27.2.2 Defining Rate-Spread Dependent Rate Dependency Patterns

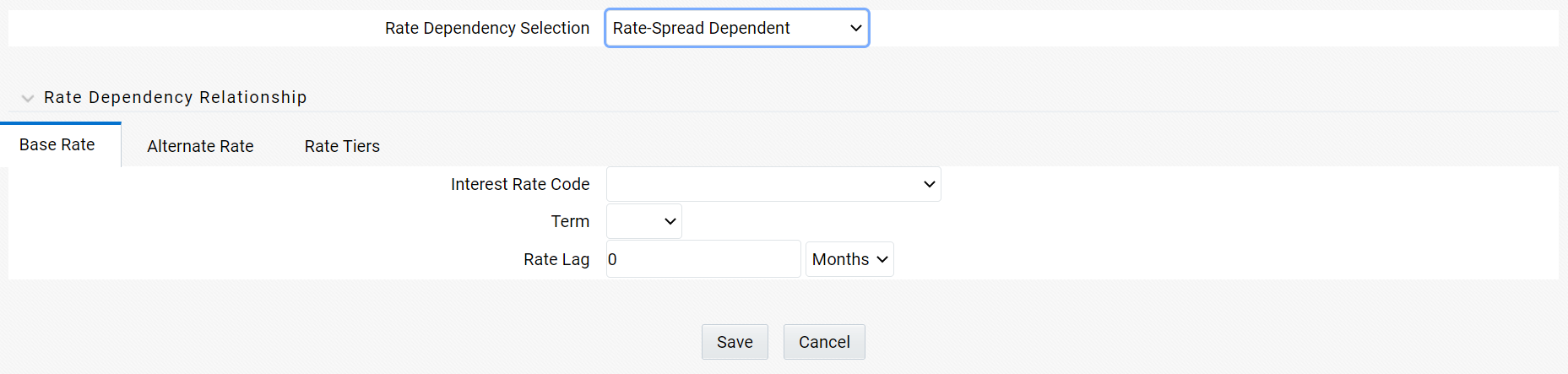

With the Rate-Spread Dependent Relationship, you can input assumptions for different spreads between two indicator interest rates. You define the first indicator interest rate, the Base Interest Rate, as described previously. The second indicator Interest Rate, the Alternate Interest Rate, also requires the selection of an Interest Rate Code, a Term Selection, and a Rate Lag.

Figure 27-4 Base Rate Tab of the Rate Dependency Pattern Rule after selecting Rate-Spread Dependent option

The rate spread equals to Alternate Interest Rate - Base Interest Rate

- Define the Base Interest Rate details. See Table.

- Select Save.

- Define the Alternate Interest Rate details. These fields are the same as the Base Rate tab.

- Select Save.

- Define the Rate Tiers for the Spreads.

- Select the Lookup Method.

- Select Save to complete the definition.