31.19 Spread from Note Rate

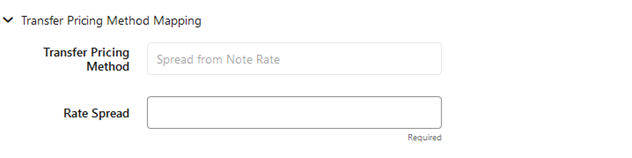

To generate transfer prices using this method, you need to provide just one parameter: a Rate Spread. This spread is added or subtracted from the Coupon Rate of the underlying transaction to generate the final transfer rate for that record.

Figure 31-21 Spread from Note Rate

While entering the Rate Spread, ensure to input it with the appropriately positive or negative sign, as illustrated in the following table. The first row describes a situation where you are transfer pricing an asset and want to have a positive matched spread for it (the difference between the contractual rate of the transaction and the transfer rate is positive). Here, you should enter a negative rate spread.

Table 31-9 Example of Rate Spread

| Account Type | Matched Spread | Sign of Rate Spread |

|---|---|---|

| Asset | Negative | Positive (Profitable) |

| Asset | Positive | Negative (Unprofitable) |

| Liability or Equity | Positive | Positive (Profitable) |

| Liability of Equity | Negative | Negative (Unprofitable) |

The following option becomes available in the application when you select this method:

- Mid-Period Repricing Option: Select the check-box beside this option to invoke the Mid-Period Repricing option.

Note:

The Spread From Note Rate Method applies only to accounts that use Account Tables as their data source.