35.1 Defining Stochastic Rate Indexes

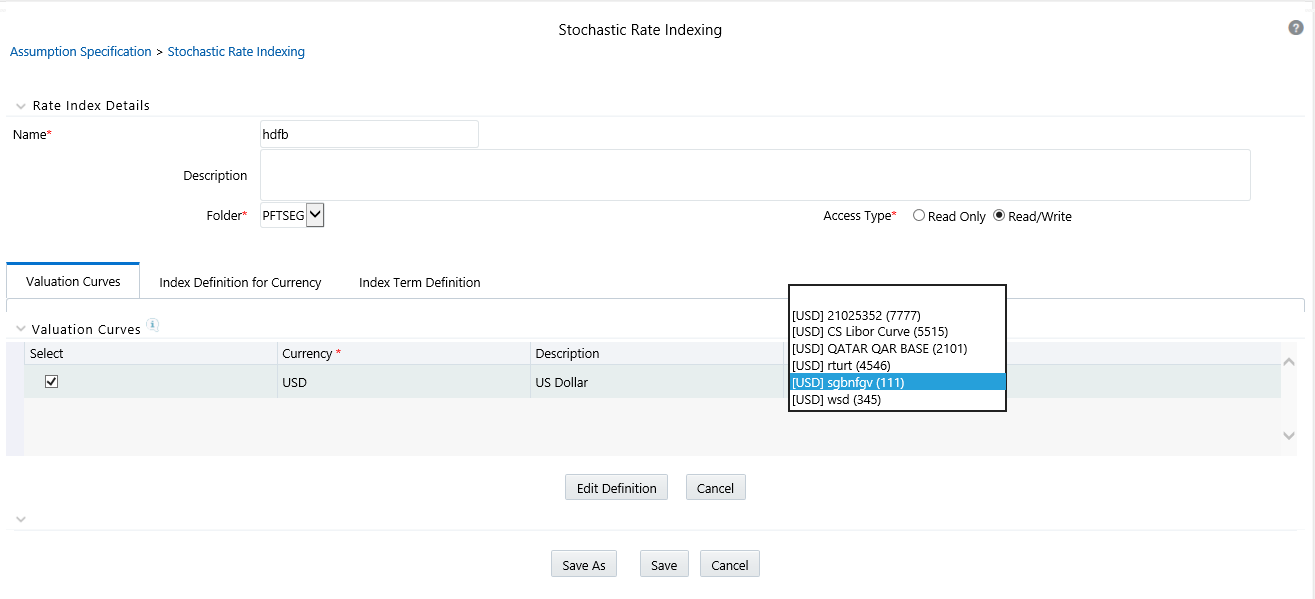

A formula must be defined for each interest rate index tied to an instrument. The formula must be in the following form:

Figure 35-1 Stochastic Rate Index Formula

To create a formula, select up to eight terms (elements) from the risk-free curve, each multiplied by a user-defined coefficient, and raised to the power of a user-defined exponent. Also, you can add a constant spread to the formula. It is not necessary to define any assumptions for the risk-free curve. Any definition for this curve is ignored and does not affect processing.

Each of the elements consists of:

- A coefficient: A multiplier to weigh each term selection.

- An exponent: An exponent to allow for polynomial curve-fitting.

- A term selection: A selection of rates associated with a term from the risk-free curve.

These elements define a different rate forecast generated for each instrument, with a given IRC. The definition of rate indexes is part of the Create Stochastic Rate Index Rule process in which rate indexes are defined for currency-valuation curve combinations. When you click Save in the Create Stochastic Rate IndexRule process, the rule is saved and the Stochastic Rate Index Rule summary page is displayed. However, the rate indexes have not yet been defined for any of the currency-valuation curve combinations. Define the rate indexes for currency-valuation curve combinations before clicking Save.

Prerequisites

- Decide on historical rate information and manage by creating Interest Rate Codes.

- Perform the steps to create or edit a Stochastic Rate Index rule.

To create a Stochastic Rate Index rule, follow these steps:

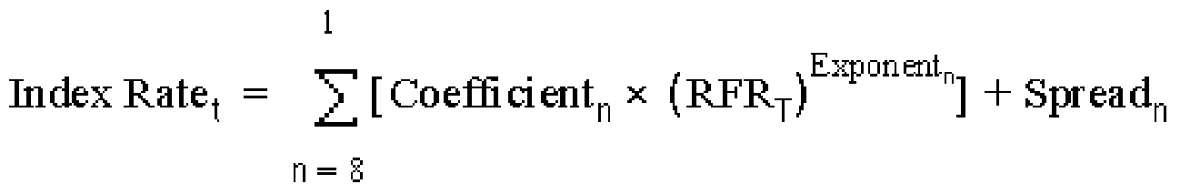

- Navigate to the Stochastic Rate Index Valuation Curve Assignment

page.

Figure 35-2 Stochastic Rate Indexing

- Enter the following information as tabulated.

Rate Index Details Window

Form fields to Define Stochastic Rate Indexes

Term Description Valuation Curve

The Valuation curve is used to calculate the future rates of Indexes (IRCs) defined in a Stochastic Rate Index rule. Assign a Valuation curve for each currency during the creating process of the Stochastic Rate Index rule. The Valuation curve and the indexed rate curves are derived from the same Referenced Currency. For example, use the US Treasury Yield Curve as the Valuation curve to calculate the forward rates of any US dollar-based Interest Rate Code.

Coefficient

A multiplier to weigh each term selection.

Exponent

An exponent to allow for polynomial curve-fitting.

Index Term

An Interest Rate Code is made up of one or many term points that denote a particular interest rate yield curve structure. OFS ALM generates future rates for term points in the Interest Rate Code based on an arithmetic formula that has the following components: A combination of term point rates from the valuation curve (with a maximum selection of eight terms or elements), which need not be the standard term points as defined in the IRC definition of the valuation curve.

A coefficient and an exponent for each of the valuation curve term points.

A single spread per index term point.

A formula must be defined for each index tied to an instrument.

Figure 35-3 Stochastic Rate Indexing Formula

Where:

t: is the term point of the index.

T: is the term point of the valuation curve.

n: is the number of term points of the valuation curve referenced.

RFR: is the rate of the specific term point on the valuation curve.

To create a formula, select up to eight-term points (elements) from the risk-free curve. Each must be multiplied by a user-defined coefficient and raised to the power of a user-defined exponent. Also, add a constant spread for each of the term points used in the formula.

- Select Currency.

- Navigate to the Valuation Curve tab and select a Valuation Curve for

the selected currency .

Note:

Only a single Valuation Curve can be associated with a particular currency. For example, if the Valuation Curve for US Dollars is US Treasury Curve, all US Dollar indexes will be associated with the US Treasury curve.

Select a risk-free interest rate structure. Not all the Interest Rate Codes in the application will have the characteristics of a risk-free rate curve, but the application will not prevent you from selecting any curve as the Valuation Curve.

- Select Apply.

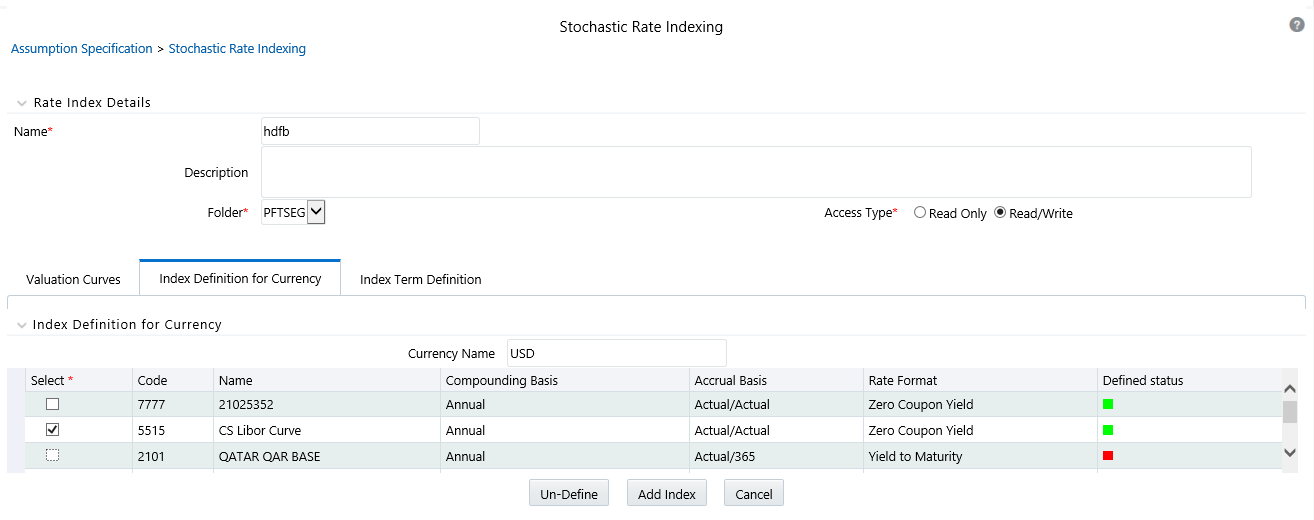

- Navigate to the Index Definition for Currency tab and select the

Index using Add Index.

Figure 35-4 Stochastic Rate Indexing

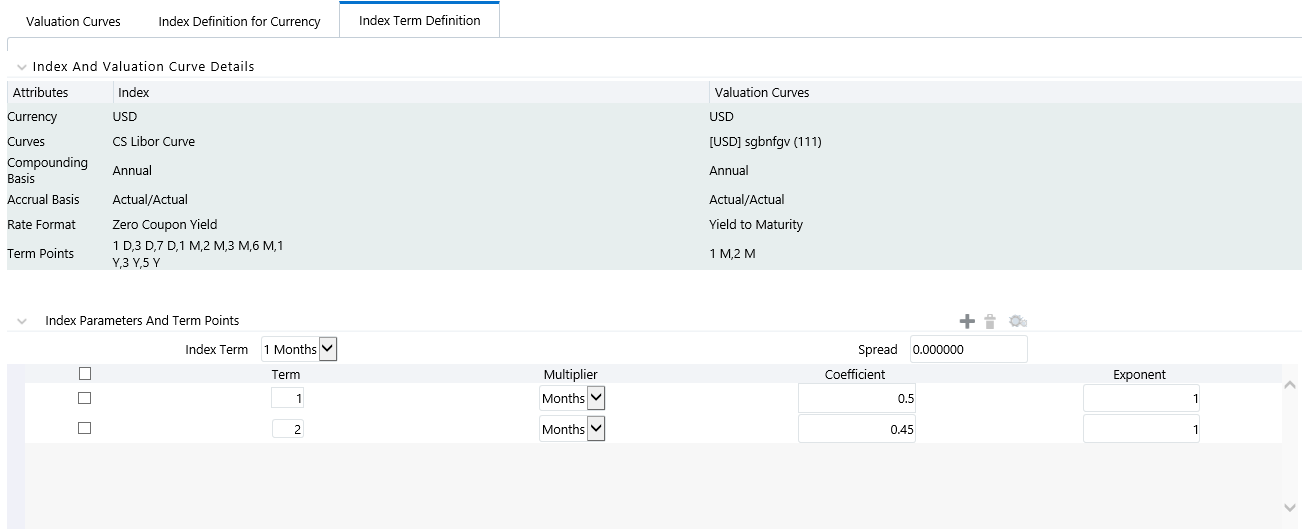

- Navigate to the Index Term Definition tab. The attributes of both the valuation curve and the selected IRC, are listed in Table 1. This information can be used as a reference to define the terms.

- Add Index Term Definitions. The Add Index Term Definition

Page is displayed. The general attributes of both the Valuation Curve and the

selected IRC, are displayed. This information can be used as a reference when you

define the terms.

Each Index Term Point can be calculated from up to eight elements of the valuation curve. The valuation curve elements specified can be any term point on the yield curve, it is not restricted to the points displayed for the valuation curve.

Figure 35-5 Stochastic Rate Indexing

- Select the Index Term.

Not all IRCs have Term Points defined. To successfully define an Index, you must define at least one of its terms. Else define one, many, or all of the Index Terms. The selection of the Index Term is limited to the standard Term Points as defined in the IRC definition.

- Enter a Spread for the Index Terms, if required. A Spread is a constant percentage added to the rate produced as a result of the Monte Carlo calculations, multiplied with the defined coefficient, and raised to the power of the mentioned exponent.

- Enter the Valuation Curve Term Point and select the Multiplier.

- Enter a coefficient for the element.

- Enter an exponent for the element.

- Repeat the last four steps for a maximum of seven more elements for each term.

- Click Apply when indexing is completed for all the required term

points.

The Stochastic Rate Index Valuation Curve page is displayed. You can navigate to the Index Definition tab and continue defining rate index relationships for the existing currency selection or switch currencies, define the valuation curve for the new currency and proceed with Rate Index definitions.

Note:

During rule creation, on the Index Definition forCurrency tab, the undefined IRCs are displayed in the top half of the window and the defined IRCs are displayed in the bottom half of the window. After saving the rule and re-entering in Edit mode, you can see the status reflected for all defined (green) and undefined (red) IRCs in the top half of the window. To Edit any Rate Index relationships, select the appropriate IRC, and again select Add Index and proceed with any changes.

- Click Save.

- The Stochastic Rate Index Rule Summary page is displayed.