9.5 Current Target Average Approach

In the current target average approach, a new business instrument is booked on the first day of the bucket so that the average of this instrument plus the average of the current position will equal the targeted average balance.

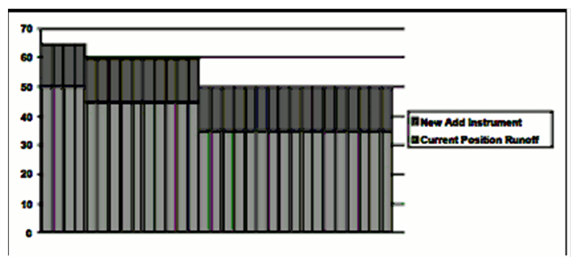

The problem with this approach is that the results are not always logical to an end-user because they do not follow the business logic of new business generated throughout the bucket. In the case represented in the following figure, the user has targeted an average balance of $55 from a starting balance of $50. The logical assumption would be that the balance grows over the bucket from $50 to a final value greater than the average. However, in this case, the ending balance is $49.84, lower than the beginning balance. Although the average balance is correct, the ending balance makes no sense.

Figure 9-8 Current Average Balance Method

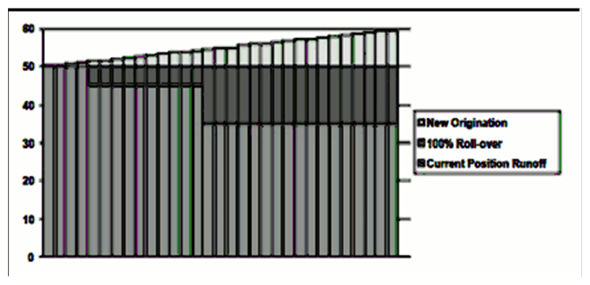

A more appropriate method would be to assume a gradual booking over the month to generate the average balance. In this case, an approach similar to the target end method could be used, where both average date and mid-bucket methods are used as shown in the following figure:

Figure 9-9 Targeting an Average Balance

This example is the same as the example in Figure New Originations Separated by Components with slightly different ending balance values. The method used to solve this case can be the same one that is demonstrated in Figure New Origination Average Date Method, using a combination of the average date method and the mid-bucket method.