3.2 Process Flow

This topic describes the information about the entire process flow for the Decision service.

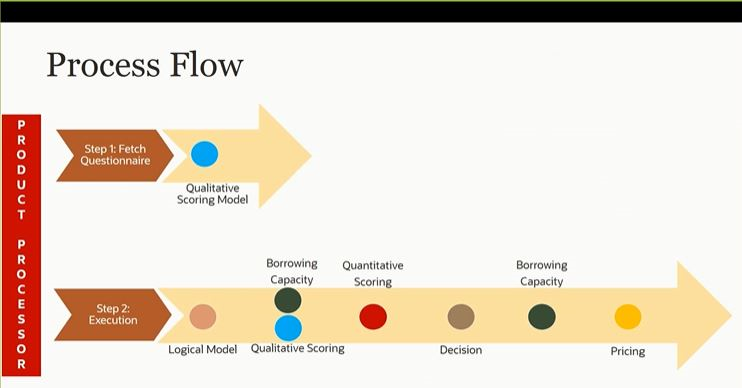

Figure 3-2 Decision Service - Process Flow

Questionnaire

The first step is to get the questionnaire. The product processor sends the data of all the applicants in the application. A qualitative scoring model is resolved for each applicant and this information along with the details of the questionnaire is sent back to the product processor. The product processor captures the response to the questions and sends back as part of the second step which is the execution of the credit decision.

Validation Model

First step in execution of the credit decision is validation screening. In this application prescreening is done to check the basic eligibility of the application as per the bank’s policy. For example, if the bank’s policy is not to fund to property in flood prone area, then as a part of this step, if the property is in flood prone area then the application will be rejected and the application will not be processed further. Or the applicant’s minimum age should be more then 18 and the applicant applying is of less than 18, in that case the application is rejected, and it will not be processed further.

Borrowing Capacity

Once eligibility is checked, the next step is borrowing capacity. This is the maximum loan amount the applicant is eligible for. The stage at which it is to be calculated depends on the configuration made. It can be calculated before the scoring after the decision. The loan amount considered for decision is minimum of requested loan amount or the amount calculated for scoring, decision and pricing.

Qualitative Score

After borrowing capacity, the next step is qualitative scoring done using the feedback from the applicants for questionnaire.

Quantitative Score

After qualitative scoring next step is quantitative scoring where scoring is done using application and bureau attributes such as salary, number of credit lines, bureau score, etc.

Decision and Grade

The decision on the application is done based on the quantitative and qualitative scores. The decision can be approve, manual or decline.

The borrowing capacity can also be calculated after the decision, in this case, the amount calculated will be used only for pricing.

Pricing

The last step is to determine the recommended interest rate. This is a risk-based price that refers to offering different interest rates to different customers depending on their risk exposure.

Parent topic: Decision Service