2.26 Process UH Dividend Component Override Detail

This topic provides the systematic instructions to override the tax rate for an UH dividend component combination.

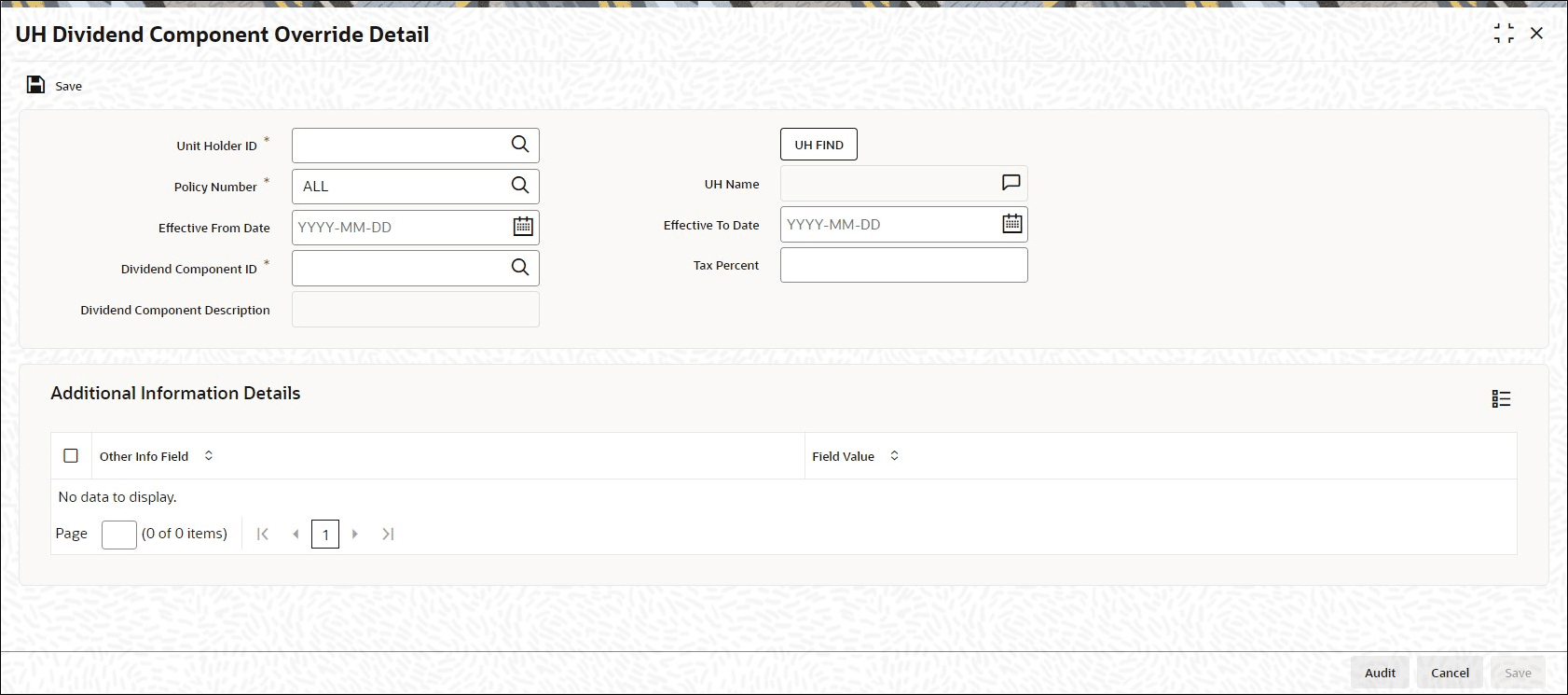

- On Home screen, type UTDDCTRO in the text box, and click Next.The UH Dividend Component Override Detail screen is displayed.

Figure 2-37 UH Dividend Component Override Detail

- On UH Dividend Component Override Detail screen, click New to enter the details.For more information on fields, refer to the field description table.

Table 2-27 UH Dividend Component Override Detail - Field Description

Field Description Unit Holder ID Alphanumeric; 12 Characters; Optional

Specify the unit holder for which the new tax rate has to be defined.

You can also query unit holder ID by clicking UH FIND button.

Unit Holder Name Display

The system displays the unit holder name for the selected unit holder ID.

Policy Number Alphanumeric; 16 Characters; Mandatory Specify the policy number for which the new tax rates to be applied. By default ALL will be selected.- If the policy number field value is maintained as

ALL(system default value), then the new tax defined for a Unit holder and component combination with the new dates and rates will be applicable across LEP and UT. - If the default value in the policy field is maintained as

UT, then the override maintained will be applicable for the UH and component only (applicable for UT alone). - If you specify the policy number then the new tax defined for a Unit holder and component combination with the new dates and rates will be applicable for the specified policy number alone and will not be applicable for any other fund where the component ID is mapped for a dividend process

Effective From Date Date Format; Mandatory Specify effective from date for the tax rate to be applicable.

Effective To Date Date Format; Mandatory Specify effective to date for the tax rate to be applicable.

Dividend Component ID Alphanumeric; 2 Characters; Mandatory Specify dividend component ID for which the new tax rate has to be defined.

Dividend Component Description Display The system displays the description for the selected dividend component ID.

Tax Percent Numeric; 5 Characters; Mandatory Specify the tax percent for the slab being defined.

The system will check if there is new tax rate for the UH-component combination and withhold the tax as per the new effective date and rate maintained.

Note: The new tax defined for a Unit holder and component combination with the new dates and rates will be applicable across UT and LEP wherever the component is mapped for the UH.

Additional Information Details The section displays the following fields. Other Info Field Display The system displays the other information.

Field Value Display The system displays the field value.

The system will allow 30 add info details along with other operations.

For instance, at the Entity Additional Information Mapping (UTDENMAP) the entity type will be

5and description will be Override WHT. - If the policy number field value is maintained as

Processing UH Dividend Component Override

- The system will check if there is new tax rate for the UH-component combination and withhold the tax as per the new effective date and rate maintained. This maintenance is applicable only during WHT processing.The new tax defined for a Unit holder and component combination with the new dates and rates will be applicable across UT and LEP wherever the component is mapped for the UH.

- If the policy number field value is maintained as

ALL(system default value), then the new tax defined for a Unit holder and component combination with the new dates and rates will be applicable across LEP and UT. - If the default value in the policy field is maintained as

UT, then the override maintained will be applicable for the UH and component only (applicable for UT alone). - If you specify the policy number, then the new tax defined for a Unit holder and component combination with the new dates and rates will be applicable for the specified policy number alone and will not be applicable for any other fund where the component ID is mapped for a dividend process.

- This maintenance will have additional information tab where the user can maintain the required additional defined values.

- The system will not allow you to maintain a duplicate record for UH-Component and date combination. If new tax rate to be maintained (override the existing override tax rate), then you should amend the record and maintain new tax rate.

- If any change to the Tax rate, the maintenance has to be closed and a new maintenance with new tax rate and date should to be maintained.

Parent topic: Maintain Reference Information