3.16 Process Dividend Components Detail

This topic provides the systematic instructions to maintain dividend component details.

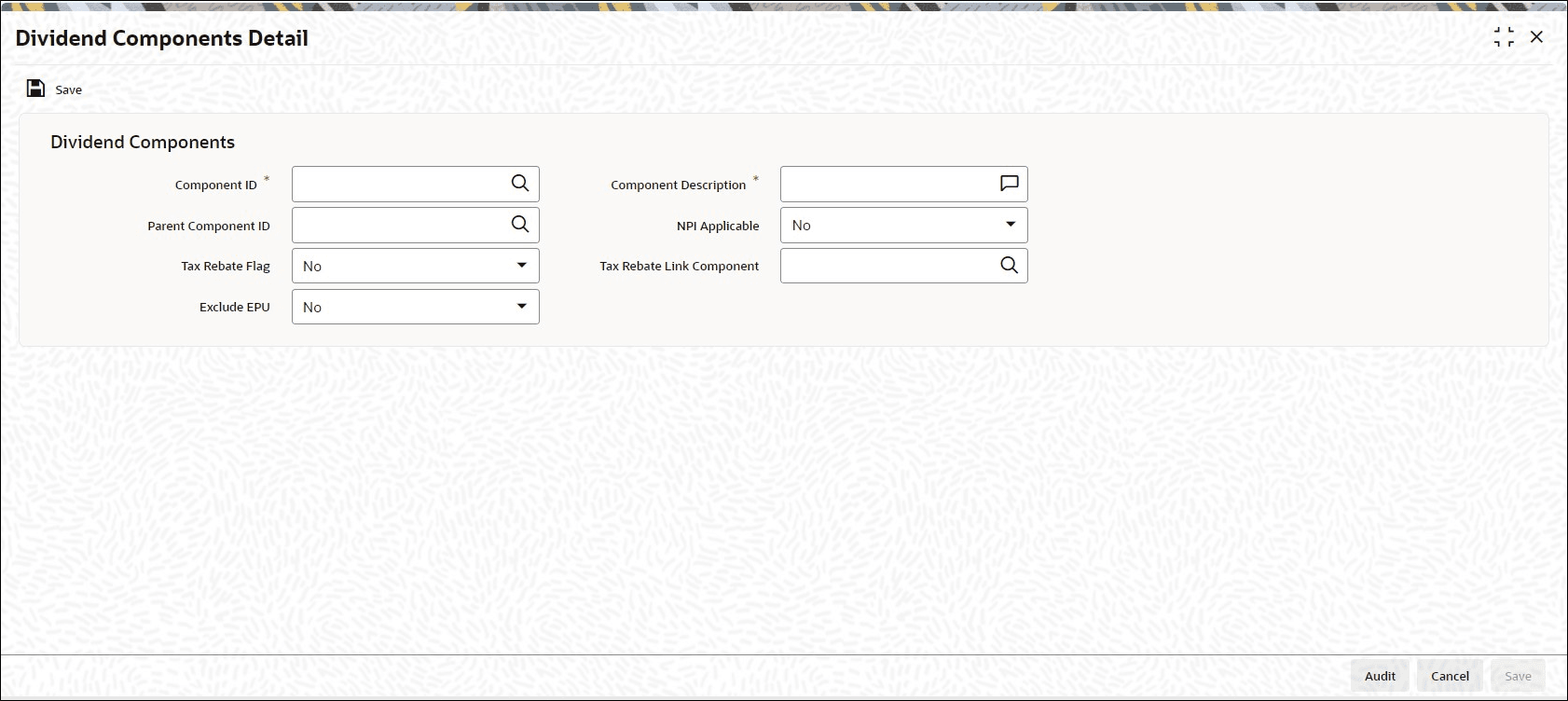

- On Home screen, type UTDDVCOM in the text box, and click Next.The Dividend Components Detail screen is displayed.

- On Dividend Components Detail screen, click New to enter the details.For more information on fields, refer to the field description table.

Table 3-14 Dividend Components Detail - Field Description

Field Description Component ID Alphanumeric; 2 Characters; Mandatory Enter a unique identifier for the dividend component that is to be classified as Non permissible income.

Component Description Display Enter a description of the component.

Parent Component ID Alphanumeric; 2 Characters; Mandatory if the component is NPI Applicable If the component has been classified as NPI Applicable then specify the parent dividend component. The parent component specified here will be used for reporting purposes. The option list contains the valid dividend component Ids maintained in the system.

NPI Applicable Optional Select

Yesfrom drop-down list to indicate that income from this component is non permissible.Tax Rebate Flag Optional Select if tax to be deducted at source or not from the list. The list displays the following values:- Yes

- No

Tax Rebate Link Component Alphanumeric; 2 Characters; Optional Specify the tax deducted at source link component to be linked.

Exclude EPU Optional Select if EPU component should be marked for exclusion of Tax or not from the adjoining drop-down list. Following are the options available:- Yes

- No

The dividend tax process will check the dividend component ID’s marked as Tax rebate and the link component. The system will calculate the dividend withholding tax amount. If the tax difference amount is greater than zero then new WHT amount will be same as of Tax Difference Amount; Otherwise New WH Tax Amount will be zero.

Processing Fund Dividend WHT

- You can mark the component defined as Tax rebate component or as a link component. The component can also be marked to define if the Tax has to be excluded or included.

The dividend tax process will check if the dividend component ID’s marked as Tax rebate and the link component and calculate the dividend withholding tax amount.

If the tax difference amount is greater than zero then new WHT amount will be same as of Tax Difference Amount; Otherwise New WH Tax Amount will be zero.

- For all other taxable dividend components (meaning taxable component id which are not maintained as Tax Rebate), the system will calculate the dividend withholding tax as per the regular method / calculation. This is applicable for both UT and LEP business.

- If Exclude EPU is maintained as

Yes, then during fund dividend processing (fund dividend screen), the system will not add up to derive the EPU else there will be no change in processing the dividend.

Parent topic: Maintain System Parameters