3.9 Process UH Non Tax Limits Detail

This topic provides the systematic instructions to set up the prescribed limits for taxable holdings for an eligible investor.

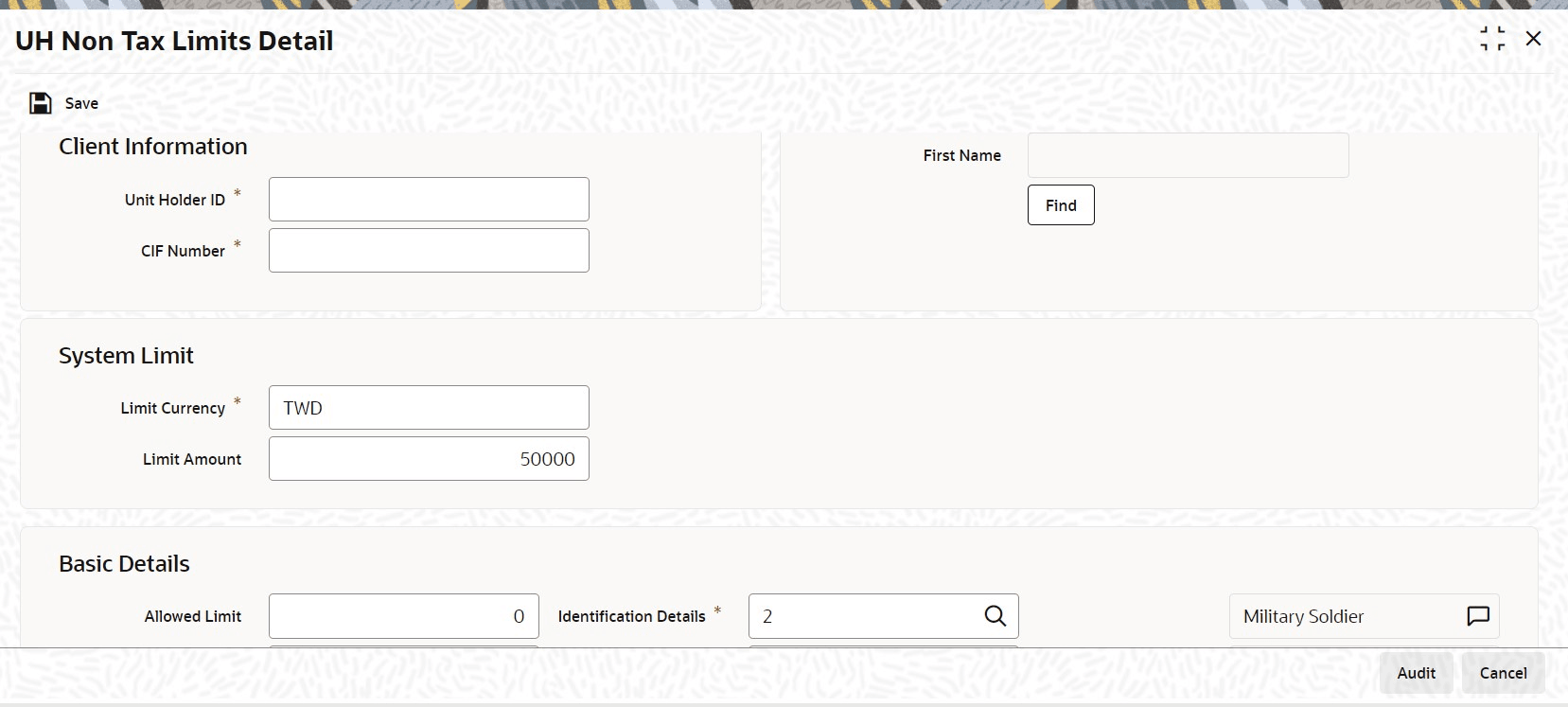

Process UH Non Tax Limits Detail

- On Home screen, type UTDUHNTX/

UTDURATX in

the text box, and click Next.The UH Non Tax Limits Detail screen is displayed.

- On UH Non Tax Limits Detail screen, click

New to enter the details.For more information on fields, refer to the field description table.

Table 3-11 UH Non Tax Limits Detail - Field Description

Field Description Client Information In this section, select the ID of the unit holder for whom you are specifying non-tax limit options.

Unit Holder ID Alphanumeric; 12 Characters; Mandatory

Enter the CIF unit holder ID for whom you are creating the non-tax limit options.

First Name Display

Specify the ID of the non-CIF unit holder for whom you are setting up the non-tax limit options in this screen. The name of the unit holder that you select is displayed alongside the field.

CIF Number Alphanumeric; 20 Characters; Mandatory for setting up non-tax limit options for a unit holder under a CIF Account

Select or specify the number of the CIF account under which the unit holder for whom you are creating the non-tax limit options is found.

When you specify the CIF number, the name of the corresponding CIF account is retrieved from the database and displayed alongside the field.

All the unit holder accounts under the CIF account that you have selected are listed in the drop down list in the unit holders for CIF field.

You can query unit holder ID and CIF number by clicking Find button.

System Limit The section displays the following fields.

Limit Currency Alphanumeric; 3 Characters; Mandatory

This is parameterized at the system level. However, you can amend this value.

Limit Amount Numeric; 22 Characters; Mandatory

This is parameterized at the system level. However, you can amend this value.

Basic Details In this section, you can indicate the total sanctioned limit across all funds for the investor.

Allowed Limit Numeric; 28 Characters; Mandatory

Specify the total non-tax limit that is applicable for investments in the selected accumulated fund, for the investor. This amount must not be higher than the total sanctioned limit across all funds, which you specified in the Basic Details section in this screen.

The sum of the allowed limits for each accumulated fund must not exceed that portion of the total sanctioned limit available for accumulated funds.

Identification Details Alphanumeric; 3 Characters; Mandatory

Select the type of identification document that is being provided for the non-tax limits option being set up for the unit holder. The system displays the description in the adjacent field.

The identification could be provided as any of the following documents:- Nominee Document

- Handicap Document

- Death Certificate

Sanction Status Mandatory

At any given date after you set up the non-tax limits for an investor in this screen, select the sanction status from the drop-down list.

The list displays the following values:- Active

- Cancel

When you are creating the non-tax limit options for the investor for the first time, the

Activeoption is displayed in this field.If you have cancelled the non-tax limit through an amendment, the

Canceloption is displayed in this field. In this state, the limit is no longer valid and will not be validated for during any transactions of the investor.You cannot alter the status displayed in this field at any juncture.

UH Info Change Status Numeric; 1 Character; Mandatory

Specify the UH info change status. The system displays the description in the adjacent field.

The Maruyu Eligibility Status option is mandatory while setting up a new non-tax record.

While setting up a new non-tax limits record in this screen, you must select the Maruyu Eligibility Status option and specify the date on which the eligibility status document was received, as mandatory information. This date is typically defaulted to the application date. The system displays the description in the adjacent field.

While specifying any changes to the non-tax limits record during an amendment in this screen, you can select the type of change document that has been received, from the list. The following options are available:- Change Limit Status: Select this option to indicate that the non-tax limit has been legally revised, and the document for the change has been received. The changed limit must also be specified in the Sanctioned Limit field.

Note: When a transfer transaction is entered for a unit holder with a non-tax limits record, the limit tracking for the amount is done based on the Average Cost and not the Transaction Base Price. Therefore, there could be a residual value for the non-taxable holdings, even if the actual number of units has come down to zero.

Only transfer by units (All Units) and percentage (by 100%) transactions may be entered for unit holders with non-tax limits records. Transfer transactions by amount cannot be entered for such unit holders in the case of change in status.- Stop Using Status: Select this option to indicate that the non-tax limit has been withdrawn or stopped for the investor and the corresponding document to this effect this has been received. The available limit must be set to zero, in the Sanctioned Limit field. Authorization of this status change will result in an automatic transfer of non-taxable holdings to taxable holdings, for the concerned unit holder.

- Loss of Eligibility Status: Select this option to indicate that the investor has been legally made ineligible to avail of the non-tax limit, and the corresponding document to this effect has been received. The available limit must be set to zero, in the Sanctioned Limit field. Authorization of this status change will result in an automatic transfer of nontaxable holdings to taxable holdings, for the concerned unit holder.

- Death Status: Select this option to indicate that the non-tax limit has been withdrawn or stopped for the investor, due to death of the investor and the corresponding document to this effect this has been received. The available limit must be set to zero, in the Sanctioned Limit field.

When an information change has been effected to the unit holder account for which the non-tax limits are being set up, the system prompts you to confirm the change for the non-tax limit investor, and to confirm the receipt of the supporting document. Based on this, it also updates the option in this field as Change Information Status option, and defaults the Document Received Date as the application date of the change.

Document Received Date Date Format; Mandatory

Specify the date on which the following documents are received:- For a new non-tax limits record, the Maruyu Eligibility Status.

- For a non-tax limit amendment, the Change Limit Status, Stop Using Status, Loss of Eligibility Status or Death Status.

By default, the application date is reckoned as the date on which the corresponding document is received.

You must specify this date as mandatory information for either a new non-tax limits record or during amendment.

Date of Death Date Format, Mandatory if the Death Status option is chosen in the Change Information Status field.

During amendment, if you are entering the change information as Death Status in the Change Information Field, specify the date of death in this field.

Non-Taxable Limits for Accumulated Funds In this section, you specify the portion of the total non-taxable limit that is applicable for investments in accumulated funds, for the unit holder. You can define individual limits for individual funds. Fund ID Alphanumeric; 6 Characters; Optional

Select the fund for which you want to indicate a non-taxable limit for the investor.

Allowed Limit Numeric; 28 Characters; Optional

Specify the total non-tax limit that is applicable for investments across all non-accumulated funds, for the investor. This amount must not be higher than the total sanctioned limit across all funds that you specified in the previous section in this screen.

Utilized Limit Display

At any given date after you have created the non-taxable limit for a unit holder, the value displayed in this field reflects the portion of the limit defined for the selected accumulated fund that has been used up, as on the date, in investments in the fund. You cannot change this value at any juncture.

Fund Base Currency Display

The value displayed in this field reflects the portion of the limit, in fund base currency, defined for the selected accumulated fund that has been used up, as on the date of viewing, in investments in the fund. You cannot change this value at any juncture.

Non-Taxable Limits for Non-Accumulated Funds In this section, you specify the portion of the total non-taxable limit that is applicable for investments in non-accumulated funds, for the unit holder.

NonAcc Allowed Limit Numeric; 22 Characters; Mandatory

Specify the non accumulated allowed limit.

Utilized Amount Display

At any given date after you have created the non-taxable limit for a unit holder, the value displayed in this field reflects the portion of the limit defined for non-accumulated funds that have been used up, as on the date, in investments in non-accumulated funds. You cannot change this value at any juncture.

- Set up Non-Tax Limits for Eligible Investors

This topic provides the systematic instructions to Set up non-tax limits for eligible investors. - Process Non-Tax Limits for Investors

This topic provides the systematic instructions to process non-tax limits for investors.

Parent topic: Entities - Set Up Investor Preferences