1.4 Fund Manager

This topic provides information on Fund Manager.

Maintain Reference Information

The Fund Manager is the entity that handles all administrative functions within the AMC.

- The set up and maintenance of reference and static data concerning all entities, currencies, exchange rate sources and exchange rates.

- The set up and maintenance of all funds floated by the AMC.

- Authorization of all data related to static information, unit holder accounts, information change requests, amended transactions, closure of accounts and bulk clients information.

The Fund Manager component, therefore, acts as an administrative core that seamlessly integrates with the rest of the system in an offline hand-off mode or an online mode.

- Entities that the AMC would transact with, such as agents, agency branches, banks, bank branches, registrars, trustees, bulk clients, check vendors, underwriters and custodians. You can also maintain different AMC’s as entities.

- The different values for static system parameters, such as countries, identification, corporation and occupation types, account types, investor categories, fee categories, and so on.

- Currency information, such as the different currencies, exchange rate sources and pair currencies. On a daily basis, you can also capture the prevalent exchange rates.

- Tax processing information that would be applicable to investor categories, country tax laws, cash dividends, brokers and funds floated by the AMC.

- The different fees, incentives or loads that would apply to transactions of investors in the funds of the AMC. This includes fees such as Contingent Deferred Sales Charge (CDSC), trailing commissions and ongoing management fees.

- The holiday calendar for the AMC.

Maintain Funds and Products

In Fund Manager, you can maintain the different funds that your AMC would offer to investors for investment. If your AMC offers investment in umbrella funds, or fund families you can maintain these in the system. You can also maintain the different products for retirement plans, or endowment policies, and so on.

Your AMC could offer investors opportunities to invest not just in a single fund, but into umbrella funds, or fund families. You can maintain these hierarchies in the system.

- Fund Demographics (the basic profile of the fund including the name and effective date)

- Corporate Actions (rules governing the processing of dividends and distribution of earnings derived by investors from investment into the fund)

- General Operating Rules (guidelines for pricing policies, automatic redemption, check writing, and so on)

- Shares Characteristics (guidelines for scrip-based and scrip-less funds, for certificate processing)

- Transaction Processing Rules (the processing limits for each transaction type, allocation rules, limits for investor categories, standing instructions and transaction requests coming through each communication mode)

- Fund Load Setup (associating the fees, charges or incentives to be applicable to investment transactions in each fund)

- Fund Formula Maintenance (maintaining expressions for calculation of NAV or transaction base price, for each transaction type)

- Fund Sale Country (identifying the countries of domicile in which the AMC can offer the fund for sale)

- Fund Transaction Currencies (identifying the currencies in which the AMC can accept investment into the fund)

- Fund Residency Restriction (identifying the nationalities of investors that can invest in the fund)

- Specific Price Dates for funds (identifying specific dates on which prevalent prices can be used for ascertaining the value of investment in the fund)

- Amount Limits for IRA Transactions (identifying the limits for investment into funds that are part of the portfolio of a retirement product)

- SI Specific Information (maintaining rules for standing instruction generation for a fund)

- Fund Delivery Instruction

- Fund Investment Account (associating the fund investment account types allowed with a fund)

- KYC Maintenance (maintaining the list of KYC documents specific to the fund)

- Additional Information (maintaining additional information under the information heads specific to an AMC)

If you do not maintain fund rules for a fund, you cannot process investment into the fund, in the system.

You can associate entities such as agents with a fund that you maintain. Such agents would be allowed to market the fund.

If check writing facilities are allowed for a fund, you can also associate the check vendors that would print the checks, for the fund.

You can maintain groups of funds, for which common loads are applicable on transactions. The group of funds (or load group) facility is especially useful for loads that are applicable in the case of privileges of the investor such as Rights of Accumulation (ROA) or a Letter of Intent (LOI).

You can also maintain processing guidelines for investment products that you offer to investors. You can maintain products with different attributes, to attract specific investors. The attributes could be funding, retirement features, premium and annuity features, loans, withdrawals and so on.

You can also maintain the NAV and the transaction base prices for each fund, for each transaction type, for each business day.

- Maintain Reference Information

- Set up Loads

- Maintain Currencies and Capturing Exchange Rates

- Other Maintenance Functions in the Maintenance Module

- Set up Funds

Refer the following topics in Fund Manager User Manual for a full discussion of all maintenance functions in Fund Manager.

Hedge funds are special type of investment funds that use leveraging and other investment strategies to hedge the exposure of a portfolio against the movements in the equity market. They can take both short and long positions, use arbitrage, trade options and bonds and invest in any opportunity where they can make impressive gains at reduced risk.

- Simple A simple hedge fund is a regular fund with normal processing rules. These funds usually have monthly dealing frequency and valuation points. Performance fee is generally accrued on monthly basis and paid out on yearly basis.

- Master-Feeder A master-feeder fund structure is set up to accept assets from both foreign and domestic investors in the most tax and trading efficient manner possible. A traditional setup consists of a master fund company into which different feeder funds invest. The transactions of feeder funds will be fed into master fund either on net or non-netted basis.

- Fund of Funds A fund of hedge fund invests in hedge funds rather than investing in individual securities. Performance fee will be collected at two levels; one for the underlying hedge funds and the other for the fund of funds. Net asset value also is calculated separately for the underlying funds and the fund of funds. The details related to the minimum and maximum number of investors investing is maintained in case of fund of funds. For fund of funds, the investors usually need to give a notice period which signifies the number of days in advance that the investor must notify the fund in order to receive the payment.

- Side Pockets A side pocket is a special type of account used in hedge funds to separate illiquid assets from other more liquid investments. Once an investment enters a side pocket account, only the present participants in the hedge fund will be entitled to a share of it. Future investors will not receive a share of the proceeds in the event the asset's returns get realized. Investors who leave the hedge fund will still receive a share of the side pocket's value when it gets realized. Investments that get locked into a side pocket cannot be redeemed until a realization event happens and the side-pocket gets converted back into a tradable series. The dealing and valuation frequencies and the net asset value of the side pockets will be different from that of the main fund.

- Maintain Reference Information

- Set up Fund Rules

- Other Fund Activities

- Fund Rule Upload Formats

Authorization Functions in Fund Manager

Each of the reference data and fund-related maintenances must be authorized within the system for them to be effective in processing.

The creation of new investor accounts (known as unit holder accounts), with all the investor preferences, and the entry of any transactions in the account are all functions that are managed in the Agency Branch. However, any changes made to authorized accounts or authorized transactions will require the scrutiny and approval of the fund manager, and can only be authorized through the Fund Manager component.

You can also authorize any interface defined with an external system as well as any defined job (associated with the Scheduler Services).

Interfaces to External Systems

The Oracle FLEXCUBE Investor Servicing provides the facility to define and process interfaces to external systems for the purpose of effecting data transfers and information exchanges. For instance, the NAV for a fund may be imported from an external Asset Management system by processing an internally defined interface.

You can define and execute these interfaces through Fund Manager.

Scheduler Services

The Oracle FLEXCUBE Investor Servicing system provides a facility that you can use to schedule any internal activities that need to be executed either on a periodic basis, or event-based frequency. When you schedule these activities, they will be executed by the Scheduler Services as preprogrammed proceedings according to the frequency defined for them.

Security and Control

The Fund Manager system provides application level security features that will prevent unauthorized users from accessing the system.

Refer the Ensuring Security topic in this User Manual for a detailed discussion of the Security Management System of Oracle FLEXCUBE Investor Servicing.

- Fund Administrator

- Supervisor

- Operator

The Fund Administrator is responsible for maintenance of reference information and the fund related information.

The Supervisor is responsible for any authorization activities carried out in Fund Manager.

The Operator is responsible for carrying out the End of Day activities.

Reports

The Fund Manager component allows you to view and print various kinds of reports either on a daily basis or at periodic intervals. E.g., If you want to print the transfer transactions that have taken place, you can print the Transfer Summary Report, which shows all the Transfer transactions received for a given date on which units have been allotted.

- Performance Across All Funds (Amount)

- Performance Across All Funds (Units)

- Unit Holder Register

- Transaction Load Listings

- Check Printing

- Payment Summary

- Letter Of Intents

- Login Tracking Report

- Unit Holder Transaction

- Unit Holder Transaction Fee

- Rejected Transactions Report

- Maturity Date Report

- Account Transfer Payments

- Exchange Rate Override Report

- Bulk Account Client Related Reports

- Fund Bank Account Transfer Report

Refer the topic Reports in Reports User Manual for a full discussion of these reports.

End of Day Processes

- Allocation of transactions of any transaction type

- EOD Maintenance

- Execute Pre-EOD

- Execute EOD

- Execute Mini EOD

- Execute BOD

- Branch Sign-on/Sign-off

- EOD Log Report

- Sending / Receiving Messages

You can also execute and process any authorized interface that has been defined with an external system, through the Online Execution of Interfaces option.

For a full discussion of the End of Day Operations Module refer the topic End of Day Activities in this User Manual.

Other Functions

In Fund Manager, the implementers maintain the system default information that will be used in processing, that is specific to your installation. You can make changes to this information subsequently, if necessary, through the Defaults Maintenance function in Fund Manager.

The Fund Manager provides a query facility that allows you to extract business information from the system database by constructing simple query statements, called the Query Builder.

The words

Screen and Form(noun) are used interchangeably

throughout the entire document. They refer to the active interface presented to the

user for the purpose of data entry operations throughout the system.

- Yes - If the user checks a checkbox, a cross-mark or a

tick-mark appears in the box, indicating to the system that the value

specified is a

Yes. - No - If the box is not checked, and is empty, the value

indicated to the system is a

No.

For example, if the Online Allocation checkbox has a cross mark or a tick-mark in it, it indicates to the system that online allocation is to be allowed. If the box is empty, it indicates to the system that on-line allocation is not to be allowed.

The user is advised to check all dates that user has specified in any of the forms before executing a Save operation.

Before You Login

- The user profile has to be defined by the system administrator for all the users of the back office.

- The Defaults required for Fund Manager, namely the default language; currency and so on must already have been defined.

Log in to Fund Manager

Invoke Fund Manager

When the Fund Manager component is installed on the workstation, you can access it through the supported browser. You must specify the URL of the installation in the Address box in the supported browser Address Bar.

For instance, if the URL of the installation is //install/fundmanager/flexsms/emg, you must key in this URL in the Address Bar of the supported browser.

You can configure the supported browser to invoke the URL of the Fund Manager installation by default.

The Login Screen

When Fund Manager is successfully invoked in the manner described above, the Login screen is displayed. In the Login screen, specify your User ID and Password to log in to the system.

If you are logging in for the first time, specify the Password allotted to you by the System Administrator. After you have logged in for the first time, the system forces you to change your password. Whenever you log in subsequently, you must use this password.

Fund Manager - Menu

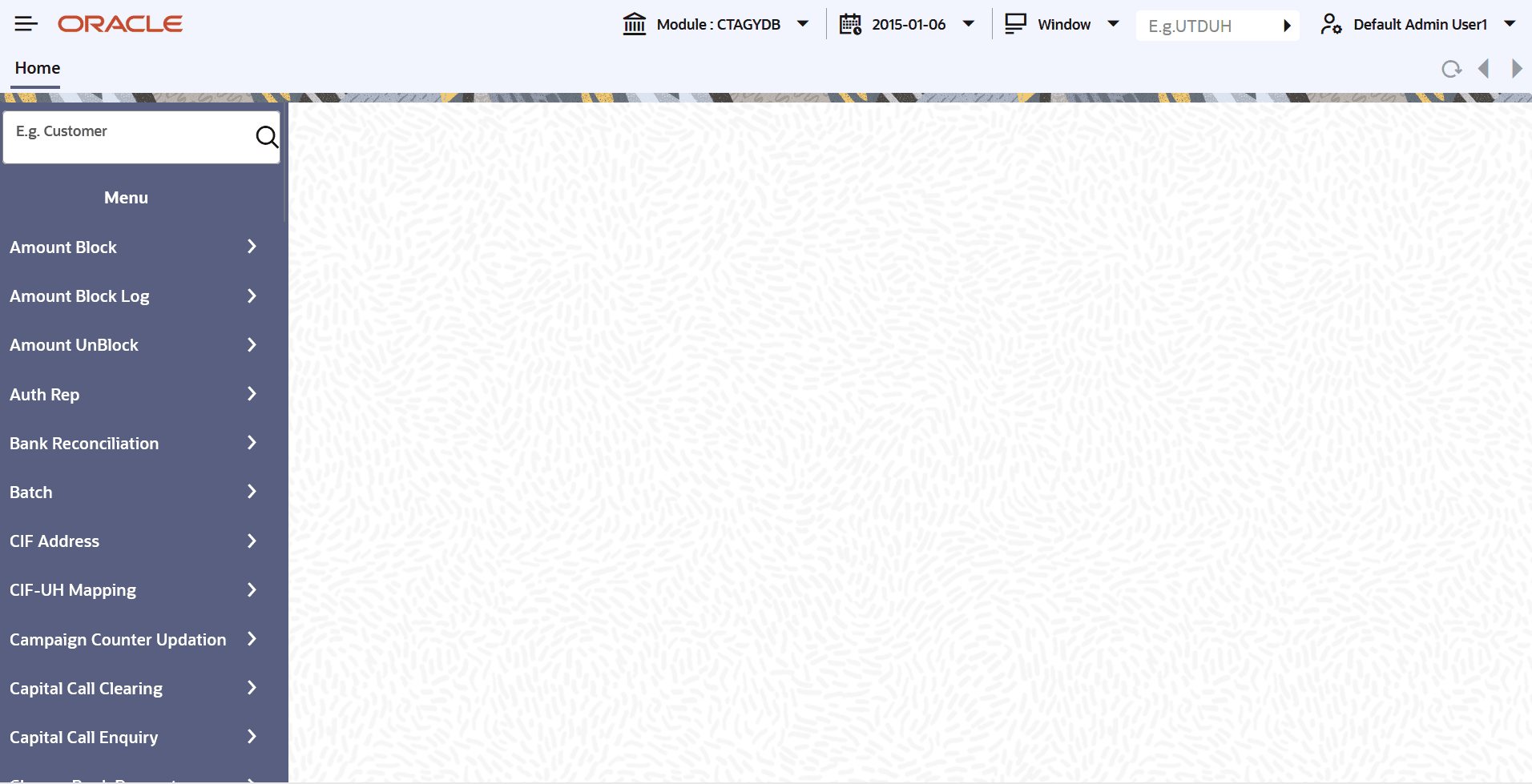

When you successfully log in to the system, the Fund Manager Main Menu screen is displayed and the various options are enabled or disabled based on the rights given to you in your user profile.

You must choose the module of your Fund Manager AMC installation in which you are going to operate in, in the AMC Branch field. When you choose the module, the menu that is accessible to you, according to the definitions made in your user profile, are displayed.

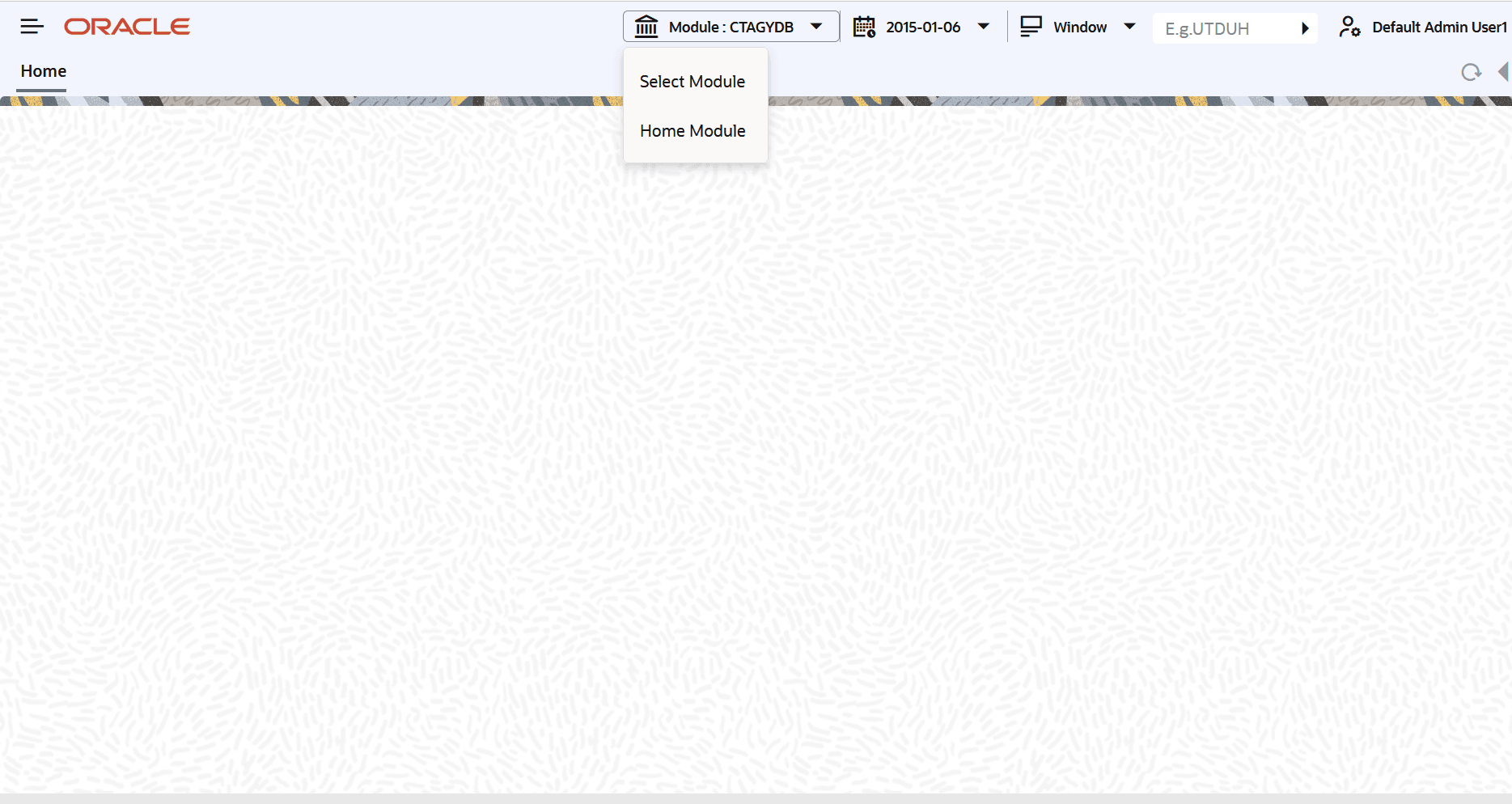

To log in to a different AMC Fund Manager module, click Module button, and choose the relevant branch in the AMC Branch field.

Figure 1-4 Module Option

Figure 1-5 Menu

You can choose any of the options from the lists.

In each screen, you will only be allowed to perform those operations that are allowed in your user profile.

If you do not perform any activity for more than ten minutes, the system will automatically log you out, after displaying a message.

Parent topic: Overview