36.1.1 Creating a Static Deterministic ALM Process Rule

Deterministic processing generates output based on a set of user-defined forecast rate scenarios. The static process indicates that new business assumptions are not included in this flow.

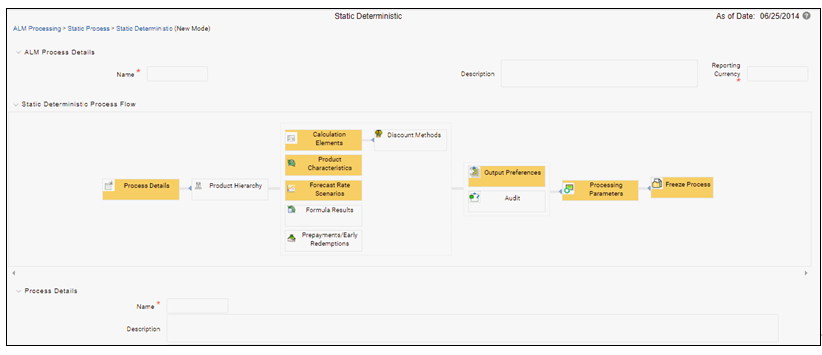

Figure 36-1 Static Deterministic ALM Process

- Fill in the necessary details in the Process Details block:

Name

Folder and Reporting Currency from respective drop-down menus

Click Apply. The process will take you to the Product Hierarchy selection options.

- In the Product Hierarchy block,

- Select a Product Hierarchy and select nodes from the hierarchy corresponding to data you want to include in the process, OR

- Alternatively, select the Source Selection button, and select the instrument tables corresponding to the data you want to include in the process.

- Select a Filter (optional), to further constrain the data to be

included in the process. Filters work as a secondary constraint, applied

after the data set is determined based on Product Hierarchy member selection

or Source Selection.

Do not use Default Product Member (value of -1) within a Product Hierarchy, for Processing. For example, if the process is running on Product Hierarchy of Common Chart of Account, do not use default chart of account member of -1.

- Data Element Filter

- Hierarchy Filter

- Group Filter

- Attribute Filter

Note:

Before using the product hierarchy approach for selecting data to include in your process, there is a procedure that must be run ("PRODUCT TO INSTRUMENT MAPPING"). This procedure can be executed from the Batch Scheduler – Run - interface.

The purpose of the Product to Instrument mapping procedure is to scan all instrument tables (FSI_D_xxx) and populate the mapping table ( FSI_M_PROD_INST_TABLE_MAP ) with a listing of the product dimension members that exist within each instrument table. When you select Products (parents or children) within an ALM or FTP process definition, the process refers to this mapping table to identify the instrument tables to include in the process.

It is recommended that you establish an internal process whereby this procedure is executed after every data load to ensure that mappings are up to date.

- Select Apply.

Related Topics: For more information on Product to Instrument mapping procedure, see Oracle Financial Services Analytical Applications Infrastructure User Guide.

- Rule Selection Blocks – The boxes in blue with the yellow highlight are required for

the definition of the process.

- In the Calculations Elements block, select either the Generated aggregated cash flow results or Stop at the Process cash flows option. By default, the Generated aggregated cash flow option is selected and required for most ALM results processing. The Stop at the Process cash flows option is only used when you do not require the aggregated results and wish to only compute detail cash flows in the FSI_O_PROCESS_CASH_FLOWS table. This is used by users who integrate with Liquidity Risk Management and need to create cash detailed flow output for a large number of instrument records. In this case, the aggregate output is not needed. The Stop at process cash flows option does not write aggregated results to the Result or Consolidated Master or Result or Consolidated Detail output tables.

- Choose the calculation elements to include in the process run: "Market Value, YTM, Duration, DV01/PV01", "Repricing Gap", "Liquidity Gap", "Average Life", "Transfer Pricing" – if defined then select the Folder and Transfer Pricing Rule, TP Adjustments – if defined* then select the Folder and TP Adjustment Rule, Effective Interest Rate, Repricing Balances and Rates, Runoff components, Prepayment Runoff – if defined, Tease, Cap, Floor and Negative Amortization Details, Standard Financial Elements.

- Include Non Rate Sensitive Bucket check-box gets enabled when ‘Repricing

Gap’ is selected. A new Attribute of product dimension ‘Interest Rate

Sensitivity Category’ is introduced to identify products as Interest Rate

sensitive or Non Interest Rate sensitive. Once ‘Include Non Rate Sensitive

Bucket’ is enabled, reprice gap output of Products which are mapped as Non

Interest Rate sensitive, would move into Non Interest Rate Sensitive bucket.

For more information on Non Interest Rate Sensitive Bucket, see Time

Buckets

If ‘Include Non Rate Sensitive Bucket’ is not enabled, engine will ignore ‘Interest Rate Sensitivity Category’ product attribute, and would treat all products as Interest Rate Sensitive. Reprice Gap output would move into respective Reprice Gap buckets.

If 'Treat Margin as Fixed Rate After First Reprice' is enabled, engine will calculate the margin of adjustable rate instruments to continue generating interest cash flows after a gap repricing event up until contractual maturity or other total runoff.

- Select the Market Value, YTM, Duration, DV01/PV01 option if you want to measure the price sensitivity for small changes in the underlying interest rate curves (DV01/PV01). For this calculation, Market Value is also required.

- Choose Embedded Option Decisioning. This is an optional selection. This is a

drop-down list with the following values:

Cashflow to Maturity– This selection ignores the option on the instrument and treats it as a regular bond. This is the default behavior.

Cashflow to the first Expiry Date– This selection forces the option on the instrument to be exercised on the first applicable date. American options exercise the option on start date if option start date > as of date. Else, if as_of_date > option start date, the option is called in the 1st time bucket.

Rate Path Dependent – This selection, checks the exercisability of the option on the bond, as per the scenario defined.

- The Calculate Option Market Value option is used to calculate the Market

Valuation (MV) for certain embedded and stand-alone (bare) options.

Supported embedded options are Calls, Puts, Caps (caplets) and Floors

(floorlets). This option will be enabled only if Market Value, YTM,

Duration, DV01/PV01 option is also selected.

For example,

When Calculate Option Market Value check-box is selected and RATE_CAP_LIFE has data filled (that is, holds a non-null value greater than 0), then Embedded CAP Option MV will be calculated.

When Calculate Option Market Value check box is selected and RATE_FLOOR_LIFE has data filled (that is, it is non-null value greater than 0 or it is less than RATE_CAP_LIFE and RATE_CAP_LIFE is greater than 0), then Embedded FLOOR Option MV will be calculated.

- Click Apply.

- If Market Value is chosen from step 1 above, the Discount Methods box will become highlighted blue and need to be defined (see Discount Methods, for rule set up). If no market value chosen, continue to step 5 below.

- Select from the discount methods box the desired method (see Discount Methods, for set up) and click Apply.

- From the Product Characteristics bar, select the desired definition and click Apply (see Product Characteristics, for rule definition).

- Select the Forecast Rates rule you want applied to the process, and click Apply. (see Forecast Rate Scenarios , to set up rate scenarios). The flow will now take you to output preferences. Or, if you want to add a prepayment rule to the process, continue to step 7 below.

- Click the Prepayments/Early Redemptions box and choose the defined prepayment rule (see Prepayment Rules ). This is an optional step.

- Output Preferences options

- Select the output dimension from the drop-down list (Options include: Product, Product/Currency, Organization/Product, Organization/Product/Currency).

- Depending on the dimension chosen, you can Consolidate to Reporting Currency by checking the box if the dimension Product /Currency or Organization/Product/Currency was chosen.

- If you have the ALMBI reporting product, you can select to export the results to the ALM BI Mart by clicking the box. You also have the option to update the Instrument Data Tables with financial measures by checking the box of the desired calculated item (Market Value, Macaulay Duration, Modified Duration, Convexity, Yield to Maturity, Average Life, DV01/PV01, Option Market Value, Structured Cashflow Attributes*). The DV01/PV01 and Option Market Value options will be enabled only if Market Value, YTM, Duration, DV01/PV01 option is selected in Calculation block. Select Apply Limit to BI option, if you want to use the defined repricing gap limit with ALM BI report. This is useful, if you want to view repricing gap report with a limit set as per your risk policy. Apply Limit to BI option will be enabled only if Move Results to ALMBI Mart option is active.

- Click Apply after the page is defined. The process will take you to the Processing Parameters section. Or you can click the audit box for the following options: If no audit options are required, skip to #6, Processing Parameters.

* The Structured Cashflow Attributes option will be enabled only if you are mapped to Moody's structured cashflow functionality.

- Audit Preferences (optional)

Known Issue

If you select FE in ALM process and data contains rate-tier instrument, then ALM process will fail.

- Detailed Cash Flow:

Check the box to record the cash flows and repricing events occurring for the desired number of records processed. For each record, daily results are written to the FSI_O_PROCESS_CASH_FLOWS table. The data in this table uses the RESULT_SYS_ID, which identifies the Process used. Select from the options below:

Input the desired number of Records in the dialog box

Select all records to be output.

In the financial elements tab below, you have the option to select the FE's you want to output in the detail cash flows table. Highlight the items in the available section and move selection over to the selected section.

Click apply, or go to step 2 for Forecast rates output.

- Tiered Balanced Cash Flows

Tiered Balanced Cash Flows option allows you to define the Tiered balance interest. The Tiered balance interest is useful when a different interest rate is paid/charged for parts of an account balance that fall within set amount ranges. Payment frequency, current payment and so on can will be defined at account level. Reprice frequency, next reprice date and so on can be defined at tier level.

Select this option when you want system to write detailed cash flows are rate tier level.

- § Forecast Rates

Select Forecast Rates to write forecast exchange, interest rates or economic indicator results to the following tables: FSI_EXCHANGE_RATES_AUDIT, FSI_INTEREST_RATES_AUDIT, and/or FSI_ECONOMIC_INDICATORS_AUDIT. For more information on the table structures, see the Oracle Financial Services Analytical Applications Data Model Data Dictionary.

Highlight items from the available code section for the desired forecast type (Interest Rate, Exchange Rate, or Economic Indicator) and move selection (or all) to the selected items box.

For consolidation of Formula Results output, ensure to select respective currencies in Audit section.

Click Apply and the screen will take you to Processing Parameters.

- Detailed Cash Flow:

- Processing Parameters:

9.

a. The processing parameters allow you to run an entire process or re-process a portion of an existing run. From the drop-down list, select Entire Process or Selective Reprocess.

b. If Selective Reprocess is selected, you can click the box “Current Position Data” to reprocess that particular data set. With selective reprocessing you can run a subset of the process to replace invalid products and to add new products. With Selective Reprocess, the Reprocessing components are enabled to selected components for reprocessing. When the Process Rule is executed, the data in the result tables are not immediately deleted. The data for the selected subset is replaced, but the rest of the results remain intact.

c. Select Auto balancing accounts: If you selected Auto Balancing in the Output Preferences (section 4.4.) the Auto Balancing Accounts option is available for re-processing. Click the box to apply.

d. Select the desired product Hierarchy Filter from the drop-down list to indicate which products should be re-processed.

e. Click Apply and the screen will take you to Freeze Process section.

10. Freeze Process

a. Select Freeze to complete the process.

b. Select Reset to erase all selections made previously within the process definition flow.

c. Select Confirm.

11. Stop Holiday Calendar checkbox is provided with a calendar date picker. If checked, a calendar is enabled on which a date can be selected. Cash flows generated post this date will not apply the holiday calendar. On selecting the checkbox a warning message will pop up statingIf Enabled, the outputs could have a combination of adjusted and unadjusted cashflows.

NOTE:

Holiday calendar is used to adjust the outputs on holiday events, which may increase processing time. If Users do not want to have adjusted output after a certain time point, say, when buckets become wider, then this field stops adjusting cashflows from that time point, reducing processing time. If user wants to have cash flow adjusted for entire processing period, then this field does not require any input.