31.20 Straight Term

When you select the Straight Term method and Standard Term Approach, the Oracle Funds Transfer Pricing Cloud Service derives the Transfer Rate using the last Repricing Date and the next Repricing Date for adjustable-rate instruments, and the Origination Date and the Maturity Date for fixed-rate instruments.

- Standard Calculation Mode:

- For Fixed Rate Products (Repricing Frequency = 0), use Yield Curve Date = Origination Date, Yield Curve Term = Maturity Date-Origination Date.

- For Adjustable Rate Products (Repricing Frequency > 0)

- For loans still in the tease period (tease end date > As-of-Date, and Tease End Date > Origination Date), use Origination Date and Tease End Date - Origination Date.

- For loans not in the tease period, use the Last Repricing Date and Repricing Frequency.

Note:

For loans in the Tease period, the Next Reprice Date should reflect the end of the Tease Period and the Reprice Frequency should reflect the expected Reprice Frequency after the tease period ends.- Remaining Term Calculation Mode:

- For Fixed Rate Products, use As-of-Date and Maturity - As-of-Date.

- For Adjustable Rate Products, use As-of-Date and Next Repricing Date - As-of-Date.

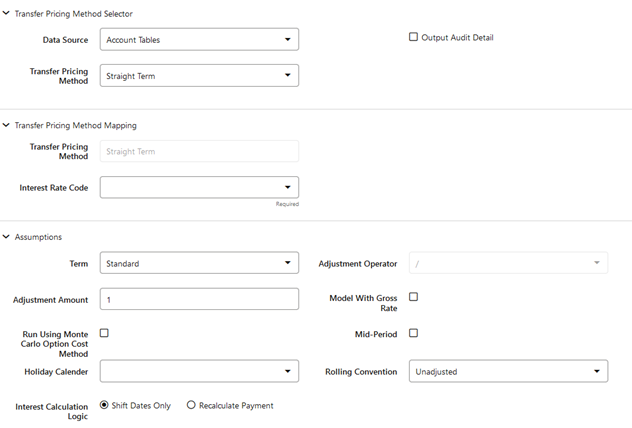

Figure 31-22 Straight Term

In addition to the standard logic used for determining the appropriate “Term”, users also have the option to select either Original Term or Repricing Frequency and also have the option to modify these terms using simple mathematical operators. These options can be useful in cases where the straight term method should be applied to the same record under different circumstances. For example, for calculating the base rate on an adjustable-rate instrument, the standard approach should be used. For the same instrument, users may further want to use the entire Original Term for applying a liquidity premium or other add-on rate. To support the second case, we give the option to directly specify the term to be used, and we further provide the option to modify the term using simple operators, such as +, -, *, /.

The following options become available in the application with this method:

- Term: Select from Standard, Original Term, or Reprice Frequency. Standard is the default selection and the resulting Term will follow the above logic. The Original Term and Reprice Frequency options allow users to override the standard logic and specify which term to use.

- Adjustment Operator: When either Original Term or Reprice Frequency is selected as the Term, the Adjustment Operator becomes active. The term Adjustment is optional and gives users the ability to modify the term

- Adjustment Amount: This input works together with the Adjustment Operator to indicate how the term should be modified.

- Interest Rate Code: Select the Interest Rate Code to be used for Transfer Pricing the account.

- Mid-Period Repricing Option: Select the check box beside this option to invoke the Mid-Period Repricing option.

- Holiday Calendar: Select whether a Holiday Calendar is applicable for calculating the charges/credits or for calculating Economic Value.

- Rolling Convention: Select the appropriate Business Day Rolling Convention if a Holiday Calendar is selected.

- Interest Calculation Logic: Select the appropriate option to indicate how the interest payment should be adjusted when a Holiday Date is encountered.

Note:

The Straight Term method applies only to accounts that use Account Tables as the Data Source.For more information, see the Working with Transfer Pricing Rules section.