13.4 No-Arbitrage Term Structure Models

The No-Arbitrage Models (Ho and Lee and Extended Vasicek) are designed to fit the current term structure of interest rates exactly. This is achieved when the price of a zero-coupon bond computed through the Monte Carlo process exactly matches today's observable market rates, as defined by the risk-free curve selection. The market price of risk is a function of time that takes care of this fit.

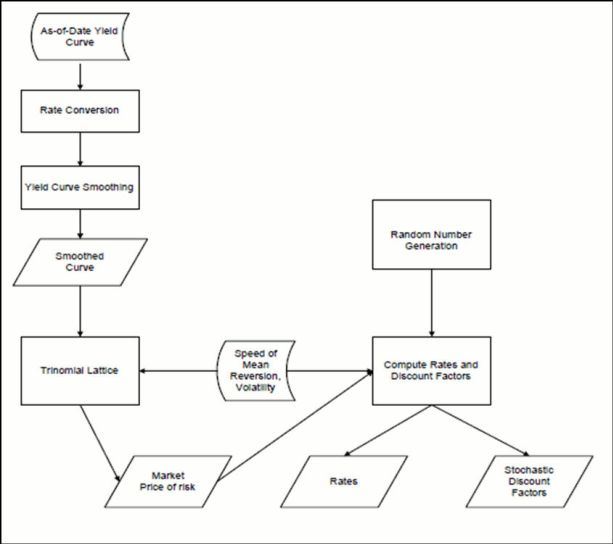

To adhere to this condition, the process flow for no-arbitrage models is more complicated. A trinomial lattice is used to compute the market price of risk to calibrate the term structure. The full original As-of-Date yield curve is used, smoothed and converted to continuous compounding, to be fed into the lattice.

Figure 13-2 Process flow for Vasicek (or Merton)