8.14.2 Arctangent Calculation Method

The Arctangent Calculation method uses the Arctangent mathematical function to describe the relationship between prepayment rates and spreads (coupon rate less market rate).

All prepayment rates should be input as annual amounts.

user-defined coefficients adjust this function to generate differently shaped curves. Specifically: CPRt = k1 - (k2 * ATAN(k3 * (-Ct/Mt + k4)))

where CPRt = annual prepayment rate in period t Ct = coupon in period t

Mt = market rate in period t

k1 - k4 = user-defined coefficients

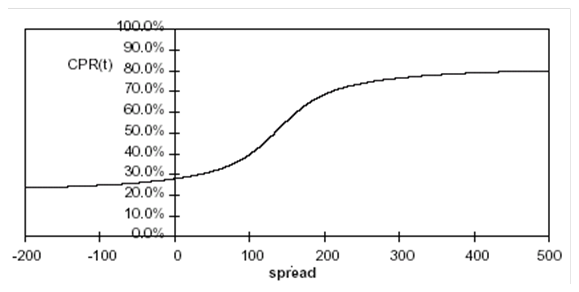

A graphical example of the Arctangent prepayment function is shown , using the following coefficients:

k1 =0.3

k2 =0.2

k3 = 10.0

k4 = 1.2

Each coefficient affects the prepayment curve differently.

Figure 8-2 A graphical example of the Arctangent Prepayment function using the coefficients

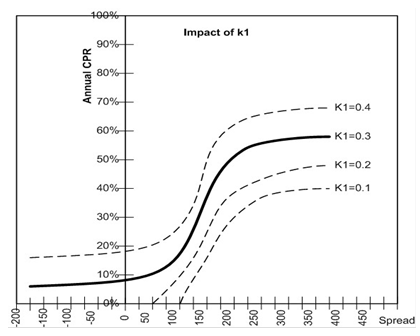

The following diagram shows the impact of K1 on the prepayment curve. K1 defines the midpoint of the prepayment curve, affecting the absolute level of prepayments. Adjusting the value creates a parallel shift of the curve up or down.

Figure 8-3 Impact of K1 on the Prepayment Curve

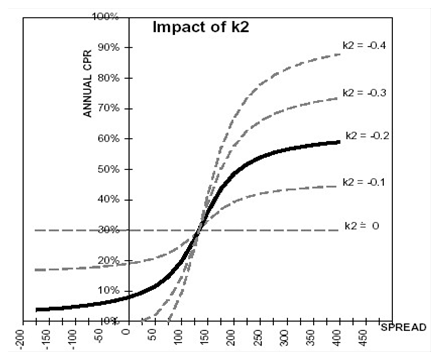

The following diagram shows the impact of K2 on the prepayment curve. K2 impacts the slope of the curve, defining the change in prepayments given a change in market rates. A larger value implies greater overall customer reaction to changes in market rates.

Figure 8-4 Impact of K2 on the Prepayment Curve

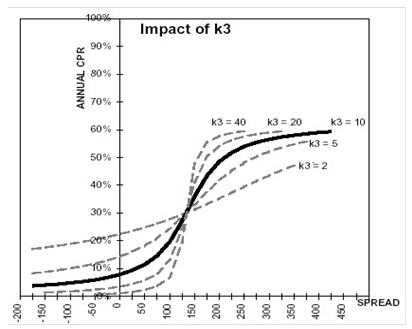

The following diagram shows the impact of K3 on the prepayment curve. K3 impacts the amount of torque in the prepayment curve. A larger K3 increases the amount of acceleration, implying that customers react more sharply when spreads reach the hurdle rate.

Figure 8-5 Impact of K3 on the Prepayment Curve

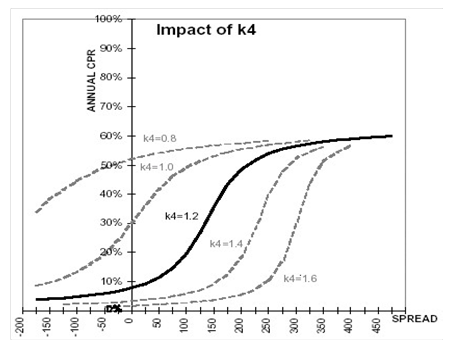

The following diagram shows the impact of K4 on the prepayment curve. K4 defines the hurdle spread: the spread at which prepayments start to accelerate. When the spread ratio = k4, prepayments

= k1.

Figure 8-6 Impact of K4 on the Prepayment Curve