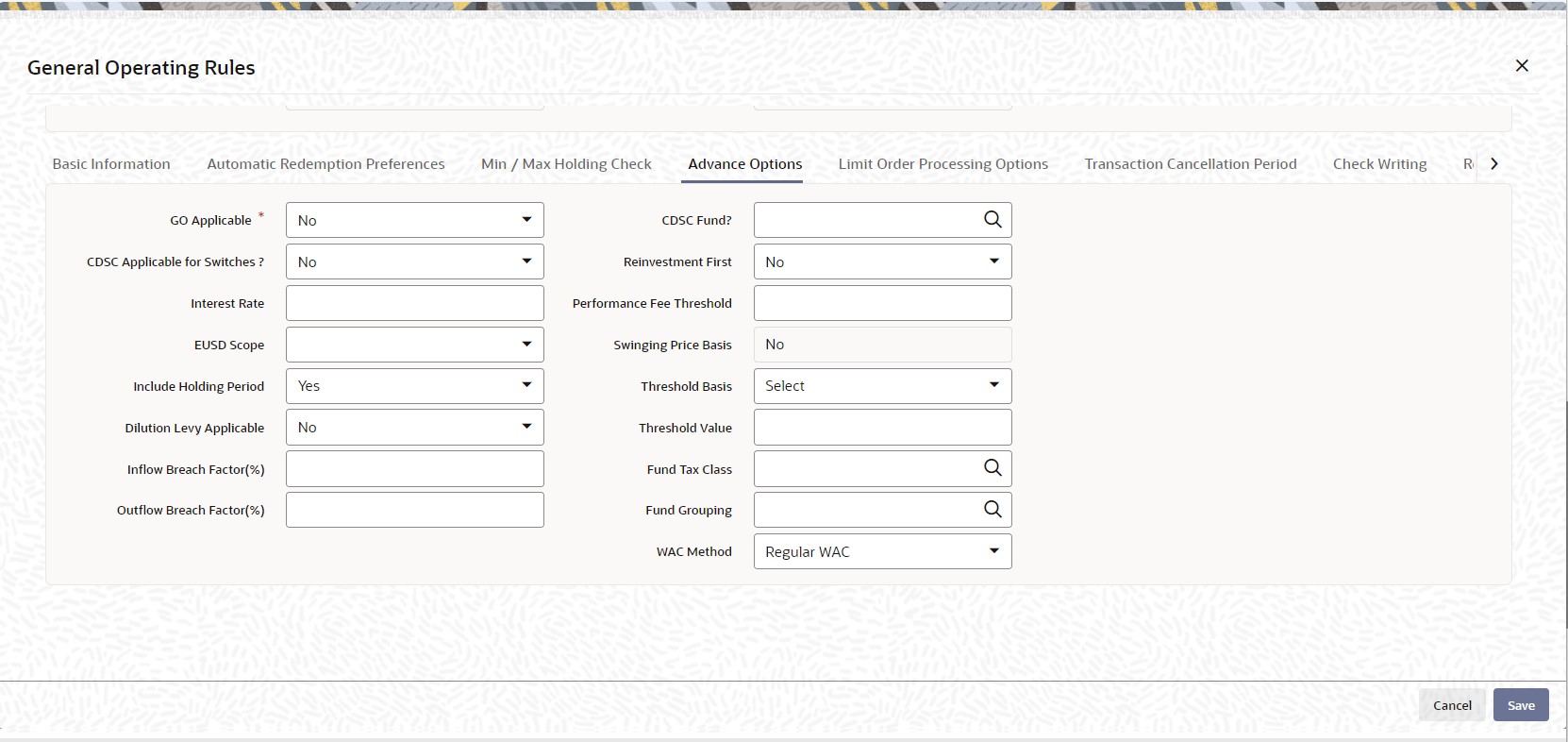

2.1.6.4 Advance Options

This topic provides information on advance options tab of general operating rules screen.

- Click on Advance Options tab in General

Operating Rules screen to specify the details.The Advance Options details are displayed in General Operating Rules screen.

For more information on fields in the screen, refer the below table.

Table 2-13 General Operating Rules - Advance Options

Field Description GO Applicable? Mandatory Select if GO is applicable or not from the adjoining drop-down list. Following are the options available:

- Yes

- No

- With Trading Box

If the value Yes is selected, then the fund will be eligible for GO generation. If the value No is selected, then the fund will not be eligible for GO generation. However, if the value with trading box is selected, then the fund will be eligible for GO generation by applying the trading box functionality and not the GO Maintenance feature.

Refer the Suspense Accounts, Statutory Accounts and Trading chapter in the Fund Manager User Manual for a fuller discussion of the trading functions available in the FC-IS system.

CDSC Fund? Alphanumeric; 2 Characters; Optional If Contingent Deferred Sales Charge (CDSC) is applicable for transactions in this fund, then specify the CDSC calculation method to be used for the fund. The options are:

- LOCOM – Lower of cost or Market Value

- Market Price – Market appreciation method

- Class B – CDSC Class B method

- Not Applicable – CDSC not applicable

- Redemption Value - Redemption method

The CDSC load should be of period based. CDSC fund load set up for redemption method to derive the CDSC amount is calculated as follows:

CDSC Load Amount = NR Units * Redemption TBP * CDSC Load %

CDSC Applicable for Switches? Optional Select Yes from drop-down list to indicate that the Contingent Deferred Sales Charge (CDSC) must be applicable to switch or exchange transactions.

Reinvestments First Numeric; 17 Characters; Mandatory Select Yes from drop-down list to indicate that reinvestment transactions must be taken up first for aging during computation of Contingent Deferred Sales Charge for redemption transactions in this fund.

This field is not applicable for onshore funds having USERMNTFIFO ageing Logic.

Interest Rate Numeric; 15 Characters; Optional Specify the interest rate.

Performance Fee Threshold Numeric; 5 Characters; Optional Specify the performance fee threshold details.

EUSD Scope Optional Select the EUSD scope of the fund from the drop-down list. The list displays the following values:

- Redemption and Switch

- Dividend

- Both

i.e. if EUSD is applicable only for redemption and switch transactions or only for dividend or for both.

Swinging Price Basis Display The system displays the Swinging Price Basis as maintained at the Fund Family Level.

If swinging price basis is not No at the fund level, then reference currency and exchange rate source fields should be maintained at the fund family level. The sale value of the funds is converted to the reference currency to arrive at the swinging price.

Include Holding Period Optional Select whether the holding period should be considered or not from the drop-down list, while calculating the age of investments during computation of Contingent Deferred Sales Charge.

Note: This option will be enabled only for CDSC applicable funds.

Threshold Basis Mandatory if the swinging price basis is semi swinging Select the basis as Amount or Percentage from the drop-down list.

Dilution Levy Applicable Optional Select Yes from drop-down list if dilution levy is applicable for the fund or else select No. Outflow and inflow breach factor can be maintained only if the value in this field is maintained as Yes. To arrive at dilution breach limit amount the system considers the inflow breach factor for IN transactions and the Outflow breach factor for OUT transactions.

Threshold Value Numeric; 30 Characters; Mandatory if the swinging price basis is semi swinging Specify the threshold value for the semi swinging price basis fund.

Only daily priced funds can be grouped under a fund family. For non daily price funds, if swinging price is applicable, each fund will have to be mapped to a separate family.

Inflow Breach Factor(%) Numeric; 5 Characters; Optional Specify the breach factor for inflow transactions, as a percentage of the fund value upon which dilution levy is applicable.

Outflow Breach Factor Numeric; 5 Characters; Optional Specify the breach factor for outflow transactions, as a percentage of the fund value, upon which dilution levy is applicable.

Fund Tax Class Alphanumeric; 3 Characters; Optional Specify tax class of a fund details. Alternatively, you can select fund tax class details from the option list. The list displays all valid fund tax Class details maintained in the system.

Fund Grouping Alphanumeric; 6 Characters; Optional Specify fund grouping details to group the funds under one fund. Alternatively, you can select fund grouping details from the option list. The list displays all valid fund grouping details maintained in the system.

You can group the different Tax Class Funds under one group for Tax Class Switch using this field. If you want to create four funds in the system, then the fund group ID should be one of the fund IDs of the four funds that you intend to create.

WAC Method Optional Select the WAC method from the drop-down list. The list display the following values:

- Regular WAC - To compute regular WAC

- Life WAC - to compute life WAC

If you select Life WAC and Base Cost is not provided while capturing a transaction, then the system will calculate Weighted Average Cost (WAC) as follows:

LIFE WAC = ((No of units in the fund before inflow) * (WAC before inflow) + (No of units in the inflow for fund) * (Unit Price of inflow)) / (Total Units in Fund)

Where,

Unit price = (Net investment amount) / number of units purchased

Net Investment amount = Gross investment amount – all Fee except the ones which are paid to AMC

The net investment amount will not exclude any Fee for which To Entity is AMC. The system will deduct any other fee (apart from those where To Entity is AMC) from the gross investment amount to arrive at the net investment amount.

Total units in Fund = (No of units in the fund) + (No of units in the inflow for the fund)

If you select a product with WAC method as LIFE WAC, and if a Switch transaction is done within the same Fund Family and Base Cost is not provided while capturing the transaction then the system will calculate WAC as follows:

Life WAC = ((No of units rolling over) * (WAC in From Fund) + (No of units in the To fund) * (WAC in To Fund)) / (Total Units in To Fund)

Where Total units in To Fund = (No of units rolling over into To Fund) + (No of units in the To fund)

The system will calculate Capital Gain or Loss as follows:

Gain / Loss = Units surrendered / redeemed from Fund* ((Price of fund on the date of Redemption / Surrender) – WAC for fund)

If there is a gain then Capital Gain Tax has to be deducted.

To deduct the capital Gain Tax, a separate Load will be mapped under Product load mapping as post allocation load. If the Slab basis is selected as weighted average then this load will be applied on the Gain portion and tax will be deducted and only the net amount will be paid to the customer.

If the Fund Family of Switch Out and Switch In Fund is same, the calculations for the Switch Out Leg will change to the extent wherein Gain will be calculated as 0.

Processing of Swinging Price

For a swinging price fund, the system computes the net transaction of sales value (Inflow - Outflow) on the application date (current date) at fund family level for the given fund and arrives at the fund price

- Net of Sales Value is Positive: The system applies the offer price to all transactions as per the maintenance at fund family level.

- Net of Sales Value is Negative: The system applies the bid price to all transactions as per maintenance at fund family level.

- Net of sales value is Zero: The system applies the mid price that is, (bid price+ offer price)/2

The gross amount in the fund family base currency is used for the net of sales value computation. For unit based transactions, the net sales is computed as follows: units applied * latest available NAV.

For Semi Swinging Funds, the system computes the net of sales value (Inflow – Outflow) for transaction date at fund family level for the given fund and arrives at the fund price based on threshold basis at fund level as follows:

If Threshold Basis is Amount then:

- System applies Offer price, if net of sales value is greater than threshold value.

- System applies Bid price, if net of sales value is less than (-1) * Threshold value.

- System applies Mid price ((Offer Price + Bid Price)/ 2), if Net of sales value is between (-1) * threshold value and threshold value.

If Threshold Basis is Percentage then:

- System applies offer price, if net of sales value is greater than threshold value percentage of Net Asset Value (NAV) of the fund.

- System applies bid price, if net of sales value is less than (-1) * threshold value percentage of net asset value of the fund.

- System applies mid price ((Offer Price + Bid Price)/ 2), if net of sales value is between (-1) * threshold value and threshold value percentage of net asset value of the fund.

Net asset value of the fund is computed as the BOD outstanding units * latest available NAV. The reference types mapped at fund family level is used to compute the net of sales value. The swinging price computed is used for unitizing all transaction types mapped at fund family level.

For transaction types not mapped at fund family level, the system does not use swinging price. The system uses the gross amount in fund base currency for net of sales value computation. For unit based transactions, the net of sales is computed by using units applied * latest available NAV.

A mini EOD computes and populates the swinging price and swinging price basis for Swinging Price and Semi Swinging Price Fund. This mini EOD is run during the day to arrive at the Total Inflow, Total Outflow, and Net Sales value.

Parent topic: General Operating Rules