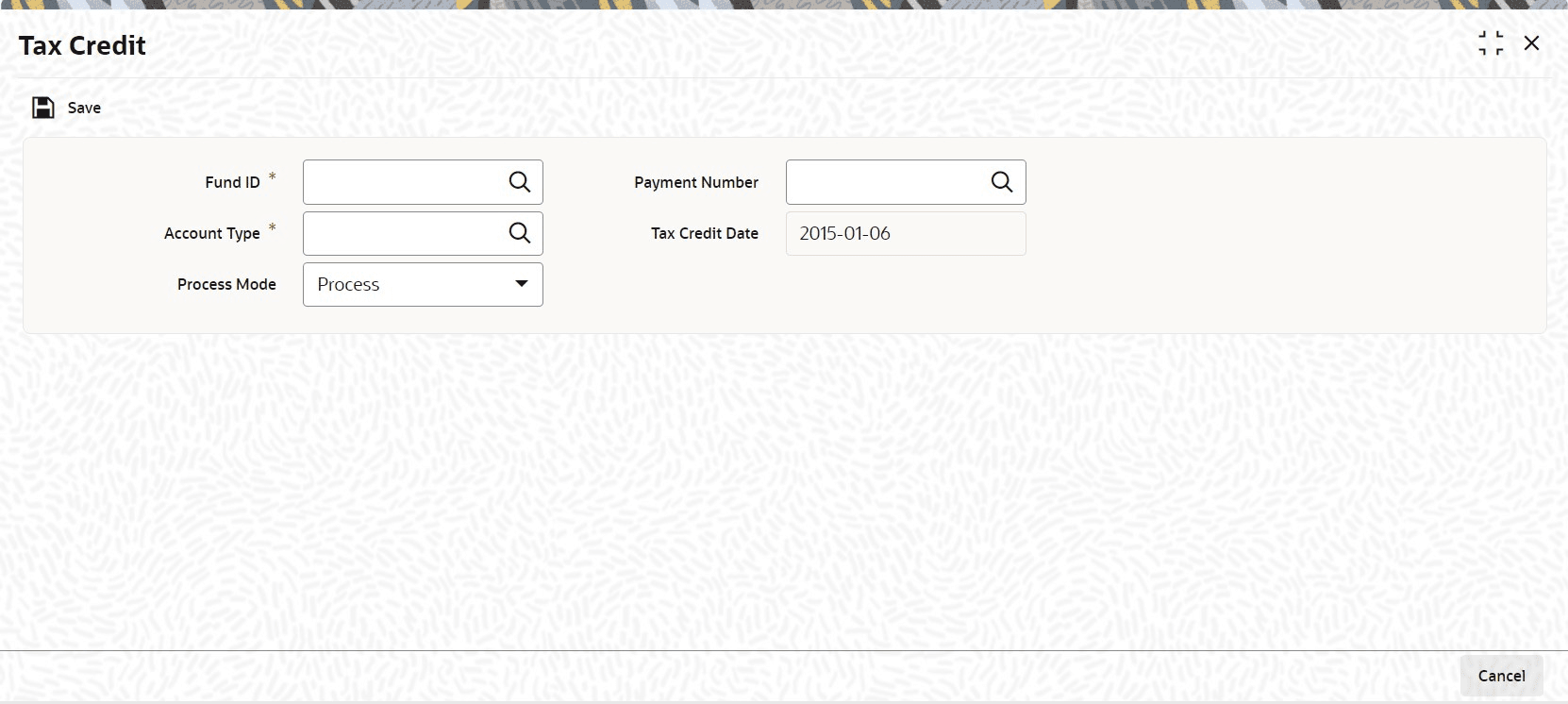

3.30 Process Tax Credit

This topic provides the systematic instructions to maintain tax credit details.

- On Home screen, type

UTDTAXCR

in the text box, and click Next.The Tax Credit screen is displayed.

- On Tax Credit screen, click New

to enter the details.For more information on fields, refer to the field description table.

Table 3-22 Tax Credit - Field Description

Field Description Fund ID Alphanumeric; 6 Characters; Optional

Specify the Fund ID. Alternatively, you can select fund ID from the option list. The list displays all valid fund ID maintained in the system.

Account Type Alphanumeric; 1 Character; Optional

Specify the Account Type. Alternatively, you can select account type from the option list. The list displays all valid account type maintained in the system.

Process Mode Optional

Select the mode of processing from the drop-down list.

The list displays the following values:- Process

- Reverse

Payment Number Alphanumeric; 1 Character; Optional

Specify the Payment Number. Alternatively, you can select payment number from the option list. The list displays all valid payment number maintained in the system.

Tax Credit Date Display

The system displays the tax credited date.

Parent topic: Entities - Set Up Investor Preferences