1.1.1 Basic Info

This topic explains the basic information tab of FCIS Standing Instructions Detail.

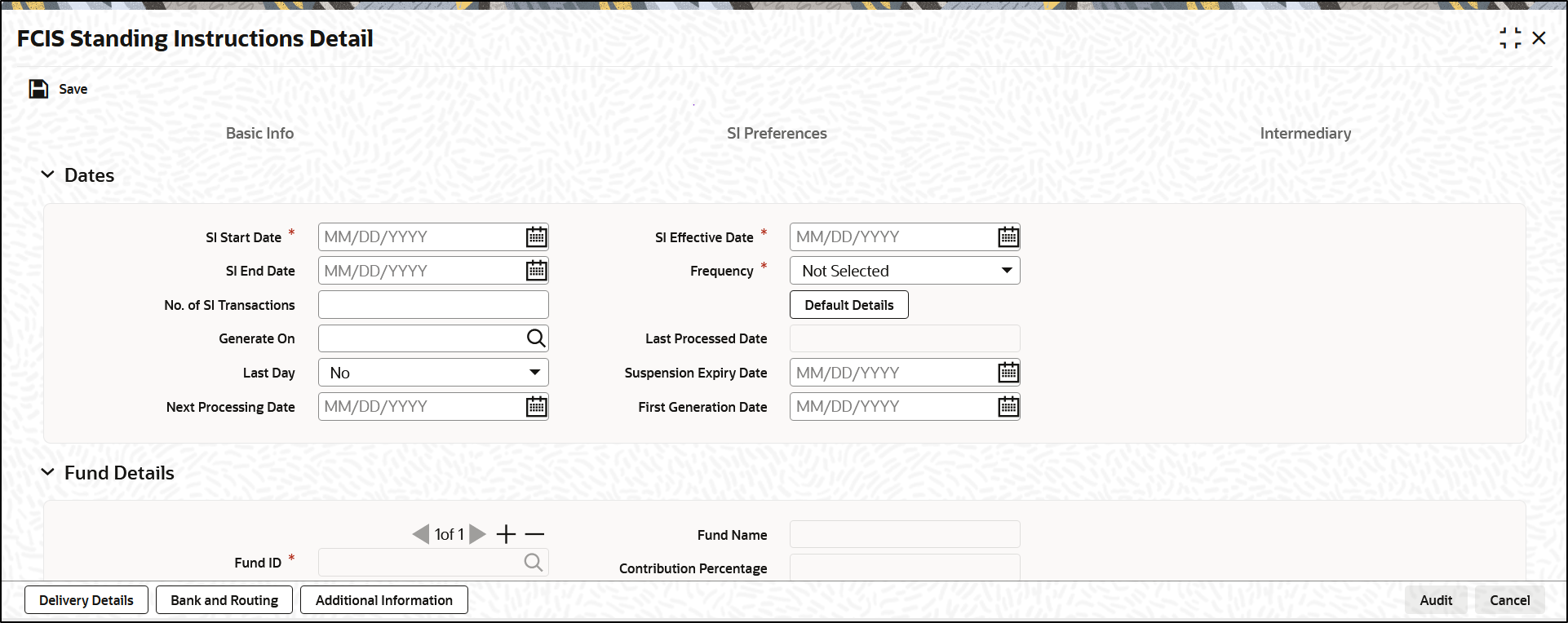

- On the FCIS Standing Instructions Detail screen, click on Basic Information tab to enter the details.The Basic Information details are displayed.

Figure 1-2 FCIS Standing Instruction Detail - Basic Information

- On Basic Information tab, specify the fields. For more information on fields, refer to the field description below,

Table 1-6 Basic Information - Field Description

Fields Description Dates In this section, specify the period during which the standing instruction is to be processed for the unit holder, as well as the frequency at which it must be processed.

SI Start Date Date Format; Mandatory Specify the date on and following which the standing instruction must be processed, at the defined frequency. You can select the date using the system provided calendar.

Note: The SI Start Date should not be beyond 27th of every month. Else the system will display an error message as SI Generation date will differ if SI start date is greater than 27.

SI End Date Date Format; Optional

Specify the date until which the standing instructions must be processed, at the defined frequency. You can select the date using the system provided calendar.

No. of SI Transactions Numeric; 22 Characters; Optional

Specify the number of SI transactions for Monthly, Quarterly, Half yearly and Yearly frequencies.

Generate On Alphanumeric; 100 Characters; Optional

Specified the transaction generated date.

Last Day Optional Select the last day from the drop-down list. The list displays the following values:- Yes

- No

If you select Yes option, the system will consider holiday rule as Prior irrespective of the Fund level maintenance.

If you select No option, the system will derive next SI generation date based on the SI start date’s Day. For instance, if SI Start Date is 28-Jan-2016 and frequency is monthly, SI generation date will be always 28th of every month as long as it is not a holiday.

If the SI generation date is a holiday, the system will generate the SI either on next working date or previous working date based on system calendar and holiday rule set up at Fund Rules. If holiday rule is not maintained, system will generate SI on next working date based on system calendar.

For example, refer the Table 1-7, and Table 1-8 tables.

Subsequent lump sum subscriptions/ regular RSP / switch-in to Source fund can be utilized for switching from Source fund into Target fund.

For example, refer the Table 1-9, Table 1-10, and Table 1-11 tables.

Next Processing Date Date Format; Optional

Select the next processing date from the adjoining calendar.

In case of SI amend, the system will validate this field against the cut off days maintained. Changing Next Processing Date is not allowed if Next Processing Date is less than or equal to Business Date + Cut off Days.

If you do not set COMPUTESINPD client country, then you can amend the next processing date.

You should manually specify Next Processing Date (NPD) in case of future dated rule effective date where rule effective date is greater than Next Processing Date of amended rule.

If you set COMPUTESINPD client country, the system computes the Next Processing Date (NPD) while saving. If you amend an SI with a future dated Rule Effective Date (RED), and if the Rule Effective Date is greater than the Next Processing Date of Amended SI, then the system will auto compute the NPD for the new rule as the next nearest date after the Rule Effective Date without changing the generation day of month (in case of monthly). However, you cannot change generation day for an SI in this case.

If you manually try to change the Next Processing Date, when this client country is set, then the system displays an error message as Next Processing Date cannot be changed by user.

Note: In case of upload and gateway, Next Processing Date must be kept blank in the upload file and request xml respectively.

SI Effective Date Date Format; Mandatory

Select the SI effective date from the adjoining calendar. If the SI effective date is greater than the current date then the next processing date is mandatory.

Note: The SI Effective date should not be during the cut-off period.

For instance, if SI start date is 8th November, and the current system date is 8th November, then the Next process date should be 8th December. If you try to amend the SI with SI effective date as 4th December, then the system displays an error message as The SI Effective date should not be during the cut-off period.

Frequency Mandatory

From the drop-down list, select the frequency at which the standing instruction must be processed, within the period defined between the start and end dates. The options available are as follows:- Monthly

- Quarterly

- Half-Yearly

- Yearly

- Weekly

- Bi-Weekly

- Daily

Note: If the SI Cut-Off Day function is applicable for this installation, it will be effective only if the frequency specified in this field is monthly or higher.

Click the Default Details button to view the following details:- Details of transactions that could result when the standing instruction is processed

- Details of any brokers identified for the transactions

- Details of the instructions given for the transactions

- Details of any escalation for the standing instruction

- Details of any payment made for the processing of standing instructions.

Last Processed Date Display

The system displays the date when this standing instruction was last processed. For a new standing instruction, this field will be blank.

Suspension Expiry Date Date Format; Optional Select the suspension expiry date from the adjoining calendar.

This field will be applicable only if you select SI Status field as Pause.

The system will automatically update SI status as Active when the Suspension Expiry Date maintained is lesser than business date. This will be achieved as part of a BOD job.

If this field is not maintained, you need to amend SI status manually to make it active or cancel.

First Generation Date Date Format; Optional Enter a date on which the system should generate a transaction apart from generating on the Standard Instruction start date. This date should be lesser than the Standard Instruction start date and Greater than or equal to the application date.

The date specified here cannot be edited or amended once you save the transaction.

Fund Details The section displays the following fields. Fund ID Alphanumeric; 6 Characters; Mandatory Select the fund in which any transactions resulting from the standing instruction must be put through. When you specify the fund, the ISIN Code of the fund is displayed in the ISIN Code field along with the fund name.

Note: This field will be displayed only if the SI level is Fund Level.

Fund Name Display The system displays the fund name for the selected fund ID.

Transaction Value Numeric; 22 Characters; Optional Specify the transaction value.

Low Contribution Amount Numeric; 18 Characters; Optional Specify the SI amount to be used for transaction generation if yield calculated is greater than or equal to positive yield % maintained

This field is applicable only if you have selected SI Level option as Fund.

The low contribution amount should be less than SI Amount.

Positive Yield % Numeric; 5 Characters; Optional Specify the positive yield percentage to be maintained for DRSP.

This field is applicable only if you have selected SI Level option as Fund.

The Positive Yield % value should be greater than negative yield % maintained.

From Issued Balances Optional Select Yes from the drop-down list, if you need to process transactions from issued balances. The drop-down list displays the following values:

- Yes

- No

- Both

Single Certificate? Mandatory only if you have chosen the Yes option in the Certificate Required field.

Select the denomination of certificates, whether single or multiple, that will be involved in the transaction, if certificates have been requested.

- For IPO and subscription, specify whether the unit holder has requested a single certificate or multiple certificates.

- For redemption, switch and transfer, specify whether a single certificate or multiple certificates are being redeemed, switched or transferred. For transfer transactions, specify whether the transferee unit holder has requested single or multiple certificates.

If you choose No option in this field, then the certificates involved in the transaction will be reckoned in denominations governed by the maximum and minimum certificate denominations specified for the fund in the Shares Characteristics rule.

KIID Compliant Select if the standing instruction is KIID compliant or not from the drop-down list. Following are the options available:

- Yes

- No

If SI is maintained for a single fund, then for the UH and Fund selected, the system will default Yes/No value based on UH level mapping. In case the fund is selected is a non UCITS fund or if there is SI maintained for multiple funds at SI Fund Info tab, then this field will be blank.

In case there is no UH mapping for the UCITS fund selected, the system will default the value to

No. While saving this record, then the system will display an error message as The Unit holder has not received the KIID.If the field is set to Yes, then the UH will receive the KIID. These entries where the KIID compliant is made as

Yesduring maintenance will be available as part of UCITS-KIID Received SI Report.Contribution Percentage Numeric; 5 Characters; Optional Indicate the percentage of holdings of the transaction that is to be generated in respect of the instruction.

High Contribution Amount Numeric; 22 Characters; Optional Specify the SI amount to be used for transaction generation if yield calculated is less than or equal to negative yield % maintained.

This field is applicable only if you have selected SI Level option as Fund.

The high contribution amount should be greater than SI Amount.

Negative Yield % Numeric; 5 Characters; Optional Specify the negative yield percentage to be maintained for DRSP.

This field is applicable only if you have selected SI Level option as Fund.

The Negative Yield % value should be less than negative yield % maintained. Negative yield % cannot be greater than positive yield%.

The system will not allow amendment of SI between cut-off date and next processing date.

You can specify the following fields only if you have selected SI Type as DRSP and Transaction Type as Subscription:- High Contribution Amount

- Low Contribution Amount

- Positive Yield %

- Negative Yield %

Investors can define a yield for each fund and based on:- If computed result is greater than or equal to positive yield, the RSP amount for the month will be the Low Contribution Amount defined, else the RSP amount will be base contribution amount specified.

- If computed result is less than or equal to negative yield, the RSP amount for the month will be the High Contribution Amount specified, else the RSP amount will be base contribution amount specified.

- If stop account is issued for an investor account, the system will not compute the yield % and system will always use the base contribution amount.

- DRSP transactions will have a new ref type

45to enable ageing sequence and separate load mapping.

Switching between RSP and DRSP is as follows:- DRSP can be switched to RSP and vice versa by amending the SI maintenance and mark the SI Type as Normal/ Dynamic.

- The system will stop yield computation if you change SI Type from Dynamic to Normal. If stop account is issued for the investor post yield computation, the system will stop the yield computation from subsequent cycle only.

- The amendment to switch RSP to DRSP or vice-versa can be done for the next SI generation date only (Next processing date), if the allowed amendment period is breached. This will be derived based on cut-off day’s field at system level.

Note: The system will perform the sales suitability (risk rating) check at the point of RSP/ DRSP set up and amendment (i.e. fund and amount). Sales suitability check will not be performed during SI generation of RSP/DRSP transactions if invriskcheck client country code is disabled.

Certificate Required? Optional For funds that have the certificate option as specified in the Shares Characteristics rules, specify whether the selected unit holder has requested certificates for the standing instruction transaction. If yes, then choose the

Yesoption in this field, and specify the number of certificates requested in the Number of Certificates field.Price Basis Alphanumeric; 10 Characters; Mandatory The default price basis defined in the Distributor Price Basis Setup, if any, for the fund, transaction type, distributor and investment account type involved in the standing instruction, is displayed in this field.

If no price basis has been maintained in the Distributor Price Basis Setup, the default price basis specified for the fund and transaction type for the instruction, from the fund rules, is displayed here.

Minimum Holding Check Required? Optional You can use this field to indicate whether the system must perform the minimum holdings validation when the subscription transactions in respect of the standing instruction are generated.

If this option is selected for a standing instruction, the system validates that the current holdings of the investor either equal or exceed the minimum holdings value specified in the Limit for Standing Instructions defined for the fund, when the subscription transactions in respect of the standing instruction are generated.

This specification can be maintained only if the Minimum Holdings check has been indicated as applicable for the fund for which the standing instructions are being entered.

Contra Leg Fund/Unitholder The section displays the following fields. Switch To Fund ID

Alphanumeric; 6 Characters; Optional Specify the switch to fund ID. Alternatively, you can select switch to fund ID from the option list. The list displays all valid switch to fund ID maintained in the system.

Note: In GTA setup,

For Normal Switch and Phase In Switch Case:- In AGY without cross branching, Fund ID and Switch to Fund ID fields can have funds selected only within same segment.

- In AGY with cross branching, Fund ID and Switch to Fund ID fields can have funds selected across segments.

For Pseudo Switch Case:- In AGY without cross branching, Fund ID, Switch to Fund ID and Switch Back Fund ID fields can have funds selected only within same segment.

- In AGY with cross branching, Fund ID, Switch to Fund ID and Switch Back Fund ID fields can have funds selected across segments.

Switch To Fund Name Display The system displays the switch to fund name for the selected switch to fund ID

To UnitHolder ID Alphanumeric; 12 Characters; Optional Specify the To unit holder ID. Alternatively, you can select To unit holder ID from the option list. The list displays all valid To unit holder ID maintained in the system.

Click the Find To UH button to query To unit holder ID.

To Unit Holder Name Display The system displays To unit holder name for the selected To unit holder ID.

Note: If client country UHFUNDRESTRICT is turned on, the System will validate Unit Holder and the Fund should belong to the same AMC. Additionally,- In case of SI Switch, Unit Holder and the To Fund should belong to the same AMC.

- In case of SI Transfer, To Unit Holder and the Fund should belong to the same AMC.

Example on Holiday Rule Maintained at Fund Rules as After

Assume 08-Mar-2016 is a holidayTable 1-7 Holiday Rule Maintained at Fund Rules as "After"

SI Generation Date Actual Generation date 8-Jan-16 8-Jan-16 8-Feb-16 8-Feb-16 8-Mar-16 9-Mar-16 Example on Holiday Rule Maintained at Fund Rules as Prior

Assume 08-Mar-2016 is a holidayTable 1-8 Holiday Rule Maintained at Fund Rules as "Prior"

SI Generation Date Actual Generation date 8-Jan-16 8-Jan-16 8-Feb-16 8-Feb-16 8-Mar-16 7-Mar-16 SI Generation Date based on Last Day

For instance, if SI Start Date is 28-Jan-2017 and frequency is monthly, The SI generation date will be as explained in the table:Table 1-9 SI Generation Date and Amount, and Last Day as Y

SI Start Date - 28-Jan-2017 Last Day - Y SI Generation Date Amount 28-Jan-17 1000 28-Feb-17 1000 31-Mar-17 1000 Table 1-10 SI Generation Date and Amount. and Last Day as N

SI Start Date - 28-Jan-2017 Last Day - N SI Generation Date Amount 28-Jan-17 1000 28-Feb-17 1000 28-Mar-17 1000 Table 1-11 SI Generation Date and Amount, and Last Day as Y/N

SI Start Date - 31-Jan-2017 Last Day - Y/N SI Generation Date Amount 31-Jan-17 1000 28-Feb-17 1000 31-Mar-17 1000 30-Apr-17 1000

Parent topic: Process FCIS Standing Instructions Detail