1.8.3 Payment Details Tab

This topic explains the transaction details tab of FCIS LEP Propagate Transaction Detail screen.

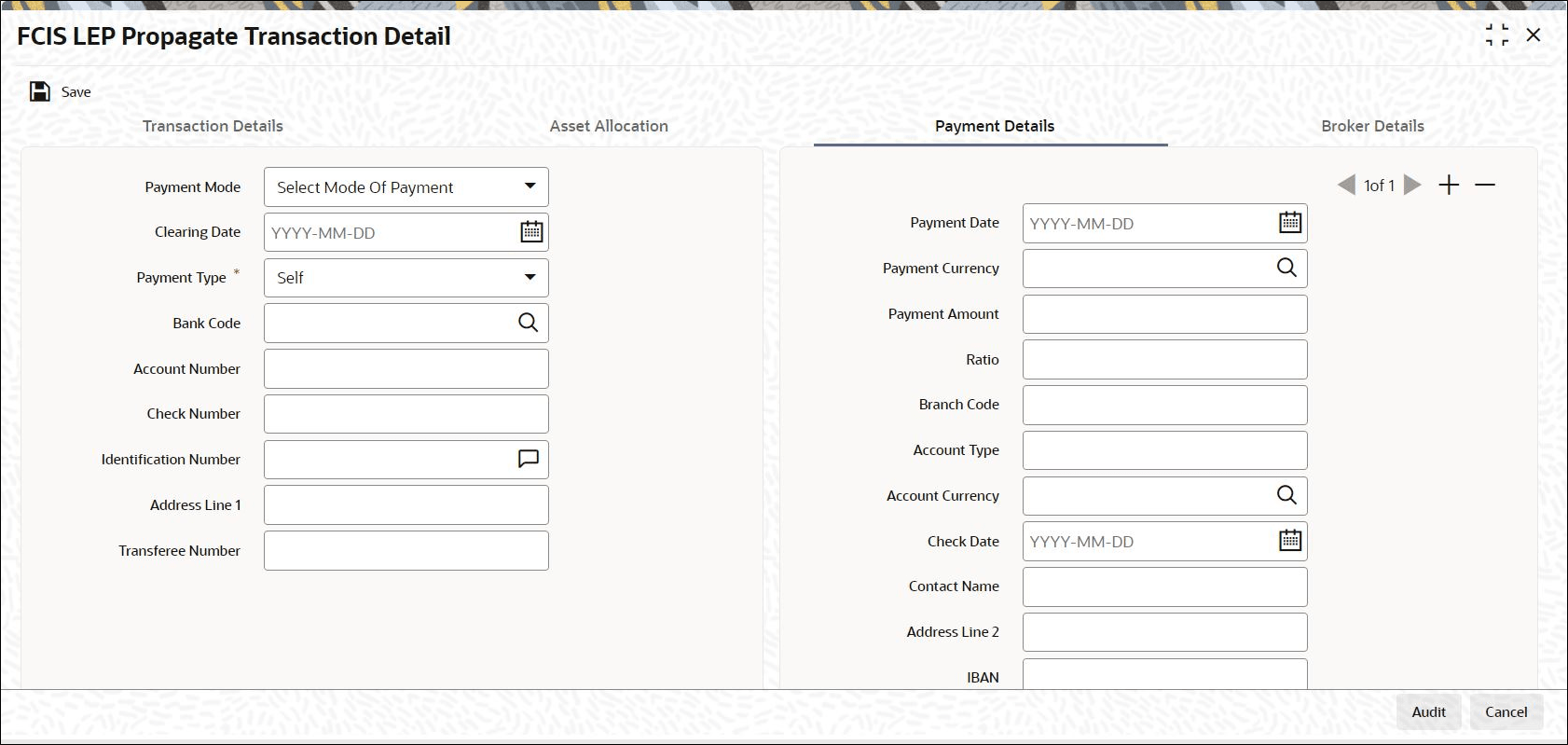

- On FCIS LEP Propagate Transaction Detail screen, click Payment Details tab to capture the details of payments made by the Policy Holder towards processing of the transaction.The Payment details are displayed.

Figure 1-14 FCIS LEP Propagate Transaction Detail_Payment Details

- On Payment Details tab, specify the fields.For more information on fields, refer to the field description table.

Table 1-11 Payment Details Tab - Field Description

Field Description Payment Details This section displays the following details.

Payment Mode Optional

Select the mode through which the payment is made by the Policy holder. This could be any one of the following, as applicable:- Cash

- Cheque

- Demand Draft

- Money Transfer

Clearing Date Date Format, Optional

Specify the Clearing Date of the payment.

Payment Type Mandatory

Select the payment type from the drop-down list. The list displays the following values:- Self

- Product

- Third Party

- Beneficiary

Bank Code Alphanumeric; 12 Characters; Optional

Select the bank code from the option list.

Account Number Alphanumeric; 34 Characters; Optional

Specify the number of the transfer account.

Check Number Alphanumeric; 16 Characters; Optional

Enter the cheque number of the cheque /draft number of the demand draft by which the payment is being made.

Identification Number Alphanumeric; 50 Characters; Mandatory

Specify the identification number.

Address Line 1 Alphanumeric; 255 Characters; Optional

Specify the address of the customer.

Transferee Number Alphanumeric; 16 Characters; Optional

Specify the transferee number.

Payment Date Date Format; Mandatory

Specify the date on which the initial investment was done. You can deposit the amount in different currencies and on different dates.

Payment Currency Alphanumeric; 3 Characters; Optional

Enter the currency in which the initial investment is being done. The initial amount can be deposited in multiple currencies.

Payment Amount Numeric; 30 Characters; Mandatory

Enter the initial investment amount being paid in the particular currency.

Ratio Numeric; 5 Characters; Optional

Specify the ratio.

Branch Code Alphanumeric; 12 Characters; Optional

Select the branch code from the option list.

Account Type Alphanumeric; 1 Character; Optional

Select the account type of the transfer account.

Account Currency Alphanumeric; 3 Characters; Optional

Specify the transaction currency.

Check Date Date Format, Optional

Enter the cheque date of the cheque /draft number of the demand draft by which the payment is being made.

Contact Name Alphanumeric; 100 Characters; Optional

Specify the contact name.

Address Line 1 Alphanumeric; 255 Characters; Optional

Specify the address of the customer.

IBAN Alphanumeric; 40 Characters; Optional

Specify the International Bank Account Number (IBAN) of the account holder.

Exchange Rate Details This section displays the following details.

Source ID Alphanumeric; 6 Characters; Optional

Specify the source ID from the adjoining option list.

Exchange Rate Applied Numeric; 21 Characters; Optional

Specify the exchange rate applied.

Transaction Currency Amount Numeric; 30 Characters; Optional

Specify the transaction currency amount.

Override Exchange Rate Optional

Select the exchange rate is overridden or not from the drop-down list. The list displays the following values:- Yes

- No

FX Deal Date Date Format; Optional

Select FX deal date from the adjoining calendar.

FX Value Date Date Format; Optional

Select the FX value date from the adjoining calendar.

If exchange rate details are not available for any settlement when the transaction or policy is entered, the system will not generate a UT transaction.

Once all the settlement details have been enriched in the Policy Transaction Exchange Rate Enrichment screen and the FCIS Enrich Exchange Rate Detail screen, the system will compute the transaction amount and generate the UT transaction.

If it is not enriched, then the system will pick the exchange rate during EOD and generate the UT transaction.

Interest Details When you click Enrich button in the Transaction Detail tab, if the investment amount has been deposited prior to the transaction date, the system will calculate and display the interest on the payment amount in the Policy Information tab. The interest will be calculated from the date of payment till the transaction date.

When you click Calculate Interest button in the Settlement Details screen, the system will calculate and display the interest amount in the Interest Amount field in the same screen.

Interest Rate Numeric; 30 Characters; Optional

Enter the rate of interest that is to be used to calculate interest amount for the particular currency.

Alternatively, you can maintain the interest rate in the Interest Rate Maintenance screen. If you do not maintain an interest rate, the system will take it as null.

Interest Amount Numeric; 30 Characters; Optional

Specify the interest amount.

Interest Amount in Transaction Currency Numeric; 30 Characters; Optional

Specify the interest amount in terms of the transaction currency.

Interest Calc. Days Numeric; 30 Characters; Optional

Specify the number of days for which interest calculation has to be done for a policy top-up based on the payment date and transaction date.

Basis Days Optional

Select the interest basis days, based on which the interest will be calculated. The options available are:- 360 days

- 365 days

Parent topic: Process FCIS LEP Propagate Transaction Detail