2.4.1 Basic Information Tab

This topic explains the basic information tab of Single Entity Maintenance Detail.

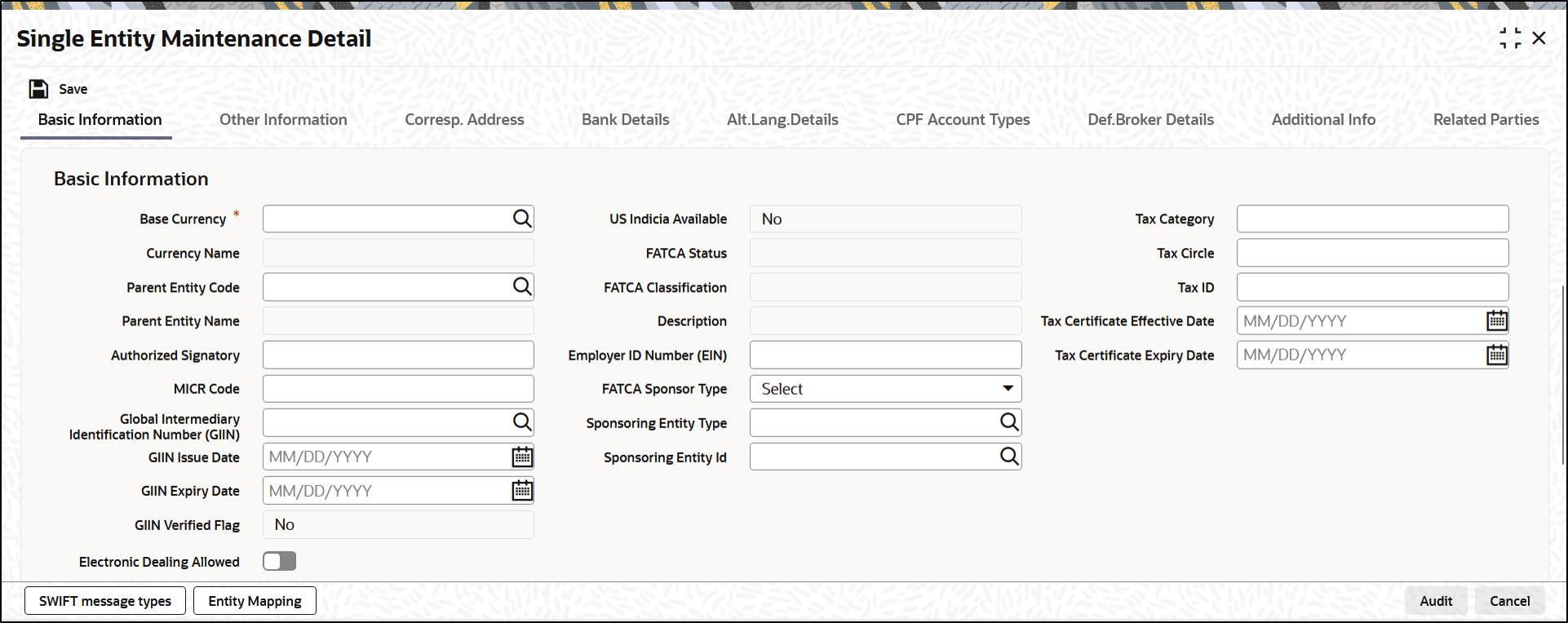

- On Single Entity Maintenance Detail screen, click Basic Information tab to enter the details.The Basic Information details are displayed.

Figure 2-4 Single Entity Maintenance Detail_Basic Information Tab

- On Basic Information Tab, specify the fields.For more information on fields, refer to the field description table.

Table 2-3 Basic Information - Field Description

Field Description Base Currency Alphanumeric; 3 Characters; Mandatory

Select the base currency of the entity, from the drop down list. This is the currency in which the entity normally transacts.

Currency Name Display

The system displays the name of the currency for the selected base currency.

Parent Entity Code Alphanumeric; 12 Characters; Optional

Specify the parent entity code. The adjoining option list displays all valid parent entity code maintained in the system. You can choose the appropriate one.

This is applicable only for specific entity types.

Parent Entity Name Display

The system displays the name for the selected parent entity code.

Authorized Signatory Alphanumeric; 70 Characters; Optional

Enter the name of the Authorized Signatory at the office of the AMC.

MICR Code Alphanumeric; 12 Characters; Optional

Specify MICR code of the specified Bank here. This code is applicable for both Bank and Bank Branch entity.

Global Intermediary Identification Number (GIIN) Alphanumeric; 30 Characters; Optional

You can select or specify the GIIN from the adjoining option list.

GIIN Issue Date Date Format; Optional

Specify the GIIN issue date.

Note: The GIIN issue date cannot be greater than the application date.

GIIN Expiry Date Date Format; Optional

Specify the GIIN expiry date.

Note: The GIIN expiry date cannot be lesser than the GIIN issue date.

GIIN Verified Flag Display

System displays the GIIN verified flag based on the GIIN.

If you specify the GIIN then, GIIN verified flag gets displayed as No.

If you select the GIIN then, GIIN verified Flag gets displayed as Yes.

Electronic Dealing Allowed Optional Check this box to enable specific AMC / Legal Entity for electronic dealing trades.

This field will be available for the entity types AMC / Legal Entity.

Default Agency Branch Optional

Check this box to default the agency branch code.

US Indicia Available Display The system defaults US Indicia Available as Yes or No depending on the following:- The nationality is US

- The country of birth is US

- The country of domicile is US

- The country of incorporation is US

- The country of correspondence or alternate address is US

- The country code of the telephone number is 01

- The country code of the bank branch address is US

FATCA Status Display

The system displays the FATCA Status based on the FATCA maintenance.

FATCA Classification Display The system displays the FATCA classification type.

Description Display

The system displays the description for the selected FATCA classification.

Employer ID Number Alphanumeric; 50 Characters; Optional Specify the employer ID number.

FATCA Sponsor Type Optional Select the FATCA sponsor type from the adjoining drop-down list. The values are:- Sponsoring Entity

- Sponsored

If you select Sponsoring Entity, you need to specify the sponsoring entity type and sponsoring entity ID.

If you select Sponsored, you need not to specify the sponsoring entity type and sponsoring entity ID.

Sponsoring Entity Type Alphanumeric; 1 Character; Optional Specify the sponsoring entity type. You can also select the valid entity type from the adjoining option list.

Sponsoring Entity ID Alphanumeric; 12 Characters; Optional Specify the sponsoring entity for the FATCA entity type. You can also select the valid entity ID from the adjoining option list.

Tax Category Alphanumeric; 12 Characters; Optional Specify the tax category.

Tax Circle Alphanumeric; 15 Characters; Optional Specify the tax circle country details.

Tax ID Alphanumeric; 50 Characters; Optional Specify the tax identification.

Tax Certificate Effective Date Date Format; Optional Specify the date from which the tax certificate is effective.

Tax Certificate Expiry Date Date Format; Optional Specify the expiry date of the tax certificate.

Week Check the appropriate box to indicate the day in a week. The options are as follows:- Sunday

- Monday

- Tuesday

- Wednesday

- Thursday

- Friday

- Saturday

Parent topic: Process Single Entity Maintenance Detail