16.2 Defining Time Bucket Rules

The definition of a Time Bucket rule is part of the Create or Edit Time Buckets rule process. When you click Save in the Create Time Buckets rule process, the rule is saved and the Time Buckets Rule Sum- mary page is displayed. However, Time Bucket assumptions may not have been defined at this point. You must define the Time Bucket assumptions before clicking Save.

In the Time Bucket Details screen, you have thress tab available for creating Time Bucket definitions.

- Income Simulation Buckets(required)

- Interest Rate GAP Buckets, including Non Interest Rate Sensitive Bucket (required only if Repricing Gap is selected during processing). For Non Interest Rate Sensitive Bucket,both Repricing Gap and Include Non Rate Sensitive Bucket are required selections.)

- Liquidity GAP Buckets (required only if Liquidity Gap is selected duringprocessing)

Prerequisites

Performing basic steps for creating or editing a Time Bucket rule. For more information, see the Creating Time Bucket Rules.

To define the Time Bucket rule, follow these steps:

- In the Income Simulation tab, follow these steps:

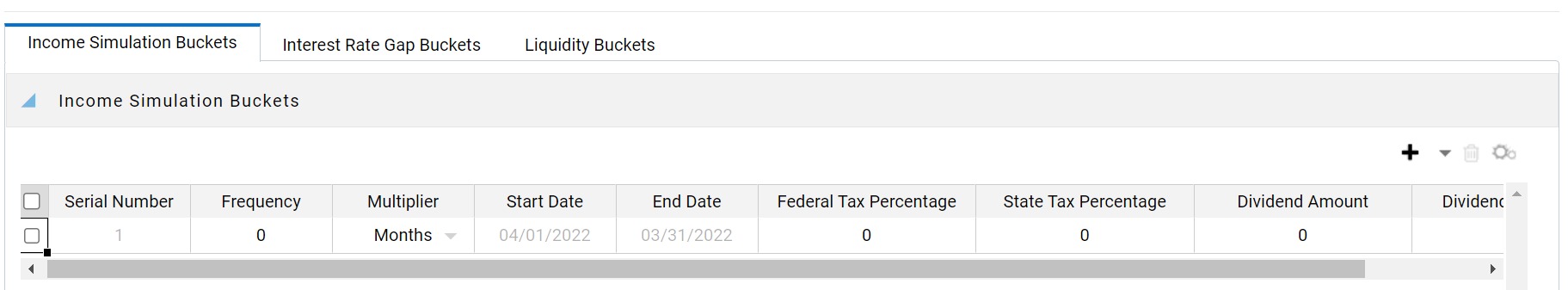

Figure 16-2 Income Simulation Buckets

- Click Add Rows and enter the desired number of rows

corresponding to the number of Income Simulation Buckets required to

create.

You can select a pre-defined number of rows from the list. For example, 3, 5, 10, or you can enter the exact number of rows required to add. The maximum number of buckets you have under any tab is 240.

- Under Frequency, enter a numeric value. For example 1. The Frequency column displays the duration of the multiplier. The frequency in conjunction with the multiplier displays the duration of the buckets. The frequency can be any number from 1 to 999.

- Under Multiplier, select an appropriate value from the

list. The Multiplier column includes

Daily, Monthly, or Yearly options.

Note:

Limit the definition of Income Simulation buckets to the date range that is relevant to your reporting requirement. It is not necessary to create catch all buckets at the end of the series. When large buckets are created, for instance, 99 Years, this can result in the following error:

INSERT Oracle Error: ORA- 01426: numeric overflow Driver

Function: drv_oci::Execute()

- Continue adding frequencies and multipliers asneeded.

After you fill in the frequencies and multipliers, the start and end dates are calculated auto- matically based on the As of Date, defined in your Application Preference settings. You may want to utilize the Data Input Helper to copy from a row where you have already defined the time bucket definition or apply a fixed value down the page. For more informa- tion, see the Data Input Helper section of OFSAA Rate Management.

- After defining time bucket frequencies, move across each row to

input the appropriate Federal Tax Percentages and State TaxPercentages.

Tax percentages are used in ALM when processing with the Autobalancing is selected. Type 35.00 for 35%. The tax rate entered is interpreted as the tax rate for that bucket regardless of the frequency of the bucket. That is, 35% entered for a monthly bucket is applied as a 35% monthly rate to the taxable income forecast for that month.

- Under Dividend Amount, type a value. Dividend amounts are used in HM when processing with the Autobalancing is selected. The values you enter here will be paid out as dividends for all rate scenarios.

- Under Dividend Percentage, type a value. Dividend

percentages are used during Autobalancing calculations. The dividend

percentage is defined as a percent of the net income after tax that will be

paid out as dividends for the period.

Total Dividends = Dividends Amount + (Dividends Percent x Net Income after Tax)

- Select Save if you are finished.

- Otherwise, navigate to the Interest Rate GAP

Bucketstab.

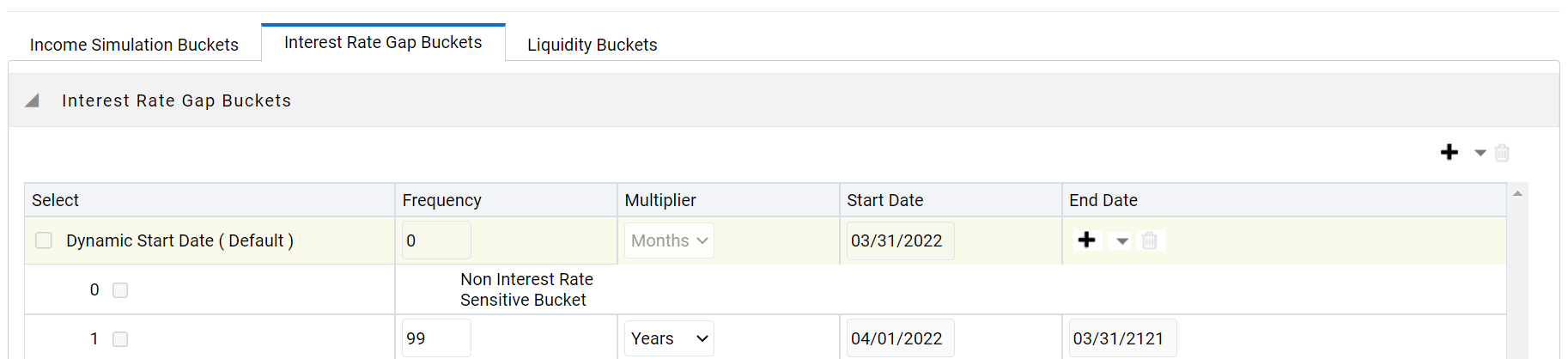

After defining Income Simulation buckets, navigate to the Interest Rate GAP Buckets tab. This tab provides two important inputs. The first is the ability to define Interest Rate GAP Buckets and optionally add a Non Interest Rate Sensitive Bucket for Non Rate Sensitive products. The second capability allows you to define one or more Dynamic Start Dates. The following steps explain how to complete each of these setup tasks.

Note:

The Interest Rate GAP Bucket can be defined from Bucket count 1 till Bucket count 239 in all dynamic start dates. The last time series time bucket in all Dynamic Start Dates will default to 99 years as a catch all bucket. This is used to verify the total runoff for reporting requirements.

- Click Add Rows and enter the desired number of rows

corresponding to the number of Income Simulation Buckets required to

create.

- In the Interest Rate GAP Buckets tab, follow these steps:

Figure 16-3 Interest Rate GAP Buckets

- Click Add Rows corresponding to the Default Dynamic

Start Date and enter the desired number of rows for your Interest Rate GAP

Buckets.

Note:

By default, the first Time Bucket in Interest Rate Gap Buckets (bucket count 0) is defined as Non Interest Rate Sensitive Bucket.

The product dimension Attribute Interest Rate Sensitivity Category identifies products as Interest Rate sensitive or Non Interest Rate sensitive. Once a product is mapped as Non Interest Rate sensitive, you must enable Include Non Interest Rate Sensitive Bucket in Process Rules (see ALM Processing). This moves reprice gap output from Non Interest Rate Sensitive products into Non Interest Rate Sensitive Bucket

- Follow steps a— d described above under Income Simulation Buckets, to complete the setup of your Interest Rate GAP Buckets and Non Interest Rate Sensitive Bucket for the defaultDynamic Start Date.

- If you would like to define additional – forward dated, Dynamic Start Dates, Click Add Dynamic Start Date to add one or more parent nodes to the bucket hierarchy.

- For each additional Dynamic Start Date row, enter the Frequency and Multiplier to determine future start date(s).

- Click Add Rows corresponding to each new Dynamic Start Date and repeat the InterestRate GAP Bucket definition steps previously described to complete the setup.

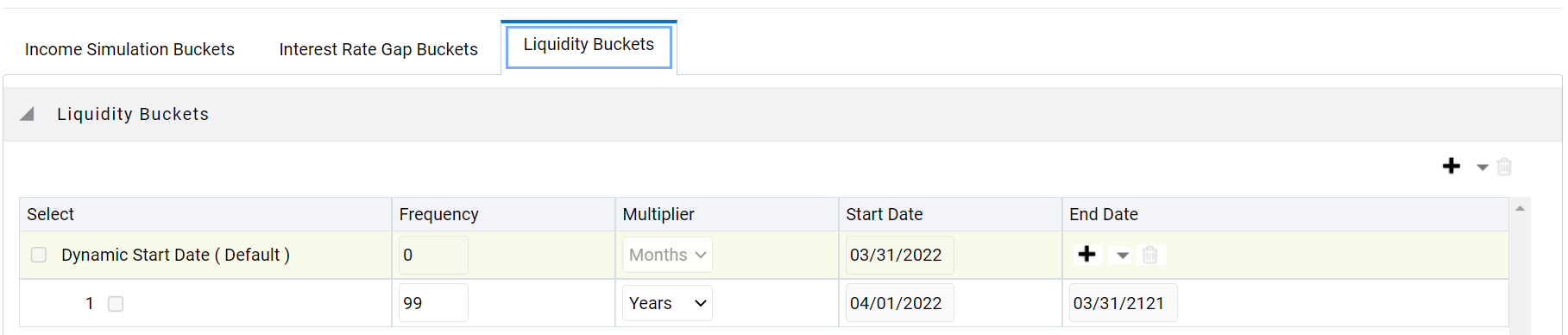

- After defining Interest Rate GAP Buckets, navigate to the

Liquidity Buckets tab. This tab has the same structure as the

Interest Rate GAP Buckets tab. It allows you to define the

Liquidity GAP Buckets for the Default Dynamic Start Date and also

allows you to add one or more addi- tional Dynamic Start Dates. The

use of Dynamic Start Dates will allow you to forecast your liquidity

position as of some future point in time, considering all relevant

assumptions, including amortization, prepayments, early withdrawals, and

rollovers.

Note:

By default, the last time series time bucket in all Dynamic Start Dates will default to 99 years as a catch all bucket. This is used to verify the total runoff for reporting requirements.

- Click Add Rows corresponding to the Default Dynamic

Start Date and enter the desired number of rows for your Interest Rate GAP

Buckets.

- In the Liquidity Buckets tab, follow these steps:

Figure 16-4 Liquidity Buckets

- Click Add Rows corresponding to the Default Dynamic Start Date and input the desired number of rows for your LiquidityBuckets.

- Follow steps b– d described under Income Simulation Buckets, to complete the setup of your Liquidity Buckets for the Default Dynamic StartDate.

- If you would like to define additional – forward dated, Dynamic Start Dates, Click Add Dynamic Start Date to add one or more parent nodes to the bucket hierarchy.

- If needed, enter the Frequency and Multiplier for the new Dynamic Start Date to determine the future start date.

- Click Add Rows corresponding to the new Dynamic Start Date and repeat the Liquidity GAP Bucket definition steps previously described.

- Click Save once you have completed the setup for all

bucket types.

Note:

Each time you change the As of Date in your Application Preferences window, all Time Bucket Rule Buckets Start Date and Bucket End Date updated automatically.

Excel Import/Export functionality is used for adding/editing time bucket information. For more information , see the section Excel Import/Export