mandatory

Specify the date on which the last premium payment will be made.

Note: The premium period of premium SIs cannot overlap.

Sub Type Alphanumeric; 3 Characters; Optional

Specify the sub type.

Last Day Mandatory

Select the last day from the drop-down list. The list displays the following values:- Yes - If you select Yes, then the system will consider it as month-end order and the transaction get processed on the last day of the month.

- No - If you select No, then the system will consider it as date based instruction and the transaction will get processed on the exact date mentioned.

In case the SI date happens on a holiday, the system will consider the next working day for LEP transaction.

For a non-leap year, the system will consider 28th as the last day of the month for February, else the system will consider 29th as last day of the month for February.

This field is applicable for monthly, quarterly, half-yearly and Yearly frequencies.

This field will indicate if the SI is a date based SI or end of frequency (frequency could be monthly, quarterly, half-yearly and Yearly). If you have selected as Yes, then the system will process the subsequent SI on the last day of the frequency selected.

If you have selected as No, then the system will process as per the given date. If it is the last date of any month, you need to select Last Day field as Yes.

You can select Yes only if the Premium start date is selected as 31st of any month. For the other dates which are not a valid last days of the month, you need to select No.

If you select 30th January as Start date and select Last Date field as Yes, then the system will display an error message as Premium Start Date is not month end, Last Day cannot be selected as Yes.

If you have selected a valid month end date, for instance, 28th of Feb (not a Leap Year) then the system will allow you to save the record without any error message.

Frequency Alphanumeric; 1 Character; Mandatory

Specify the frequency at which the premium payments will be made, for this Policy, by the Policy Holder.

Transaction Currency Alphanumeric; 3 Characters; Optional

Specify the transaction currency.

Source ID Alphanumeric; 6 Characters; Optional

Specify the source ID.

Transaction Category Alphanumeric; 1 Character; Optional

Select the transaction category from the adjoining drop-down list. Following are the options available:- Legal

- Advised Business

- Execution Only

Description Display

The system displays the description for the selected transaction category.

Value Numeric; 30 Characters; Mandatory

Specify the amount paid by the Policy Holder as the premium amount for the Policy.

Payment Details This section displays the following details.

Payment Mode Alphanumeric; 2 Characters; Optional

Select the mode of the premium payment.

You have the following options:- Cheque

- Transfer

Bank Code Alphanumeric; 12 Characters; Optional

Specify the bank code from which the transfer of payment is being made. The adjoining option list displays valid bank codes maintained in the system. You can choose the appropriate one.

Branch Code Alphanumeric; 12 Characters; Optional

Specify the branch from which the transfer of payment is being made.

Bank Name Display

The system displays the name of the bank for the selected bank code.

Branch Name Display

The system displays the name of the branch for the selected branch code.

Account Holder Name Alphanumeric; 100 Characters; Optional

Specify the account holder name.

Account Type Alphanumeric; 1 Character; Optional

Specify the account type from which the transfer of payment is being made.

Account Number Alphanumeric; 34 Characters; Optional

Specify the account number from which the transfer of payment is being made.

Account Currency Alphanumeric; 3 Characters; Optional

Specify the account currency of the account number from which the transfer of payment is being made.

IBAN Alphanumeric; 40 Characters; Optional

Specify the International Bank Account Number (IBAN) of the account holder.

Escalation Details This section displays the following details.

Escalation Start Date Date Format, Optional

Specify the date from which escalation will commence. This date must be earlier than the End Date of the Policy, and must be later than the Premium Start Date.

Escalation End Date Date Format, Optional

Specify the date from which the escalation must cease to be applied on the annuity. This date must be later than the Premium Start Date. If the Premium Escalation Start Date has been specified, then the End Date is mandatory and must be specified.

Escalation Mode Optional

Annuity payments can be escalated periodically as a pre-defined percentage, amount or market value. Select the mode from the drop-down list.

Escalation Frequency Alphanumeric; 1 Character; Optional

Select the frequency at which the escalation is to be applied, from the values in the drop-down list. If the Start Date has been specified, the frequency is mandatory and must be specified.

Description Display

The system displays the description for the selected escalation frequency.

Escalation Value Numeric; 30 Characters; Optional

Specify the escalation amount that is to be applied.

Cheque Details This section displays the following details.

Cheque Number Alphanumeric; 16 Characters; Mandatory

Enter the cheque number of the cheque by which the premium is being paid.

Cheque Date Date Format, Mandatory

Enter the cheque date of the cheque by which the premium is being paid.

Asset Allocation This section displays the following details.

Fund ID Alphanumeric; 6 Characters; Mandatory

Specify the fund ID. Alternatively, you can select fund ID from the option list. The list displays all valid fund ID maintained in the system.

Fund Name Display

The system displays the name of the selected fund ID.

Ratio Numeric; 6 Characters; Mandatory

Specify the percentage of asset allocation.

Parent topic: Process Policy Maintenance Detail