1.5 Agency Branch

This topic provides information on Agency Branch.

(Required) Enter introductory text here, including the definition and purpose of the concept.

Details on Agency Branch

The Agency Branch is the entity that actually interacts with the investors or unit holders in an AMC scenario.

- The servicing and maintenance of unit holder accounts and daily unit holder operations.

- The servicing and maintenance of brokers.

- The entry, maintenance and processing of transactions.

- The setting up of standing instructions for unit holders.

- The maintenance of the clearing status of payment instruments used in transaction processing.

- Other functions that include maintenance of deals for unit holders, income distribution options, letters of intent, non-tax limits, and so on.

- Maintenance of static data such as system parameters, defaults for the agency branch or the AMC, additional information heads for unit holders, fee categories for unit holders, and mapping of information heads for entities.

Servicing Investors

- Creating and maintaining new unit holder accounts.

- Setting up deals, standing instructions, letters of intent options, income distribution options and non-tax limits for unit holder accounts.

- Making changes to the information in authorized unit holder accounts.

- Closing unit holder accounts.

- Capturing details of authorized representatives for unit holders.

For a fuller understanding of how unit holder servicing is facilitated in the system, refer topic Managing Investor Accounts.

Entry, Maintenance and Processing of Transactions

Applications for any transactions that the investors want to enter into using their accounts in the AMC are accepted and processed in the Agency Branch. The transactions are entered into the system, and they can be tracked at all stages in the processing cycle.

- IPO subscription transactions

- Subscription transactions

- Redemption transactions

- Switch transactions involving switching of units from one fund to another for a unit holder.

- Transfer transactions involving transferring of units from one unit holder to another within a fund.

- Blocking of units (lien processing)

- Unblocking of units (lifting of lien)

- Consolidation of units

- Splitting of units

- Reissue of units

- Enrichment of payment details for a transaction

For a fuller understanding of how the entry and processing of transactions is facilitated in the system, refer topic Processing Transactions.

Setting up Standing Instructions for Unit Holders

Any Regular Savings/ Withdrawal Plans that an investor desires to issue standing instructions for can be set up and maintained in the Agency Branch.

The system provides for the maintenance of standing instructions for a unit holder.

For a fuller understanding of how the entry and processing of standing instructions transactions is facilitated in the system, refer topic Maintaining Standing Instructions.

Clearing of Payment Instruments

The clearing status of payment instruments used for transactions and standing instructions can be updated at the Agency Branch.

For a complete understanding of how the clearing of payment instruments is facilitated in the system, refer topic Data Entry.

The system provides an option to print the acknowledgment/confirmation slips on-line. They can be printed again, if required, for investor related operations.

Unit Holder Account Servicing Operations

The investor fills out an account opening application and hands it over to the agent along with supporting documents. The Account Administrator crosschecks the application and the supporting documents and enters the details into the system. The system prints an acknowledgment slip on saving the new account. After the new account is authorized, the unit holder number for the account is generated.

The request for opening an account could be made by any means, through telephone, fax, etc.

The unit holder fills out an account closure application along with the redemption slips to redeem the units held in various funds and hands them over to the agent. The agent checks the details and enters them into the system. The system marks the account as pending closure.

If the number of units in all the funds for a unit holder becomes zero, then the system closes the corresponding unit holder account automatically. An account once closed can be re-opened.

The unit holder fills out a change request application and hands it over to the Agent. The agent checks the details and inputs it into the system. The agent will then hand over the acknowledgment slip to the unit holder.

Transactions Operations

If the transaction request is being made directly over the counter, the unit holder fills out a transaction application and hands it over to the teller. Alternatively, the transaction requests can be made by any means, such as by telephone, through fax, and so on. The unit holder can pay by cash, transfer, check, credit card or demand draft. The teller checks the completeness of the form and inputs the transaction details into the system. If a fee is to be collected from the unit holder at the time of accepting the application form, the system prompts for this.

The system validates the details that were entered against the fund rules. The fund manager allocates the IPO subscription/ subscription based on the NAV declared for the fund for that day. After the allocation, the agency branch can print the confirmation/ rejection note.

If the fund is scrip-based, the certificate-related information is also captured either from the fund or the unit holder based on the fund rule definition.

The fund manager allocates the redemption based on the NAV or any other formula that is computed for the fund for that day or the last fund price declaration day. If the redemption allocation is partial on a given date, the unit holder will receive multiple confirmation notes for the transaction. After the allocation, the agency branch can print the confirmation / rejection note. The check or the draft as specified by the unit holder that is equal to the redemption consideration handed over.

If the fund is scrip-based, the certificate-related information, including the denominations, is also captured either from the fund or the unit holder based on the fund rule definition.

Wherever certificates are to be surrendered to the AMC, the certificate numbers are captured and validated against the certificate information defined in the system.

The system validates the details that were entered against the fund rules for switch transaction. The fund manager allocates the switch based on the NAV declared for the fund or based on any other formula for that day or the last day of declaration of price. If the switch allocation is partial on a given date, the unit holder will receive multiple confirmation notes for the same transaction. The other activities are same as those that are followed in a normal transaction, as for any of the transaction types.

If the fund is scrip-based, the certificate - related information, including the denominations, is also captured either from the fund or the unit holder, based on the fund rule definition. Wherever certificates are to be surrendered to the AMC, the certificate numbers are captured and validated against the certificate information defined in the system.

The system validates the details that were entered, against the fund rules and issues an acknowledgment slip to the unit holder for a transfer transaction. The fund manager allocates the transfer based on the NAV declared for the fund for that day or any other transfer price. After the allocation, the agency branch can print the confirmation/ rejection note. The allocation information is then used to update the transferee and transferor.

If the fund is scrip-based, the certificate related information is also captured either from the fund or the unit holder based on the fund rule definition.

The system validates the details that were entered, against the fund rules and issues an acknowledgment slip to the unit holder for a block transaction. The fund manager allocates the block based on the NAV declared for the fund for that day or on any special block prices that could be derived through any specific formula. All the other activities are the same as those followed for any of the transaction types. The scrip-based funds are also handled in the same manner as for the other transaction types.

The system validates the details entered, against the fund rules and issues an acknowledgment slip to the unit holder for the unblock transactions. The fund manager allocates the unblock transaction based on the NAV declared for the fund or any special unblock price for that day. All the other activities are the same as those followed for any of the transaction types.

The system validates the details entered, against the scrip-based fund rules and issues an acknowledgment slip to the unit holder for the consolidation transaction. The fund manager allocates the consolidation based on the NAV declared for the scrip-based fund for that day or any other formula based price. After the allocation, the agency branch can print the confirmation / rejection note. The certificate related information is also captured either from the fund or the unit holder based on the fund rule definition. In the system, consolidation transactions are supported only for scrip- based funds.

The system validates the details entered, against the scrip-based fund rules and issues an acknowledgment slip to the unit holder for the reissue transaction. The fund manager allocates the reissue based on the NAV declared for the scrip-based fund for that day. After the allocation, the agency branch can print the confirmation/ rejection note. The certificate related information is also captured either from the fund or the unit holder based on the fund rule definition. In the system, reissue transactions are supported only for scrip-based funds.

Security and Control

The Oracle FLEXCUBE Investor Servicing system provides application level security features that will prevent unauthorized users from accessing the system.

For a detailed discussion of the Security Management System of Oracle FLEXCUBE Investor Servicing, refer Ensuring Security.

- Teller – This role is responsible for accepting the transaction requests from investors. The teller will check all the application forms and enter the transactions in the system.

- Supervisor – This role is responsible for authorizing the transactions entered by the teller group.

- Accounts Officer – This role is responsible for opening, maintaining and closing unit holder Accounts.

Conventions to be followed in Screens

The words Screen and Form(noun) are used interchangeably throughout the entire document. They refer to the active interface presented to the user for the purpose of data entry operations throughout the system.

Yes or No.

- If the user checks a checkbox, a cross-mark or a tick-mark appears in the box, indicating to the system that the value specified is a

Yes. - If the box is not checked, and is empty, the value indicated to the system is a

No.

For example, if the Online Allocation checkbox has a cross mark or a tick-mark in it, it indicates to the system that online allocation is to be allowed. If the box is empty, it indicates to the system that online allocation is not to be allowed.

The user is advised to check all dates that he has specified in any of the forms before executing a Save operation.

Before You Log in

- The user profile has to be defined by the System Administrator for all the users of the branch.

- The Defaults required for the branch namely the default language; currency and so on must already have been defined.

Log in to Agency Branch

When the Agency Branch component is installed on the workstation, you can access it through the browser.

In the Login screen, specify your User ID and Password to log in to the system.

If you log in for the first time, specify the Password allotted to you by the System Administrator. After you have logged in for the first time, the system forces you to change your Password. Whenever you log in subsequently, you must use this Password.

Agency Branch - Menu

When you successfully log into the system, the Agency Branch Main Menu screen is displayed and the various options are enabled or disabled based on the rights given to you in your user profile.

You must choose the branch of the AMC that you are going to operate in, in the AMC Branch field. When you choose the AMC branch, the menu that is accessible to you, according to the definitions made in your user profile, are displayed.

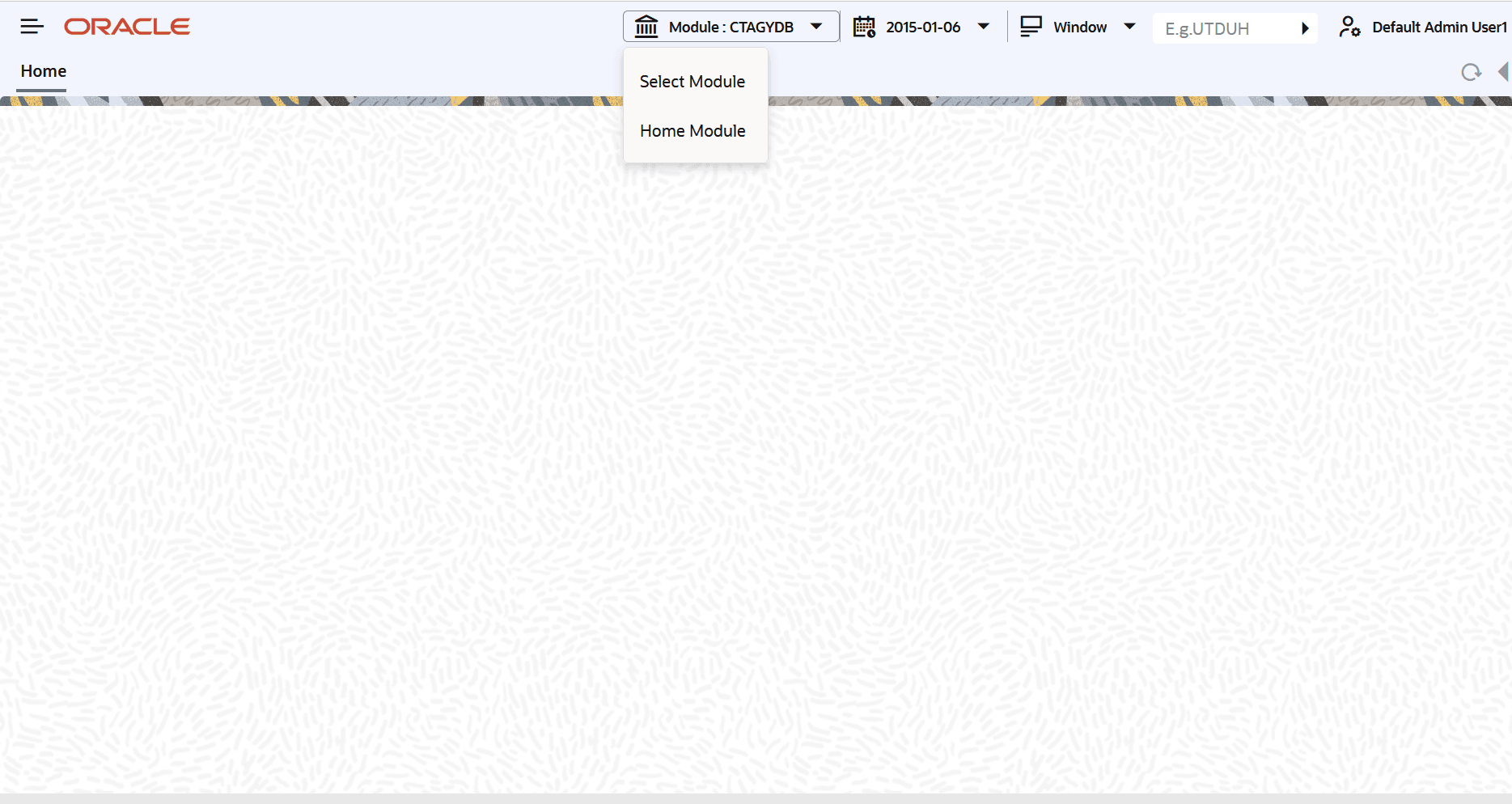

To log in to a different branch, click Module button, and choose the relevant branch in the AMC Branch field.

Figure 1-6 Module Option

You can specify the operations from the main menu items in your user profile. If you do not perform any activity for more than the time maintained as the session timeout, the system will automatically log you out, after displaying a message.

Parent topic: Overview