13.3 Arbitrage Term Structure Model

Arbitrage models (Merton and Vasicek) use the first-rate from today's yield curve (smoothed and converted to continuous compounding, as described later in the section). It feeds directly the Rate Generator along with the term structure parameters to produce monthly rates, stochastic discount factors for each scenario and month, and discrete rates for any maturity.

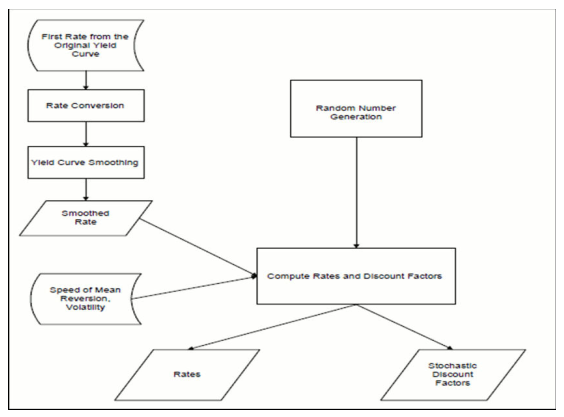

The following diagram shows the process flow for Vasicek (or Merton) models in the Rate Generator:

Figure 13-1 Process flow for Vasicek (or Merton) models in the Rate Generator

Description of process flow for Vasicek (or Merton) Models follows:

The disadvantage of these models is that they do not automatically fit today's term structure. The parameters can be chosen so that arbitrage models provide a close fit to many of the real yield curves, but the fit is usually not exact and often gives significant errors. To achieve no-arbitrage conditions, the model itself can be used to calibrate the parameters of the model. Given the prices of benchmark securities, the model finds the rate probabilities such that, when they are used as input to the pricing tool, the output will be as close as possible to the original prices.