1.1.3 KYC Check

KYC check for the retail customer is populated based on the product selected by that customer. The banks can directly perform the KYC check by themselves or reach external agencies for the KYC Information.

For successful retail onboarding, the customer must be compliant with all the necessary KYC checks.

Note:

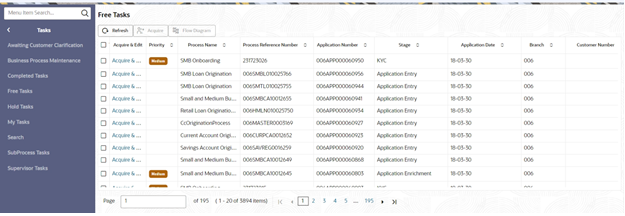

The fields marked as Required are mandatory.- To acquire and edit the KYC task, click Tasks. Under

Tasks, click Free Task.

The system displays the Free Tasks screen.

- Click Acquire and Edit in the Free

Tasks screen for the application for which KYC

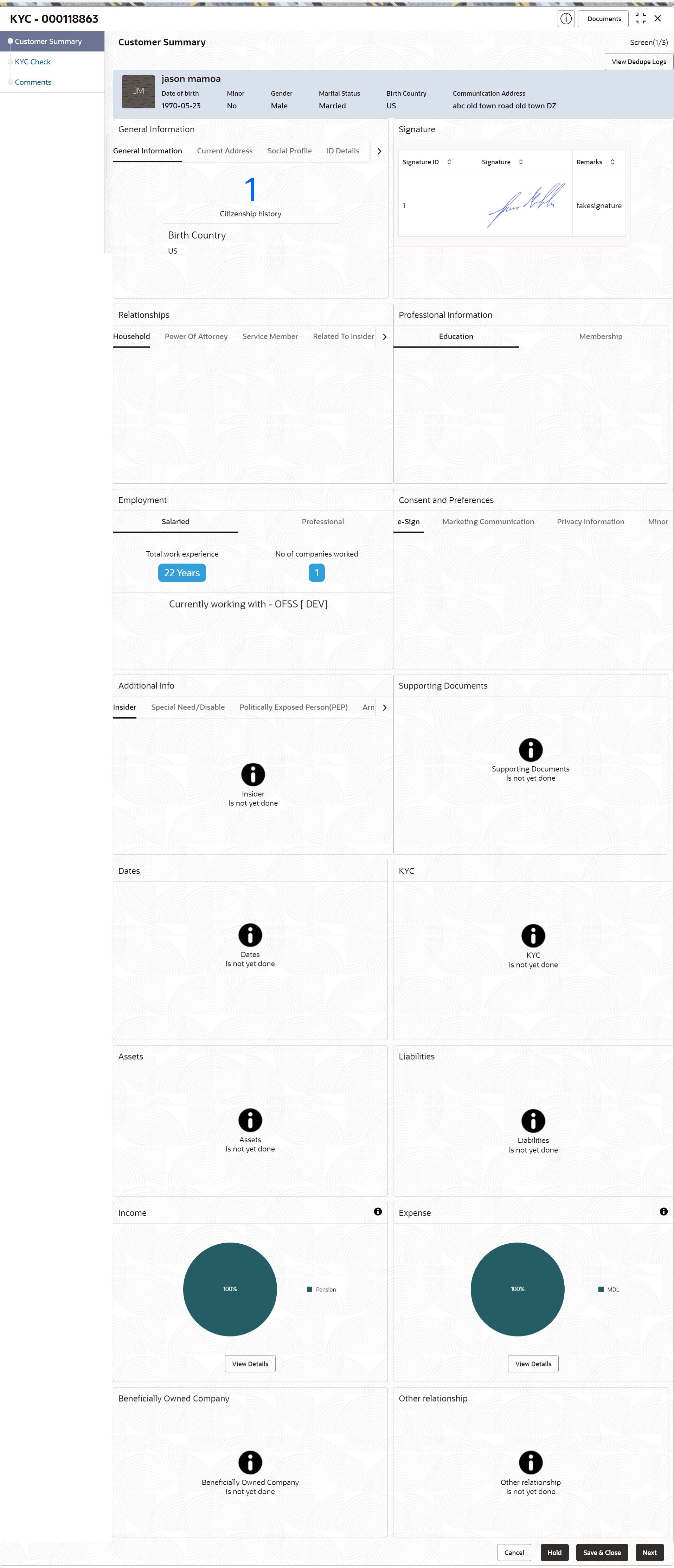

Check stage has to be acted upon.The Customer Summary screen displays.

- On the Customer Summary screen, verify the details that

are displayed in tiles.For more information on fields, refer to the field description table.

Table 1-54 Customer Summary - Tile Description

Tile Description General Information In this tile, the following details are displayed: - Citizenship

- Address

- Social Profile

Professional Information In this tile, the following details are displayed: - Education

- Membership

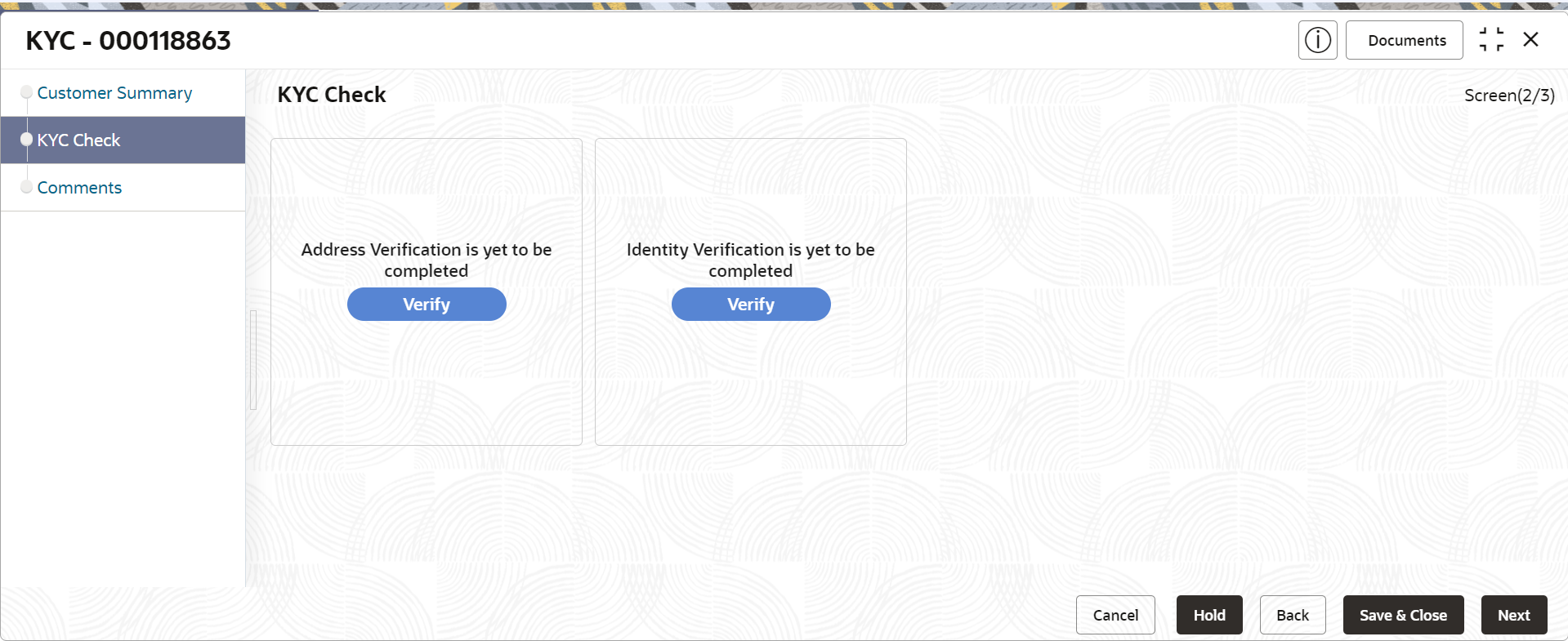

Employment Displays the employment details of the customer. Dependent Displays the dependent details of the customer. Dates Displays the details of the dates. KYC Displays the KYC details. Assets Displays the assets details. Liabilities Displays the liabilities details. Income Displays the income details. Expense Displays the expense details. View details In the corresponding tile, click this icon to view the detailed information. - Click Next.The KYC Check screen displays.OBPY support 13 different KYC check as follows

- Address Check

- Identity Check

- Police DB Check

- Credit Score Check

- Education Qualification

- Field Verification

- Reference Check

- Suit Filed

- PEP Identification

- AML Check

- FATCH Check

- SDN Check

- Sanction Check

KYC Checks are listed during KYC stage, based on the Mandatory and Optional KYC check configuration except PEP Identification. PEP Identification check is displayed, if customer is determined as Politically Exposed Person (PEP) during Enrichment Stage → Additional Info.

For more information about Mandatory and Optional KYC check configuration, refer to the Party Onboarding Configuration User Guide.

- Verify all the KYC Checks listed.

Table 1-55 Address Check - Field Description

Field Description Name as in the document Name as per documents provided for KYC check of the party. ID Number ID number of a document uploaded for a party. DOB as on Document Date of birth as per KYC check of the party. Address as in Document Address as per the document provided during KYC Check process. Reference number Any related reference number for the KYC check of the party. Verification Type Select the verification type of the KYC check for the party from the drop-down list. The available options are: - Internal

- External

Note:

List of values can be configured through Entity Maintenance.Verification Medium Select the verification medium of the KYC check for the party from the drop-down list. The available options are: - Manual

- Online

Note:

List of values can be configured through Entity Maintenance.Verification Status Select the verification status of the KYC check for the party from the list of values. The available options are: - Compliant

- Non-Compliant

- Yet to Verify

Note:

List of values can be configured through Entity Maintenance.Issued On Issuance date of identification as per KYC check of the party. Verified On Verification date of the KYC check for the party. Valid Till Verification valid till date of the KYC check for the party. Verification Remarks Verification remarks provided for the KYC check. KYC ID Type Select ID type of identification of the party from the following drop-down list. The available options are: - Proof Of Identity

- Proof Of Residence

Note:

List of values can be configured through Entity Maintenance.Note:

For Entity Maintenance details, refer to the Oracle Banking Party Configurations User Guide.Table 1-56 Identity Check

Field Description KYC ID Type ID Type of identification of the party. Name as in the document Name as per documents provided for KYC check of the party. ID Number ID number of a document uploaded for a party. DOB as on Document Date of birth as per KYC check of the party. Address as in Document Address as per the document provided during KYC Check process. Reference number Any related reference number for the KYC check of the party. Verification Type Select verification type of the KYC check for the party from the drop-down list. The available options are: - Internal

- External

Note:

List of values can be configured through Entity Maintenance.Verification Medium Select verification medium of the KYC check for the party from the drop-down list. The available options are: - Manual

- Online

Note:

List of values can be configured through Entity Maintenance.Verification Status Select verification status of the KYC check for the party from the drop-down list. The available options are: - Compliant

- Non-Compliant

- Yet to Verify

Note:

List of values can be configured through Entity Maintenance.Issued On Issuance date of identification as per KYC check of the party. Verified On Verification date of the KYC check for the party. Valid Till Verification valid till date of the KYC check for the party. Verification Remarks Verification remarks provided for the KYC check. Note:

For Entity Maintenance, refer Oracle Banking Party Configurations User Guide.Table 1-57 Police DB Check

Field Description House/Building Building name as per KYC check of the party. Street Street as per KYC check of the party. Area Area as per KYC check of the party. City City as per KYC check of the party. State State as per KYC check of the party. Country Select country as per KYC check of the party from the drop-down list. Note:

List of values can be configured through Common Core Maintenance for Country Code.Zipcode Zipcode as per KYC check of the party. Phone Phone number as per KYC check of the party. Under Policy Jurisdiction Legal jurisdiction as per police KYC check of the party. Address Visited (Yes/No) Address visited by party as per KYC check of the party. Police DB Checked Flag to identify, if police database is been checked as part of police KYC check. Record Found (Yes/No) Party found in records as per suits KYC check of the party. Reference ID Any related reference number for the KYC check of the party. Verification Status Select verification status of the KYC check for the party from the drop-down list. - Compliant

- Non-Compliant

- Yet to Verify

Note:

List of values can be configured through Entity Maintenance.Verification On Verification date of the KYC check for the party. Valid Till Verification valid till date of the KYC check for the party. Verification Remarks Verification remarks provided for the KYC check. Note:

For Entity Maintenance, refer to the Oracle Banking Party Configurations User Guide.Table 1-58 Credit Score Check - Field Description

Field Description Agency Name Agency Name of the Credit Score. Last Reported Monthly Income Last reported monthly income as per credit KYC check of the party. Transunion/CIBIL/Credit Score Credit score as per credit KYC check of the party. No of ongoing Loans Number of loans of the party as per credit KYC check of the party. No of Closed Loans Number of closed loans of the party as per credit KYC check of the party. No of Credit Enquiry (Past 6 Month) Number of credit enquiries of the party as per credit KYC check of the party. No of Loans Re-structured Number of restructured loans of the party as per credit KYC check of the party. No of Loans with overdue Number of overdue loans of the party as per credit KYC check of the party. Reference number Any related reference number for the KYC check of the party. Verified On Verification date of the KYC check for the party. Valid Till Verification valid till date of the KYC check for the party. Verification Status Select verification status of the KYC check for the party from drop-down list. - Compliant

- Non-Compliant

- Yet to Verify

Note:

List of values can be configured through Entity Maintenance.Verification Remarks Verification remarks provided for the KYC check. Table 1-59 Education Qualification

Field Description Name as in the certificate Name as in the certificate. Registration Number Registration Number as per in the certificate. Education Category Category of education as per education details of the party. Education Type Education type as per the certificate of education of the party. Course Course of study as per education details of the party. Specialization Specialization in certificate as per education KYC check of the party. University Name University in the certificate as per education details of the party. Issued On Issuance date of identification as per KYC check of the party. Reference number Any related reference number for the kyc check of the party. Verification Type Select verification type of the KYC check for the party from the drop-down list. - Internal

- External

Note:

List of values can be configured through Entity Maintenance.Verification Medium Select verification medium of the KYC check for the party from the drop-down list. - Manual

- Online

Note:

List of values can be configured through Entity Maintenance.Verification Status Select verification status of the KYC check for the party from the drop-down list. - Compliant

- Non-Compliant

- Yet to Verify

Note:

List of values can be configured through Entity Maintenance.Verified On Verification date of the KYC check for the party. Valid Till Verification valid till date of the KYC check for the party. Verification Remarks Verification remarks provided for the KYC check. Table 1-60 Field Verification - Field Description

Field Description Address Type Select the address type as per field verification KYC check of the party from the drop-down list. - Permanent Address

- Residential Address

- Communication Address

- Office Address

Note:

List of values can be configured through Entity Maintenance.House / Building Specify building name as per KYC check of the party. Street Specify street as per KYC check of the party. Locality Specify locality as per KYC check of the party. Landmark Specify address landmark as per field KYC check of the party. Area Specify area as per KYC check of the party. City Specify city as per KYC check of the party. State Specify state as per KYC check of the party. Country Select country as per KYC check of the party from the list of values. Note:

List of values can be configured through Common Core Maintenance for country code.Zipcode Zipcode as per KYC check of the party. Field Investigation Done (Yes/No) Flag to identify, if field investigation is completed as part of field KYC check of the party. Agency Name Agency Name conducted field verification. Reference number Any related reference number for the KYC check of the party. Customer Found Address found for a party as per field KYC check of the party. Customer Operating Since Residing since at a address as per field KYC check of the party. Verification Medium Verification medium of the KYC check for the party Select from the following list of values. List of values can be configured through Entity Maintenance. - Manual

- Online

Verification Result Select verification status of the KYC check for the party from the drop-down list. - Compliant

- Non-Compliant

- Yet to Verify

Note:

List of values can be configured through Entity Maintenance.Verified On Verification date of the KYC check for the party. Valid Till Verification valid till date of the KYC check for the party. Verification Remarks Verification remarks provided for the KYC check. Note:

For Entity Maintenance, refer to the Oracle Banking Party Configurations User Guide.Table 1-61 Reference Check - Field Description

Field Description Reference Check Reference Check provided. House / Building Building name as per KYC check of the party. Street Street as per KYC check of the party. Area Area as per KYC check of the party. City City as per KYC check of the party. State State as per KYC check of the party. Country Select country as per KYC check of the party from drop-down list. Note:

List of values can be configured through Common Core Maintenance for Country Code.Zipcode Zipcode as per KYC check of the party. Phone Phone number as per KYC check of the party. Address Visited (Yes/No) Address visited by party as per KYC check of the party. Available at Contact Number Flag to identify, if phone number is verified as per reference KYC check of the party. Relationship Select relationship type of the related party from the drop-down list. - Spouse

- Mother

- Son

- Daughter

- Guardian

- Father

Note:

List of values can be configured through Entity Maintenance.Year of Association Years of association as per reference KYC check of the party. Verification Status Select verification status of the KYC check for the party from the drop-down list. - Compliant

- Non-Compliant

- Yet to Verify

Note:

List of values can be configured through Entity Maintenance.Verified On Verification date of the KYC check for the party. Valid Till Verification valid till date of the KYC check for the party. Verification Remarks Verification remarks provided for the KYC check. Note:

For Entity Maintenance, refer to the Oracle Banking Party Configurations User Guide.Table 1-62 Suit Filed

Field Description House / Building Building name as per KYC check of the party. Street Street as per KYC check of the party. Area Area as per KYC check of the party. City City as per KYC check of the party. State State as per KYC check of the party. Country Select the country as per KYC check of the party from the list of values. Note:

List of values can be configured through Common Core Maintenance for Country Code.Zipcode Zipcode as per KYC check of the party. Phone Phone number as per KYC check of the party. Under Policy Jurisdiction Legal jurisdiction as per police KYC check of the party. Court Jurisdiction Check Required (Yes/No) Flag to identify, if court records are checked for a party. Address Visited (Yes/No) Address visited by party as per KYC check of the party. Record Found (Yes/No) Party found in records as per suits KYC check of the party. Reference Number Any related reference number for the KYC check of the party. Verification Status Select verification status of the KYC check for the party from the following drop-down list. - Compliant

- Non-Compliant

- Yet to Verify

Note:

List of values can be configured through Entity Maintenance.Verified On Verification date of the KYC check for the party. Valid Till Verification valid till date of the KYC check for the party. Verification Remarks Verification remarks provided for the KYC check. Note:

For Entity Maintenance, refer to the Oracle Banking Party Configurations User Guide.Table 1-63 PEP Identification

Field Description Politically Exposed (Yes/No) Flag to identify, if party is politically exposed. Exposed Country (Yes/No) Country of exposure as per PEP KYC check of the party. Relationship Select relationship type of the related party from the drop-down list. - Spouse

- Mother

- Son

- Daughter

- Guardian

- Father

Note:

List of values can be configured through Entity Maintenance.Exposed with Exposure details as per the PEP KYC check of the party. Name as in the PEP List Name as per PEP KYC check of the party. Citizenship as in the PEP List Citizenship as per PEP KYC check of the party. Exposed Score Exposure score details as per the PEP KYC check of the party. Reference number Any related reference number for the KYC check of the party. Verification Type Select verification type of the KYC check for the party from the drop-down list. - Internal

- External

Note:

List of values can be configured through Entity Maintenance.Verification Medium Select verification medium of the KYC check for the party from the drop-down list. - Manual

- Online

Note:

List of values can be configured through Entity Maintenance.Verification Status Select verification status of the KYC check for the party from the drop-down list. - Compliant

- Non-Compliant

- Yet to Verify

Note:

List of values can be configured through Entity Maintenance.Verified On Verification date of the KYC check for the party. Valid Till Verification valid till date of the KYC check for the party. Risk Clarification Select risk classification as per KYC check of the party from the drop-down list. - Risky

- Medium

- Low

Note:

List of values can be configured through Entity Maintenance.Risk Score Risk score as per KYC check of the party. Verification Remarks Verification remarks provided for the KYC check. Note:

For Entity Maintenance, refer to the Oracle Banking Party Configurations User Guide.Table 1-64 AML Check

Field Description Customer Listed in AML (Yes/No) Flag to identify, if party is available in the list as per AML KYC check of the party. Source of Funds Select sources of funds as per AML KYC check of the party. - Account Owned By Company

- Account Owned By Parents

Source of Wealth Select sources of wealth as per AML KYC check of the party. - Business

- Employment

Name as in the document Name in the list as per AML KYC check of the party. Citizenship In AML List Select citizenship as per PEP KYC check of the party from the drop-down list. Note:

List of values can be configured through Common Core Maintenance for Country Code.Country where listed Select listed country as per AML KYC check of the party from the drop-down list. Note:

List of values can be configured through Common Core Maintenance for Country Code.Risk Score Risk score as per KYC check of the party. Reference Number Any related reference number for the KYC check of the party. Verification Type Select verification type of the KYC check for the party from the drop-down list. - Internal

- External

Note:

List of values can be configured through Entity Maintenance.Verification Medium Select verification medium of the KYC check for the party from the drop-down list. - Manual

- Online

Note:

List of values can be configured through Entity Maintenance.Verification Status Select verification status of the KYC check for the party from the drop-down list. - Compliant

- Non-Compliant

- Yet to Verify

Note:

List of values can be configured through Entity Maintenance.Verified On Verification date of the KYC check for the party. Valid Till Verification valid till date of the KYC check for the party. Risk Clarification Select risk classification as per KYC check of the party from the drop-down list. - Risky

- Medium

- Low

Note:

List of values can be configured through Entity Maintenance.Risk Score Risk score as per KYC check of the party. Verification Remarks Verification remarks provided for the KYC check. Note:

For Entity Maintenance, refer to the Oracle Banking Party Configurations User Guide.Table 1-65 FATCA Check

Field Description US Citizen (Yes/No) Flag to identify, if party is a US citizen. Country of Residence Select country of residence as per basic information of the party from the list of values. Note:

List of values can be configured through Common Core Maintenance for Country Code.Tax Identification Number Tax Identification Number as per FATCA check. Country of Issuance Select country of issuance as per FATCA KYC details of the party from the list of values. Note:

List of values can be configured through Common Core Maintenance for Country Code.Reference Number Any related reference number for the KYC check of the party. Verification Type Select verification type of the KYC check for the party from the drop-down list. - Internal

- External

Note:

List of values can be configured through Entity Maintenance.Verification Medium Select verification medium of the KYC check for the party from the drop-down list. - Manual

- Online

Note:

List of values can be configured through Entity Maintenance.Verification Status Select verification status of the KYC check for the party from the drop-down list. - Compliant

- Non-Compliant

- Yet to Verify

Note:

List of values can be configured through Entity Maintenance.Verified On Verification date of the KYC check for the party. Valid Till Verification valid till date of the KYC check for the party. Verification Remarks Verification remarks provided for the KYC check. Note:

For Entity Maintenance, refer to the Oracle Banking Party Configurations User Guide.Table 1-66 SDN Check

Field Description Found in SDN Search? (Yes/No) Flag to identify, if party is available in the list as per SDN (OFAC) KYC check of the party. ID of the SDN match ID of the SDN (OFAC) match as per SDN (OFAC) KYC check of the party. Score of the SDN match Score as per SDN KYC check of the party. Program name Program name as per SDN (OFAC) KYC check of the party. House / Building Building name as per KYC check of the party. Street Street as per KYC check of the party. Locality Locality as per KYC check of the party. Landmark Address landmark as per field KYC check of the party. Area Area as per KYC check of the party. City City as per KYC check of the party. State State as per KYC check of the party. Country Country as per KYC check of the party. Zipcode Zipcode as per KYC check of the party. Phone Phone number as per KYC check of the party. Reference Number Any related reference number for the KYC check of the party. Verification Type Select verification type of the KYC check for the party from the drop-down list. - Internal

- External

Note:

List of values can be configured through Entity Maintenance.Verification Medium Select verification medium of the KYC check for the party from the drop-down list. - Manual

- Online

Note:

List of values can be configured through Entity Maintenance.Verification Status Select verification status of the KYC check for the party from the drop-down list. - Compliant

- Non-Compliant

- Yet to Verify

Note:

List of values can be configured through Entity Maintenance.Verified On Verification date of the KYC check for the party. Valid Till Verification valid till date of the KYC check for the party. Note:

For Entity Maintenance, refer to the Oracle Banking Party Configurations User Guide.Table 1-67 Sanction Check

Field Description Found in List Check to identify, if customer is found in sanctions check list. Sanction List Name Sanctions list name as per regulatory sanctions lists. Name as in List Name of the party as found in sanctions list. Address in List Address of the party as found in sanctions list. Reference number Reference number of sanctions KYC check. Verification Type Select verification type of the KYC check for the party from the drop-down list. - Internal

- External

Note:

List of values can be configured through Entity Maintenance.Verification Medium select verification medium of the KYC check for the party from the drop-down list. - Manual

- Online

Note:

List of values can be configured through Entity Maintenance.Verification Status Select verification status of the KYC check for the party from the drop-down list. - Compliant

- Non-Compliant

- Yet to Verify

Note:

List of values can be configured through Entity Maintenance.Verified On Date of verification of sanctions check. Valid Till Valid till date of sanctions check. Verification Remarks Verification remarks provided for the KYC check. Risk Clarification Select risk classification as per KYC check of the party from the drop-down list. - Risky

- Medium

- Low

Note:

List of values can be configured through Entity Maintenance.Risk Score Risk score as per KYC check of the party. Note:

For Entity Maintenance, refer to the Oracle Banking Party Configurations User Guide. - Click Submit.On the KYC Check screen, the verification details are updated in the corresponding tile.

- Verify all the KYC checks listed for the selected product.

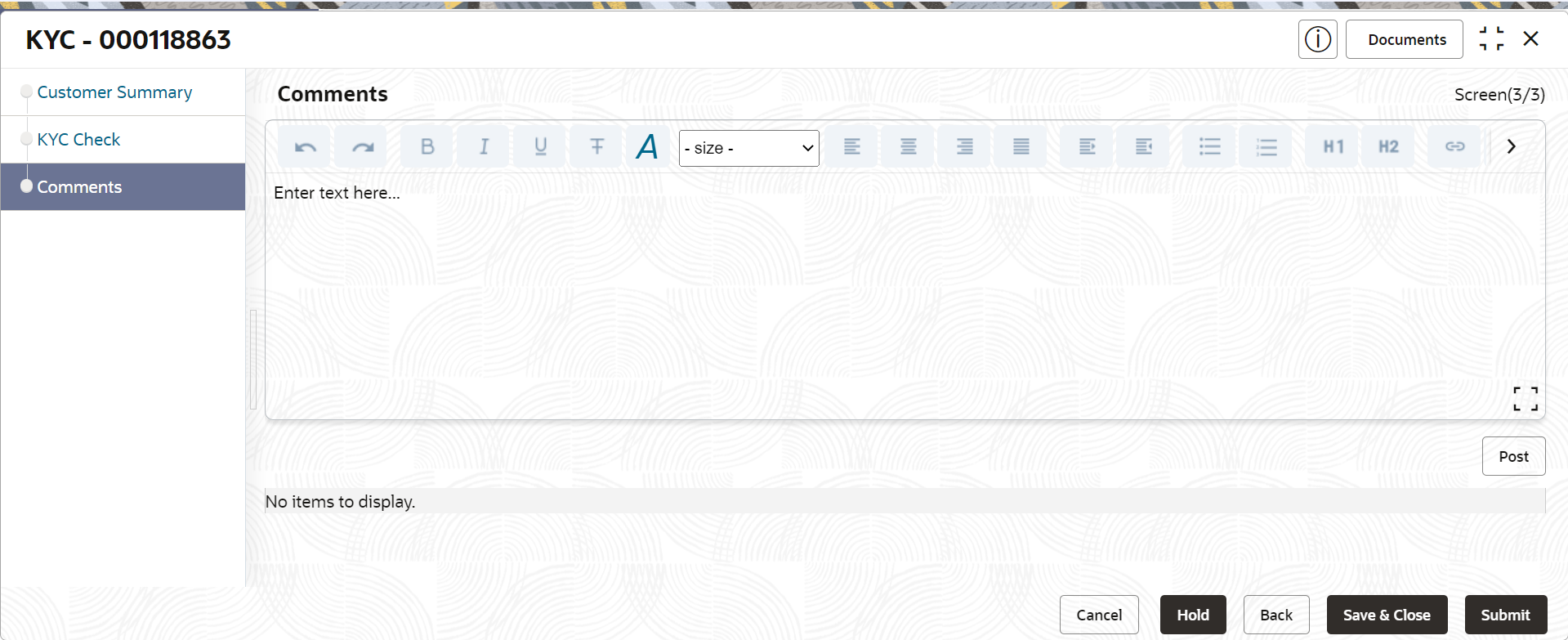

- Click Next.The Comments screen displays.

- Specify the overall comments for the KYC stage.

- On the Comments screen, perform the following

actions:

Table 1-68 Actions - Description

Actions Description Post Click Post. The comments are posted below the text box. Submit Click Submit. The Checklist window is displayed. Outcome On the Checklist window, select the Outcome as Approve or Reject and click Submit. Based on the value selected for the outcome, the following conditions apply: -

If Approve is selected, the task is moved to the Recommendation stage.

- If Reject is selected, the task is terminated.

-

Parent topic: Retail Onboarding